Global Adhesion Barrier Market Size, Share, and COVID-19 Impact Analysis, By Product (Synthetic and Natural), By Type (Film, Gel, & Liquid), By Application (Cardiovascular, Neurological Surgery, Gynecological Surgery, & Orthopedic), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: HealthcareGlobal Adhesion Barrier Market Insights Forecasts to 2032

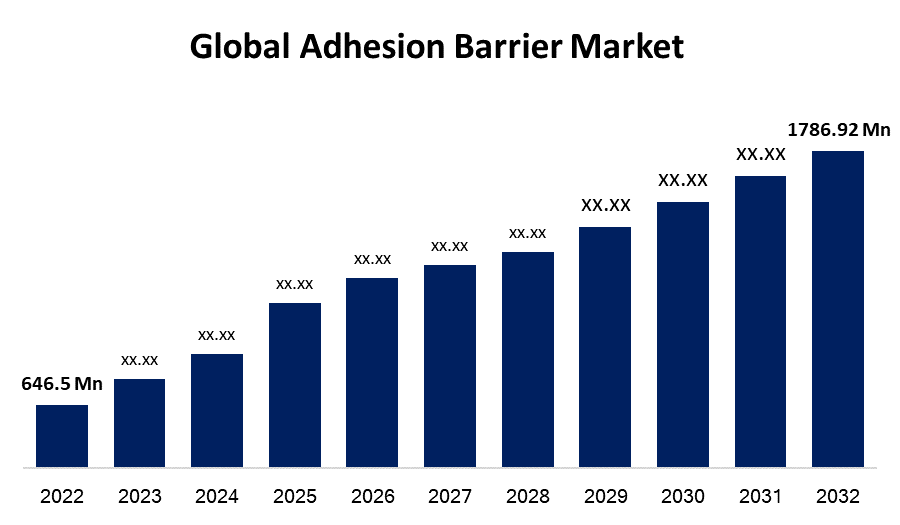

- The Global Adhesion Barrier Market Size was valued at USD 646.5 Million in 2022.

- The Market Size is Growing at a CAGR of 7.5% from 2022 to 2032.

- The Worldwide Adhesion Barrier Market size is expected to reach USD 1786.92 Million by 2032.

- Asia Pacific is expected To Grow the fastest during the forecast period.

Get more details on this report -

The Global Adhesion Barrier Market Size is expected to reach USD 1786.92 Million by 2032, at a CAGR of 7.5% during the forecast period 2022 to 2032.

Market Overview

An adhesion barrier is a medical device implant intended to reduce internal scarring between organs and internal tissues after surgery. Gels, physical film/mesh, cloth, and other forms are available. The adhesion barrier is crucial in preventing post-surgical problems in patients. Adhesion disorders are a significant source of concern and morbidity in the adhesion barrier market, particularly for patients with post-operative problems. As a result, adhesion barriers are highly suggested and utilized by surgeons to decrease problems in a variety of departments such as gynecology, general surgery, and so on. A few major variables are predicted to drive considerable growth in the adhesion barrier industry. The expansion of trauma treatment facilities and the upgrading of healthcare infrastructure will propel the industry ahead. Furthermore, the rising prevalence of sports-related injuries is likely to fuel market expansion. According to recent Stanford Children's Health data, more than 10% of the nearly 30 million children who participate in some sort of sports incur injuries each year.

Report Coverage

This research report categorizes the global adhesion barrier market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global adhesion barrier market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global adhesion barrier market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global Adhesion Barrier Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 646.5 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.5% |

| 2032 Value Projection: | USD 1786.92 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Type, By Application, By Region. |

| Companies covered:: | Johnson & Johnson, Baxter International, Becton, Dickinson, and Company, Integra LifeSciences, Anika Therapeutics, Atrium Medical Corporation, FzioMed, MAST Biosurgery, Innocoll Holdings, Betatech Medical, CorMatrix Cardiovascular, Inc., Terumo Corporation, BiosCompass, WL Gore & Associates, Allosource. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Post-surgical adhesions cause a variety of difficulties in various procedures, including severe abdominal pain in the case of abdominal surgeries, infertility in women after gynecological surgery, and physical disability in patients following neurological surgeries. Because of the catastrophic effects of post-surgical adhesions in patients, the market for treatments like adhesion barriers is expanding. Furthermore, given the increase in the number of procedures conducted globally, the value of these items will become more obvious in the future years. Also, the British Heart Foundation anticipates that 32,938 heart operations and other cardiac treatments will be conducted in England in October 2021. The rising frequency of operations and surgeries is likely to raise demand for adhesion barriers, pushing market expansion. Adhesion barriers are commonly utilized following procedures to reduce scarring and prevent adhesions.

