Global Aeroengine Composites Market Size, Share, and COVID-19 Impact Analysis, by Application (Commercial Aircraft, Military Aircraft, and General Aviation Aircraft), Component (Fan Blades, Fan Case, Guide Vanes, Shrouds, and Other Components), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aeroengine Composites Market Insights Forecasts to 2033

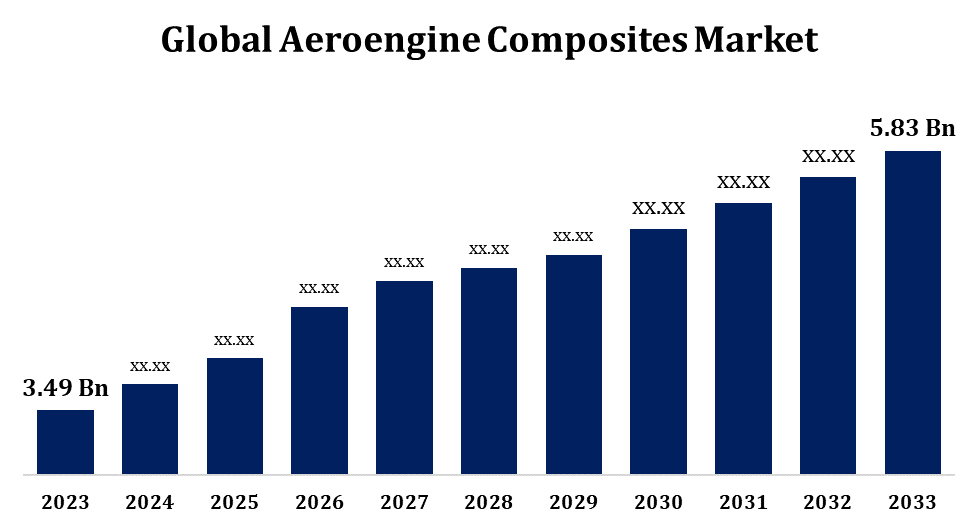

- The Aeroengine Composites Market Size was valued at USD 3.49 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.27% from 2023 to 2033.

- The Worldwide Aeroengine Composites Market Size is Expected to reach USD 5.83 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aeroengine Composites Market Size is Expected to reach USD 5.83 Billion by 2033, at a CAGR of 5.27% during the forecast period 2023 to 2033.

The aeroengine composites market is experiencing substantial growth driven by the increasing demand for lightweight and fuel-efficient aircraft. Composites, particularly carbon fiber-reinforced polymers, are being used more frequently in engine components due to their superior strength-to-weight ratio, corrosion resistance, and ability to withstand extreme temperatures. The market is bolstered by advancements in manufacturing technologies such as resin transfer molding and automated fiber placement, which improve production efficiency and reduce costs. Major players in the aerospace industry are investing in composite material innovations to enhance performance and sustainability. Additionally, the rise of next-generation aircraft and the need to meet stringent emission regulations are key factors accelerating market expansion. However, high production costs and challenges in recycling composite materials may pose constraints.

Aeroengine Composites Market Value Chain Analysis

The aeroengine composites market value chain comprises several key stages, starting with raw material suppliers who provide carbon fibers, resins, and other essential inputs. These materials are processed by intermediate manufacturers who create composite preforms, tapes, and fabrics tailored to specific aeroengine applications. The next stage involves composite component manufacturers who utilize advanced techniques like resin transfer molding and automated fiber placement to produce engine parts, including fan blades, casings, and nacelles. Original equipment manufacturers (OEMs) and aerospace firms integrate these components into engines, often collaborating closely with composite manufacturers for customization and innovation. The value chain is supported by research institutions and technology providers focused on enhancing composite properties and production efficiencies. Additionally, regulatory bodies ensure that components meet stringent safety and performance standards.

