Global Acrylamide Market Size, Share, and COVID-19 Impact Analysis, By Product (Polyacrylamide, Acrylamide Copolymers, and Acrylamide Crystals), By Application (Wastewater Treatment, Dispersing Agent, Oil Recovery Agent, and Stabilizer & Thickener), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Acrylamide Market Insights Forecasts to 2033

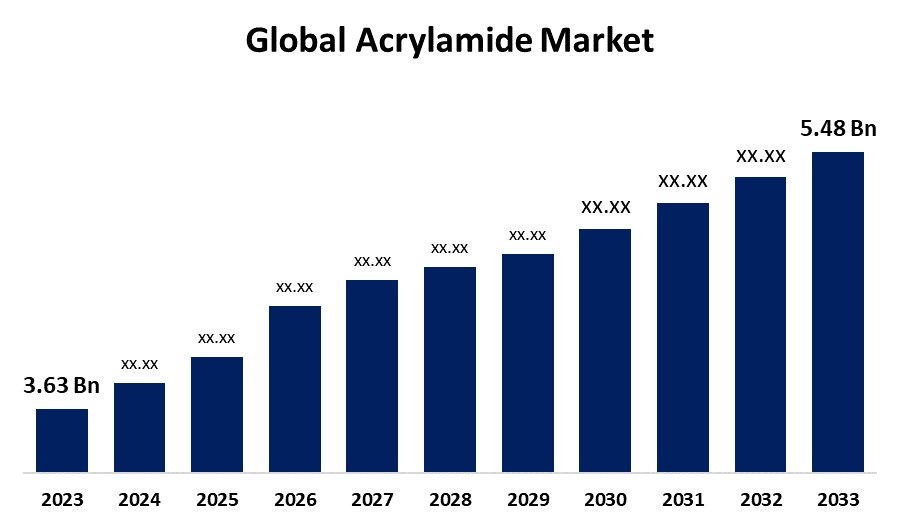

- The Global Acrylamide Market Size was Valued at USD 3.63 Billion in 2023

- The Market Size is Growing at a CAGR of 4.20% from 2023 to 2033

- The Worldwide Acrylamide Size is Expected to Reach USD 5.48 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Acrylamide Market Size is Anticipated to Exceed USD 5.48 Billion by 2033, Growing at a CAGR of 4.20% from 2023 to 2033.

Market Overview:

Acrylamide is a chemical composite that is typically used in the manufacture of paper, dye, and other commercial products. Acrylamide is widely found in plant-based harvests such as grain products, potato products, and coffee which will aid in fueling the market growth. The all-inclusive acrylamide market has grown dramatically due to growing demand from noteworthy end-use trades such as water treatment and personal care. Acrylamide is applied as a flocculant in the dealing of public and manufacturing wastewater, serving to remove suspended solids and organic matter. The rising mandate for clean water, mainly in emerging nations, is estimated to fuel the demand for acrylamide in the water treatment trade. The rising alertness of personal care hygiene and the growing necessity for personal care products and cosmetics throughout the world are likely to drive the growth of the acrylamide market. The increase in the demand for various applications in the making of polyacrylamide is further utilized as water-soluble thickeners and an upsurge in the use of the compound in several manufacturing processes such as the making of paper and treatment of sewage water and drinking water speeds up the market growth. The upsurge in demand for acrylamide in products such as adhesives and food packaging, as well as the compound's use as a superabsorbent in diapers and other incontinence, all influence the market growth.

Report Coverage:

This research report categorizes the market for the global Acrylamide market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global Acrylamide market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global Acrylamide market.

Global Acrylamide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.63 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.20% |

| 2033 Value Projection: | USD 5.48 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 226 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By Region |

| Companies covered:: | Dia-Nitrix Co., Ltd,Kemira Oyj,Jiangxi Changjiu Agrochemical Co., Ltd,Mitsui Chemicals, Inc,Ecolab Inc,INEOS,Petro China Daiqing,Rudong Natian,Beijing Hengju,Cytec Industries Incorporated,The Dow Chemical Company,National Aluminum Company Limited,Zhejiang Xinyong Biochemical Co. Ltd.,Yongsan Chemicals Inc.,Ashland,Anhui Jucheng Fine Chemicals Co. Ltd.,BASF SE,SNF Group, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors:

The increase in the acrylamide section is being anticipated by motives such as augmented paper consumption, growing demand for fabrics, increasing demand for oil and gas, and amplified government spending on water treatment. In the acrylamide trade, a prominent trend is the growing demand for polyacrylamide in wastewater treatment applications. The mounting emphasis on eco-friendly sustainability has augmented wastewater programs worldwide, driving the demand for efficient water treatment chemicals. Additionally, there is a cumulative interest in the formation of novel, bio-based acrylamide derivatives as substitutes for traditional petroleum-based products is expected to drive market growth.

Restraining Factors:

Acrylamide is very hazardous and can create difficulties for people such as detrimental effects on male fertility, nerve damage, muscular weakness, and coordination, the government's tight regulations limiting acrylamide usage might impede the expansion of the acrylamide sector.

Market Segmentation:

The global acrylamide market share is classified into product and application.

