Global 3D Printing High Performance Plastic Market Size, Share, and COVID-19 Impact Analysis, By Type (Photopolymers, ABS & ASA, Polyamide/Nylon), By Form (Filament, Ink, Powder), By End-use (Automotive, Medical, Aerospace & Defense), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal 3D Printing High Performance Plastic Market Insights Forecasts to 2033

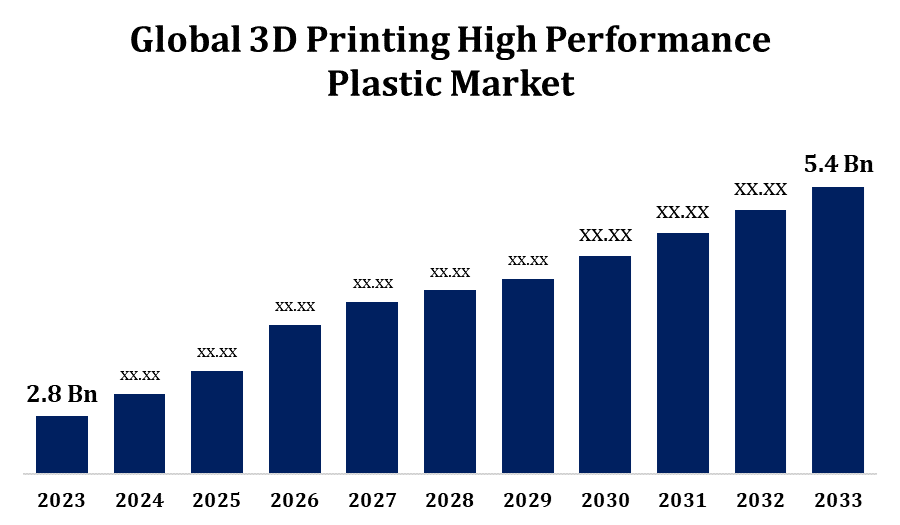

- The 3D Printing High Performance Plastic Market was valued at USD 2.8 billion in 2023.

- The Market is Growing at a CAGR of 6.79% from 2023 to 2033.

- The Global 3D Printing High Performance Plastic Market is Expected to reach USD 5.4 billion by 2033.

- Asia Pacific is Expected to Grow the Fastest during the Forecast period.

Get more details on this report -

The Global 3D Printing High Performance Plastic Market is expected to reach USD 5.4 billion by 2033, at a CAGR of 6.79% during the forecast period 2023 to 2033.

The 3D printing high-performance plastic market is experiencing rapid growth, driven by advancements in industries like aerospace, automotive, and healthcare. High-performance plastics, including PEEK, PPSU, and PEI, offer superior mechanical strength, thermal stability, and resistance to chemicals, making them ideal for complex, durable 3D-printed components. Innovations in materials and additive manufacturing processes have expanded the applications of these plastics, enabling lighter, stronger parts with intricate designs that meet stringent regulatory standards. Increased demand for customized, lightweight, and efficient solutions is pushing manufacturers to adopt high-performance plastics in 3D printing. Additionally, as production costs decrease and more industries recognize the benefits of these materials, the market is set to grow, supporting sustainability efforts and paving the way for next-generation manufacturing.

3D Printing High Performance Plastic Market Value Chain Analysis

The value chain of the 3D printing high-performance plastic market spans raw material suppliers, manufacturers, technology providers, and end-users. It begins with suppliers of specialized polymers like PEEK, PPSU, and PEI, whose production requires advanced chemical engineering. Manufacturers then process these polymers into forms suitable for 3D printing, such as filaments or powders, often in collaboration with material scientists to ensure consistent quality and performance. Technology providers play a critical role, offering 3D printing equipment and software that can handle high-performance plastics, optimizing print precision and efficiency. End-users in sectors like aerospace, automotive, and healthcare drive demand, leveraging these materials for applications requiring high strength, heat resistance, and design flexibility. This interconnected chain fosters innovation, quality assurance, and efficient production, making high-performance plastic 3D printing a viable alternative to traditional manufacturing.

