Global Aerospace and Defense Chemical Distribution Market Size, Share, and COVID-19 Impact Analysis, By Product (Lubricants & Greases, Oils & Hydraulic Fluids, Adhesives & Sealants, Paints & Coatings, Cleaners & Solvents, and Others), By End-use (Aerospace and Defense), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aerospace and Defense Chemical Distribution Market Insights Forecasts to 2033

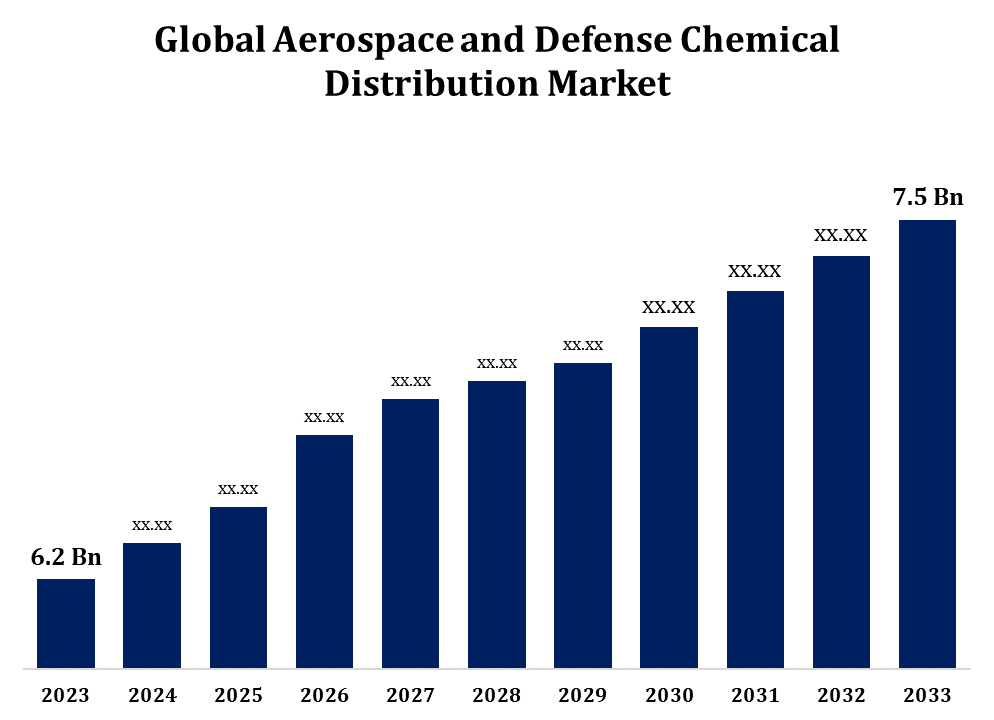

- The Aerospace and Defense Chemical Distribution Market was valued at USD 6.2 Billion in 2023.

- The Market Size is Growing at a CAGR of 1.92% from 2023 to 2033.

- The Worldwide Aerospace and Defense Chemical Distribution Market Size is Expected to reach USD 7.5 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aerospace and Defense Chemical Distribution Market Size is Expected to reach USD 7.5 Billion by 2033, at a CAGR of 1.92% during the forecast period 2023 to 2033.

The aerospace and defense chemical distribution market is driven by the increasing demand for specialized chemicals, including adhesives, sealants, coatings, lubricants, and cleaning agents, essential in aircraft manufacturing, maintenance, and defense applications. As the aerospace industry grows, particularly with the rise of commercial air travel and defense spending, the need for chemical solutions ensuring performance, safety, and regulatory compliance intensifies. Key players in this market focus on distribution efficiency, ensuring global supply chains meet the stringent quality and safety standards set by aerospace and defense sectors. Additionally, sustainability initiatives are gaining traction, with an emphasis on eco-friendly chemicals and materials. North America and Europe dominate the market due to strong aerospace and defense industries, but emerging economies are expected to present growth opportunities in the coming years.

