Global 4K Set-Top Box Market By Product Type (Satellite, Cable, Hybrid, IPTV/OTT STBs (Internet Protocol Television/Over-the-Top), Others), By Application (Residential, Commercial), By Distribution Channel (Offline, Online); By Region (U.S., Canada, Mexico, Rest of North America, The UK, France, Germany, Italy, Spain, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, the Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America) - Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2021-2030

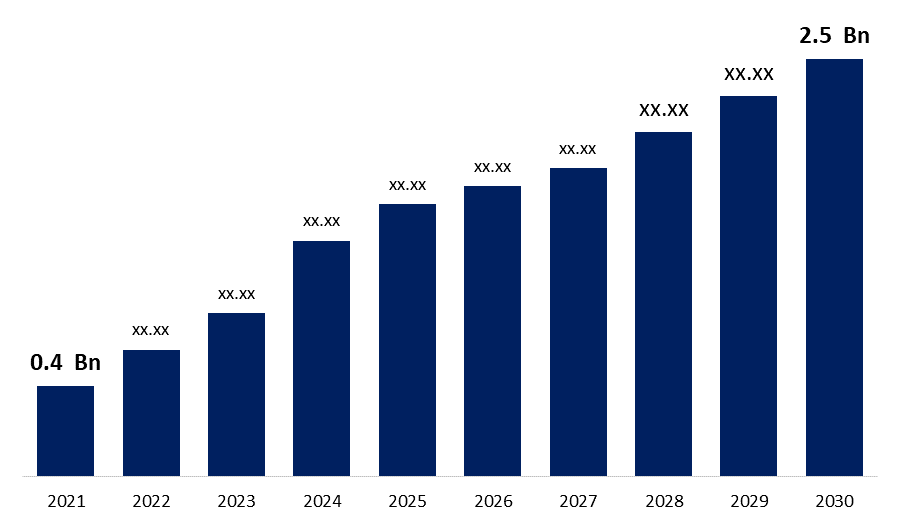

Industry: Semiconductors & ElectronicsThe global 4k Set-Top Box Market size was USD 0.4 Billion in 2021and is projected to reach USD 2.5 Billion by 2030 exhibiting a CAGR of 4.7% during the forecast period. A set-top box (STB) is a hardware that receives, decodes, and displays digital television transmissions. Set-top boxes are most used in cable and satellite television applications. The market is expected to develop because of the increasing demand in over-the-top (OTT) platforms such as Netflix, Hulu, and Prime Video, and others. In addition, rising demand for 4K high-definition in-home entertainment is likely to boost 4K set-top box sales. To improve customer experience, key companies in this market are focused on new product launches. For example, Tata Sky, a DTH provider, announced Tata Sky Binge+, a new Android-based 4K set-top box in January 2020 to provide users with exceptional features.

Get more details on this report -

During the projection period, the market is projected to benefit from the spread of internet services and broadband, as well as on-demand video content and HD channels. TV viewership patterns are being influenced positively by market factors such as technology advancements such as 4K and 8K support and smart home service integration in STBs. Industry participants will contribute to the market expansion by launching new UHD and OTT boxes. Various government initiatives aimed at hastening the digitalization of television services, particularly in Latin America and Asia, may offer new business opportunities.

COVID-19 Analysis

The breakout of COVID-19 in 2020 and 2021 wreaked havoc on the market. A major slowdown in new set-top box installations was caused by a number of industry issues, including restrictions on social movements and goods shortages as a result of the shipping prohibition. During the pandemic, market leaders like Broadband SAS, Mybox Technologies Pvt Ltd., Kaon Media Co., Ltd., and TechniSat Digital GmbH suffered major financial losses. However, due to a shift in consumer focus toward a better TV viewing experience post-pandemic, the industry is expected to see stable demand.

Product Outlook

The satellite segment is expected to dominate the market share in 2020 of global 4k set-top box market owing to the most popular STBs because to their lower device costs, less weight, and smaller design compared to IPTV and hybrid STBs, boosting industry value. Furthermore, a satellite set-top box provides access to a diverse choice of national and international channels, bringing consumers up to date on current events throughout the world. Advanced satellite set-top boxes come with a variety of functions, including live program recording, video on demand, and multimedia interactive services, all of which contribute to the industry's growth. Manufacturers are concentrating on increasing the speed with which satellite STBs are produced in order to reduce inventory.

The IPTV/OTT segment is anticipated to emerge as the fastest-growing region of the global 4k set-top box market over the forecast period owing to OTT taking advantage of the public internet to deliver material from service providers such as Hulu and Netflix, making it cheaper. OTT services, unlike IPTV, do not guarantee the quality of media material and do not deliver live programming. Over the projected period, the deployment of OTT and IPTV services is expected to assist cable operators in expanding their client database.

