Global Aerospace Adhesives And Sealants Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Adhesives, Sealants), By Resin Type (Epoxy, Silicone), By End-User (Commercial Aviation, Military And Defense), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aerospace Adhesives And Sealants Market Insights Forecasts to 2033

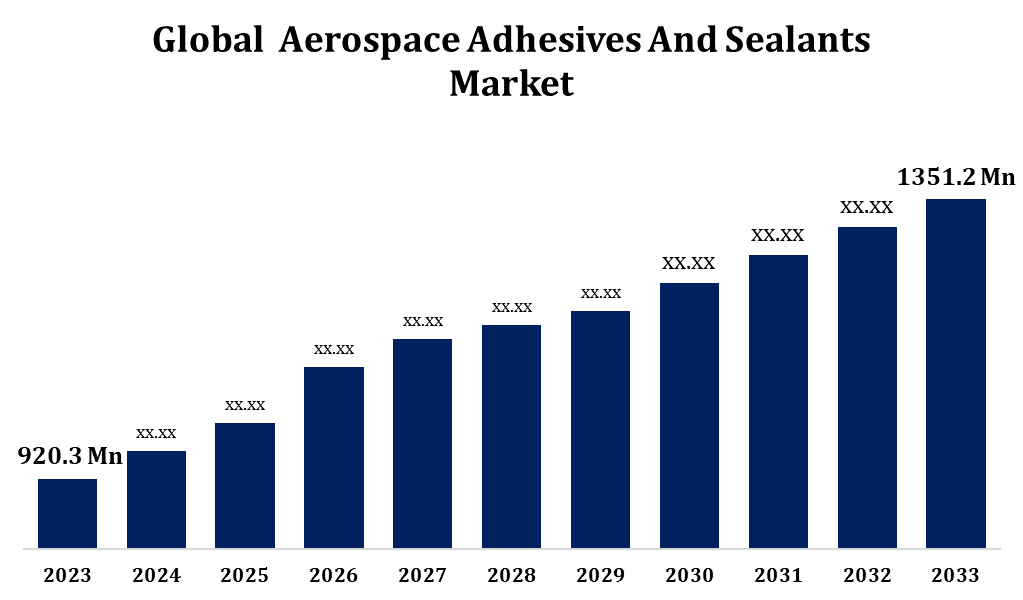

- The Aerospace Adhesives And Sealants Market was valued at USD 920.3 Million in 2023.

- The Market Size is Growing at a CAGR of 3.92% from 2023 to 2033.

- The Worldwide Aerospace Adhesives And Sealants Market Size is Expected to reach USD 1351.2 Million by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aerospace Adhesives And Sealants Market Size is Expected to reach USD 1351.2 Million by 2033, at a CAGR of 3.92% during the forecast period 2023 to 2033.

The global aerospace adhesives and sealants market is experiencing significant growth, driven by the increasing demand for lightweight, fuel-efficient aircraft. These specialized materials play a crucial role in ensuring structural integrity, improving durability, and enhancing performance in extreme environmental conditions. With advancements in aircraft manufacturing technologies, particularly in the commercial and defense sectors, the need for high-performance adhesives and sealants is rising. The market is also benefiting from the growing adoption of composite materials in aircraft design. Key applications include bonding and sealing in airframes, engines, interiors, and other critical components. Additionally, stringent safety regulations and a focus on reducing maintenance costs are further propelling market growth. Major players are investing in R&D to develop environmentally friendly and cost-effective solutions, aiming to meet evolving industry standards and customer demands.

Aerospace Adhesives And Sealants Market Value Chain Analysis

The aerospace adhesives and sealants market value chain involves multiple stages, from raw material suppliers to end-users in the aerospace industry. It begins with the procurement of key raw materials such as resins, polymers, and chemicals, sourced from chemical manufacturers. These raw materials are then processed by adhesive and sealant manufacturers to create specialized formulations tailored to aerospace applications. Distributors and suppliers bridge the gap between manufacturers and aircraft producers, ensuring timely delivery and compliance with industry standards. The end-users—aircraft manufacturers, MRO (maintenance, repair, and overhaul) service providers, and OEMs (original equipment manufacturers)—apply these products in various areas, including structural bonding, sealing, and surface protection. The value chain is influenced by factors like technological advancements, regulatory compliance, and supply chain efficiency, with increasing emphasis on sustainability and cost-effectiveness.

