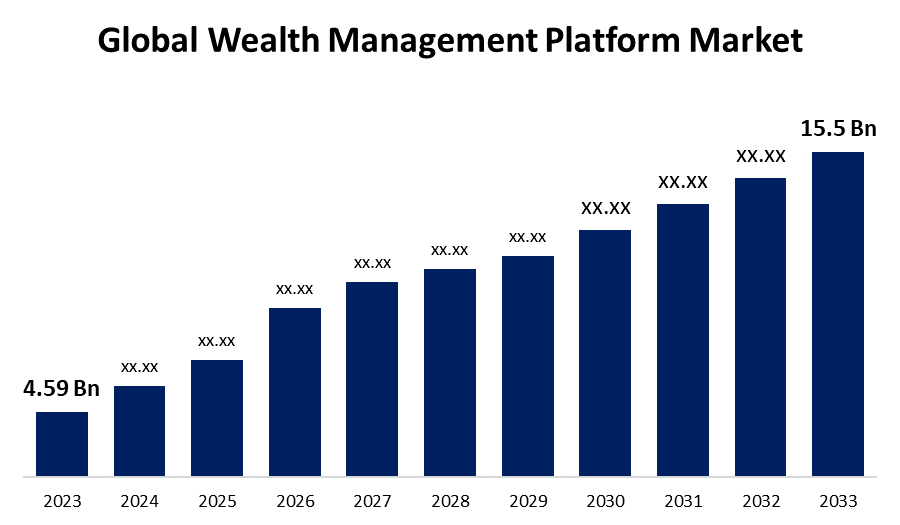

Global Wealth Management Platform Market Size To Worth USD 15.5 Billion by 2033 | CAGR Of 12.9%

Category: Information & TechnologyGlobal Wealth Management Platform Market Size To Worth USD 15.5 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Wealth Management Platform Market Size is to grow from USD 4.59 Billion in 2023 to USD 15.5 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 12.9% during the projected period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 Market data tables and figures & charts from the report on the "Global Wealth Management Platform Market Size, Share, and COVID-19 Impact Analysis, By Advisory Model (Human Advisory, Robo Advisory, and Hybrid), By Business Function (Portfolio Accounting & Trading Management, Performance Management, Risk & Compliance Management, Reporting, Financial Advice Management, and Others), By End-user (Trading & Exchange Firms, Investment Management Firms, Brokerage Firms, Banks, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033)." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/wealth-management-platform-market

The wealth management platform is a piece of software that is primarily intended for tracking and organizing financial data. It also provides services for tax laws, legal counsel, property planning, personal spending, banking, and investment management. A wealth management platform is a front-to-mid advice platform that provides a true 360-degree perspective of a customer's wealth. The growing acceptance of digitalization across numerous sectors and industries, together with banking institutions' increased focus on system automation and the establishment of workflows to facilitate customer lives, are driving growth in the global wealth management platform market. Numerous advantages are offered by wealth management platforms, such as standardized services, enhanced and streamlined business operations through system automation, regulatory requirement compliance, better user experience, and enriched and streamlined company operations. The market for wealth management platforms will expand as a result of the growing advancements in blockchain and artificial intelligence. The artificial intelligence system keeps track of financial data and gives relevant user recommendations. Blockchain technology combined with artificial intelligence tracks consumer spending patterns and trends and then uses that data to provide approximate calculations. However, a lack of knowledge among the target audience regarding the significance and advantages of the wealth management platform may hinder the growth of the market. Furthermore, a significant obstacle to the expansion of the global wealth management platform market is the absence of specialized technical knowledge needed to administer the platform.

The human advisory segment is anticipated to hold the greatest share of the global wealth management platform market during the projected timeframe.

Based on the advisory model, the global wealth management platform market is divided into human advisory, Robo advisory, and hybrid. Among these, the human advisory segment is anticipated to hold the greatest share of the global Wealth Management Platform market during the projected timeframe. This is due to the complexity of financial planning and monitoring, which calls for a level of emotional intelligence and sophisticated comprehension that artificial intelligence cannot provide.

The portfolio accounting & trading management segment is anticipated to grow at the fastest pace in the global wealth management platform market during the projected timeframe.

Based on the business function, the global wealth management platform market is divided into portfolio accounting & trading management, performance management, risk & compliance management, reporting, financial advice management, and others. Among these, the portfolio accounting & trading management segment is anticipated to grow at the fastest pace in the global wealth management platform market during the projected timeframe. This is because the portfolio accounting and trading management segment makes it possible to monitor the performance of individual stocks within a stock portfolio and make predictions about which investments may rise or fall.

The banks segment is predicted to grow at the highest pace in the Wealth Management Platform market during the estimated period.

Based on the end-user, the global wealth management platform market is divided into trading & exchange firms, investment management firms, brokerage firms, banks, and others. Among these, the banks segment is predicted to grow at the highest pace in the wealth management platform market during the estimated period. This is because so many people use banking websites and mobile applications on different platforms; as a result, banks accumulate a substantial amount of undesirable data that they can use to plan and monitor financial statistics according to customer needs.

North America is expected to hold the largest share of the global wealth management platform market over the forecast period.

Get more details on this report -

North America is expected to hold the largest share of the global wealth management platform market over the forecast period. This is due to North America's robust financial industry, which offers wealth management platforms a favorable environment in which to flourish. Furthermore, there are a significant number of high-net-worth individuals in the North American region, which may support the expansion of the global wealth management platform market. Moreover, the adoption of massive data and artificial intelligence (AI), two major technologies that are crucial to modern wealth management systems, is highest in North America. Furthermore, the market's growth is being fueled by the regional government's installation of a strict and well-defined regulatory framework that encourages confidence in wealth management services.

Europe is predicted to grow at the fastest pace in the global wealth management platform market during the projected timeframe. This is because digital technology has upended several European industries, resulting in the emergence of new business models and the demise of established ones. Wealth management companies are attracting new clients and assets with their technology-driven business strategies. Moreover, there are several providers of vital wealth management systems in the region; their recent investments have created fresh opportunities.

Major vendors in the Global Wealth Management Platform Market include Profile Systems and Software S.A., Prometeia S.p.A, SS&C Technologies Inc., Avaloq (NEC Corporation), Backbase, Tata Consultancy Services Limited, Temenos Headquarters SA., Broadridge Financial Solutions Inc., Comarch SA, Crealogix AG, Fidelity National Information Services Inc., Fiserv Inc., Infosys Limited, SEI Investments Company, and others

Recent Developments

- In June 2023, to give its investment banking platform end-to-end investing capabilities, Backbase purchased the digital wealth platform Nucoro.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Wealth Management Platform Market based on the below-mentioned segments:

Global Wealth Management Platform Market, By Advisory Model

- Human Advisory

- Robo Advisory

- Hybrid

Global Wealth Management Platform Market, By Business Function

- Portfolio Accounting & Trading Management

- Performance Management

- Risk & Compliance Management

- Reporting

- Financial Advice Management

- Others

Global Wealth Management Platform Market, By End-user

- Trading & Exchange Firms

- Investment Management Firms

- Brokerage Firms

- Banks

- Others

Global Wealth Management Platform Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?