Global 5G Fixed Wireless Access Market Size, Share, and COVID-19 Impact Analysis, By Offering (Hardware, Service), By Demography (Urban, Semi-urban, Rural), By Operating Frequency (Sub 6GHz, 24-39 GHz, Above 39 GHz), By Application (Residential, Commercial, Industrial, Government, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Semiconductors & ElectronicsGlobal 5G Fixed Wireless Access Market Insights Forecasts to 2030

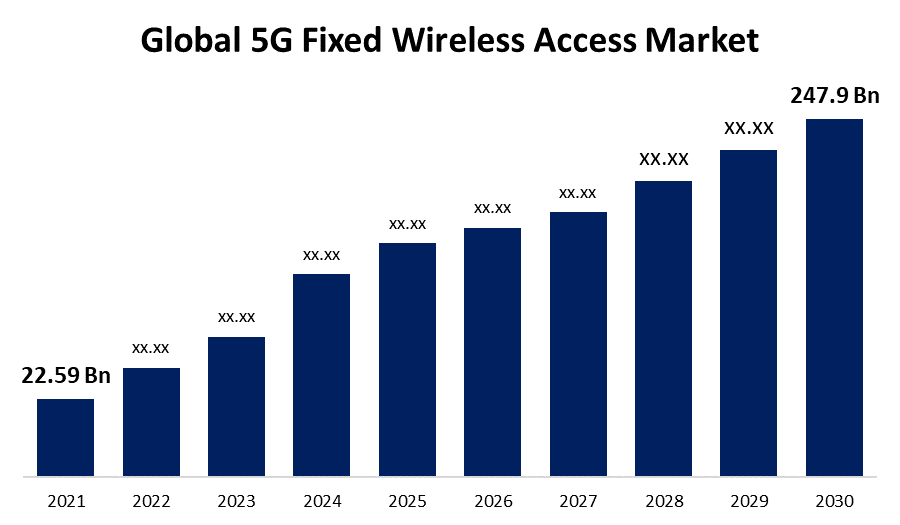

- The 5G Fixed Wireless Access Market Size was valued at USD 22.59 Billion in 2021.

- The Market is growing at a CAGR of 30.5% from 2021 to 2030

- The Worldwide 5G Fixed Wireless Access Market Size is expected to reach USD 247.9 Billion by 2030

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global 5G Fixed Wireless Access Market Size is expected to reach USD 247.9 Billion by 2030, at a CAGR of 30.5% during the forecast period 2021 to 2030.

With the introduction of 5G, technological advancement is colliding with the expectations of fixed line services and pricing strategies. Fixed Wireless Access allows the network companies to provide ultra-high-speed internet service in suburban and rural areas where installing and maintaining fiber-optic cable would be prohibitively expensive. This is useful for both residential and commercial applications. Utilizing 5G Fixed Wireless Access in the lower frequency band of the radio spectrum, wired broadband alternatives can be delivered quickly and affordably. 5G FWA can offer a level of service bandwidth capacity equivalent to fibre optic cables in the mm wavelength range.

The high expenses and technical difficulties of providing fixed broadband have always presented an obstacle to the band of high internet services. Even as technological advances like WiMAX have made attempts to avoid the local loop and stop the fiber trench, such initiatives have repeatedly failed mainly because they needed a brand-new overlay infrastructure and high-priced specialized machinery. 5G Fixed Wireless Access, on the other hand, uses structured 3GPP frameworks and commonly used mobile materials to provide ultra-high-speed broadband access to residential and company users.

Global 5G Fixed Wireless Access Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 22.59 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 30.5% |

| 2030 Value Projection: | USD 247.9 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 135 |

| Segments covered: | By Offering, By Demography, By Operating Frequency, By Application, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Huawei Technologies Co., Ltd., Telefónica S.A., Cohere Technologies, Inc., Ericsson, Nokia, CableFree, AT&T Inc., Telus Corporation, Samsung Electronics, Inseego Corp., Orange S.A., Qualcomm Technologies, Inc., Intel Corporation, MediaTek Inc., COMMSCOPE, Verizon Communications Inc. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global demand for fixed wireless access is increasing as a result of technological developments amounting from LTE to 5G. Fixed wireless access provides for low connection delay and the broad distribution of broadband connections to domestic consumers as well as medium-sized enterprises (SMEs). Furthermore, the rapid expansion of the 5G FWA market is anticipated to be driven by the development of 5G coverage. Wireless connectivity at high data rates is now possible with 5G, which makes it an effective proposition for wired telecommunications services.