Global 4K Set-Top Box Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 0.4 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 4.7% |

| 2030 Value Projection: | USD 2.5 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | Product Type, By Application, By Distribution Channel, By Region, |

| Companies covered:: | ZTE Corporation, Huawei Technologies, Technicolor SA, Intek Digital Inc, Skyworth Digital Ltd, Sagemcom SAS, Broadcom, ARRIS International PLC (CommScope Inc.), HUMAX Electronics Co. Ltd, Gospell Digital Technology Co. Limited, Kaon Media Co. Limited, Shenzhen Coship Electronics Co. Ltd, Evolution Digital LLC, Shenzhen SDMC Technology Co. Ltd. |

| Growth Drivers: | 1) The residential segment is expected to dominate the market share 2) The satellite segment is expected to dominate the market share |

| Pitfalls & Challenges: | The breakout of COVID-19 in 2020 and 2021 wreaked havoc on the market. |

Get more details on this report -

Application Outlook

The residential segment is expected to dominate the market share in 2020 of the global 4k set-top box market owing to the government actions that support television transmission are producing a healthy market picture for STBs around the world. Market leaders are forming strategic alliances with significant firms like SFR and Orange, which will help the industry thrive.

Distribution Channel Outlook

The offline segment is expected to dominate the market share in 2020 of the global 4k set-top box market owing to the various STB OEMs and e-commerce industry players launching new physical stores in order to boost customer shopping experiences and market data.

Regional Outlook

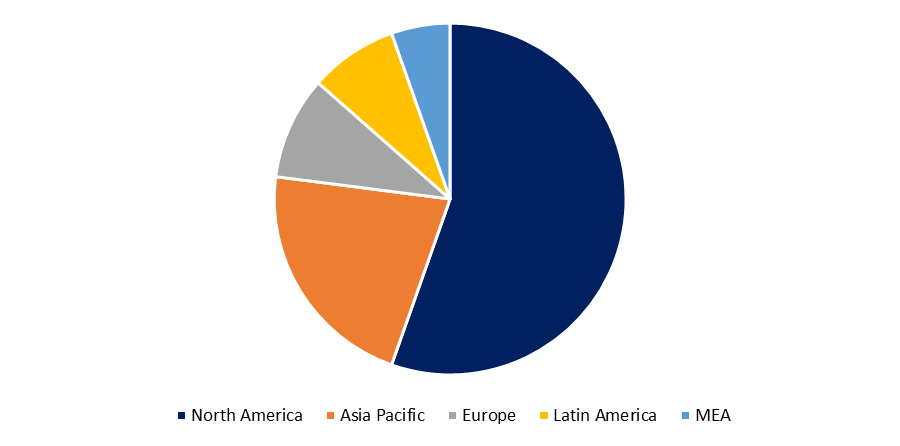

North America is expected to dominate the market share in 2020 of the global 4k set-top box market owing to the greater adoption of 4K HD and smart TVs, rising consumer per capita income, and increased 4K technology investments are all contributing to the region's growth. Key players in this region are concentrating on introducing 4K set-top boxes to enhance client demand. For the TDS TV+ cloud-based video platform, TDS Telecom and Arris International have planned to offer an Android TV-based VIP6102W UHD IP set-top solution in July 2019. This solution will meet the end-user requirement for an efficient, easy-to-use, and simple video solution.

Get more details on this report -

The Asia Pacific segment is predicted to emerge as the fastest-growing region of the global 4k set-top box market over the forecast period owing to the presence of key market players like Huawei Technologies, ZTE Corporation, and others. These leading market players are concentrating on developing new products in order to expand their product range. For example, to extend its client base, ZTE Corporation announced its new 4K Hybrid dongle set-top box (STB) in September 2019 at the International Broadcasting Convention (IBC) 2019 in Amsterdam.

Key Companies & Recent Developments

Partnerships, strategic mergers, and acquisitions are expected to be the most successful strategies for industry participants to get speedy access to growing markets while also improving technological capabilities. For instance, in July 2019, TDS Telecom and Arris International planned to deploy an Android TV-based VIP6102W UHD IP set-top solution for the TDS TV+ cloud-based video platform. In addition, product differentiation and developments, as well as service expansion, are projected to help organizations thrive in the market. For instance, in September 2021, Technicolor provided TIM with next-generation Android TV set-top boxes (STBs) to give Italians access to premium services from broadcasters and over-the-top (OTT) providers such as Netflix, Amazon, Infinity, Disney+, and DAZN. For instance, in October 2020, ZTE Corporation made a strategic collaboration with with China Unicom and can provide 5G connection in coastal and hilly areas using converged gateway, multipoint AP, and mesh protocol in the downlink by launching 5G convergent set-top box with a gigabit gateway and router. For instance, in July 2021, Sagemcom launched a new version, IP/DVB-T2 Ultra HD Set-top Box for TIM based on the Broadcom BCM72180 quad-core SoC with incorporated Wi-Fi 6 and AV1 decoding capabilities and runs at 24k DMIPS.

Market Segmentation of Global 4K Set-Top Box Market

By Product Type

- Satellite

- Cable

- Hybrid

- IPTV/OTT (Internet Protocol Television/Over-the-Top

- Others

By Application

- Residential

- Commercial

Key Players

- ZTE Corporation

- Huawei Technologies

- Technicolor SA

- Intek Digital Inc.

- Skyworth Digital Ltd

- Sagemcom SAS

- Broadcom

- ARRIS International PLC (CommScope Inc.)

- HUMAX Electronics Co. Ltd

- Gospell Digital Technology Co. Limited

- Kaon Media Co. Limited

- Shenzhen Coship Electronics Co. Ltd

- Evolution Digital LLC

- Shenzhen SDMC Technology Co. Ltd

Need help to buy this report?