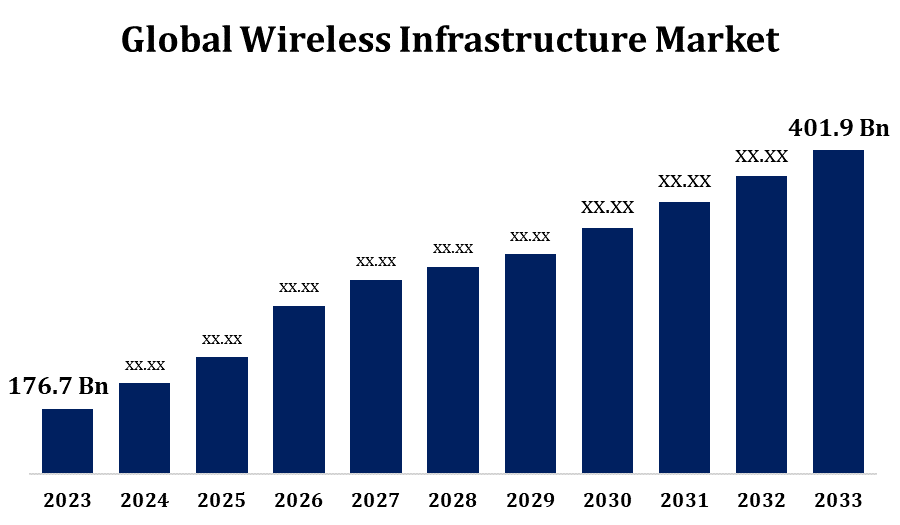

Global Wireless Infrastructure Market Size to Worth USD 401.9 Billion by 2033 | CAGR of 8.56%

Category: Aerospace & DefenseGlobal Wireless Infrastructure Market Size to Worth USD 401.9 Billion by 2033

According to a research report published by Spherical Insights & Consulting, the Global Wireless Infrastructure Market Size to grow from USD 176.7 Billion in 2023 to USD 401.9 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 8.56% during the forecast period.

Get more details on this report -

Browse key industry insights spread across 200 pages with 110 Market data tables and figures & charts from the report on the "Global Wireless Infrastructure Market Size By Platform (Defense, Government, Commercial); By Type (Satellite, 2G & 3G, 4G, 5G); By Infrastructure (Small and Macro Cells, Radio Access Networks, Mobile Core, Distributed Area Network, SATCOM), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033." Get Detailed Report Description Here: https://www.sphericalinsights.com/reports/wireless-infrastructure-market

With the increasing usage of smartphones, tablets, Internet of Things devices, and other connected devices, a robust wireless infrastructure is becoming more and more essential to enable seamless communication and fast data transfer. A significant amount of money is being invested in wireless infrastructure to support the deployment of 5G networks, which will offer higher capacity, reduced latency, and quicker data rates. Examples of these include big MIMO (Multiple Input Multiple Output) antennas, small cell deployment, and other state-of-the-art technologies. Smart cities, healthcare, manufacturing, and the automotive industry are among the sectors driving the demand for wireless infrastructure to support the connectivity requirements of Internet of Things (IoT) devices.

Wireless Infrastructure Market Value Chain Analysis

Component manufacturers provide the hardware and software for wireless infrastructure, including base stations, antennas, radios, switches, routers, and other networking devices. Vendors of network equipment receive these components, which are essential for building wireless networks. Network equipment vendors design, develop, and manufacture the infrastructure equipment used in wireless communication networks. They integrate parts from several suppliers to build base stations, access points, controllers, and other network components. Telecommunication operators or service providers that own and operate wireless networks include mobile operators, internet service providers (ISPs), and other telecommunications companies. Infrastructure suppliers lease or sell physical assets, such as towers, poles, and rooftops, to telecommunication operators for the purpose of deploying wireless infrastructure. Technology providers offer services, software, and platforms to raise the performance, security, and efficiency of wireless networks. System integrators are experts in the design, implementation, and integration of complex wireless network solutions. End users are individuals, businesses, and organisations who utilise wireless communication services and apps. They rely on wireless infrastructure for services like texting, phone calls, internet access, IoT connectivity, and other wirelessly enabled functions.

Wireless Infrastructure Market Opportunity Analysis

The development and expansion of 5G networks present significant opportunities for providers of wireless infrastructure. Massive MIMO antennas, edge computing platforms, and tiny cells are among the infrastructure components that will be in greater demand as 5G technology becomes more widely used. These components are necessary to enable novel use cases like virtual and augmented reality (VR), as well as faster data rates and lower latency. The proliferation of IoT devices across a wide range of industries, including healthcare, manufacturing, transportation, and smart cities, presents opportunities for wireless infrastructure providers. As the number of connected devices and demand for mobile data rises, network densification becomes necessary to improve coverage and capacity in busy and urban areas.