The demand for 5G Fixed Wireless Access is also anticipated to be driven by private 5G networks, which provide enhanced security, customizability, low latency, increased network capacity, and enhanced reliability. Private 5G networks may be more promising to companies and other entities that handle sensitive information since they are able to deliver greater security than open networks. This increased security may boost the 5G FWA market implementations, which provide high-speed connectivity over a protected wireless connection. Over the course of the forecast period, regions that are currently underserved or unserved by wired network broadband networks are anticipated to offer the market lucrative expansion opportunities. Furthermore, following the July 5G spectrum auction in India, a leading service provider stated a goal of serving 100 million residences and millions of enterprises with 5G FWA services.

In order to meet the growing demand from a variety of consumers around the world, many 5G FWA access solution providers are concentrating on releasing cutting-edge solutions. The demand for lightning-fast broadband services is also driven by the development of the Internet of Things (IoT) and smart home technologies, which is expected to drive the 5G FWA market growth. Rather than requiring a wired connection, devices are able to link straight to the internet and transmit in real-time using 5G FWA. This results in an enhanced integrated and cost-effective home setting, with devices interacting with one another to optimize work activities and enhance user satisfaction.

Restraining Factors

The transition from conventional networks to 5G FWA will be challenging since conventional fronthaul/backhaul networks are contradictory with the latest, cutting-edge fronthaul/backhaul equipment. As a result, the 5G fixed wireless access market could expand more gradually. Market expansion is also hampered by the high component costs of the millimeter-wave spectrum. The high precision required for small component manufacturing raises production costs and causes non-line-of-sight issues.

Market Segmentation

By Offering Insights

The service segment is dominating the market with the largest revenue share over the forecast period.

On the basis of offering, the global 5G fixed wireless access market is segmented into hardware and service. Among these, the service segment is dominating the market with the largest revenue share of 72% over the forecast period. Mobile broadband networks have been upgraded globally to meet the growing demand for the Internet, which has contributed to the growth of this segment. As a result of the emergence of data-intensive application processes and the development of the Internet of Things, both companies and customers are demanding more rapid and dependable broadband access. 5G fixed wireless access networks, with their high speed and high bandwidth, are an excellent alternative for achieving these requirements, and network operators are quickly increasing their products and services to meet this market pressure. The services segment of the 5G FWA market is projected to continue growing and contribute to significant market share in the long term since these services get more and more widely available.

By Demography Insights

The urban segment accounted for the largest market share over the forecast period.

On the basis of demography, the global 5G fixed wireless access market is segmented into urban, semi-urban, and rural. Among these, the urban segment is dominating the market and is going to continue its dominance over the forecast period. The expansion of 5G FWA solutions in urban areas is primarily being fueled by a number of key variables, including rising demand for ultra-fast internet access, the increasing popularity of smart city development, a growing number of IoT devices, and trends in 5G technology. Additionally, 5G FWA solutions can accommodate an enormous amount of wireless networks, which is crucial for processes like the Internet of Things (IoT) and smart home automation, as the number of connected devices is projected to grow rapidly in the forecast period, particularly in urban areas.

By Operating Frequency Insights

The 6 GHz segment accounted for the largest revenue share of more than 45% over the forecast period.

On the basis of operating frequency, the global 5G fixed wireless access market is segmented into sub 6 GHz, 24-39 GHz, and above 39 GHz. Among these, the 6 GHz segment is dominating the market with the largest revenue share of 45% over the forecast period. A major factor contributing to the segment's growth is the sub-6 GHz operating frequency's capacity to provide improved coverage through building and wall structures and to provide better connectivity in both indoor as well as outdoor settings. Additionally, broadband providers can offer high-speed, low delayed internet access to rural areas without requiring the installation of significant fiber architecture through the utilization of the sub 6 GHz frequency band for 5G FWA operations.

By Application Insights

The commercial segment accounted for the largest revenue share of more than 37% over the forecast period.

