Global Aero Engine Composite Material Market Size By Application (Commercial Aircraft, Military Aircraft, and General Aviation Aircraft), By Component (Fan Blades, Guide Vanes, Shrouds, Engine Casing, Engine Nacelle, and Other Cold End Parts), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Aero Engine Composite Material Market Insights Forecasts to 2033

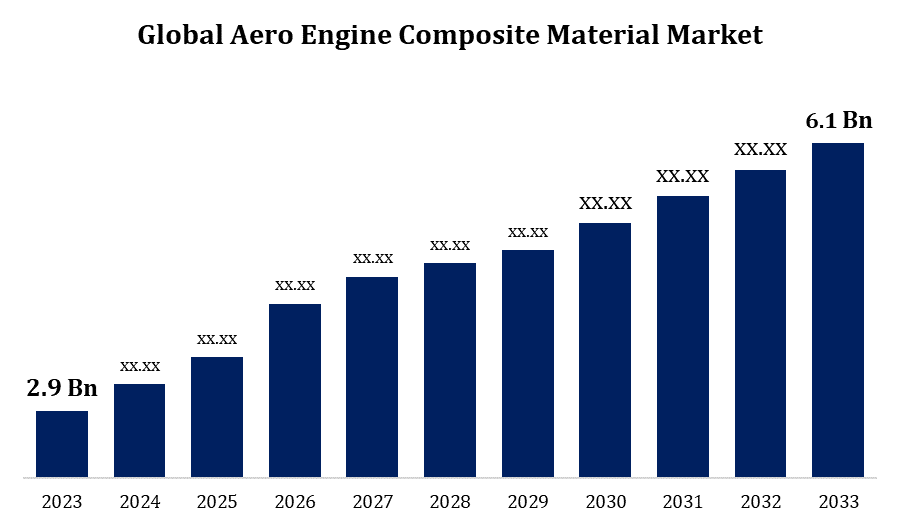

- The Aero Engine Composite Material Market Size was valued at USD 2.9 Billion in 2023.

- The Market is Growing at a CAGR of 7.72% from 2023 to 2033

- The Global Aero Engine Composite Material Market Size is Expected to reach USD 6.1 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Aero Engine Composite Material Market Size is Expected to reach USD 6.1 Billion by 2033, at a CAGR of 7.72% during the forecast period 2023 to 2033.

The aero engine composite material market is expanding rapidly, propelled by technological breakthroughs, rising demand for fuel-efficient aircraft, and the aerospace industry's emphasis on lowering weight and emissions. Composite materials are lighter than traditional materials such as metals, resulting in increased fuel efficiency and lower emissions. As airlines and aircraft manufacturers work to meet severe environmental standards while lowering operational costs, the demand for composite materials in aero engines is increasing. The rising need for commercial and military aircraft, fueled by increased air travel and defence spending, is driving the demand for innovative materials in aero engine development.

Global Aero Engine Composite Material Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 2.9 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 7.72% |

| 023 – 2033 Value Projection: | USD 6.1 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Component, By Region, By Geographic Scope |

| Companies covered:: | Materion Corporation, Royal Ten Cate, Hexcel Corporation, Owen Corning, Solvay, Teijin, SGL Group, Mitsubishi Rayon Co., Renegade Materials Corporation, Toray Industries, and other key vendors |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Aero Engine Composite Material Market Value Chain Analysis

The aero engine composite material market value chain is complex and involves various stages, from raw material suppliers providing fibers, resins, and additives, to material manufacturers producing prepregs and intermediate products. Composite manufacturers then create final components, such as turbine blades and fan cases, which are used by aero engine manufacturers like GE Aviation, Rolls-Royce, and Safran. These manufacturers design, develop, and test engines incorporating these composites to meet stringent aerospace standards. Aerospace OEMs, including Boeing and Airbus, integrate these engines into their aircraft, while specialized MRO providers ensure the maintenance and repair of these composite components. The entire value chain is driven by continuous R&D, innovation, collaboration, and a focus on sustainability to meet market demands and regulatory requirements.

Aero Engine Composite Material Market Opportunity Analysis

The aero engine composite material market presents significant opportunities driven by several key factors. The demand for more fuel-efficient and environmentally friendly aircraft is a major driver, as composite materials offer substantial weight reductions and improved performance compared to traditional materials. Advancements in technology, such as high-temperature-resistant composites and innovative manufacturing techniques like additive manufacturing, are expanding the applications of composites in aero engines. The growing production of commercial and military aircraft, along with the rapid expansion of the aerospace sector in emerging markets, further fuels the demand for advanced composite materials. Additionally, the emphasis on sustainability and reducing carbon emissions aligns with the adoption of lightweight, high-performance composites. Collaborative efforts between material suppliers, technology providers, and aerospace manufacturers to develop and integrate next-generation composite solutions will enhance the market's growth prospects.

