Global Advanced Materials for Semiconductor Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Compound Semiconductors, Two-Dimensional Materials, Nanomaterials, Organic Semiconductors, Others), By Application (Power Electronics, High-frequency Devices, Photovoltaics, Memory and Storage, Optoelectronics, and Others), By End-User Industry (IT and Telecommunications, Consumer Electronics, Aerospace and Defense, Healthcare, Industrial, Building and Automation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Advanced MaterialsGlobal Advanced Materials for Semiconductor Market Insights Forecasts to 2033

- The Global Advanced Materials for Semiconductor Market Size was Valued at USD 50.4 Billion in 2023

- The Market Size is Growing at a CAGR of 12.10% from 2023 to 2033

- The Worldwide Advanced Materials for Semiconductor Market Size is Expected to Reach USD 157.87 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

![]()

Get more details on this report -

The Global Advanced Materials for Semiconductor Market Size is Anticipated to Exceed USD 157.87 Billion by 2033, Growing at a CAGR of 12.10% from 2023 to 2033.

Market Overview

Advanced semiconductor materials are used in a wide range of electric and optical devices, including diodes, transistors, and integrated circuits. They work in the manufacturing of cell phones, industrial devices, self-driving vehicles, advanced medical devices, and other electronic products. These materials are designed or synthesized at the atomic or molecular level to enhance specific characteristics such as conductivity, optical transparency, thermal stability, and mechanical strength. They are essential components in the fabrication of advanced electronic devices and systems, enabling innovations in areas such as telecommunications, consumer electronics, renewable energy, and healthcare. Examples include compound semiconductors (e.g., gallium nitride, indium phosphide), two-dimensional materials (e.g., graphene, transition metal dichalcogenides), nanomaterials (e.g., quantum dots, nanowires), and organic semiconductors (e.g., organic light-emitting diodes, organic photovoltaics). Advanced semiconductor materials play a critical role in pushing the boundaries of semiconductor technology, enabling faster processors, more efficient solar cells, flexible displays, and other cutting-edge applications in modern electronics. For instance, the Ministry of Electronics and Information Technology, Government of India, Indian electronics manufacturing continues thriving, and the need for semiconductors will increase quickly. India's electronics production, which was valued at $101 billion in 2022, is forecast to triple to USD 300 billion by 2026, with mobile phone production doubling from USD 44 billion in 2023 to an estimated $110 billion by 2026 the growth drives the advanced materials for semiconductors market.

Report Coverage

This research report categorizes the market for advanced materials for the semiconductor market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the advanced materials for the semiconductor market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the advanced materials for the semiconductor market.

Global Advanced Materials for Semiconductor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 50.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.10% |

| 2033 Value Projection: | USD 157.87 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Material Type, By Application, By End-User Industry, By Region |

| Companies covered:: | WOLFSPEED, INC., Coherent Corp., Sumitomo Electric Industries Ltd., LG Chem Ltd., BASF SE, KYOCERA Corporation, Nichia Corporation, Samsung Electronics Co., Ltd., Soitec, Applied Materials, AXT, Inc., ENTEGRIS, IQE PLC, Resonac Holdings Corporation, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The advanced materials for the semiconductor market are driven by several key factors including a combination of technological advancements, and increasing demand from diverse industries such as IT and telecommunications, consumer electronics, automotive, healthcare, aerospace, and industrial automation. Key factors fueling growth include the rising adoption of IoT and AI technologies, which require high-performance semiconductors, and the emergence of new applications like autonomous vehicles and flexible electronics. Government regulations promoting energy efficiency and sustainability also play a crucial role, alongside significant investments in R&D, global economic trends, and competitive dynamics within the semiconductor industry. These elements collectively shape the market, fostering innovation in materials science, semiconductor processing, and application development to meet evolving consumer and industrial demands worldwide.

Restraining Factors

The advanced materials for the semiconductor market face several challenges that could constrain its growth dominance including high manufacturing costs associated with complex production processes, technological complexities that slow innovation cycles, and vulnerabilities in the global supply chain leading to potential shortages. Intellectual property protection issues, stringent regulatory requirements, and market fragmentation further complicate market dynamics, while the cyclical nature of end-user industries adds variability to demand. Additionally, environmental sustainability concerns and the need for scalable integration of advanced materials present ongoing hurdles.

Market Segmentation

The advanced materials for the semiconductor market share are classified intomaterial type, application, and end-user industry.

- The compound semiconductors segment is estimated to hold the highest market revenue share through the projected period.