Aerospace Adhesives And Sealants Market Opportunity Analysis

The aerospace adhesives and sealants market presents significant growth opportunities, driven by increasing demand for fuel-efficient, lightweight aircraft and the growing adoption of advanced composite materials. As aerospace manufacturers aim to reduce overall aircraft weight and improve fuel efficiency, the need for high-performance bonding and sealing solutions is rising. Emerging trends, such as the use of electric and hybrid aircraft, further expand market prospects, requiring innovative adhesive technologies that meet specific performance criteria. Additionally, the growing focus on sustainable and environmentally friendly products creates opportunities for the development of low-VOC (volatile organic compound) adhesives and sealants. Expanding demand in regions like Asia-Pacific, with increased air travel and aircraft production, also provides substantial market potential for manufacturers focused on innovation, regulatory compliance, and cost-effective solutions.

Global Aerospace Adhesives And Sealants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 920.3 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.92% |

| 2033 Value Projection: | 1351.2 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 197 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Resin Type, By End-User |

| Companies covered:: | 3M, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman International LLC, PPG Industries, Inc., Arkema Group, Avery Dennison Corporation, Beacon Adhesives, Inc., Chemique Adhesives & Sealants Ltd, DELO Industrie Klebstoffe GmbH & Co. KGaA, Dow, Illinois Tool Works, Inc., and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aerospace Adhesives And Sealants Market Dynamics

Growth in Commercial Aviation to propel the market growth

The growth in commercial aviation is a key driver propelling the aerospace adhesives and sealants market. With increasing air travel demand, particularly in emerging markets like Asia-Pacific and the Middle East, airlines are expanding their fleets and upgrading aircraft for better efficiency. This surge in aircraft production and deliveries boosts the demand for advanced adhesives and sealants, essential for structural bonding, sealing, and weight reduction. The shift towards lightweight materials like composites in aircraft design further elevates the need for high-performance adhesives to ensure durability and safety. Additionally, the growing focus on fuel efficiency, lower emissions, and maintenance cost reduction in commercial aviation contributes to the rising adoption of innovative adhesives and sealants, which offer enhanced bonding solutions in modern aircraft manufacturing and repairs.

Restraints & Challenges

The aerospace adhesives and sealants market faces several challenges that could impact its growth. One key issue is the high cost of raw materials, such as resins and polymers, which can drive up production costs and reduce profit margins for manufacturers. Additionally, stringent regulatory requirements and certifications for safety, performance, and environmental compliance add complexity to the production and approval processes. The market also contends with the growing demand for sustainable, low-VOC (volatile organic compound) adhesives, which requires significant R&D investment to develop eco-friendly alternatives. Moreover, the volatility in the supply chain, exacerbated by geopolitical tensions and fluctuating raw material availability, can disrupt production timelines. Finally, competition from alternative bonding technologies, such as mechanical fasteners and welding, presents another challenge for the widespread adoption of adhesives and sealants in the aerospace industry.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace Adhesives And Sealants Market from 2023 to 2033. The region is a hub for both commercial and defense aviation, with increasing aircraft production and rising investments in military aviation. The adoption of lightweight materials, such as composites and alloys, in aircraft manufacturing boosts the demand for specialized adhesives and sealants that enhance performance and fuel efficiency. Additionally, the region's strong focus on technological advancements and R&D in aerospace technologies further fuels market growth. Strict regulatory standards related to safety, emissions, and environmental impact encourage the development of high-performance, eco-friendly products. With growing air travel and defense budgets, North America remains a key market for aerospace adhesives and sealants.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries like China, India, and Japan are becoming major hubs for both commercial and military aviation, driving demand for advanced bonding and sealing solutions. The growing middle class and rising disposable incomes are boosting air passenger traffic, prompting airlines to expand fleets and upgrade aircraft, thereby increasing the need for adhesives and sealants. Additionally, the region's focus on domestic aircraft manufacturing and maintenance, repair, and overhaul (MRO) activities further strengthens market prospects. Asia-Pacific's emphasis on fuel-efficient, lightweight aircraft has led to the adoption of advanced composites, driving demand for high-performance adhesives. Emerging aerospace programs in the region offer significant growth opportunities for manufacturers.

