Global Adipic Acid Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Cyclohexane, Phenol, Cyclohexanol, Cyclohexanone, and Benzene), By Application (Polyurethane, Nylon 6,6 Fiber, Nylon 6,6 Resin, Adipate Esters, and Others), By End-Use (Automotive, Electrical & Electronics, Packaging & Consumer Goods, Building & Construction, Textile, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Adipic Acid Market Insights Forecasts to 2033

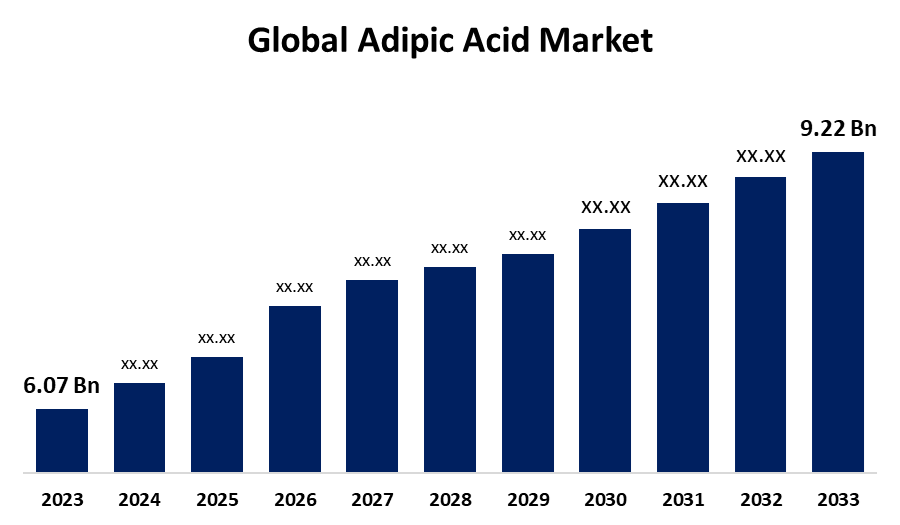

- The Global Adipic Acid Market Size was Estimated at USD 6.07 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 4.27% from 2023 to 2033

- The Worldwide Adipic Acid Market Size is Expected to Reach USD 9.22 Billion by 2033

- Europe is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Adipic Acid Market Size is anticipated to exceed USD 9.22 Billion by 2033, growing at a CAGR of 4.27% from 2023 to 2033. The rising usage of adipic acid across diverse end-use applications including electrical & electronics, automotive, building & construction, packaging & consumer goods, and textiles is driving the market for adipic acid.

Market Overview

The adipic acid market refers to the global trade, production, and sale of adipic acid, a chemical compound used to make nylon, polyurethanes, and other industrial products. Adipic acid, a white crystalline powder of C6-straight chain dicarboxylic acid, is a mostly used chemical in the world. Polyester polyols for polyurethane systems, plasticizers, and lubricant components are all made from adipic acid in industries such as construction, automotive, and medical. Additionally, the acid and its derivatives are used in the food sector as flavoring, leavening, gelling aids, acidulants, and buffering reagents. They are also employed in the manufacturing of textile treatment agents, fungicides, insecticides, dyes, and pharmaceuticals (such as cephalosporin intermediates). The market is expected to increase in the upcoming years due to the increasing demand for nylon 6,6 fiber and polyurethane across a variety of sectors. The rising need for energy-efficient buildings, comfortable automobile interiors, and durable consumer goods leads to the demand for polyurethane, thereby offering lucrative market growth opportunities for adipic acid.

Report Coverage

This research report categorizes the adipic acid market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the adipic acid market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the adipic acid market.

Global Adipic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.07 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.27% |

| 2033 Value Projection: | USD 9.22 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Application, By End-Use and COVID-19 Impact Analysis |

| Companies covered:: | Ascend Performance Materials, BASF SE, DOMO Chemicals, INVISTA, LANXESS, Liaoyang Tianhua Chemical Co., Ltd, Radici Partecipazioni S.p.A., Solvay, Tangshan Zhonghao Chemical Co., Ltd., Asahi Kasei Corporation, and others key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Nylon 6,6 manufacturing accounts for the majority of adipic acid consumption. The growing adoption of nylon 6,6 across multiple industries such as automotive, textile, carpet industry, electrical & electronic components, industrial machinery, and consumer goods is propelling the adipic acid market demand. The expansion of the packaging industry with the e-commerce growth and demand for packaged goods are driving the market demand for adipic acid.

Restraining Factors

The increasing environmental concerns about greenhouse gas emissions, especially nitrous oxide in adipic acid manufacturing are limiting the market growth for adipic acid, particularly in regions with strict environmental regulations or strong sustainability initiatives.

Market Segmentation

The adipic acid market share is classified into raw material, application, and end-use.

- The cyclohexane segment holds the largest market share and is expected to grow at a significant CAGR during the forecast period.

Based on the raw material, the adipic acid market is classified into cyclohexane, phenol, cyclohexanol, cyclohexanone, and benzene. Among these, the cyclohexane segment holds the largest market share and is expected to grow at a significant CAGR during the forecast period. Adipic acid is industrially produced from cyclohexane via the oxidation process. The rapid industrialization and the expansion of the textile and automotive sectors, which is a major use of adipic acid and cyclohexane, are driving the market.

