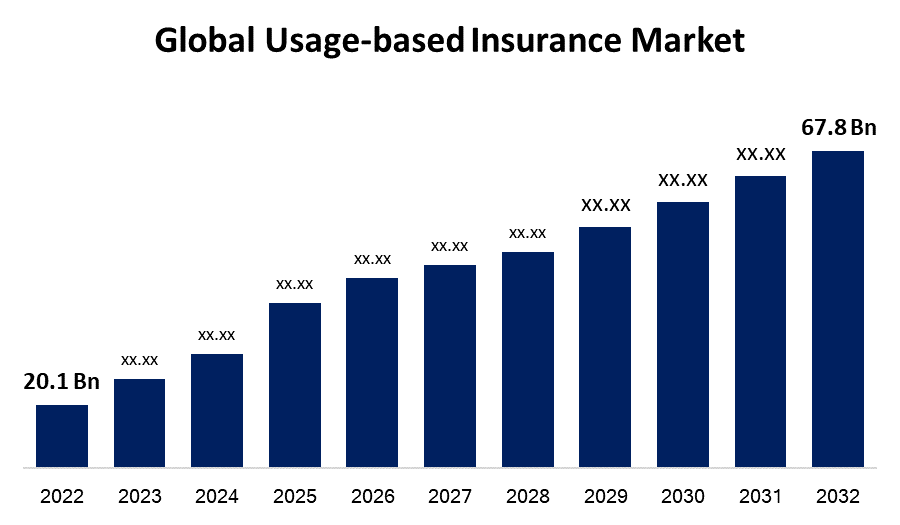

Global Usage Based Insurance Market Size To Grow USD 67.8 Billion by 2032 | CAGR of 29.2%

Category: Banking & FinancialGlobal Usage Based Insurance Market Size To Worth $67.8 Billion by 2032

According to a research report published by Spherical Insights & Consulting, the Global Usage Based Insurance Market Size To Grow from USD 20.1 Billion in 2022 to USD 67.8 Billion by 2032, at a Compound Annual Growth Rate (CAGR) of 29.2% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 100 Market data tables and figures & charts from the report on "Global Usage-based Insurance Market Size, Share, and COVID-19 Impact Analysis, By Package (PAYD, PHYD, MHYD), By Technology (OBD-II, Black Box, Smartphone, Embedded), by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032." https://www.sphericalinsights.com/reports/usage-based-insurance-market

Usage-based insurance, in contrast to standard auto insurance, bases the estimation of your insurance cost on the volume of driving you perform. Your driving style and mileage both have a big impact on how much your car insurance will cost. The insurer uses data such as your driving speed, acceleration rate, braking pattern, and if you use a phone while driving to calculate the cost of your insurance. With this insurance, you can reduce your costs if you don't drive your car much and it promotes safe driving. Based on data such as driving speed, acceleration rate, whether or not a person uses a phone while driving, and other criteria, the insurer figures out how much insurance will cost. Usage-based insurance decreases expenses for drivers who don't use their automobiles regularly and promotes safe driving. Usage-based insurance uses a telematics device to track how the car is driven. Programmes for usage-based insurance collect "telematics" information on automobiles using cellular, GPS, or other technologies.

COVID 19 Impact

The usage-based insurance business has seen tremendous growth in recent years, but the COVID-19 pandemic is predicted to cause part of that growth to slow down in 2020. This is related to the fact that most governments have put their citizens on lockdown and banned all international travel in an effort to curb the virus's spread. As a result, despite the global health crisis, insurers have updated their existing policies to include pay-as-you-drive, usage-based insurance, and telematics insurance, as well as adopting technology to streamline the claim processing and enhance user experience.

One of the main drivers of market expansion is the rising popularity of usage-based insurance, which is a result of the increased demand for remote diagnostics to track customer driving habits. Aside from this, the industry is being positively impacted by the rising demand for usage-based insurance because insurers can enhance customer relationship management with regular reports and customised monthly bills. Additionally, there is a growing global need to lower traffic accidents and encourage driver safety. Due to lower insurance premiums and risk-based costs, usage-based insurance is becoming more popular, which is fueling the market's expansion.

As the market for passenger vehicles, the most prevalent type of electric mobility, grows, the demand for telematics devices is projected to increase. The demand for UBI solutions in passenger vehicles will be fueled by a significant change in the sale and production of passenger vehicles. However, it is projected that high telematics installation costs and other data security issues may restrain the market's expansion.

