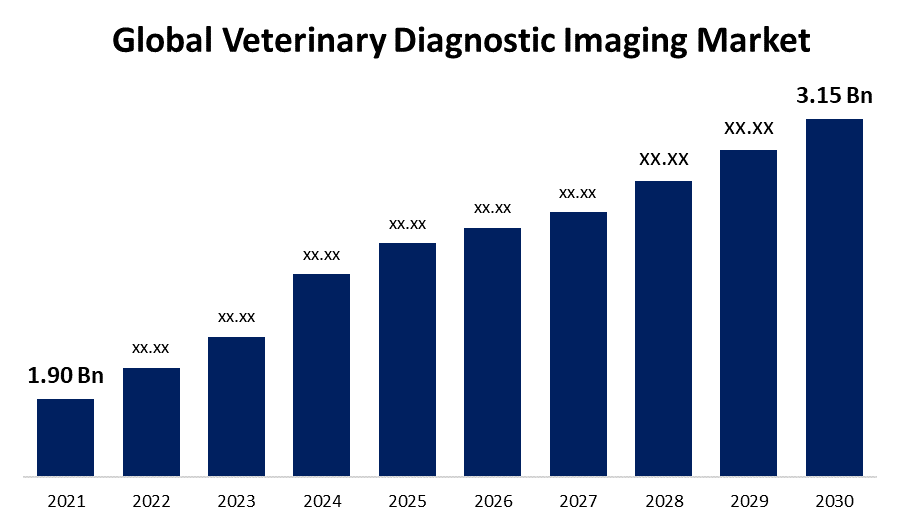

Global Veterinary Diagnostic Market Size To Worth USD 3.15 Billion by 2030 | CAGR of 7.5%

Category: HealthcareGlobal Veterinary Diagnostic Imaging Market worth $3.15 Billion by 2030

According to a research report published by Spherical Insights & Consulting, the Global Veterinary Diagnostic Imaging Market Size to grow from USD 1.90 billion in 2021 to USD 3.15 Billion by 2030, at a Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 130 market data tables and figures & charts from the report on on "Global Veterinary Diagnostic Imaging Market Size, Share, and COVID-19 Impact Analysis By Product (X-ray, Ultrasound, MRI, CT Imaging, Video Endoscopy), By Solutions, By Animal Type (Small, Large), By Application (Orthopedics and Traumatology, Cardiology, Oncology, Respiratory, Neurology, Dental Application, Others), By End-use (Veterinary Clinics & Hospitals, Others), by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/veterinary-diagnostic-imaging-market

To obtain medical images of animals in order to identify illness, veterinary imaging, a branch of veterinary medicine, is utilised. Diseases in pets, large animals, live-stock animals, and other animals are identified using imaging techniques like radiography, X-ray, ultrasound imaging, MRI, CT imaging, endoscopic imaging, and others. Non-invasive veterinary imaging technologies are widely used to diagnose a number of diseases or issues in farm animals like cattle and pigs as well as companion animals like cats, dogs, horses, birds, bunnies, and goats. Many imaging methods, like as radiography, CT scanning, magnetic resonance imaging, and ultra sound imaging systems, are frequently used to diagnose these animals. To assist in the diagnosis of diseases, these systems are usually integrated.

COVID 19 Impact

The introduction of Covid-19 had an effect on every aspect of the healthcare industry, including veterinary imaging. When numerous non-essential procedures were prohibited worldwide during the pandemic, it was discovered that the Covid-19 had marginally slowed market growth. In addition, there were severe limitations on the movement of people and products, which limited the number of patients who could visit veterinary hospitals. Similar to the lack of qualified veterinarians, the suspension or postponement of elective surgery severely impacted the operations of veterinary facilities, marginally harming market suppliers. Nonetheless, the pandemic has increased pet ownership in a number of countries, which has raised the delivery of animal care and, as a result, the demand for veterinary imaging. For instance, a May 2021 report by the American Society for the Prevention of Cruelty to Animals found that one in five families adopted a cat or dog during the early stages of the COVID-19 outbreak (ASPCA). Awareness of companion animal diagnosis and care has increased as a result of adoptions during the outbreak. As a result, it is projected that the adoption of pets would lead to an increase in the long-term need for veterinary imaging services.

The use of multimodal imaging equipment is predicted to increase over the forecasted period, leading to market growth. Both the quantity of companion animals and the adoption rate have grown globally. Many studies have linked owning a companion animal to a range of health benefits, such as a reduction in cardiac arrhythmias, stabilisation of blood pressure, reduction in anxiety, improvement in psychological stability, and general well-being. There will probably be a higher demand for pet care products and services as the number of pets rises. The expansion of adjacent sectors like veterinary imaging would be aided by this. An increase in the pharmaceutical industry and R&D spending will open up opportunities for the growth of the veterinary imaging market. Multimodal imaging equipment development and use have considerably grown with the continued advancement of imaging technology. Pharmaceutical businesses' increased R&D expenditures are closely tied to the industry's restructuring, particularly the growth of the biotechnology sector.