High-speed internet and connectivity are becoming more and more necessary due to the rise in the usage of bandwidth-intensive activities like online gaming, cloud computing, and video streaming. Both consumers and businesses expect faster and more reliable wireless networks to support their digital lives and business operations. Owing to intense market competition, service providers and telecom operators need to spend in expanding and improving their wireless infrastructure to gain a competitive edge. Offering high-speed networks with outstanding performance and coverage is essential to attracting and retaining customers in a highly competitive industry.Many industries are implementing digital transformation projects, and fast and dependable connectivity is required to support cloud-based apps, data analytics, and Internet of Things deployments.

Installing wireless infrastructure requires a significant financial investment, especially for 5G and other next-generation technologies. The cost of acquiring spectrum, purchasing equipment, and building networks can be significant, particularly in densely populated urban regions or remote rural areas. The spectrum supply is very controlled and limited, especially for the permitted bands that mobile operators use. Spectrum shortages can cause congestion, interference, and challenges in providing adequate capacity and coverage, especially in urban areas where there is a high demand for wireless services. Handling technical difficulties like signal propagation, radio frequency interference, interoperability issues, and network optimisation is necessary for managing and implementing wireless infrastructure.

Insights by Platform

The commercial segment accounted for the largest market share over the forecast period 2023 to 2033. Organisations are adopting digital transformation initiatives to enhance consumer contentment, augment efficiency, and generate novel company prospects. Wireless infrastructure is crucial for the support of digital transformation because it provides high-speed connectivity, mobility, and access to cloud-based apps and services. In order to improve customer engagement, maximise operational efficiency, and deliver customised experiences, the retail and hotel industries are investing in wireless infrastructure. Wi-Fi networks, mobile payment methods, location-based applications, and digital signage all depend on wireless connectivity to function properly. The healthcare industry is putting wireless infrastructure into place to support telemedicine, remote patient monitoring, electronic health records (EHR), and medical Internet of things devices.

Insights by Type

The 4G segment accounted for the largest market share over the forecast period 2023 to 2033. Even though 5G deployment is accelerating, 4G networks continue to form the backbone of mobile communication infrastructure in many regions of the world. In areas where 5G coverage is limited or where 5G deployment is still occurring, 4G networks continue to be the primary means of delivering high-speed mobile internet services. In urban, suburban, and rural areas, 4G networks offer widespread coverage, offering a huge user base dependable access and rapid data services. 4G network expansion and enhancement is being funded by wireless operators in order to offer seamless coverage and capacity to customers.The availability and affordability of 4G-capable gadgets, like tablets, smartphones, and Internet of Things devices, contribute to the segment's constant growth.

Insights by Infrastructure

The distributed area networks segment accounted for the largest market share over the forecast period 2023 to 2033. Due to the growing popularity of mobile devices and increased data consumption, there is a demand for more wireless coverage and capacity in both indoor and outdoor environments. Distributed area networks increase wireless coverage, improve signal quality, and increase network capacity in areas with high population densities or challenging radio frequency conditions to satisfy this need. Conventional macrocell networks may not be able to provide adequate coverage and capacity in highly populated metropolitan locations such as stadiums, airports, retail centres, and office towers. Distributed area networks are a useful tool that enhances user experience and optimises spectrum usage by distributing wireless signals from centralised base stations to several antennas placed strategically across the network.

