Global 5G Chipset Market Size, Share, and COVID-19 Impact Analysis, By Type (Modems, RFICs, and Others), By Operating Frequency (Sub-6 GHz, 24-39 GHz, and Above 39 GHz), By Processing Node Type (7 nm, 10 nm, and Others), By Deployment Type (Telecom Base Station Equipment, Smartphones/Tablets, Connected Vehicles, Connected Devices, Broadband Access Gateway Devices, and Others), By Industry Vertical (Manufacturing, Energy & Utilities, Media & Entertainment, IT & Telecom, Transportation & Logistics, Healthcare, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Semiconductors & ElectronicsGlobal 5G Chipset Market Insights Forecasts to 2032

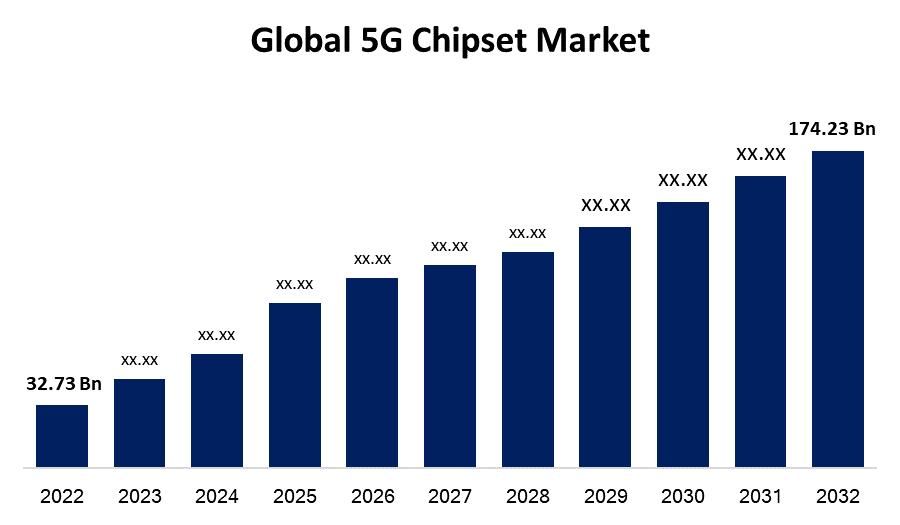

- The 5G chipset Market Size was valued at USD 32.73 Billion in 2022.

- The Market Size is Growing at a CAGR of 18.2% from 2022 to 2032.

- The Worldwide 5G chipset Market Size is expected to reach USD 174.23 Billion by 2032

- North America is expected To Grow the fastest during the forecast period.

Get more details on this report -

The Global 5G chipset Market Size is expected to reach USD 174.23 Billion by 2032, at a CAGR of 18.2% during the forecast period 2022 to 2032.

Market Overview

A 5G chipset refers to the integrated circuit that powers devices to connect and communicate over the fifth generation (5G) wireless network. It is a crucial component in smartphones, tablets, IoT devices, and other wireless devices. The 5G chipset incorporates advanced technologies to enable faster data speeds, lower latency, and increased network capacity compared to previous generations. It supports multiple frequency bands, including both sub-6 GHz and mmWave bands, and utilizes techniques like beamforming and massive MIMO for improved coverage and signal strength. The chipset also includes security features to ensure data privacy and protection. With the advent of 5G chipsets, users can experience enhanced mobile connectivity, real-time applications, and the potential for transformative technologies like autonomous vehicles, remote surgery, and smart cities.

Report Coverage

This research report categorizes the market for 5G chipset market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the 5G chipset market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the 5G chipset market.