3D Printing High Performance Plastic Market Opportunity Analysis

The 3D printing high-performance plastic market presents significant opportunities, fueled by rising demand in sectors requiring durable, lightweight, and complex components. Aerospace and automotive industries seek these advanced materials for parts that offer weight reduction without compromising strength, enhancing fuel efficiency and performance. In healthcare, biocompatible and sterilizable high-performance plastics enable customized medical devices and implants, creating a shift toward personalized treatment solutions. Emerging applications in electronics and defense further expand the market, with high-performance plastics providing reliable thermal and chemical stability. The growing emphasis on sustainable manufacturing also opens doors for recyclable or biodegradable high-performance plastics. As technological advances improve 3D printing efficiency and lower costs, the market is poised for substantial growth, supporting innovation across industries with precise, adaptable, and eco-friendly solutions.

Global 3D Printing High Performance Plastic Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.4 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.79% |

| 2033 Value Projection: | USD 5.4 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Form, By End-use, By Region and COVID-19 Impact Analysis |

| Companies covered:: | 3D Systems Corporation (US), Arkema (France), BASF SE (Germany), Stratasys, Ltd. (US), Solvay (Belgium), Shenzhen eSUN Industrial Co., Ltd. (China), Evonik Industries AG (Germany), EOS (Germany), Formlabs (US), SABIC (Saudi Arabia), CRP TECHNOLOGY S.r.l. (Italy), Henkel AG & Co. KGaA (Germany), Huntsman International LLC (US), Ensinger (Germany), Zortrax (Poland), and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

3D Printing High Performance Plastic Market Dynamics

The increasing demand for customized and personalized products is fueling innovation

In the 3D printing high-performance plastic market, the rising demand for customized and personalized products is a major driver of innovation. Industries such as aerospace, automotive, and healthcare increasingly require tailored solutions to meet unique functional, structural, and aesthetic needs. High-performance plastics, like PEEK and PEI, are ideal for producing complex, durable parts that can withstand extreme conditions, allowing manufacturers to design with greater flexibility and precision. This customization trend supports the development of advanced 3D printing technologies that can work with these specialized materials, enabling faster prototyping and streamlined production. Additionally, as the market expands, manufacturers are exploring recyclable and bio-based options, enhancing sustainability in personalized manufacturing and paving the way for innovative, eco-friendly practices across multiple industries.

Restraints & Challenges

High-performance plastics like PEEK, PPSU, and PEI are costly to produce and require specialized equipment for effective processing, resulting in higher upfront costs for manufacturers. This limits accessibility, especially for small and medium-sized enterprises looking to adopt 3D printing technology. Additionally, the technical complexities of working with these materials demand skilled operators and stringent quality controls to ensure product consistency and reliability, adding further operational expenses. Regulatory compliance in sectors like aerospace, healthcare, and automotive also poses hurdles, as 3D-printed parts must meet strict standards. Lastly, limited material recyclability and sustainability concerns remain, pushing manufacturers to balance performance with eco-friendly practices in a competitive, rapidly evolving market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the 3D Printing High Performance Plastic Market from 2023 to 2033. The U.S., in particular, is home to leading aerospace companies and medical device manufacturers who rely on high-performance plastics like PEEK, PPSU, and PEI for their durability, lightweight properties, and resistance to extreme conditions. Advanced manufacturing hubs and a robust R&D ecosystem further boost North America's market growth, as companies prioritize innovation in high-quality, customized parts. Government support and investments in additive manufacturing technologies also foster market expansion, while collaborations with research institutions enhance material performance and production efficiency. The region's focus on sustainability has spurred interest in recyclable or bio-based high-performance plastics, positioning North America as a market leader.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China and Japan are leading the charge, with strong government support for advanced manufacturing technologies. Asia-Pacific’s large manufacturing base and expanding healthcare sector create a high demand for high-performance plastics, such as PEEK and PPSU, used for their strength, chemical resistance, and lightweight properties. Additionally, the region’s competitive labor and production costs attract investments, while partnerships with global firms enhance technological expertise. Sustainability concerns are also pushing Asian manufacturers to explore recyclable materials and eco-friendly practices, positioning the region as an emerging leader in high-performance, 3D-printed plastic applications.