- The polyacrylamide segment accounted for the largest share of the market during the forecast period.

Based on the product, the global acrylamide market is categorized into polyacrylamide, acrylamide copolymers, and acrylamide crystals. Among these, the polyacrylamide segment accounted for the largest share of the market during the forecast period. Polyacrylamides are water-soluble synthesized linear polymers composed of acrylamide or a mixture of acrylamide and acrylic acid. Polyacrylamide is utilized in pulp and paper business, farming, food processing, mining, and as a flocculant in wastewater treatment. Polyacrylamides (PAMs) are water-soluble, high-molecular-weight molecules formed by polymerizing the monomer acrylamide. They are frequently employed for erosion and sediment control (ESC) applications and are anticipated to enlarge in the coming years. Polyacrylamide is commonly employed in analytical procedures in laboratories by scientists for separating proteins on their molecular weight and charges which will further support the growth of the segment.

- The wastewater treatment segment is expected to boost the market growth over the forecast period.

Based on the application, the global acrylamide market is categorized into wastewater treatment, dispersing agent, oil recovery agent, and stabilizer & thickener. Among these, the wastewater treatment segment is expected to boost the market growth over the forecast period. Wastewater treatment is an important procedure in many industries, including regional, manufacturing, and commercial. Acrylamide is widely utilized as a flocculant in water and wastewater treatment procedures. It helps to remove pollutants, suspended objects, and organic matter from water, enhancing its nutritional value and making it suitable for a variety of uses. Additionally, the growth of sectors such as oil and gas, pharmaceuticals, chemical products, and food and beverage has aided the water and wastewater treatment industry.

Regional Segment Analysis of the Global Acrylamide Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is projected to hold the largest share of the global acrylamide market over the forecast period.

Get more details on this report -

Asia-Pacific is projected to hold the largest share of the global acrylamide market over the forecast period. Asia-Pacific is expected to grow at a moderate rate throughout the projected period. Increasing disposable income in emerging markets is increasing demand for convenience products, which is boosting the global acrylamide market. China has the largest market share and will be the leading acrylamide user over the forecast period due to its rapid development. The dominance is linked to the existence of major economies such as China, India, and Japan. China is regarded as the dominant country in the Asia Pacific area. The high demand is mostly due to current large-scale projects in China. For instance, in March 2024 China invested a record 1.2 trillion yuan (about 168.9 billion US dollars) in the development of water conservancy infrastructure, a 10.1% increase over the previous year.

Europe region is also expected to fastest CAGR growth during the forecast period. The development of the oil and gas and water treatment industries has an impact on regional product consumption. The commission observed that expenditures in several member States remain relatively inadequate to achieve compliance with the urban wastewater treatment directive. As a result, government investments might grow in the coming years, which will help regional product makers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global acrylamide market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies:

- Dia-Nitrix Co., Ltd

- Kemira Oyj

- Jiangxi Changjiu Agrochemical Co., Ltd

- Mitsui Chemicals, Inc

- Ecolab Inc

- INEOS

- Petro China Daiqing

- Rudong Natian

- Beijing Hengju

- Cytec Industries Incorporated

- The Dow Chemical Company

- National Aluminum Company Limited

- Zhejiang Xinyong Biochemical Co. Ltd.

- Yongsan Chemicals Inc.

- Ashland

- Anhui Jucheng Fine Chemicals Co. Ltd.

- BASF SE

- SNF Group

- Others

Key Market Developments:

- In January 2024, SNF, the world's top polyacrylamide maker, launched a $250 million development plan in the Sultanate of Oman through self-financing and collaborations. With an active content capacity of over 1.5 million tonnes, SNF is the world's leading provider of complete chemical enhanced oil recovery (EOR) solutions.

- In June 2022, Black Rose Industries Ltd. constructed a commercial manufacturing unit in India to manufacture acrylamide solids. With this capacity growth, the business claims to be the exclusive maker of acrylamide solids.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global acrylamide market based on the below-mentioned segments:

Global Acrylamide Market, By Product

- Polyacrylamide

- Acrylamide Copolymers

- Acrylamide Crystals

Global Acrylamide Market, By Application

- Wastewater Treatment

- Dispersing Agent

- Oil Recovery Agent

- Stabilizer & Thickener

Global Acrylamide Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global acrylamide market over the forecast period?The global acrylamide market size is expected to grow from USD 3.63 Billion in 2023 to USD 5.48 Billion by 2033, at a CAGR of 4.20 % during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global acrylamide market?Asia-Pacific is projected to hold the largest share of the global acrylamide market over the forecast period.

-

3. Who are the top key players in the acrylamide market?Dia-Nitrix Co., Ltd, Kemira Oyj, Jiangxi Changjiu Agrochemical Co., Ltd, Mitsui Chemicals, Inc, Ecolab Inc, INEOS, Petro China Daiqing, Rudong Natian, Beijing Hengju, Cytec Industries Incorporated, The Dow Chemical Company, National Aluminum Company Limited, Zhejiang Xinyong Biochemical Co. Ltd, Yongsan Chemicals Inc, Ashland, Anhui Jucheng Fine Chemicals Co. Ltd, BASF SE, SNF Group, and Others.

Need help to buy this report?