Global 155mm Ammunition Market Size, Share, and COVID-19 Impact Analysis, By Technology (Guided and Unguided), By Component (Projectiles, Primers, Propellants, and Fuze), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal 155mm Ammunition Market Insights Forecasts to 2033

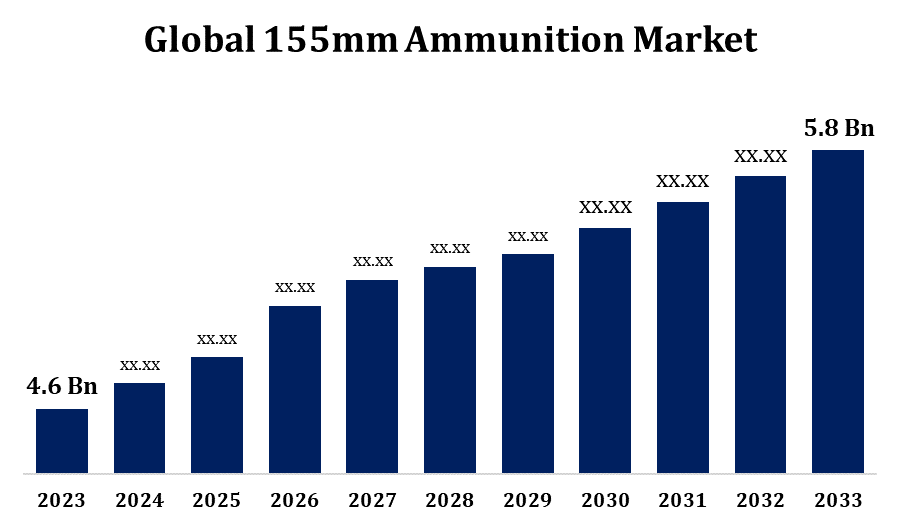

- The Global 155mm Ammunition Market was valued at USD 4.6 Billion in 2023.

- The Market is Growing at a CAGR of 2.35% from 2023 to 2033

- The Worldwide 155mm Ammunition Market Size is Expected to reach USD 5.8 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global 155mm Ammunition Market Size is Expected to reach USD 5.8 billion by 2033, at a CAGR of 2.35% during the forecast period 2023 to 2033.

The 155mm ammunition market is witnessing significant growth due to increasing defense budgets and rising geopolitical tensions. This caliber, essential for artillery systems, is favored for its balance of range, power, and versatility in various combat scenarios. Technological advancements are driving the development of precision-guided munitions, enhancing effectiveness and minimizing collateral damage. Key players are investing in research and development to innovate and improve existing ammunition capabilities. The demand is further propelled by ongoing military modernization programs and the need for interoperability among NATO forces.

155mm Ammunition Market Value Chain Analysis

The 155mm ammunition market value chain encompasses several key stages, beginning with raw material procurement, primarily involving metals like steel and chemical compounds for explosives. Manufacturers then design and produce the ammunition, incorporating advanced technologies for precision and efficiency. This is followed by rigorous testing and quality assurance to meet stringent military standards. Logistics and distribution play a critical role, ensuring timely and secure delivery to defense forces globally. Maintenance and lifecycle management services are essential for ensuring the longevity and reliability of the ammunition. The final stage involves end-users, primarily military organizations, which utilize the ammunition in various operational scenarios. Collaboration among suppliers, manufacturers, logistics providers, and end-users is crucial for optimizing the value chain and meeting the high demands of modern defense operations.

155mm Ammunition Market Opportunity Analysis

The 155mm ammunition market presents significant opportunities driven by global defense modernization initiatives and escalating geopolitical tensions. Increasing defense budgets, particularly in emerging economies, are fueling demand for advanced artillery systems. Innovations in precision-guided munitions offer potential for market expansion, as military forces seek to enhance accuracy and reduce collateral damage. There's also a growing focus on developing environmentally friendly ammunition, opening avenues for sustainable solutions. Strategic partnerships and collaborations among defense contractors, coupled with government support, are fostering a competitive landscape. Additionally, the shift towards network-centric warfare and integrated defense systems underscores the need for interoperable and technologically sophisticated ammunition.

Global 155mm Ammunition Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.6 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.35% |

| 2033 Value Projection: | USD 5.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Technology, By Component, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Raytheon Technologies Inc., General Dynamics Corporation, Northrop Grumman Corporation, BAE Systems PLC, China North Industries Corporation, Thales Group, Leonardo S.p.A., Olin Corporation, Rheinmetall AG, Elbit Systems Ltd., Saab AB, Norma Precision AB, Remington Arms Company LLC, Nammo AS, Denel SOC Ltd., Nexter Group, Fiocchi Munizioni SPA, Ammo Inc., RUAG Holding AG, Munitions India Ltd., Savage Arms, Hornady Manufacturing Company, MSM Group s.r.o., Federal Premium Ammunition, Winchester Ammunition Inc., Magtech Ammunition Company Inc., Poongsan Corporation, JSC Arsenal AD, and other key vendors. |

| Growth Drivers: | Increased Defence Budget for Military Modernization to Drive Market Growth |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

155mm Ammunition Market Dynamics

Increased Defence Budget for Military Modernization to Drive Market Growth

The increased defense budgets globally are significantly driving the growth of the 155mm ammunition market, as military modernization programs gain momentum. Nations are investing heavily in upgrading their artillery systems to enhance combat effectiveness and ensure strategic superiority. This surge in funding facilitates the procurement of advanced 155mm ammunition, known for its range, precision, and destructive capability. Modern military doctrines emphasize precision-guided munitions, propelling demand for technologically advanced 155mm shells. Additionally, interoperability requirements among allied forces, especially NATO members, further boost market expansion. The focus on upgrading aging military equipment and integrating new technologies into defense arsenals underscores the critical role of 155mm ammunition in contemporary and future warfare scenarios, driving substantial market growth.