Market Dynamics

Aero Engine Composite Material Market Dynamics

Increasing Application of Composite Materials in Technologically Advanced Engines to Drive Market Growth

The increasing application of composite materials in technologically advanced engines is a key driver of growth in the aero engine composite material market. Composite materials, known for their superior strength-to-weight ratio, durability, and resistance to high temperatures, are being increasingly integrated into modern aero engines to enhance performance and efficiency. These materials significantly reduce the weight of engine components, leading to improved fuel efficiency and lower carbon emissions, which are critical for meeting stringent environmental regulations and reducing operational costs. Furthermore, the aerospace industry's push towards innovation and sustainability is driving the development of new composite materials with enhanced properties, such as higher temperature resistance and greater fatigue strength.

Restraints & Challenges

Composite materials are produced using complicated and costly procedures such as high-temperature curing and precise layering techniques. This leads in higher costs than typical materials such as metals. Composites require expensive raw ingredients such as carbon fibres and resins. Additionally, the supply chain for certain commodities may be constrained, resulting in higher prices. The composite materials supply chain is prone to disruptions, which can affect material availability and pricing. The aircraft industry relies on a small number of suppliers for high-quality composite materials, resulting in possible bottlenecks and supply problems.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aero Engine Composite Material Market from 2023 to 2033. The Aero Engine Composite Material Market in North America is a significant segment within the global aerospace industry. North America stands as the largest market for Aero Engine Composites, with a strong emphasis on fuel efficiency, environmental sustainability, and operational performance driving the demand for lightweight composite materials. The region's market is characterized by advancements in composite manufacturing processes, such as resin infusion and automated lay-up, which have expanded the capabilities and applications of Aero Engine Composites. Additionally, the market in North America benefits from the presence of major engine manufacturers like GE Aviation and Pratt & Whitney, who are key players driving innovation and development in the aerospace sector. The region's focus on technological advancements and the adoption of advanced composite materials in aircraft engines positions North America as a key player in shaping the future of aviation through the utilization of Aero Engine Composites.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The demand for Aero Engine Composites in the Asia-Pacific region is fueled by the rising air passenger traffic, improving economies, and increasing defense expenditure in countries like India and China. Additionally, the market in Asia-Pacific is witnessing advancements in aerospace technology, with the evolution of engine designs necessitating materials that can withstand the demands of modern aviation, where Aero Engine Composites play a central role in meeting these challenges. The Asia-Pacific Aircraft Engine Market, which includes the Aero Engine Composite Material segment, is expected to reach significant values, reflecting the region's growing importance in the global aerospace industry.

Segmentation Analysis

Insights by Application

The commercial aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. The commercial aircraft sector held the largest market share in the Aero Engine Composites Market, owing to rising demand for narrowbody aircraft and increased orders from major manufacturers like as Airbus and Boeing. The use of composite materials in commercial aviation engines, such as 3-D woven carbon fibre composite fan blades and fan casings, is a prominent trend that is helping to drive the segment's growth. Companies such as GE are actively developing new composite technologies for engines such as the GE9X, which is developed for Boeing's 777X aircraft, hence supporting the growth of the commercial aircraft segment in the Aero Engine Composite Material Market.

Insights by Component

The engine casing segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Engine casings play an important role in aircraft engines, and there is a growing demand for lightweight materials such as composite engine casings to improve fuel efficiency and overall performance. As the aerospace industry concentrates on creating innovative composite materials for engine components, the engine casing segment is expected to increase significantly, driven by the benefits these materials provide in terms of weight reduction and operating efficiency. Furthermore, the introduction and upgrading of advanced aero engine composite material processing technologies by major market players, such as GE Aviation and Rolls-Royce, are key strategies that will further propel the growth of the engine casing segment within the Aero Engine Composite Material Market.

Recent Market Developments

- In July 2022, Hexcel applauded the successful first flight of the Airbus 321XLR. Hexcel supplies sophisticated composite materials for the A321XLR airframe and CFM International LEAP-1A engine, which power modern aeroplanes.

Competitive Landscape

Major players in the market

- Materion Corporation

- Royal Ten Cate

- Hexcel Corporation

- Owen Corning

- Solvay

- Teijin

- SGL Group

- Mitsubishi Rayon Co.

- Renegade Materials Corporation

- Toray Industries

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aero Engine Composite Material Market, Application Analysis

- Commercial Aircraft

- Military Aircraft

- General Aviation Aircraft

Aero Engine Composite Material Market, Component Analysis

- Fan Blades

- Guide Vanes

- Shrouds

- Engine Casing

- Engine Nacelle

- Other Cold End Parts

Aero Engine Composite Material Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?