Global Acetylene Black Market Size, Share, and COVID-19 Impact Analysis, By Type (Powder Form and Granular Form), By Application (Adhesives/Sealants/Coatings, Batteries, Rubber, Greases, Cosmetics & Personal Care, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Acetylene Black Market Insights Forecasts to 2033

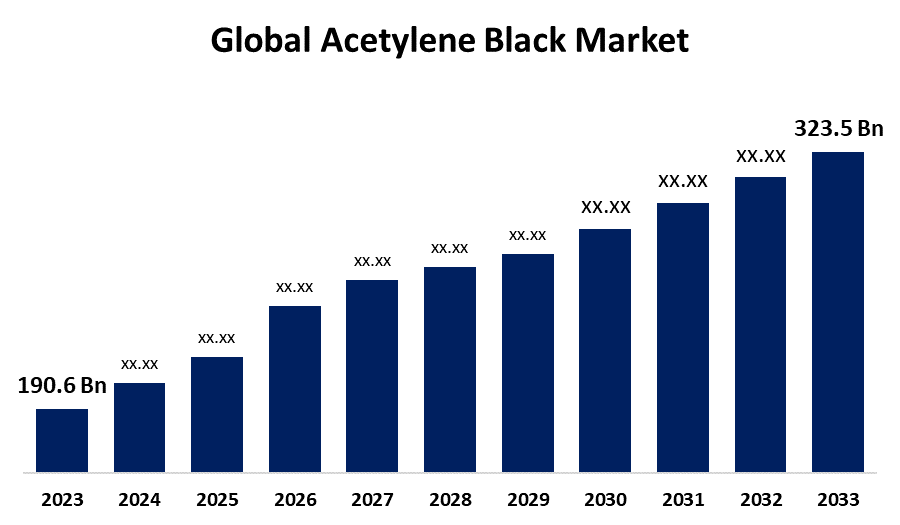

- The Global Acetylene Black Market Size was Estimated at USD 190.6 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 5.43% from 2023 to 2033

- The Worldwide Acetylene Black Market Size is Expected to Reach USD 323.5 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Acetylene Black Market Size is anticipated to Exceed USD 323.5 Billion by 2033, Growing at a CAGR of 5.43% from 2023 to 2033. The increasing need for battery manufacturing and expanding electronics & automotive sectors are bolstering the acetylene black market growth.

Market Overview

The acetylene black market refers to the market for a conductive chemical used in batteries, rubber, and other applications. The surging demand for lithium-ion batteries has driven the market for acetylene black. Acetylene black is a type of carbon black made by the thermal decomposition of acetylene gas. This product is available in powder and granular forms, as well as standard and battery grades. Further, it is characterized by relatively high electrical conductivity and is used chiefly as a filler in dry cells, rubber, and plastics. It is useful material in many different industries, including energy storage, because of its exceptional qualities, which include high surface area, high electrical conductivity, and strong thermal stability. The rising production of batteries is offering lucrative market growth opportunities for acetylene black.

Report Coverage

This research report categorizes the acetylene black market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the acetylene black market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the acetylene black market.

Acetylene Black Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 190.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.43% |

| 2033 Value Projection: | USD 323.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 238 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Sun Petrochemicals, UBIQ TECHNOLOGY CO., LTD., Orion Engineered Carbons, Tianjin Yiborui Chemical Co., Ltd., Denka Company Limited, Ningxia Jinhua Chemical Co., Ltd., Xiahuayuan Xuguang Chemical Co., Ltd, Hexing Chemical Industry, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The extensive use of acetylene black as a conductive additive for battery cathode and anode preparation is driving the acetylene black market demand. Further, the increasing use of acetylene black as a conductive carbon material in electric vehicles (EVs) for producing lithium-ion batteries is propelling the market. In addition, applications such as batteries, power cables, and tires are propelling the market demand for acetylene black.

Restraining Factors

The availability of alternative products including silica, carbon black, graphite, conductive polymers, and metal oxides that are used in diverse end-use industries are challenging the acetylene black market. The price volatility of raw materials is hindering the acetylene black market.

Market Segmentation

The acetylene black market share is classified into type and application.

- The powder form segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the acetylene black market is classified into powder form and granular form. Among these, the powder form segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. Powdered form of acetylene black is used as a conductive additive in batteries and electronic components. The advent of electric vehicles, renewable energy, and other technologies that require high electrical conductivity are driving the market demand.

- The batteries segment held the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the acetylene black market is classified into adhesives/sealants/coatings, batteries, rubber, greases, cosmetics & personal care, and others. Among these, the batteries segment held the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. The rising consumption of product in battery production owing to the demand for lithium-ion batteries for EVs, energy storage systems, and consumer electronics. The surging trend for advanced and efficient battery technologies is driving the market.

Regional Segment Analysis of the Acetylene Black Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the acetylene black market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the acetylene black market over the predicted timeframe. The region's focus on innovation and technology for high-performance batteries and advanced materials has led to high market growth. Further, the expanding automotive industry is expected to propelling the market demand for acetylene black. In addition, the widespread use of battery electrodes and conductive materials are contributing to propel market demand.

Europe is expected to grow at the fastest CAGR growth of the acetylene black market during the forecast period. The need for high-performance products, the growing emphasis on sustainability, and environmental regulations are propelling the acetylene black market. The presence of global top automakers in region like Germany as well as the trend towards electric vehicle is propelling the regional market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the acetylene black market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sun Petrochemicals

- UBIQ TECHNOLOGY CO., LTD.

- Orion Engineered Carbons

- Tianjin Yiborui Chemical Co., Ltd.

- Denka Company Limited

- Ningxia Jinhua Chemical Co., Ltd.

- Xiahuayuan Xuguang Chemical Co., Ltd

- Hexing Chemical Industry

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Global speciality chemicals firm Orion S.A. recently announced the groundbreaking of its battery materials plant in the city of La Porte, southeast of Houston in the state of Texas, claimed as "the only facility" in the United States producing acetylene-based conductive additives for lithium-ion batteries.

- In November 2023, SCC joined hands with Denka to invest 1.48 billion baht to build an Acetylene Black factory for use in the EV battery production chain, located in Rayong Province.

- In October 2022, SCG Chemicals Public Company Limited or SCGC inked a joint venture agreement with Denka Company Limited or Denka, Japan. The joint venture was established to operate an acetylene black manufacturing business in the province of Rayong. The production capacity would be approximately 11,000 tonnes annually and is expected to commence by early 2025.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the acetylene black market based on the below-mentioned segments:

Global Acetylene Black Market, By Type

- Powder Form

- Granular Form

Global Acetylene Black Market, By Application

- Adhesives/Sealants/Coatings

- Batteries

- Rubber

- Greases

- Cosmetics & Personal Care

- Others

Global Acetylene Black Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the acetylene black market over the forecast period?The acetylene black market is projected to expand at a CAGR of 5.43% during the forecast period.

-

2. What is the market size of the acetylene black market?The Acetylene Black Market Size is Expected to Grow from USD 190.6 Billion in 2023 to USD 323.5 Billion by 2033, at a CAGR of 5.43% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the acetylene black market?Asia Pacific is anticipated to hold the largest share of the acetylene black market over the predicted timeframe.

Need help to buy this report?