Restraining Factors

Despite being aware of these risks, surgeons are hesitant to use adhesion barriers due to a lack of/limited strong clinical evidence supporting the safety and efficacy of marketed adhesion barrier treatments. Furthermore, due to concerns about the safety and efficacy of adhesion barriers, firms are having difficulty obtaining marketing authorization for their goods. In addition, the industry has seen the termination of authorized adhesion barrier treatments due to unsatisfactory clinical outcomes in recent years.

Market Segmentation

- In 2022, the synthetic segment is dominating the market with the largest market share during the forecast period.

Based on product, the global adhesion barrier market is segmented into different segments such as synthetic and natural. Among these segments, the synthetic segment has the biggest revenue share over the predicted period due to its robust bioresorbability and biocompatibility. Synthetic adhesion barriers are inexpensive, which is projected to boost category sales. In addition, the segment's dominance is attributed in part to the availability of commercial synthetic adhesion barriers. The industry is further divided into hyaluronic acid, regenerated cellulose, polyethylene glycol, and others. Because of its ability to draw and retain a large amount of moisture, hyaluronic acid dominates the segment.

- In 2022, the film segment is dominating the largest market share during the forecast period.

Based on type, the global adhesion barrier market is segmented into film, gel, & liquid. Among these segments, the film segment is leading the market owing to the substantial proportion of this sector may be due to the availability of a diverse variety of film-form adhesion barriers, as well as solid clinical data confirming their safety and efficacy. These qualities, together with their ease of use, have led to a greater acceptance of film-form adhesion barriers among surgeons than gel- and liquid-form adhesion barriers.

- In 2022, the cardiovascular segment is dominating the market with the largest market share over the forecast period.

Based on application, the global adhesion barrier market is segmented into various segments such as cardiovascular, neurological surgery, gynecological surgery, & orthopedic. Among these segments, the cardiovascular segment has the biggest revenue share over the forecast period due to the continued growth in the incidence and prevalence of heart-related illnesses is expected to drive the use of sticky barriers in cardiovascular surgery. According to the National Heart, Lung, and Blood Institute, approximately 2 million individuals worldwide have open-heart surgery. Furthermore, the use of adhesion barriers in cardiovascular procedures helps to avoid the establishment of peristomal adhesion.

Regional Segment Analysis of the adhesion barrier market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is dominating the market with the largest market growth during the forecast period

Get more details on this report -

North America is leading the significant market growth during the forecast period due to the presence of significant companies such as Johnson & Johnson, Baxter International, Integra LifeSciences, Anika Therapeutics, and FzioMed. Furthermore, the increased prevalence of orthopedic illnesses, along with the widespread use of enhanced treatment methods, is likely to boost market growth in the United States. Moreover, the presence of a significant number of patients associated with various diseases such as gynecology, neurology, and orthopedic problems, among others, is projected to be a key driving element for regional growth.

In Asia Pacific, the market for adhesion barrier market is predicted to develop rapidly over the forecast period due to an aging population and an increase in the prevalence of cardiac and neurosurgery, all of which necessitate surgical procedures. Furthermore, increased private sector investment in healthcare and quickly developing medical tourism are predicted to support the region's adhesion barrier market expansion.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global adhesion barrier market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Johnson & Johnson

- Baxter International

- Becton, Dickinson, and Company

- Integra LifeSciences

- Anika Therapeutics

- Atrium Medical Corporation

- FzioMed

- MAST Biosurgery

- Innocoll Holdings

- Betatech Medical

- CorMatrix Cardiovascular, Inc.

- Terumo Corporation

- BiosCompass

- WL Gore & Associates

- Allosource

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2022, the field of bio-regenerative medicine MEDICLORE, a fourth-generation sol-gel anti-adhesion agent, was CGBIO's entry into the Indonesian market. When MEDICLORE is injected into the body, it transforms from a sol to a very viscous gel at body temperature. This gel-like condition acts as a physical barrier in the surgical site, preventing adhesion while the wound heals.

- In October 2021, Toray Industries, Inc. agreed with ASKA Pharmaceutical Co., Ltd. to develop and market an adhesion barrier product in Japan. According to the deal, both firms will collaborate to create the device, which will then be manufactured by Toray and marketed solely in Japan by ASKA. This strategic development will assist the firms in expanding their product portfolios and increasing their income.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Adhesion Barrier Market based on the below-mentioned segments:

Global Adhesion Barrier Market, By Product

- Synthetic

- Natural

Global Adhesion Barrier Market, By Type

- Film

- Gel

- Liquid

Global Adhesion Barrier Market, By Application

- Cardiovascular

- Neurological Surgery

- Gynecological Surgery

- Orthopedic

Adhesion Barrier Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?