Aeroengine Composites Market Opportunity Analysis

The aeroengine composites market offers significant growth opportunities driven by the aerospace industry's increasing focus on sustainability and fuel efficiency. As airlines seek to reduce operational costs and comply with stricter environmental regulations, demand for lightweight, durable composites is rising. Innovations in composite materials, such as advanced carbon fibers and ceramic matrix composites, provide opportunities for manufacturers to create more efficient aeroengine components. The expanding production of next-generation aircraft and the rapid adoption of composite-intensive designs further enhance market prospects. Emerging markets in Asia-Pacific and the Middle East, coupled with a growing aftermarket for maintenance, repair, and overhaul (MRO) services, present additional opportunities for market expansion. Collaborative R&D initiatives and technological advancements in manufacturing processes, such as 3D printing, also contribute to future growth potential.

Global Aeroengine Composites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.49 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.27% |

| 2033 Value Projection: | USD 5.83 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 208 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, Component, By Region |

| Companies covered:: | Airbus SAS, Albany International Corp., BASF SE, Comtek Advanced Structures Ltd., DuPont de Nemours, Inc., FACC AG, General Dynamics Mission Systems, Inc., General Electric Company, GKN Aerospace Services Limited, Godrej & Boyce Manufacturing Company Limited, Hexcel Corporation, Honeywell International, Inc., IHI Corporation, LMI Aerospace, Inc. by Sonaca SA, Meggitt PLC by Parker Hannifin Corporation, Pratt & Whitney by RTX Corporation, Rolls-Royce PLC, Safran S.A., SGL Carbon SE, Solvay S.A., Spirit AeroSystems Inc., Tata Advanced Systems Limited, Teijin Limited, Zoltek Corporation by Toray Group, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aeroengine Composites Market Dynamics

Substantial rise in passenger traffic to propel the market growth

The substantial rise in passenger traffic is a key factor driving the growth of the aeroengine composites market. As global air travel demand increases, particularly in emerging markets like Asia-Pacific and the Middle East, airlines are expanding their fleets and seeking more fuel-efficient, lightweight aircraft to reduce operational costs. This surge in passenger traffic compels original equipment manufacturers (OEMs) to adopt advanced composite materials, such as carbon fiber-reinforced polymers and ceramic matrix composites, in engine components to enhance fuel efficiency and performance. Additionally, the need to accommodate growing passenger volumes with quieter, more efficient aircraft aligns with environmental regulations and noise reduction standards, further boosting the demand for aeroengine composites. This trend is expected to support robust market growth over the coming years.

Restraints & Challenges

High production costs associated with advanced composite materials, such as carbon fiber-reinforced polymers and ceramic matrix composites, pose a significant barrier, particularly for smaller manufacturers. Additionally, complex manufacturing processes require specialized equipment and expertise, which can limit scalability and drive up costs. The recycling and disposal of composite materials remain a major concern, given the environmental impact and stringent regulations around waste management. Market players also face challenges in ensuring consistent quality and reliability, as composites must meet strict safety and performance standards in the aerospace industry. Furthermore, supply chain disruptions, such as raw material shortages and geopolitical tensions, can create uncertainties in material availability and pricing, affecting the overall market stability.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aeroengine Composites Market from 2023 to 2033. The region's emphasis on developing lightweight, fuel-efficient engines to meet stringent environmental regulations and reduce operating costs boosts the demand for advanced composites, such as carbon fiber-reinforced polymers and ceramic matrix composites. Additionally, substantial investments in research and development, coupled with government support and defense contracts, contribute to market growth. The rising production rates of next-generation aircraft and the expanding maintenance, repair, and overhaul (MRO) sector further stimulate demand for composite materials.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Developing nations are investing heavily in modernizing their aircraft fleets and developing indigenous aerospace capabilities. This growth is further supported by government initiatives to promote local manufacturing and reduce dependency on foreign suppliers. The rising demand for fuel-efficient, lightweight aircraft to meet stringent emission norms is accelerating the adoption of advanced composite materials, such as carbon fiber-reinforced polymers, in engine components. Additionally, the region's robust maintenance, repair, and overhaul (MRO) industry creates opportunities for composite use in aftermarket applications. However, challenges such as high initial costs and limited technical expertise may constrain growth.