Restraints & Challenges

The 155mm ammunition market faces several challenges despite its growth prospects. High production costs, driven by the need for advanced materials and precision engineering, pose a significant barrier. Stringent regulatory requirements and compliance with international standards add to the complexity and expense of manufacturing. Additionally, geopolitical tensions can disrupt supply chains, affecting the timely availability of raw materials and components. Technological advancements also necessitate continuous investment in research and development, which can strain resources, especially for smaller manufacturers. Environmental concerns regarding the disposal and environmental impact of ammunition residues further complicate market dynamics. Lastly, the cyclical nature of defense budgets, influenced by political and economic factors, can lead to fluctuating demand, making long-term market stability a challenge.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the 155mm Ammunition Market from 2023 to 2033. The United States, as a major player, significantly contributes to market expansion through its large-scale procurement and development of advanced artillery systems. Initiatives to enhance precision and lethality in long-range fire support bolster demand for sophisticated 155mm munitions. Collaborations between defense contractors and government agencies foster innovation and technological advancements. Additionally, the presence of key manufacturers and a well-established defense infrastructure support market dynamics. Canada's defense modernization programs and participation in NATO further amplify regional demand. Overall, North America's strategic focus on maintaining military superiority ensures a strong and growing market for 155mm ammunition.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries like China, India, and South Korea are investing heavily in modernizing their artillery capabilities, driving demand for advanced 155mm munitions. Geopolitical tensions and border disputes necessitate enhanced military preparedness, further propelling market growth. Technological advancements and indigenous production initiatives in these countries are fostering local manufacturing capabilities, reducing reliance on imports. Additionally, collaborations with global defense companies and participation in international military exercises enhance interoperability and operational readiness.

Segmentation Analysis

Insights by Technology

The unguided segment accounted for the largest market share over the forecast period 2023 to 2033. The unguided segment of the 155mm ammunition market continues to witness growth, driven by its cost-effectiveness and widespread utility in conventional artillery operations. These munitions remain a staple for many military forces due to their simplicity, reliability, and ease of mass production. While guided munitions offer precision, the high costs associated with their development and deployment make unguided shells a practical choice for sustained, high-volume fire support. Ongoing conflicts and the need for efficient area saturation further sustain demand for unguided 155mm ammunition. Advances in manufacturing techniques are also improving the accuracy and effectiveness of these traditional munitions. Consequently, despite the rising prominence of precision-guided options, the unguided segment maintains a crucial role in military arsenals globally.

Insights by Component

The propellant segment dominates the market and has the largest market share over the forecast period 2023 to 2033. The growth is driven by advancements in propellant technologies and increasing demand for enhanced artillery performance. Modern military operations require munitions with improved range, consistency, and reliability, fueling research and development in propellant formulations. Innovations such as insensitive munitions, which reduce the risk of accidental explosions, and eco-friendly propellants address both safety and environmental concerns, contributing to market expansion. Additionally, the integration of smart and modular propellant systems allows for customizable performance, aligning with the needs of various combat scenarios.

Recent Market Developments

- In January 2022, Elbit Systems has announced that its SIGMA next-generation 155mm fully automated self-propelled wheeled howitzer would replace the Israeli Armed Forces' arsenal of M109 crawler howitzers. SIGMA is compatible with the IDF's ammunition depots.

Competitive Landscape

Major players in the market

- Raytheon Technologies Inc.

- General Dynamics Corporation

- Northrop Grumman Corporation

- BAE Systems PLC

- China North Industries Corporation

- Thales Group

- Leonardo S.p.A.

- Olin Corporation

- Rheinmetall AG

- Elbit Systems Ltd.

- Saab AB

- Norma Precision AB

- Remington Arms Company LLC

- Nammo AS

- Denel SOC Ltd.

- Nexter Group

- Fiocchi Munizioni SPA

- Ammo Inc.

- RUAG Holding AG

- Munitions India Ltd.

- Savage Arms

- Hornady Manufacturing Company

- MSM Group s.r.o.

- Federal Premium Ammunition

- Winchester Ammunition Inc.

- Magtech Ammunition Company Inc.

- Poongsan Corporation

- JSC Arsenal AD

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

155mm Ammunition Market, Technology Analysis

- Guided

- Unguided

155mm Ammunition Market, Component Analysis

- Projectiles

- Primers

- Propellants

- Fuze

155mm Ammunition Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the 155mm Ammunition?The global 155mm Ammunition Market is expected to grow from USD 4.6 billion in 2023 to USD 5.8 billion by 2033, at a CAGR of 2.35% during the forecast period 2023-2033.

-

2. Who are the key market players of the 155mm Ammunition Market?Some of the key market players of the market are Raytheon Technologies Inc., General Dynamics Corporation, Northrop Grumman Corporation, BAE Systems PLC, China North Industries Corporation, Thales Group, Leonardo S.p.A., Olin Corporation, Rheinmetall AG, Elbit Systems Ltd., Saab AB, Norma Precision AB, Remington Arms Company LLC, Nammo AS, Denel SOC Ltd., Nexter Group, Fiocchi Munizioni SPA, Ammo Inc., RUAG Holding AG, Munitions India Ltd., Savage Arms, Hornady Manufacturing Company, MSM Group s.r.o., Federal Premium Ammunition, Winchester Ammunition Inc., Magtech Ammunition Company Inc., Poongsan Corporation, JSC Arsenal AD.

-

3. Which segment holds the largest market share?The propellants segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the 155mm Ammunition market?North America dominates the 155mm Ammunition market and has the highest market share.

Need help to buy this report?