On the basis of application, the global 5G fixed wireless access market is segmented into residential, commercial, industrial, government, and others. Among these, the commercial segment is dominating the market with the largest revenue share of 37% over the forecast period. The leading factors influencing the growth of the segment are the increasing IoT technology and the exponentially growing use of video conferencing solutions. The significance of high-speed internet is expanding as companies increasingly rely on cloud-based services. Commercial customers may find 5G FWA to be a more effective approach than wired network connectivity because it can offer greater speeds for the internet and more dependable connectivity. Additionally, as remote work becomes more prevalent, video conferencing is being implemented more frequently in professional environments.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 32.5% market share over the forecast period, owing to the rapidly increasing 5G infrastructure investments will be a primary driver of market growth over the forecast period. The implementation of small cells, fiber-optic cables, and other network elements constitute the most significant expenditures incurred in 5G infrastructure in North America. Furthermore, the North American authorities are encouraging 5G technology deployment through a number of campaigns and guidelines intended to enhance internet infrastructure. The growth of the region over the anticipated period is encouraged by such factors.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. Due to the region's fastest-growing and leading industrialized economies, rising demand from emerging economies such as China, Japan, India, and South Korea is propelling the region's 5G fixed wireless access market growth. Moreover, the region has a rapidly expanding e-commerce market as well as a growing demand for digital services such as online gaming, streaming services, and social media. The high-speed internet needed for these services can be provided by 5G FWA, making it a desirable choice for customers in the region.

List of Key Market Players

- Huawei Technologies Co., Ltd.

- Telefónica S.A.

- Cohere Technologies, Inc.

- Ericsson

- Nokia

- CableFree

- AT&T Inc.

- Telus Corporation

- Samsung Electronics

- Inseego Corp.

- Orange S.A.

- Qualcomm Technologies, Inc.

- Intel Corporation

- MediaTek Inc.

- COMMSCOPE

- Verizon Communications Inc.

Key Market Developments

- In Feb 2023, Ericsson and Australia's National Broadband Network announced the signing of a memorandum of understanding (MoU) that will pave the way for greater collaboration in fixed wireless telecommunications research, development, and innovation. Ericsson will supply nbnTM with next-generation technology critical to enabling 5G in many existing towers across the nbnTM Fixed Wireless network under the terms of the exclusive agreement.

- In April 2022, UScellular has introduced its 5G mmWave high-speed internet service in parts of ten cities in collaboration with Qualcomm Technologies, Inc. and Inseego. The Inseego WavemakerTM FW2010 outdoor 5G CPE, powered by the Qualcomm® 5G Fixed Wireless Access Platform Gen 1 with Snapdragon® X55 5G Modem-RF System, delivers high-speed internet access wirelessly to customers' homes or businesses.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the Global 5G Fixed Wireless Access Market based on the below-mentioned segments:

5G Fixed Wireless Access Market, By Offering Analysis

- Hardware

- Service

5G Fixed Wireless Access Market, By Demography Analysis

- Urban

- Semi-urban

- Rural

5G Fixed Wireless Access Market, By Operating Frequency Analysis

- Sub 6GHz

- 24-39 GHz

- Above 39 GHz

5G Fixed Wireless Access Market, Application Analysis

- Residential

- Commercial

- Industrial

- Government

- Others

5G Fixed Wireless Access Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which region is dominating the 5G Fixed Wireless Access market?North America is dominating the 5G Fixed Wireless Access market with more than 32.5% market share.

-

2. What is the market size of the 5G Fixed Wireless Access market?The Global 5G Fixed Wireless Access Market is expected to grow from USD 22.59 billion in 2021 to USD 247.9 billion by 2030, at a CAGR of 30.5% during the forecast period 2021-2030.

-

3. What are the elements driving the growth of the 5G Fixed Wireless Access market?Rising demand for high-speed internet, advancements in 5G technology, the rise of remote working, and the expansion of 5G network coverage are key elements driving the 5G fixed wireless access market growth.

-

4. Which are the key companies in the market?Huawei Technologies Co., Ltd., Telefónica S.A., Cohere Technologies, Inc., Ericsson, Nokia, CableFree, AT&T Inc., Telus Corporation, Samsung Electronics, Inseego Corp., Orange S.A., Qualcomm Technologies, Inc., Intel Corporation, MediaTek Inc., COMMSCOPE, Verizon Communications Inc.

-

5. Which segment dominated the 5G Fixed Wireless Access market share?The services segment in offering type dominated the 5G Fixed Wireless Access market in 2021 and accounted for a revenue share of over 72%.

-

6. Which segment holds the largest market share of the 5G Fixed Wireless Access market?The commercial segment based on application type holds the maximum market share of the 5G Fixed Wireless Access market.

Need help to buy this report?