Segmentation Analysis

Insights by Application

The commercial aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are investing in new, lightweight aircraft that utilize advanced composite materials, such as carbon fiber-reinforced polymers and ceramic matrix composites, to improve fuel efficiency, reduce emissions, and lower operational costs. The rising production rates of next-generation aircraft, like the Boeing 787 and Airbus A350, which incorporate a high percentage of composite materials in their engines, further support market expansion. Additionally, the growing focus on reducing aircraft weight to comply with stringent regulatory standards and noise reduction mandates enhances the adoption of composites in the commercial aviation sector, driving sustained growth.

Insights by Component

The fan blades segment accounted for the largest market share over the forecast period 2023 to 2033. Advanced composite materials, such as carbon fiber-reinforced polymers, are being increasingly used in fan blades due to their superior strength-to-weight ratio, fatigue resistance, and ability to withstand extreme conditions. These properties enable significant weight reduction, leading to improved fuel efficiency and lower emissions, which align with the aerospace industry's sustainability goals. Major aircraft manufacturers, like Boeing and Airbus, and engine makers, such as GE Aviation and Rolls-Royce, are adopting composite fan blades in their next-generation engines to enhance performance and reduce noise. Additionally, the rise in global aircraft deliveries and fleet modernization efforts further propel the segment's growth.

Recent Market Developments

- In November 2021, Albany International Corp. and Safran Aircraft Engines announced a collaboration extension through 2046. In order to create a joint venture for the development of high-tech composite parts (resin transfer moulded and 3D woven) intended for aircraft engines, landing gears, and nacelles, Albany International and Safran signed the initial framework agreement in 2006.

Competitive Landscape

Major players in the market

- Airbus SAS

- Albany International Corp.

- BASF SE

- Comtek Advanced Structures Ltd.

- DuPont de Nemours, Inc.

- FACC AG

- General Dynamics Mission Systems, Inc.

- General Electric Company

- GKN Aerospace Services Limited

- Godrej & Boyce Manufacturing Company Limited

- Hexcel Corporation

- Honeywell International, Inc.

- IHI Corporation

- LMI Aerospace, Inc. by Sonaca SA

- Meggitt PLC by Parker Hannifin Corporation

- Pratt & Whitney by RTX Corporation

- Rolls-Royce PLC

- Safran S.A.

- SGL Carbon SE

- Solvay S.A.

- Spirit AeroSystems Inc.

- Tata Advanced Systems Limited

- Teijin Limited

- Zoltek Corporation by Toray Group

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aeroengine Composites Market, Application Analysis

- Commercial Aircraft

- Military Aircraft

- General Aviation Aircraft

Aeroengine Composites Market, Component Analysis

- Fan Blades

- Fan Case

- Guide Vanes

- Shrouds

- Other Components

Aeroengine Composites Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aeroengine Composites Market?The global Aeroengine Composites Market is expected to grow from USD 3.49 billion in 2023 to USD 5.83 billion by 2033, at a CAGR of 5.27% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aeroengine Composites Market?Some of the key market players of the market are Airbus SAS, Albany International Corp., BASF SE, Comtek Advanced Structures Ltd., DuPont de Nemours, Inc., FACC AG, General Dynamics Mission Systems, Inc., General Electric Company, GKN Aerospace Services Limited, Godrej & Boyce Manufacturing Company Limited, Hexcel Corporation, Honeywell International, Inc., IHI Corporation, LMI Aerospace, Inc. by Sonaca SA, Meggitt PLC by Parker Hannifin Corporation, Pratt & Whitney by RTX Corporation, Rolls-Royce PLC, Safran S.A., SGL Carbon SE, Solvay S.A., Spirit AeroSystems Inc., Tata Advanced Systems Limited, Teijin Limited, and Zoltek Corporation by Toray Group.

-

3. Which segment holds the largest market share?The fan blades segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aeroengine Composites Market?North America dominates the Aeroengine Composites Market and has the highest market share.

Need help to buy this report?