Based on the material type, the advanced materials for the semiconductor market are classified into compound semiconductors, two-dimensional materials, nanomaterials, organic semiconductors, and others. Among these, the compound semiconductors segment is estimated to hold the highest market revenue share through the projected period. These materials, composed of elements like gallium arsenide (GaAs) and gallium nitride (GaN), offer superior electrical, optical, and thermal properties compared to traditional silicon semiconductors. Compound semiconductors are widely used in telecommunications, aircraft, defense, and high-power electronics. They thrive in high-frequency operations and harsh conditions, which drives their widespread use. Continuous advancements in materials science and fabrication techniques further enhance their performance and expand their applications in sectors demanding reliability and efficiency. Compound semiconductors continue to lead due to their established industrial use and technological advancement, emphasizing their critical role in improving semiconductor technology and addressing different market demands.

- The memory and storage segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the advanced materials for the semiconductor market are divided into power electronics, high-frequency devices, photovoltaics, memory and storage, optoelectronics, and others. Among these, the memory and storage segment is anticipated to hold the largest market share through the forecast period. This segment encompasses semiconductor materials crucial for various memory and storage devices, including DRAM, NAND flash memory, and emerging non-volatile memory technologies. The dominance of memory and storage is driven by escalating demand from consumer electronics such as smartphones and laptops, as well as from data centers powering cloud computing services. Enterprises also rely heavily on advanced memory solutions for efficient data management and processing. Technological advances in semiconductor materials continue to improve the capacity, speed, and energy efficiency of memory and storage devices, reinforcing the segment's leadership. Emerging applications in AI, machine learning, driverless vehicles, and IoT devices drive up demand for advanced semiconductor materials in memory and storage applications.

The IT and telecommunications segment dominates the market with the largest market share through the forecast period.

Based on the end-user industry, the advanced materials for the semiconductor market are categorized into IT and telecommunications, consumer electronics, aerospace and defense, healthcare, industrial, building, and automation. Among these, the IT and telecommunications segment dominates the market with the largest market share through the forecast period. This segment's leadership is driven by robust demand from data centers supporting cloud computing and big data analytics, as well as the rapid advancement of 5G telecommunications networks requiring high-performance semiconductor materials. Furthermore, the expansion of IoT applications and enterprise IT solutions further propels demand, emphasizing the critical role of advanced semiconductor technologies in powering digital connectivity and innovation across industries. Technological advancements continue to drive competitiveness within the IT and telecommunications sector, reinforcing its position as a key driver of growth in the global semiconductor materials market.

Regional Segment Analysis of the Advanced Materials for Semiconductor Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

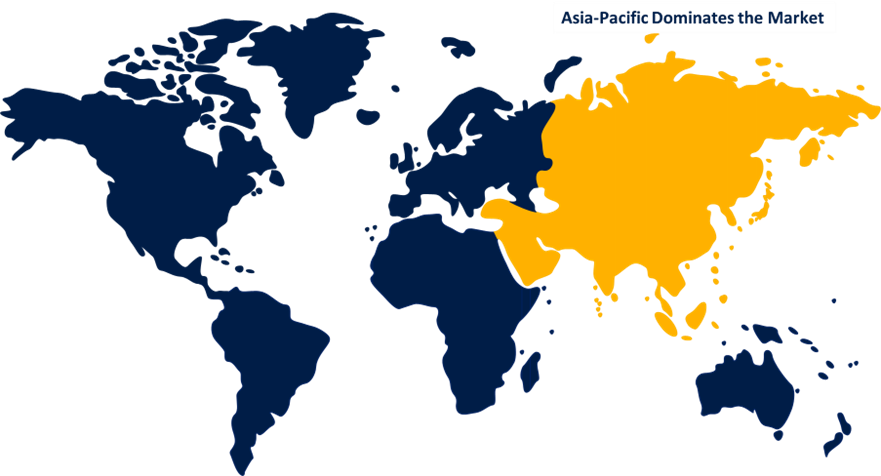

Asia Pacific is anticipated to hold the largest share of the advanced materials for the semiconductor market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the advanced materials for the semiconductor market over the predicted timeframe. Top of FormAsia Pacific region is attributed to the region benefits from being a global hub for semiconductor manufacturing, with key players and major foundries located in countries like China, Japan, South Korea, and Taiwan. These countries have established robust semiconductor ecosystems encompassing R&D facilities, production capabilities, and a skilled workforce. Moreover, Asia Pacific's dominance is fueled by increasing investments in technology infrastructure, rapid industrialization, and the growing adoption of advanced electronics across diverse sectors such as consumer electronics, automotive, telecommunications, and industrial automation. The region's expanding middle class and rising disposable incomes also drive demand for electronic devices, further boosting the semiconductor market. Additionally, favorable government policies and initiatives supporting semiconductor manufacturing and technology development contribute to Asia Pacific's leadership position in the market.

