Global Acrylic Acid Market Size, Share, and COVID-19 Impact Analysis, By Derivative (Acrylic Esters, Acrylic Polymers, Others), By Application (Surface Coating, Adhesives and Sealants, Surfactants, Sanitary Products, Textiles, and Other Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Specialty & Fine ChemicalsGlobal Acrylic Acid Market Insights Forecasts to 2033

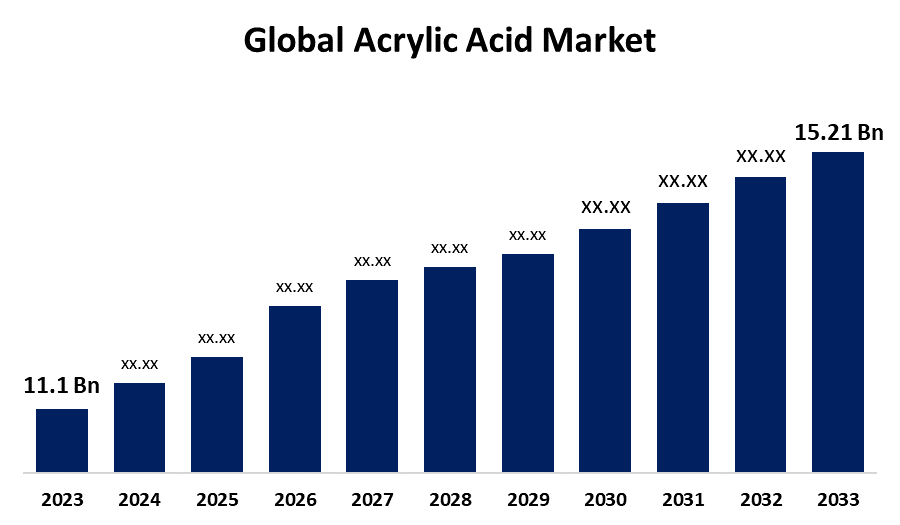

- The Global Acrylic Acid Market Size was Valued at USD 11.1 Billion in 2023

- The Market Size is Growing at a CAGR of 3.20% from 2023 to 2033

- The Worldwide Acrylic Acid Market Size is Expected to Reach USD 15.21 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Acrylic Acid Market Size is Anticipated to Exceed USD 15.21 Billion by 2033, Growing at a CAGR of 3.20% from 2023 to 2033.

Market Overview

Acrylic acid is an inorganic compound having the formula C3H4O2 and is the simplest of the unsaturated acids. Acrylic acid serves as a feedstock for the manufacture of acrylate esters. Paper treatment, plastic additives, textiles, sealants, adhesives, and surface coatings are some of the applications for acrylic ester. Additionally, acrylic acid is used in the manufacture of sanitary medical equipment, detergents, and wastewater treatment chemicals. The acrylic acid market is primarily driven by increased demand for polymers, paints and coatings, and personal care products. Rising demand for acrylic acid from emerging nations like India and China is also driving the worldwide acrylic acid market's growth.

Report Coverage

This research report categorizes the market for acrylic acid market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the acrylic acid market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the acrylic acid market.

Global Acrylic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 11.1 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 3.20% |

| 2033 Value Projection: | USD 15.21 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Derivative, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | BASF SE, Arkema, Evonik Industries AG, Shandong Haili Chemical Industry Co. Ltd., Nippon Shokubai Co. Ltd., Dow Chemical Company, LG Chem, Mitsubishi Chemical Holdings Corporation, The Lubrizol Corporation, Myriant Corporation, Formosa Plastic Group, and others Key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The acrylic acid market is being propelled by increased demand for superabsorbent polymers and the broad acceptance of acrylic-based products in emerging economies such as the Asia Pacific region. The commercialization of bio-based acrylic acid, as well as the growing demand for poly (methyl methacrylate) or PMMA resins in various industries, are likely to create a lot of growth prospects in this market. The increasing demand for paints and coatings is driving the acrylic acid market. The expanding demand for superabsorbent polymers in the personal care industry, the expansion of the construction industry, and the rising demand for water-based adhesives are among the primary drivers driving market growth. Acrylate esters generated from acrylic acid are crucial elements in a variety of coatings, including architectural coatings, OEM finishes for automobiles and other items, and special-purpose coatings.

Restraining Factors

The acrylic acid market faces several challenges that could potentially hinder its growth. These include fluctuating prices of raw materials like propylene, stringent environmental regulations affecting production costs, and competition from substitute chemicals in various applications. Economic cycles also play a significant role, in influencing demand for acrylic acid-based products during downturns. Additionally, technological advancements in alternative materials and ongoing health and safety concerns related to acrylic acid usage add further complexities to market dynamics.

Market Segmentation

The acrylic acid market share is classified into derivative and application.

