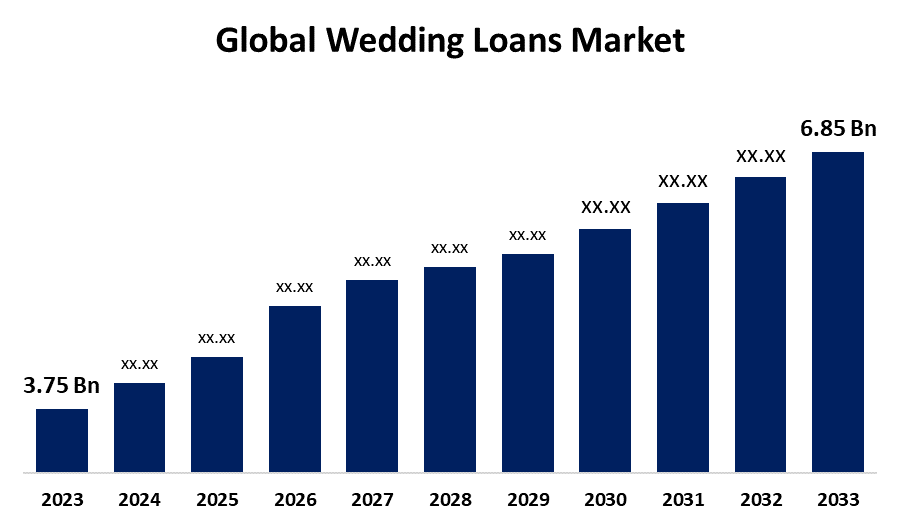

Global Wedding Loans Market to Exceed USD 6.85 Billion by 2033 | CAGR of 6.21%

Category: Banking & FinancialGlobal Wedding Loans Market to Exceed USD 6.85 Billion by 2033

According to a research report published by Spherical Insights & Consulting, the Global Wedding Loans Market Size Expected to Grow from USD 3.75 Billion in 2023 to USD 6.85 Billion by 2033, at a CAGR of 6.21% during the forecast period 2023-2033.

Get more details on this report -

Browse 210 market data Tables and 45 Figures spread through 256 Pages and in-depth TOC on the "Global Wedding Loans Market Size, Share, and COVID-19 Impact Analysis, By Loan Amount (Small Loans, Medium Loans, and Large Loans), By Interest Rate (Fixed Interest Rate and Floating Interest Rate), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/wedding-loans-market

A wedding loan, often referred to as a marriage loan, is a sort of personal loan meant to enable consumer who need money to pay for wedding-related obligations. It can make it simpler for insurers to manage wedding-related expenditures, whether they are related to venue reservations, catering, décor, or buying bridal gowns and jewellery. Furthermore, the primary drivers of the wedding loans market are the growing acceptance of non-traditional weddings, the growing cost of weddings, and the growing appeal of destination weddings. Destination weddings have become more and more popular in recent years as couples look to create unique and memorable experiences for both themselves and their guests. Additionally, wedding costs have been increasing, as seen by the fact that the average wedding in the US currently costs over $30,000. However, the high interest rates on wedding loans are limiting the market's growth by making them a less desirable option for couples looking to finance their wedding.

The small loans segment is expected to hold the largest share of the global wedding loans market during the projected timeframe.

Based on loan amount, the global wedding loans market is categorized as small loans, medium loans, and large loans. Among these, the small loans segment is expected to hold the largest share of the global wedding loans market during the projected timeframe. Large loans are the most prevalent in this category, allowing couples to plan extravagant weddings with all the extras and luxuries that guests want. The increasing trend of wedding personalization, which drives couples to look for specialized financial solutions to realize their dream celebrations, is driving market growth.

The fixed interest rate segment is expected to grow at the fastest CAGR during the projected timeframe.

Based on the interest rate, the global wedding loans market is categorized as fixed interest rate and floating interest rate. Among these, the fixed interest rate segment is expected to grow at the fastest CAGR during the projected timeframe. This is because it provides clients with a clear view of the monthly payments and the total loan amount. Predictability and transparency are advantageous to couples organizing a wedding since they help them better manage their money and steer clear of unforeseen expenses.

North America is projected to hold the largest share of the global wedding loans market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global wedding loans market over the forecast period. Rising wedding costs are currently drive the wedding loan business in North America and escalating the desire for the perfect wedding among many couples. Since many couples in North America are searching for brides and appropriate venues for the ceremony, the cost of the wedding has gone up. The number of North Americans trying to get loans to pay for these costs rises dramatically as a result.

Asia-Pacific is expected to grow at the fastest CAGR growth of the global wedding loans market during the forecast period. The convenience, speed, and personalized solutions offered by lenders have led to an increase in the local wedding loan market. This is due to the flexibility of loan amounts and conditions; couples can now more easily obtain the funds they require to finance their dream weddings. Since they offer an alternate perspective on this age-old problem that can be tailored to meet various financial goals and mindsets, stretch loans have grown in popularity as an alternative to traditional wedding financing.

Major vendors in the global wedding loans market are LightStream, Lending Club, Discover Personal Loans, Earnest, SunTrust, Prosper Marketplace, Oportun, Finance of America, Marcus by Goldman Sachs, American Express, SoFi, Upstart, Avant, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Development

- In December 2023, a prominent financial services company and part of the prestigious Tata Group, Tata Capital, unveiled a state-of-the-art new loan app that offers customized wedding finance. The app offers instant paperless approval for loans for which customers are pre-qualified. By following a simple application, check, and fund transfer process, borrowers can get funds without having to deal with time-consuming paperwork.

Market Segment

- This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global wedding loans market based on the below-mentioned segments:

Global Wedding Loans Market, By Loan Amount

- Small Loans

- Medium Loans

- Large Loans

Global Wedding Loans Market, By Interest Rate

- Fixed Interest Rate

- Floating Interest Rate

Global Wedding loans Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?