Segmentation Analysis

Insights by Type

The photopolymers segment accounted for the largest market share over the forecast period 2023 to 2033. Photopolymers are ideal for creating highly detailed and complex geometries, making them valuable in sectors like healthcare for producing dental and orthopedic components, as well as in electronics for intricate prototypes. Advances in photopolymer technology have improved material properties, enhancing strength, thermal stability, and biocompatibility, thus broadening their use in demanding applications. Additionally, photopolymers are compatible with stereolithography (SLA) and digital light processing (DLP) 3D printing methods, which are popular for their fine detail and high resolution. As more industries recognize the potential of photopolymer-based 3D printing for custom, precise, and durable parts, this segment is poised for strong growth.

Insights by Form

The filament segment accounted for the largest market share over the forecast period 2023 to 2033. Filaments made from high-performance plastics, such as PEEK, PEI, and PPSU, offer exceptional mechanical strength, chemical resistance, and thermal stability, making them ideal for functional prototypes and end-use parts that need to withstand extreme conditions. Advances in filament materials have expanded their usability, allowing for higher-quality printing and improved performance. Additionally, the growing adoption of fused deposition modeling (FDM) 3D printers, which primarily use filament-based materials, contributes to this segment’s growth. With increasing demand for custom, lightweight components and enhanced filament properties, this segment is expected to play a pivotal role in the high-performance plastic market’s expansion.

Insights by End Use

The medical segment accounted for the largest market share over the forecast period 2023 to 2033. High-performance plastics like PEEK and PPSU are increasingly used in applications such as surgical implants, prosthetics, and custom-made orthotics due to their biocompatibility, strength, and resistance to wear and chemicals. The ability to produce complex geometries tailored to individual patient needs has revolutionized personalized medicine, with 3D printing enabling rapid prototyping and cost-effective production of one-off devices. Additionally, high-performance plastics offer excellent sterilization properties, making them suitable for medical instruments and components that require stringent hygiene standards. As healthcare providers seek more efficient, cost-effective, and patient-specific solutions, the demand for high-performance plastic 3D printing in the medical sector is poised to continue growing.

Recent Market Developments

- On October 2023, Evonik has introduced a pioneering carbon-fiber reinforced PEEK filament, claiming it to be the "world's first" filament designed for 3D-printed medical implants.

Competitive Landscape

Major players in the market

- 3D Systems Corporation (US)

- Arkema (France)

- BASF SE (Germany)

- Stratasys, Ltd. (US)

- Solvay (Belgium)

- Shenzhen eSUN Industrial Co., Ltd. (China)

- Evonik Industries AG (Germany)

- EOS (Germany)

- Formlabs (US)

- SABIC (Saudi Arabia)

- CRP TECHNOLOGY S.r.l. (Italy)

- Henkel AG & Co. KGaA (Germany)

- Huntsman International LLC (US)

- Ensinger (Germany)

- Zortrax (Poland)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

3D Printing High Performance Plastic Market, Type Analysis

- Photopolymers

- ABS & ASA

- Polyamide/Nylon

3D Printing High Performance Plastic Market, Form Analysis

- Filament

- Ink

- Powder

3D Printing High Performance Plastic Market, End Use Analysis

- Automotive

- Medical

- Aerospace & Defense

3D Printing High Performance Plastic Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the 3D Printing High Performance Plastic Market?The global 3D Printing High Performance Plastic Market is expected to grow from USD 2.8 billion in 2023 to USD 5.4 billion by 2033, at a CAGR of 6.79% during the forecast period 2023-2033.

-

2. Who are the key market players of the 3D Printing High Performance Plastic Market?Some of the key market players of the market are 3D Systems Corporation (US), Arkema (France), BASF SE (Germany), Stratasys, Ltd. (US), Solvay (Belgium), Shenzhen eSUN Industrial Co., Ltd. (China), Evonik Industries AG (Germany), EOS (Germany), Formlabs (US), SABIC (Saudi Arabia), CRP TECHNOLOGY S.r.l. (Italy), Henkel AG & Co. KGaA (Germany), Huntsman International LLC (US), Ensinger (Germany), and Zortrax (Poland).

-

3. Which segment holds the largest market share?The medical segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the 3D Printing High Performance Plastic Market?North America dominates the 3D Printing High Performance Plastic Market and has the highest market share.

Need help to buy this report?