- The acrylic esters segment is estimated to hold the highest market revenue share through the projected period.

Based on the derivative, the acrylic acid market is classified into acrylic esters, acrylic polymers, and others. Among these, the acrylic esters segment is estimated to hold the highest market revenue share through the projected period. This is primarily due to its diverse applications and broad value across multiple industries. Acrylic esters or acrylates are transparent, volatile liquids. They are mildly soluble in water, but soluble in alcohols, ethers, and other organic solvents. Acrylate esters are an important derivative of acrylic acid and primary applications include paints, acrylic gums, viscosity adhesives, and acrylic fabrics, among others. Acrylates offer various desired features to polymers, including clarity, color stability, aging, and heat resistance, as well as superior weatherability, resulting in increased product demand in the coating and adhesive industries. Acrylic acid and its derivative acrylic esters are multi-use monomers with the ability to produce a wide range of multi-purpose polymers.

- The surface coating segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the acrylic acid market is divided into surface coating, adhesives and sealants, surfactants, sanitary products, textiles, and other applications. Among these, the surface coating segment is anticipated to hold the largest market share through the forecast period. Acrylic acid esters are most commonly used in surface coatings because of their diverse qualities, which lead to improved paint and coating formulations. Acrylic acid esters have high adhesion, durability, and weather resistance, making them a popular choice for surface coatings in the automotive, construction, and consumer products sectors. Acrylic acid esters' ability to impart gloss, color retention, and corrosion protection, together with their compatibility with a wide range of other chemicals, pushes their adoption in surface coatings, consolidating their importance in the acrylic acid market's application landscape.

Regional Segment Analysis of the Acrylic Acid Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the acrylic acid market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the acrylic acid market over the predicted timeframe. Rapid industrialization and infrastructure development are increasing downstream product demand in China and India. Both countries have grown as global industrial hubs, increasing demand for acrylic acid in industries such as superabsorbent polymers, paints, and construction chemicals. Local producers are expanding their capacity to meet the increasing demands of the home industry. Asia Pacific has the highest demand for baby and adult diapers emerging markets such as India, Taiwan, Malaysia, and Indonesia are expected to be the hotspots for personal care products containing superabsorbent polymers (SAP). The growing usage of superabsorbent polymer (SAP) in personal care products, agriculture, and cosmetics, as well as the use of water-based paints and coatings due to environmental laws requiring VOC reduction, are expected to boost the market in the area. The sector in this region is expected to have a bright future due to rapid expansion and innovation, as well as industry consolidations among acrylic acid makers.

Bottom of Form

North America is expected to grow at the fastest CAGR growth of the acrylic acid market during the forecast period. The region features a large number of raw material suppliers and acrylic acid industries. Some of the world's top acrylic acid firms, including Dow Chemicals and Arkema, are headquartered in the United States. The favorable business environment and simple supply of feedstock have encouraged industry players to focus on capacity expansion. Additionally, the region benefits from strong demand from end-use sectors such as paints, sealants, and adhesives, where acrylic acid-based products are widely used.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the acrylic acid market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Arkema

- Evonik Industries AG

- Shandong Haili Chemical Industry Co. Ltd.

- Nippon Shokubai Co. Ltd.

- Dow Chemical Company

- LG Chem

- Mitsubishi Chemical Holdings Corporation

- The Lubrizol Corporation

- Myriant Corporation

- Formosa Plastic Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, Lummus Technology, a global provider of process technologies and value-driven energy solutions, announced an agreement with Air Liquide Engineering & Construction to acquire rights to license and market ester-grade acrylic acid technology, as well as light and heavy acrylates process technology.

- In May 2023, NIPPON SHOKUBAI CO., LTD. announced that its subsidiary PT. NIPPON SHOKUBAI INDONESIA held an inauguration ceremony on May 23, 2023, for the new acrylic acid facility with a production capacity of 100,000 MT/Y in Cilegon, Banten, Indonesia.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the acrylic acid market based on the below-mentioned segments:

Global Acrylic Acid Market, By Derivative

- Acrylic Esters

- Acrylic Polymers

- Others

Global Acrylic Acid Market, By Application

- Surface Coating

- Adhesives and Sealants

- Surfactants

- Sanitary Products

- Textiles

- Other Applications

Global Acrylic Acid Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the acrylic acid market over the forecast period?The acrylic acid market is projected to expand at a CAGR of 3.20% during the forecast period.

-

2. What is the market size of the acrylic acid market?The Global Acrylic Acid Market Size is Expected to Grow from USD 11.1 billion in 2023 to USD 15.21 Billion by 2033, at a CAGR of 3.20% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the acrylic acid market?Asia Pacific is anticipated to hold the largest share of the acrylic acid market over the predicted timeframe.

Need help to buy this report?