Global 5G Chipset Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 32.73 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 18.2% |

| 2032 Value Projection: | USD 174.23 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Operating Frequency, By Processing Node Type, By Deployment Type, By Industry Vertical, By Region. |

| Companies covered:: | Huawei Technologies, Inc, MediaTek Inc, Intel Corporation, Samsung, Infineon Technologies AG, Qualcomm Technologies, Inc, Unisoc Communications Inc, Qorvo, Inc, Anokiwave, Inc, Xilinx, Nokia Corporation, Renesas Electronics Corporation, NXP Semiconductors NV, Analog Devices Inc, Cavium Inc |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The 5G chipset market is driven by several key factors. The growing demand for high-speed and low-latency connectivity is a major driver. With the increasing adoption of bandwidth-intensive applications such as video streaming, virtual reality, and IoT devices, the need for faster and more reliable networks has surged. The proliferation of 5G-enabled smartphones and devices has fueled the demand for 5G chipsets. As consumers seek to upgrade their devices to take advantage of the enhanced capabilities of 5G networks, there is a significant market opportunity for chipsets that enable seamless 5G connectivity. The development of advanced technologies like autonomous vehicles, smart cities, and industrial automation is heavily dependent on 5G networks, driving the demand for 5G chipsets. Overall, government initiatives and investments in 5G infrastructure and deployment have further propelled the growth of the 5G chipset market.

Restraining Factors

The 5G chipset market faces certain restraints that impact its growth. The high cost of 5G infrastructure deployment and network upgrades is a significant restraint. The implementation of 5G networks requires substantial investments in infrastructure, including base stations and equipment, which can be a deterrent for network operators. Additionally, the limited coverage and availability of 5G networks in certain regions pose a challenge for the widespread adoption of 5G chipsets. Furthermore, regulatory challenges, such as spectrum allocation and licensing, can create barriers to entry for chipset manufacturers. Overall, interoperability issues between different 5G network standards and compatibility with existing technologies can hinder seamless integration of 5G chipsets into devices and networks.

Market Segmentation

- In 2022, the RFICs segment accounted for around 42.7% market share

On the basis of the type, the global 5G chipset market is segmented into modems, RFICs, and others. The radio frequency integrated circuits (RFICs) segment has emerged as the dominant player in the 5G chipset market. RFICs play a crucial role in wireless communication systems by converting digital signals into radio frequency signals for transmission and vice versa. They are widely used in 5G devices and infrastructure, including smartphones, base stations, and other wireless devices. Several factors contribute to the dominance of the RFICs segment. RFICs enable the essential functions of 5G networks, such as signal amplification, filtering, and modulation/demodulation. They are responsible for efficient and reliable wireless communication, ensuring high-speed data transfer and low latency. The increasing demand for higher frequency bands, such as mmWave, in 5G networks requires advanced RFICs capable of handling these frequencies. RFICs offer the necessary performance and power efficiency for operating in these frequency ranges. Moreover, the RFICs segment benefits from continuous advancements in semiconductor technology, enabling the integration of more functionalities and improving overall performance. Overall, the RFICs segment dominates the 5G chipset market due to its essential role in enabling reliable and efficient wireless communication in 5G networks.

- In 2022, the smartphones segment dominated with more than 46.5% market share

Based on the type of deployment, the global 5G chipset market is segmented into telecom base station equipment, smartphones/tablets, connected vehicles, connected devices, broadband access gateway devices, and others. The smartphone segment has emerged as the dominant player in the 5G chipset market, capturing the largest market share. This dominance can be attributed to several factors. Smartphones are one of the primary drivers of 5G adoption, as consumers seek to upgrade their devices to take advantage of the enhanced capabilities offered by 5G networks. As a result, there is a significant demand for 5G chipsets to power these smartphones and enable seamless connectivity. Smartphone manufacturers have been actively incorporating 5G capabilities into their flagship devices, creating a strong market for 5G chipsets. Moreover, the increasing availability of affordable 5G smartphones in various price segments has further boosted the demand for 5G chipsets, leading to the smartphone segment's dominance in the market share.