Segmentation Analysis

Insights by Product Type

The adhesives segment accounted for the largest market share over the forecast period 2023 to 2033. The adhesives segment is experiencing robust growth in the aerospace adhesives and sealants market, driven by the increasing use of lightweight materials like composites and advanced alloys in aircraft manufacturing. Adhesives offer superior bonding solutions, replacing traditional mechanical fasteners, thereby reducing aircraft weight and enhancing fuel efficiency. This shift is particularly significant in the production of modern commercial and military aircraft, where durability, strength, and resistance to extreme conditions are essential. The demand for high-performance structural adhesives, such as epoxy, polyurethane, and acrylic-based formulations, is rising as they provide reliable bonding for various aircraft components, including airframes, interiors, and engines. Additionally, the push for more fuel-efficient and eco-friendly aircraft designs has further fueled innovation in aerospace adhesives, enhancing their adoption across the industry.

Insights by Resin Type

The epoxy segment accounted for the largest market share over the forecast period 2023 to 2033. Epoxy adhesives are widely used in aerospace applications for bonding composite materials, metals, and thermoplastics, offering excellent adhesion under extreme environmental conditions such as high temperatures, pressure, and chemical exposure. This makes epoxy adhesives ideal for use in critical areas like airframes, engine components, and structural assemblies. The increasing adoption of composite materials in aircraft manufacturing to reduce weight and improve fuel efficiency has driven demand for epoxy-based adhesives. Additionally, the epoxy segment benefits from its versatility and reliability, which are essential for meeting stringent safety and performance standards in the aerospace industry. Continued R&D efforts to enhance epoxy formulations are further contributing to the segment's growth.

Insights by End User

The commercial aviation segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are expanding their fleets, particularly in regions like Asia-Pacific and the Middle East, which has boosted the need for advanced adhesives and sealants for airframes, interiors, and critical components. The shift towards lightweight aircraft, aimed at improving fuel efficiency and reducing carbon emissions, has led to greater adoption of composites and other advanced materials, further enhancing the demand for adhesives over traditional fastening methods. Adhesives play a key role in reducing aircraft weight while ensuring structural integrity and durability. Additionally, maintenance, repair, and overhaul (MRO) activities in the commercial sector are expanding, further driving the use of adhesives and sealants in both new and existing aircraft.

Recent Market Developments

- In April 2022, Master Bond has introduced EP4S-80, a one-component, silver-filled epoxy designed to meet NASA's stringent Low Outgassing Requirements. This advanced epoxy is ideal for bonding, sealing, filling, and encapsulating in applications requiring EMI/RFI shielding and static dissipation, where electrical conductivity is essential.

Competitive Landscape

Major players in the market

- 3M

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- PPG Industries, Inc.

- Arkema Group

- Avery Dennison Corporation

- Beacon Adhesives, Inc.

- Chemique Adhesives & Sealants Ltd

- DELO Industrie Klebstoffe GmbH & Co. KGaA

- Dow

- Illinois Tool Works, Inc.

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace Adhesives And Sealants Market, Product Type Analysis

- Adhesives

- Sealants

Aerospace Adhesives And Sealants Market, Resin Type Analysis

- Epoxy

- Silicone

Aerospace Adhesives And Sealants Market, End User Analysis

- Commercial Aviation

- Military And Defense

Aerospace Adhesives And Sealants Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aerospace Adhesives And Sealants Market?The global Aerospace Adhesives And Sealants Market is expected to grow from USD 920.3 million in 2023 to USD 1351.2 million by 2033, at a CAGR of 3.92% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aerospace Adhesives And Sealants Market?Some of the key market players of the market are 3M, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman International LLC, PPG Industries, Inc., Arkema Group, Avery Dennison Corporation, Beacon Adhesives, Inc., Chemique Adhesives & Sealants Ltd, DELO Industrie Klebstoffe GmbH & Co. KGaA, Dow, and Illinois Tool Works, Inc.

-

3. Which segment holds the largest market share?The epoxy segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aerospace Adhesives And Sealants Market?North America dominates the Aerospace Adhesives And Sealants Market and has the highest market share.

Need help to buy this report?