Global Aerosol Drug Delivery Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Dry Powder Inhalers, Metered Dose Inhalers, Nebulizers), By Application (Asthma, Chronic Obstructive Pulmonary Disease, Cystic Fibrosis, Non-Respiratory Diseases [Diabetes, Analgesia, Parkinson’s Diseases]), By Distribution Channels (Retail Pharmacies, Hospital Pharmacies, E-commerce), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: HealthcareGlobal Aerosol Drug Delivery Devices Market Insights Forecasts to 2033

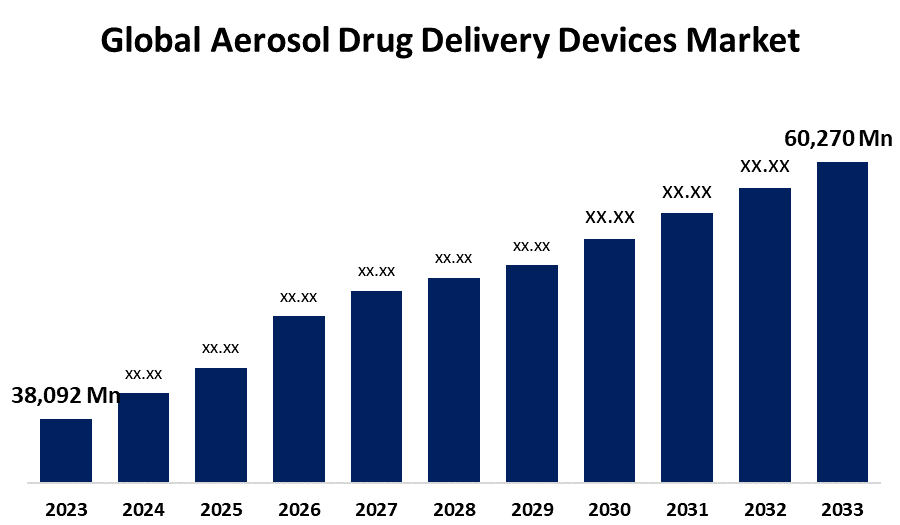

- The Global Aerosol Drug Delivery Devices Market Size Was Valued at USD 38,092 Million in 2023

- The Market Size is Growing at a CAGR of 4.70% from 2023 to 2033

- The Worldwide Aerosol Drug Delivery Devices Market Size is Expected to Reach USD 60,270 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aerosol Drug Delivery Devices Market Size is Anticipated to Exceed USD 60,270 Million by 2033, Growing at a CAGR of 4.70% from 2023 to 2033.

Market Overview

Aerosol drug delivery devices are medical equipment that administer medication directly to the respiratory system by inhalation. These devices are used to treat various respiratory disorders, such as asthma, chronic obstructive pulmonary disease (COPD), and other lung difficulties. Aerosol drug delivery devices, such as MDIs, DPIs, and nebulizers, are crucial for treating respiratory conditions by delivering medication directly to the lungs, enhancing treatment efficacy, and minimizing side effects.

Aerosol drug delivery devices are used during surgical procedures and provide emergency relief for severe allergic reactions. The effectiveness of these devices depends on particle size, device use, and patient-specific needs.

For Instance, 2024, In July 2023, Viatris Inc., a global healthcare company, and Kindeva Drug Delivery L.P. launched Breyna (budesonide and formoterol fumarate dihydrate) Inhalation Aerosol, the first generic version of AstraZeneca's Symbicort with an Abbreviated New Drug Application (ANDA) approved by the US Food and Drug Administration (FDA).

Report Coverage

This research report categorizes the market for aerosol drug delivery devices based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the aerosol drug delivery devices market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the aerosol drug delivery devices market.

Global Aerosol Drug Delivery Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 38,092 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.70% |

| 2033 Value Projection: | USD 60,270 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application, By Distribution Channels, By Region |

| Companies covered:: | 3M Company, Aerogen, Inc., GlaxoSmithKline PLC (GSK), Johnson & Johnson, Koninklijke Philips N.V., Metall Zug Group, Merck & Co., Inc., Recipharm AB, Teva Pharmaceutical Industries Limited, Vectura Group PLC, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the aerosol drug delivery devices market is propelled by several key factors including the increasing prevalence of respiratory diseases like asthma and COPD fuels the demand for effective delivery systems. Technological advancements, including improved inhalers and nebulizers, enhance drug delivery efficiency and patient compliance. The aging population, rising awareness, and educational efforts about aerosol devices further support market expansion. Furthermore, innovations in drug formulations and non-invasive delivery methods, supportive regulatory frameworks, and increased healthcare investment contribute to the aerosol drug delivery devices market.