Technology Insights

Black Box segment holds the largest market share over the forecast period

On the basis of technology, the global usage based insurance market is segmented into OBD-II, black box, smartphone, embedded. Among these, black box segment holds the largest market share over the forecast period. A type of auto insurance known as telematics, often known as black box use based insurance, uses technology to track and record a policyholder's driving habits. Based on how frequently a person drives and how risky (or safe) they are behind the wheel, the goal is to calculate the cost of their insurance. The demand for black boxes will increase as usage-based insurance for heavy-duty vehicles uses telematics insurance more frequently. Italy specifically has the highest penetration in the European region right now. Additionally, the UBI market is observing a transition from a black box to an embedded system.

Package Insights

MHYD dominates the market with the largest market share over the forecast period

Based on the package, the global usage based insurance market is segmented into PAYD, PHYD, and MHYD. Among these, MHYD is dominating the market with the largest market share over the forecast period. It is an expanded version of PHYD that informs drivers of opportunities for development. Similar to PHYD, the MHYD systems rate the driver by gathering data on various driving behaviours, such as rapid cornering, forceful braking, and overspeeding. It also implies that certain areas, like speed and braking, could use improvement. However, it is predicted that this usage-based insurance model will be adopted at a slower rate in developing countries than in mature markets. Apart from that, it is projected that during the course of the forecast year, data analytics will advance with MHYD's momentum.

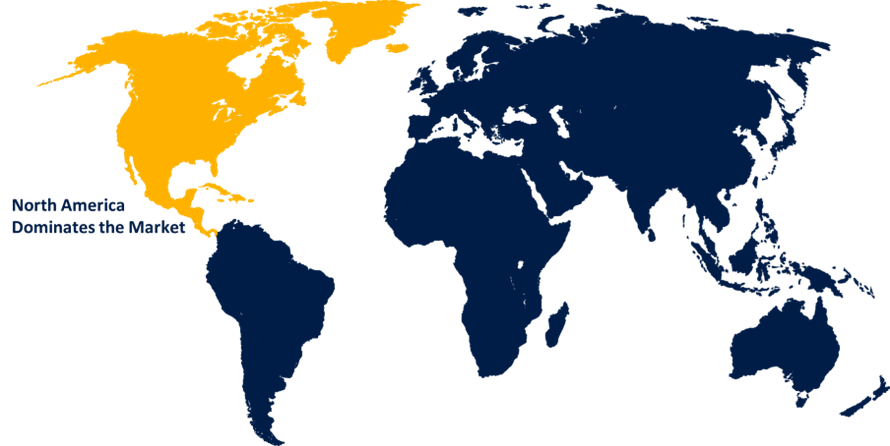

Regional Insights

North America is dominating the market with the largest market share over the forecast period

Get more details on this report -

North America is dominating the global Usage-based Insurance market over the forecast period. The market in North America is expected to expand because to the increased popularity of Mobility as a Service and the increase in collaborations between telematics and insurance companies. Government officials are promoting the use of telematics-enabled auto insurance to reduce the number of accidents. As a result, IT firms and automakers are in a heated rivalry to advance technology.

Asia-Pacific is now experiencing the fastest market growth in the usage-based insurance market as a result of rising consumer awareness, the expansion of the car sector, a shift in emphasis towards remote diagnostic technologies, and an increase in the number of connected vehicles.

Major vendors in the Global Usage based Insurance Market include Mechatronic Systems Inc., TrueMotion, Cambridge Mobile Telematics, Insure The Box Limited, Progressive Casualty Insurance Company, Modus Group, LLC, Inseego Corp, Metromile Inc., The Floow Limited, Vodafone, Allstate Insurance Company, Octo Group, , TomTom International, Allianz, AXA Equitable Life Insurance Company, , Liberty Mutual Insurance, Verizon, Sierra Wireless, , Mapfre, Movitrack Viasat, Inc., ASSICURAZIONI GENERALI S.P.A., and UNIPOLSAI ASSICURAZIONI S.P.A.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Usage-based Insurance Market based on the below-mentioned segments:

Usage-based Insurance Market, Packge Analysis

- PAYD

- PHYD

- MHYD

Usage-based Insurance Market, Technology Analysis

- OBD-II

- Black Box

- Smartphone

- Embedded

Usage-based Insurance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?