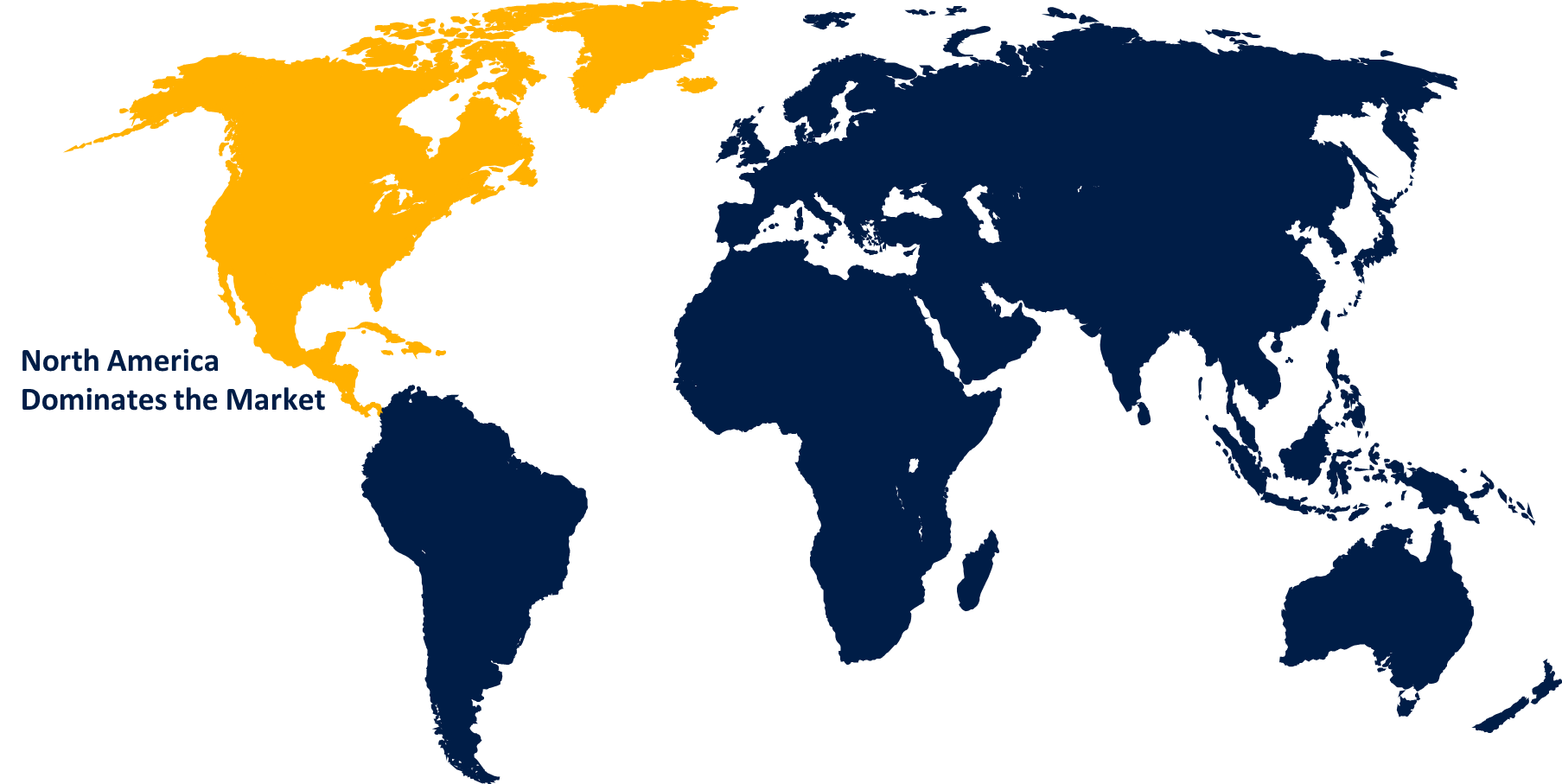

Insights by Region

Get more details on this report -

North America is anticipated to dominate the Wireless Infrastructure Market from 2023 to 2033. The region's extensive smartphone use, strong 4G LTE coverage, and ongoing 5G network deployment have resulted in a steady increase in investments in wireless infrastructure. North America is leading the 5G deployment wave, with major US and Canadian cellular operators actively installing 5G networks in cities and targeted areas. These deployments are driving investments in new infrastructure, like as large MIMO antennas, fiber-optic backhaul, and small cells, to provide high-speed, low-latency connectivity. In order to meet the evolving needs of consumers and businesses for quick data, dependable connectivity, and state-of-the-art services, North American wireless carriers are modernising their networks.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. A number of Asia-Pacific nations are at the forefront of the global rollout of 5G networks. China is leading the way in the rollout of 5G, having made significant investments in spectrum purchase and infrastructure development. Other countries in the region, like South Korea and Japan, are also pushing the adoption of 5G through aggressive network expansion and commercialization initiatives. Asia Pacific now has a sizable and diverse mobile subscriber base as a result of the quick adoption of smartphones and mobile internet services. Due to this expanding subscriber base, there is an increasing demand for mobile apps, multimedia content, and data services, which is being fulfilled by investments in wireless infrastructure.

Recent Market Developments

- In January 2023, the online retail giant Amazon announced the opening of Amazon Air, its freight service, and its two cargo aircraft in India.

Major players in the market

- D-Link Corporation

- Qualcomm Technologies Inc.

- Huawei Technologies Co., Ltd.

- ZTE Corporation

- Fujitsu Ltd.

- NEC CORPORATION

- NXP Semiconductors

- Cisco Systems, Inc.

- Mavenir

- Samsung

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Wireless Infrastructure Market, Platform Analysis

- Defense

- Government

- Commercial

Wireless Infrastructure Market, Type Analysis

- Satellite

- 2G & 3G

- 4G

- 5G

Wireless Infrastructure Market, Infrastructure Analysis

- Small and Macro Cells

- Radio Access Networks

- Mobile Core

- Distributed Area Network

- SATCOM

Wireless Infrastructure Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?