- The nylon 6,6 fiber segment dominated the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the adipic acid market is classified into polyurethane, nylon 6,6 fiber, nylon 6,6 resin, adipate esters, and others. Among these, the nylon 6,6 fiber segment dominated the market with the largest market share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Nylon 6,6 is increasingly used to produce lightweight, durable plastic which is employed in the rapidly expanding automotive and electrical & electronics sectors, thereby driving the market demand for adipic acid.

- The electrical & electronics segment dominates the market with the largest market share and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the adipic acid market is classified into automotive, electrical & electronics, packaging & consumer goods, building & construction, textile, and others. Among these, the electrical & electronics segment dominates the market with the largest market share and is expected to grow at a significant CAGR during the forecast period. In the electrical & electronics sector, adipic acid is ideally used in applications such as circuit breakers, connectors, computer motherboards, power tool housings, and terminal blocks for electronic devices.

Regional Segment Analysis of the Adipic Acid Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

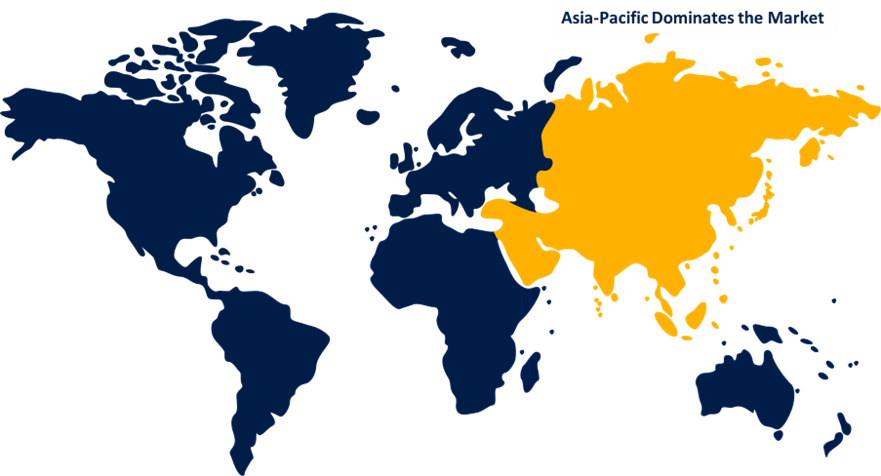

Asia Pacific is anticipated to hold the largest share of the adipic acid market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the adipic acid market over the predicted timeframe. The increasing usage of adipic acid-derived nylon materials in clothing, sportswear, hosiery, and fashion accessories in the region is driving the market growth. The growing automotive, textile, and construction industries along with the rapid urbanization in China and India are contributing to propelling the adipic acid market.

Europe is expected to grow at the fastest CAGR growth of the adipic acid market during the forecast period. The increasing use of electronic devices like smartphones, computers, and televisions with the growing digitalization is contributing to driving the market for adipic acid in the electrical & electronics industry. The implementation of stringent regulations for reducing the environmental impact of carbon emissions and promoting recycling is contributing to propelling the adipic acid market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the adipic acid market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ascend Performance Materials

- BASF SE

- DOMO Chemicals

- INVISTA

- LANXESS

- Liaoyang Tianhua Chemical Co., Ltd

- Radici Partecipazioni S.p.A.

- Solvay

- Tangshan Zhonghao Chemical Co., Ltd.

- Asahi Kasei Corporation

- Solvay

- Sumitomo Chemical Co., Ltd.

- Tokyo Chemical Industry Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2022, Toray Industries, Inc., announced that it has developed the world’s first 100% bio-based adipic acid, a raw material for nylon 66 (polyamide 66), from sugars derived from inedible biomass.

- In January 2020, DOMO Chemicals, a leading producer of high-quality engineering materials for a diverse range of markets, announced that the company has completed its acquisition of Solvay’s Performance Polyamides Business in Europe.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the adipic acid market based on the below-mentioned segments:

Global Adipic Acid Market, By Raw Material

- Cyclohexane

- Phenol

- Cyclohexanol

- Cyclohexanone

- Benzene

Global Adipic Acid Market, By Application

- Polyurethane

- Nylon 6,6 Fiber

- Nylon 6,6 Resin

- Adipate Esters

- Others

Global Adipic Acid Market, By End-Use

- Automotive

- Electrical & Electronics

- Packaging & Consumer Goods

- Building & Construction

- Textile

- Others

Global Adipic Acid Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the adipic acid market over the forecast period?The adipic acid market is projected to expand at a CAGR of 4.27% during the forecast period.

-

2. What is the market size of the adipic acid market?The Adipic Acid Market Size is Expected to Grow from USD 6.07 Billion in 2023 to USD 9.22 Billion by 2033, at a CAGR of 4.27% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the adipic acid market?Asia Pacific is anticipated to hold the largest share of the adipic acid market over the predicted timeframe.

Need help to buy this report?