The market's growth will be constrained by the high price of imaging equipment. Equipment for veterinary imaging is expensive. Entry-level console (portable) ultrasound systems cost between USD 22,000 to USD 75,000 in wealthy nations like Germany, the United States, Japan, and the United Kingdom.

Product Insights

X-Ray segment is dominating the market with the largest market share over the forecast period.

On the basis of product, the global veterinary imaging market is segmented into X-ray, Ultrasound, MRI, CT Imaging, Video Endoscopy. Among these, the X-Ray segment is dominating the market with the largest market share over the forecast period. X-rays are one of the most often utilised diagnostic techniques in veterinary clinics as a result of an increase in the prevalence of orthopaedic issues in animals. The numerous teleradiology and radiographic diagnosis concepts are also covered by pet insurance. Hence, improved awareness of the many radiographic imaging alternatives for pets as well as increased adoption of pet insurance are key factors driving the segment's rise.

The video endoscopy market is expected to grow at the fastest rate in the future years. The segment is expected to be greatly influenced over the anticipated time period by the expanding development and introduction of cutting-edge diagnostic tools for veterinary care. Major market rivals are also introducing contemporary veterinary video endoscopy to strengthen their competitive situation. For instance, in November 2022, OmniVision unveiled its OH02B 2-megapixel resolution image sensor for reusable and disposable endoscopes.

Animal Type Insights

Small animal segment is dominating the market with the highest market share over the forecast period.

Based on the animal type, the global veterinary diagnostic imaging market is segmented into small animals and large animals. Among these, small animal segment is dominating the market with the highest market share over the forecast period. The number of companion animals, rising pet care costs, rising adoption of pet insurance, rising rates of acute and chronic illnesses, and technological developments in imaging modalities for small animals are all contributing to the growth of this market. In addition, the development of technology in veterinary diagnostic imaging equipment has made it possible to quickly, precisely, and less painfully diagnose health problems in small animals. Over the forecast term, this is fueling segmental growth overall.

Solution Insights

Equipment segment accounted the largest market share over the forecast period.

On the basis of solution, the global veterinary diagnostic imaging market is segmented into equipment, accessories/ consumables, PACS. Among these, equipment segment accounted the largest market share over the forecast period. The key driver of the expansion is the rise in demand for high-tech, user-friendly veterinary diagnostic imaging equipment. Moreover, the segmental expansion is being fueled by the growing need for and installation of modern diagnostic equipment in veterinary clinics and hospitals. In contrast, the PACS market is expected to grow at the quickest rate due to the numerous advantages that can be acquired by integrating PACS software with veterinary imaging technologies, including benefits for storing and sharing data, easy access, and the creation of direct and cascading benefits. Not only this, but also growing knowledge of PACS imaging techniques among veterinary technicians and practitioners has led to an increase in market demand, spurring market expansion.

Application Insights

Orthopedic and traumatology segment is dominating the market with the largest market share over the forecast period.

Based on the application, the global veterinary diagnostic imaging market is segmented into orthopedics and traumatology, oncology, cardiology, neurology, respiratory, dental application, others. Among these, the orthopedics and traumatology segment is dominating the market and will continue its dominance over the forecast period. The segmental growth is being influenced by the rising number of small animal occurrences of bone fractures. In addition to this, the frequency of traffic accidents is a major factor in small animals' bone fractures. Also, the rising demand for precise diagnoses, the expanding number of animal care facilities, and the rising frequency of joint and bone injuries in animals are all contributing to the segment's rise.

End Use Insights

Veterinary clinics and hospitals accounted the largest market share over the forecast period.

On the basis of end use, the global veterinary diagnostic imaging market is segmented into veterinary clinics and hospitals, others. Due to the rising demand for veterinary diagnostic imaging tools in animal healthcare facilities, veterinary clinics and hospitals held the greatest market share among them over the predicted period. In addition, the increase in hospital-key company partnerships aimed at providing cutting-edge veterinary diagnostic imaging tools and the widespread use of cutting-edge veterinary imaging technologies are fueling the segment's growth.

Regional Insights

North America is dominating the market with the largest market share over the forecast period.

Get more details on this report -

Due to an increase in pet adoption, the adoption of strategic efforts by market players, as well as an increase in animal health issues, North America has recorded the greatest market share over the forecast period. According to a report by the North American Pet Health Insurance Association, 3.1 million pet insurance policies will have been bought in the US as of 2020. The demand for advanced healthcare services has expanded in tandem with the rise in the purchasing of high-end pet insurance policies. On the other hand, Asia Pacific is experiencing the fastest market growth due to rising household disposable income, rising animal healthcare costs, rising demand for advanced veterinary imaging systems, and rising pet humanization. These factors are all contributing to the region's rapid market growth.

Major vendors in the Global Veterinary Diagnostic Imaging Market are Agfa- Gevaert N.V., Esaote SpA, Fujifilm holdings corp. (Sonosite, Inc.), General Electric (GE Healthcare), IMV Technologies group, (IMV imaging), IDEXX Laboratories, Inc., Mindray Medical International Ltd., MinXray, Inc., Siemens AG, and Toshiba Corporation (Canon Medical Systems Corporation).

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?