Restraining Factors

The aerosol drug delivery devices market faces several challenges that could impede its growth including high costs associated with advanced devices can limit accessibility, particularly in lower-income areas. Device complexity might lead to user errors, affecting treatment efficacy and patient adherence. Stringent regulatory requirements can delay innovation and market entry. Competition from alternative delivery methods and limited patient awareness also pose significant barriers.

Market Segmentation

The aerosol drug delivery devices market share is classified intoproduct, application, and distribution channels.

- The metered dose inhalers segment is estimated to hold the highest market revenue share through the projected period.

Based on the product, the aerosol drug delivery devices market is classified into dry powder inhalers, metered dose inhalers, and nebulizers. Among these, the metered dose inhalers segment is estimated to hold the highest market revenue share through the projected period. MDIs are known for their convenience and effectiveness, and they can deliver medication in a precise dose, which might contribute to their leading position in the market. Metered dose inhalers aerosol devices treat respiratory conditions like asthma, chronic obstructive pulmonary disease, and cystic fibrosis by spraying medication into the patient's lungs. MDIs might be preferred because of their ease of use, widespread acceptance among patients and healthcare providers, and long-standing market presence.

- The asthma segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the aerosol drug delivery devices market is divided into asthma, chronic obstructive pulmonary disease, cystic fibrosis, and non-respiratory diseases. Among these, the asthma segment is anticipated to hold the largest market share through the forecast period. Asthma is a widespread non-communicable disease. Asthma is a chronic condition characterized by pulmonary airway inflammation and constriction. Asthma affects people of all ages, although it is more common in young children. In some situations, a person with a previous asthma diagnosis might develop allergic asthma symptoms. Long-term exposure to dust, gasses, or fumes can also lead to asthmatic symptoms. Exercising can also result in exercise-induced bronchoconstriction, which makes it difficult for the airways to dilate. Although there is presently no cure for asthma, medications can help alleviate symptoms. Dry powder inhalers, metered dose inhalers, and nebulizers are frequently used to provide asthma medication directly into the lungs.

- The retail pharmacies segment dominates the market with the largest market share through the forecast period.

Based on the distribution channels, the aerosol drug delivery devices market is categorized into retail pharmacies, hospital pharmacies, and e-commerce. Among these, the retail pharmacies segment dominates the market with the largest market share through the forecast period. The dominance of the retail pharmacies segment is due to their widespread accessibility, convenience for consumers, and the broad range of products they offer. Retail pharmacies are often preferred by patients for obtaining aerosol drug delivery devices due to their ease of access and integration with insurance and reimbursement processes.

Regional Segment Analysis of the Aerosol Drug Delivery Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