North America is expected to grow at the fastest CAGR growth of the advanced materials for semiconductor market during the forecast period. The rapid growth of advanced materials for the semiconductor market in North America can be attributed to several key factors. Firstly, North America is home to a significant concentration of leading semiconductor companies, research institutions, and technology innovators. These entities drive continuous advancements in semiconductor materials, fostering a competitive environment conducive to innovation and market growth. Furthermore, North America boasts a robust demand for advanced semiconductor materials across various industries including consumer electronics, automotive, aerospace, healthcare, and industrial automation. The region's strong emphasis on technological innovation and adoption of cutting-edge technologies such as artificial intelligence (AI), Internet of Things (IoT), and 5G networks further fuels the demand for high-performance semiconductor materials. Moreover, favorable government policies and initiatives supporting research and development in semiconductor technologies, coupled with investments in infrastructure and manufacturing capabilities, contribute to the region's growth prospects. Additionally, collaborations between academia, industry, and government entities promote technological advancements and accelerate the commercialization of advanced semiconductor materials driving the market growth in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the advanced materials for semiconductor market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- WOLFSPEED, INC.

- Coherent Corp.

- Sumitomo Electric Industries Ltd.

- LG Chem Ltd.

- BASF SE

- KYOCERA Corporation

- Nichia Corporation

- Samsung Electronics Co., Ltd.

- Soitec

- Applied Materials

- AXT, Inc.

- ENTEGRIS

- IQE PLC

- Resonac Holdings Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, DuPont announced that it will present a complete spectrum of modern circuit materials and solutions at the 2024 International Electronic Circuits Exhibition in Shanghai. DuPont will exhibit at Booth 8L06 at the National Exhibition and Convention Center (NECC). Its product range includes fine lines, signal integrity, power, and thermal management.

- In April 2024, The CHIPS Act's, manufacturing incentives resulted in significant investments in the United States. Since the introduction of the CHIPS Act, companies in the semiconductor ecosystem have launched dozens of new projects across America, totaling approximately $450 billion in private capital. These announced initiatives will generate over 56,000 employments in the semiconductor ecosystem and support hundreds of thousands of other jobs across the United States economy.

- In April 2024, Penn State and Morgan Advanced Materials signed a memorandum of understanding (MOU) to accelerate research and development of silicon carbide, or SiC. Morgan enters a five-year, multimillion-dollar initiative with Penn State to improve high-voltage semiconductor performance, supplying graphite materials and solutions for SiC development.

- In April 2024, Coherent Corp. a leader in wide- and ultrawide-bandgap semiconductors, announced that it has received $15 million in funding from the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act of 2022, which provides the Department of Defense (DoD) with $2 billion to strengthen and revitalize the US semiconductor supply chain.

- In March 2024, Japan and the Federal Union intend to formally collaborate on the development of advanced materials in industries such as semiconductors and EV batteries, in part to reduce their dependence on China.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the advanced materials for the semiconductor market based on the below-mentioned segments:

Global Advanced Materials for Semiconductor Market, By Material Type

- Compound Semiconductors

- Two-Dimensional Materials

- Nanomaterials

- Organic Semiconductors

- Others

Global Advanced Materials for Semiconductor Market, By Application

- Power Electronics

- High-frequency Devices

- Photovoltaics

- Memory and Storage

- Optoelectronics

- Others

Global Advanced Materials for Semiconductor Market, By End-User Industry

- IT and Telecommunications

- Consumer Electronics

- Aerospace and Defense

- Healthcare

- Industrial

- Building and Automation

Global Advanced Materials for Semiconductor Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the advanced materials for the semiconductor market over the forecast period?The advanced materials for semiconductor market is projected to expand at a CAGR of 12.10% during the forecast period.

-

2.What is the market size of the advanced materials for the semiconductor market?The Global Advanced Materials for Semiconductor Market Size is Expected to Grow from USD 50.4 Billion in 2023 to USD 157.87 Billion by 2033, at a CAGR of 12.10% during the forecast period 2023-2033.

-

3.Which region holds the largest share of the advanced materials for the semiconductor market?Asia Pacific is anticipated to hold the largest share of the advanced materials for the semiconductor market over the predicted timeframe.

Need help to buy this report?