Global Aerosol Filling Machines Market Size, Share, and COVID-19 Impact Analysis, By Machine Type (Automated, Semi-Automated, Manual), By End-User (Pharmaceuticals, Food & Beverage, Cosmetics, Homecare, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Advanced MaterialsGlobal Aerosol Filling Machines Market Insights Forecasts to 2033

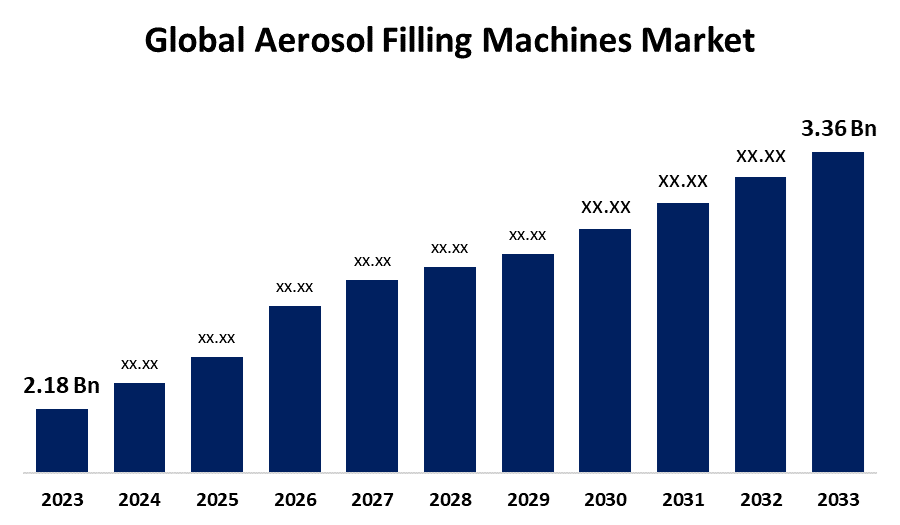

- The Global Aerosol Filling Machines Market Size was Valued at USD 2.18 Billion in 2023

- The Market Size is Growing at a CAGR of 4.42% from 2023 to 2033

- The Worldwide Aerosol Filling Machines Market Size is Expected to Reach USD 3.36 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aerosol Filling Machines Market Size is Anticipated to Exceed USD 3.36 Billion by 2033, Growing at a CAGR of 4.42% from 2023 to 2033.

Market Overview

Aerosol filling machines are specialized equipment designed for packaging products in aerosol cans or containers. These machines fill pressurized cans with various formulations, including liquids, gels, or foams, and then seal them for distribution. The filling process often involves several stages, including product preparation, filling, propellant injection, and sealing. The aerosol-filling machines market is propelled due to rising consumer demand, technological advancements, hygiene awareness, sustainability trends, food and beverage expansion, strict regulatory compliance, and the demand for customizable solutions. The market's expansion is supported by growth in emerging markets and increased production capacity, creating opportunities for innovation and development.

Aerosol filling machines are essential in various industries for packaging various products, including personal care, household cleaners, pharmaceuticals, food and beverage, industrial, automotive, and pet care.

Report Coverage

This research report categorizes the market for aerosol filling machines based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the aerosol filling machines market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the aerosol filling machines market.

Global Aerosol Filling Machines Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.18 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.42% |

| 2033 Value Projection: | USD 3.36 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Machine Type, By End-User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Terco, Inc., Smart Makina, Speed Line Aerosol, Filling Equipment, OPTIMA Packaging Group, Jrpacking, COSMAR, ZIGLER POLSKA Sp. z o.o., METALNOVA S.p.A., COSTER GROUP, and Others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the aerosol filling machines market is driven by several key factors including the growing demand for aerosol products across personal care, household, and industrial sectors. Technological advancements in automation and precision filling enhance efficiency, while raising awareness of hygiene, particularly post-pandemic, boosting the market for aerosol disinfectants. Furthermore, sustainability trends push for eco-friendly packaging, and the expanding food and beverage industry creates new opportunities for aerosol applications. Regulatory compliance and the demand for customizable filling solutions further motivate manufacturers to invest in advanced machinery. Moreover, emerging markets and the demand for increased production capacity are significant contributors to market growth, positioning the sector for continued innovation and expansion.