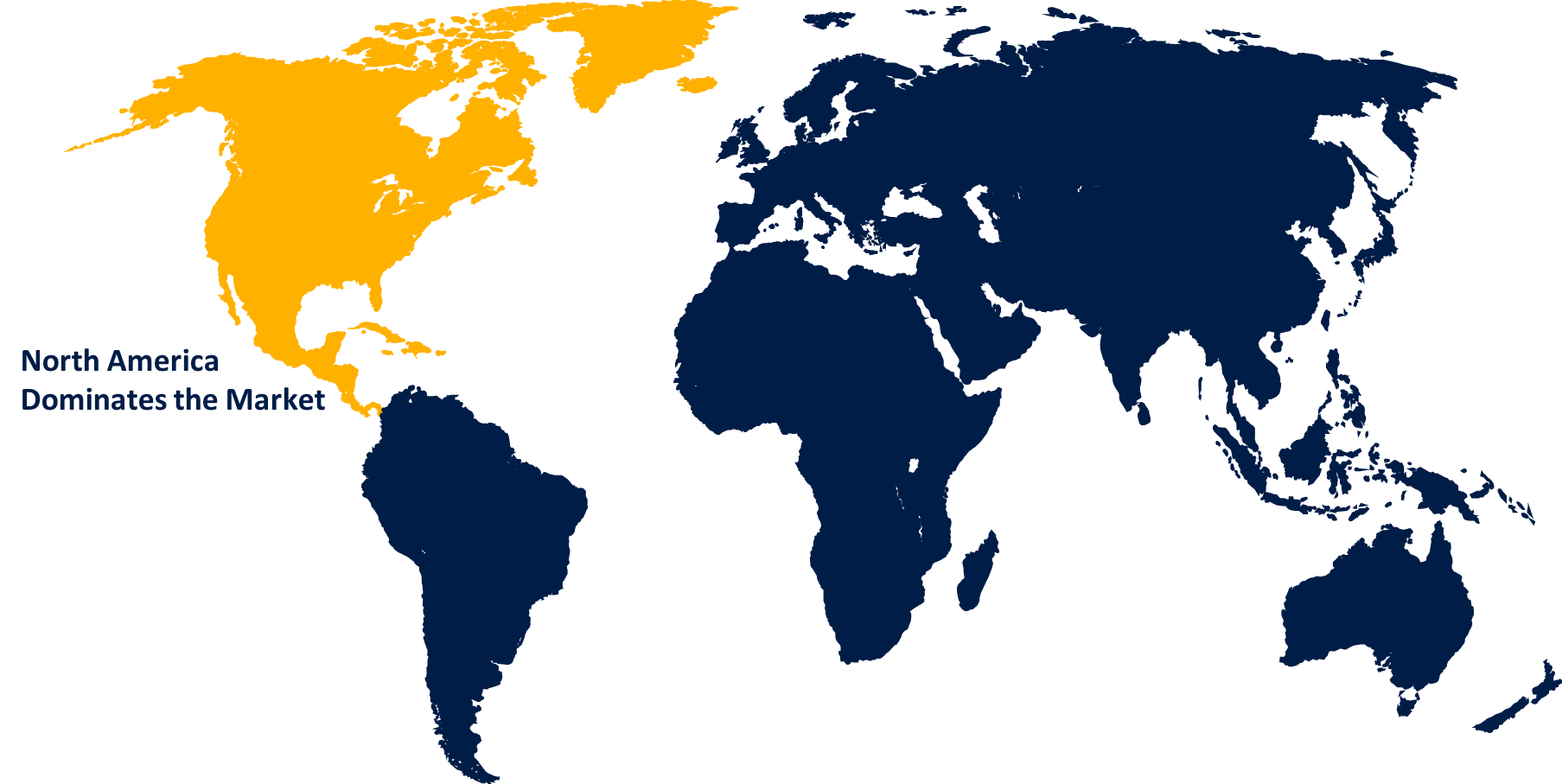

North America is anticipated to hold the largest share of the aerosol drug delivery devices market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the aerosol drug delivery devices market over the predicted timeframe. The dominance of the region is driven by the region's advanced healthcare infrastructure, high prevalence of respiratory conditions, and significant presence of major pharmaceutical and medical device companies. Furthermore, robust healthcare spending and supportive regulatory environments further enhance market growth.

Asia Pacific is expected to grow at the fastest CAGR growth of the aerosol drug delivery devices market during the forecast period. The Asia-Pacific region's fastest expansion is due to a large population, increased public awareness, affordability, R&D development, healthcare reforms, technological advancements, and rising demand for inhalers, nebulizers, and home healthcare devices. Leading manufacturers are expanding their presence in emerging Asia-Pacific countries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the aerosol drug delivery devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M Company

- Aerogen, Inc.

- GlaxoSmithKline PLC (GSK)

- Johnson & Johnson

- Koninklijke Philips N.V.

- Metall Zug Group

- Merck & Co., Inc.

- Recipharm AB

- Teva Pharmaceutical Industries Limited

- Vectura Group PLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Medline launched the Hudson RCI TurboMist small-volume nebulizer for administering medication in respiratory treatment.

- In June 2024, Aseptika introduced the PUFFClicker3, a universal smart inhaler dose tracker that works with both pressurized metered dose inhalers (pMDI) and dry powder inhalers (DPI).

- In March 2024, Berry Global introduced the BerryHaler, a two-chamber, dry powder inhaler (DPI) with a dose counter intended to improve patient access to and enhance the successful delivery of combination medications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the aerosol drug delivery devices market based on the below-mentioned segments:

Global Aerosol Drug Delivery Devices Market, By Product

- Dry Powder Inhalers

- Metered Dose Inhalers

- Nebulizers

Global Aerosol Drug Delivery Devices Market, By Application

- Asthma

- Chronic Obstructive Pulmonary Disease

- Cystic Fibrosis

- Non-Respiratory Diseases

- Diabetes

- Analgesia

- Parkinson’s Diseases

Global Aerosol Drug Delivery Devices Market, By Distribution Channels

- Retail Pharmacies

- Hospital Pharmacies

- E-commerce

Global Aerosol Drug Delivery Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?