Regional Segment Analysis of the 5G Chipset Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

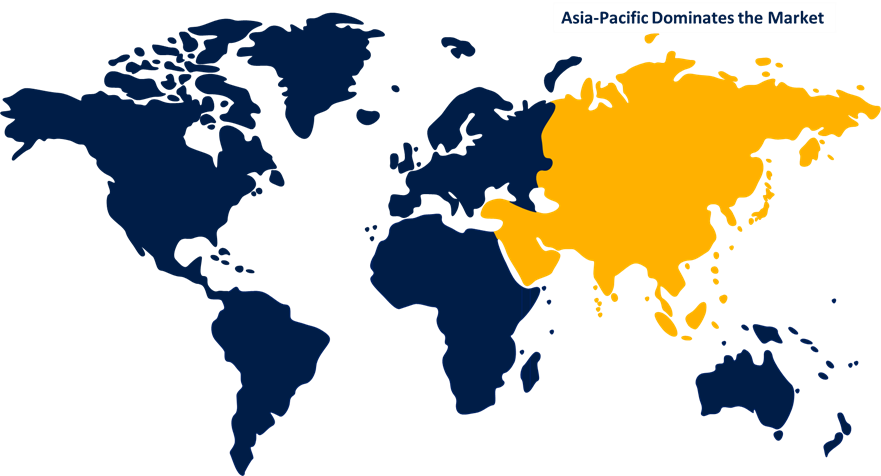

Asia-Pacific dominated the market with more than 39.5% revenue share in 2022.

Get more details on this report -

Based on region, Asia-Pacific has emerged as a dominant player in the 5G chipset market, holding the largest market share. Several factors contribute to this regional growth. Asia-Pacific is home to some of the world's largest and fastest-growing economies, such as China, India, Japan, and South Korea. These countries have made significant investments in 5G infrastructure, creating a robust market for 5G chipsets. The region has a massive population with a high smartphone penetration rate, driving the demand for 5G-enabled devices and consequently increasing the demand for 5G chipsets. Moreover, Asia-Pacific boasts a strong manufacturing base, making it a hub for smartphone production, which further fuels the adoption of 5G chipsets. Additionally, the region is witnessing rapid digital transformation and the development of smart cities, autonomous vehicles, and IoT applications, all of which rely on 5G networks and contribute to the increased demand for 5G chipsets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global 5G chipset market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Huawei Technologies, Inc.

- MediaTek Inc.

- Intel Corporation

- Samsung

- Infineon Technologies AG

- Qualcomm Technologies, Inc.

- Unisoc Communications Inc.

- Qorvo, Inc.

- Anokiwave, Inc.

- Xilinx

- Nokia Corporation

- Renesas Electronics Corporation

- NXP Semiconductors NV

- Analog Devices Inc.

- Cavium Inc.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, Qualcomm Technologies, Inc., a semiconductor technology company, introduced its latest 6th generation 5G radio frequency modem called Snapdragon X75. The key highlight of the Snapdragon X75 5G modem is its support for 5G-Advanced (5G-A), a network protocol that surpasses the capabilities of standard 5G connections. With 5G-A, users can experience enhanced benefits such as higher bandwidth and reduced latency, paving the way for a wide range of exciting applications for both consumers and enterprises.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global 5G chipset market based on the below-mentioned segments:

5G Chipset Market, By Type

- Modems

- RFICs

- Others

5G Chipset Market, By Operating Frequency

- By Operating Frequency

- Sub-6 GHz

- 24-39 GHz

- Above 39 GHz

5G Chipset Market, By Processing Node Type

- 7 nm

- 10 nm

- Others

5G Chipset Market, By Deployment Type

- Telecom Base Station Equipment

- Smartphones/Tablets

- Connected Vehicles

- Connected Devices

- Broadband Access Gateway Devices

- Others

5G Chipset Market, By Industry Vertical

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- IT & Telecom

- Transportation & Logistics

- Healthcare

- Others

5G Chipset Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?