Restraining Factors

The aerosol filling machines market is constrained by several factors including high initial investment costs can deter smaller manufacturers from acquiring advanced machinery. Competition from alternative packaging solutions, such as pump sprays, and market saturation in certain regions intensifies price pressures. Furthermore, stringent regulatory challenges related to safety and environmental standards can increase compliance costs and complicate manufacturing processes.

Market Segmentation

The aerosol filling machines market share is classified into machine type and end-user.

- The semi-automated segment is estimated to hold the highest market revenue share through the projected period.

Based on the machine type, the aerosol filling machines market is classified into automated, semi-automated, and manual. Among these, the semi-automated segment is estimated to hold the highest market revenue share through the projected period. The segment dominance is attributed to its balance of efficiency and cost-effectiveness, making it an attractive option for many manufacturers. Semi-automated machines offer improved speed and precision compared to manual options and require less investment than fully automated systems. This versatility makes them particularly appealing to medium-sized businesses looking to scale production without incurring the high costs associated with fully automated solutions.

- The cosmetics segment is anticipated to hold the largest market share through the forecast period.

Based on the end-user, the aerosol filling machines market is divided into pharmaceuticals, food & beverage, cosmetics, homecare, and others. Among these, the cosmetics segment is anticipated to hold the largest market share through the forecast period. The cosmetics segment's prominence is due to increasing demand for aerosolized cosmetic products, such as deodorants, hairsprays, and skincare treatments, which offer convenience and ease of application. The rising trend of personal grooming and beauty products, coupled with innovation in formulations and packaging, further boosts the cosmetics segment.

Regional Segment Analysis of the Aerosol Filling Machines Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the aerosol filling machines market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the aerosol filling machines market over the predicted timeframe. Rapid industrialization, increasing consumer demand for aerosol products in personal care, home care, and food & beverage sectors, and a growing middle-class population with rising disposable incomes contribute to the region's growth. Furthermore, the region is witnessing significant investments in manufacturing capabilities and technological advancements, making it an attractive hub for aerosol production. The presence of major manufacturers and a robust supply chain further enhance market growth in Asia Pacific.

North America is expected to grow at the fastest CAGR growth of the aerosol filling machines market during the forecast period. The region's rapid expansion is attributed to a strong emphasis on innovation and technology in manufacturing processes and a growing demand for aerosol products in sectors such as personal care, pharmaceuticals, and household cleaning. The region’s well-established retail infrastructure and increasing consumer awareness of hygiene and personal grooming further contribute to the rising demand for aerosol filling machines.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the aerosol filling machines market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Terco, Inc.

- Smart Makina

- Speed Line Aerosol

- Filling Equipment

- OPTIMA Packaging Group

- Jrpacking

- COSMAR

- ZIGLER POLSKA Sp. z o.o.

- METALNOVA S.p.A.

- COSTER GROUP

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Colep Packaging, a packaging solutions provider, announced that it had acquired the remaining ownership in ALM, a Spanish aluminum aerosol maker. Two years after acquiring a 40% holding, the business purchased the remaining 60% of ALM's shares.

- In October 2021, Coster launched a new aerosol-filling machine portfolio with 53eC, a new indexing machine. The new indexing machine is designed for high output, extra flexibility, and connectivity.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the aerosol filling machines market based on the below-mentioned segments:

Global Aerosol Filling Machines Market, By Machine Type

- Automated

- Semi-Automated

- Manual

Global Aerosol Filling Machines Market, By End-User

- Pharmaceuticals

- Food & Beverage

- Cosmetics

- Homecare

- Others

Global Aerosol Filling Machines Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the aerosol filling machines market over the forecast period?The aerosol filling machines market is projected to expand at a CAGR of 4.42% during the forecast period.

-

2. What is the market size of the aerosol filling machines market?The Global Aerosol Filling Machines Market Size is Expected to Grow from USD 2.18 Billion in 2023 to USD 3.36 Billion by 2033, Growing at a CAGR of 4.42% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the aerosol filling machines market?Asia Pacific is anticipated to hold the largest share of the aerosol filling machines market over the predicted timeframe.

Need help to buy this report?