Aerospace and Defense Chemical Distribution Market Value Chain Analysis

The aerospace and defense chemical distribution market value chain involves multiple stages, from raw material suppliers to end users. It begins with chemical manufacturers producing specialized chemicals like coatings, adhesives, and lubricants essential for aerospace and defense applications. Distributors play a critical role, acting as intermediaries between manufacturers and customers, ensuring the chemicals are delivered in compliance with strict safety, quality, and environmental regulations. These distributors often provide value-added services, such as packaging, storage, logistics, and technical support, to meet the complex needs of aerospace OEMs (Original Equipment Manufacturers) and MRO (Maintenance, Repair, and Overhaul) service providers. End users include aircraft manufacturers, defense contractors, and airlines, who rely on these chemicals for production and maintenance. Effective distribution ensures continuity and reliability in the highly regulated aerospace and defense sectors.

Aerospace and Defense Chemical Distribution Market Opportunity Analysis

The aerospace and defense chemical distribution market presents significant growth opportunities driven by advancements in aircraft technology, increased defense budgets, and a growing focus on maintenance, repair, and overhaul (MRO) services. With the push for lightweight, fuel-efficient aircraft, demand for high-performance adhesives, coatings, and composite materials is rising. The growing adoption of eco-friendly and sustainable chemical solutions, including green coatings and bio-based lubricants, also offers new market potential, especially as regulatory bodies impose stricter environmental standards. Emerging markets in Asia-Pacific, the Middle East, and Latin America are experiencing increased defense spending and aerospace manufacturing, further expanding the customer base for distributors. The integration of digital solutions, like inventory management and tracking systems, creates opportunities for improving supply chain efficiency and customer satisfaction, fueling market expansion.

Global Aerospace and Defense Chemical Distribution Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.92% |

| 2033 Value Projection: | USD 7.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-use |

| Companies covered:: | Aero Hardware & Parts Company, Aerospace Chemical Supplies Ltd, Aviall, Inc., Aviation Chemicals Solutions, Inc., Aviocom B.V., Boeing Distribution Services, E.V. Roberts, Ellsworth Adhesives, Graco Supply Company, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aerospace and Defense Chemical Distribution Market Dynamics

Technological advancements in aerospace technologies

Technological advancements in aerospace, such as the development of lightweight, fuel-efficient aircraft and the use of advanced materials like composites and carbon fiber, are driving growth in the aerospace and defense chemical distribution market. These innovations demand specialized chemicals, including high-performance adhesives, coatings, and sealants, that ensure structural integrity, durability, and safety under extreme conditions. The rise of additive manufacturing (3D printing) for aircraft components has also increased the need for custom chemical solutions, such as specialized resins and powders. Furthermore, the growing focus on sustainability and reducing carbon emissions is leading to the adoption of eco-friendly chemicals, like water-based coatings and bio-lubricants. Distributors that can supply these advanced, compliant chemical products are positioned to benefit from the increasing technological demands in aerospace and defense sectors.

Restraints & Challenges

The aerospace and defense chemical distribution market faces several challenges, including stringent regulatory compliance and safety standards. The industry must adhere to strict environmental, health, and safety regulations, which vary across regions, adding complexity to global operations. Managing hazardous materials, such as adhesives, coatings, and lubricants, requires specialized handling, storage, and transportation, increasing operational costs. Additionally, the market is impacted by supply chain disruptions, especially in the wake of geopolitical tensions, fluctuating raw material prices, and transportation bottlenecks. Ensuring consistent quality and timely delivery across global markets is crucial but difficult due to these factors. Another challenge is the increasing demand for sustainable and eco-friendly chemicals, requiring distributors to adapt their portfolios to meet both regulatory and customer expectations while maintaining performance and safety standards, which can be costly and time-consuming.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace and Defense Chemical Distribution Market from 2023 to 2033. The region is home to key aircraft manufacturers, such as Boeing, Lockheed Martin, and Northrop Grumman, which heavily rely on chemical products for manufacturing, maintenance, and repair. Increasing defense spending, particularly in the U.S., fuels demand for specialized chemicals, including coatings, adhesives, sealants, and lubricants used in aircraft production and military applications. North America's stringent regulatory framework, including environmental and safety standards, shapes the chemical supply chain, requiring distributors to ensure compliance. The region also leads in technological advancements, such as lightweight aircraft materials and eco-friendly chemicals, further driving growth. Additionally, North America's focus on sustainability encourages the adoption of greener chemicals, providing new opportunities for distributors in this highly competitive market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. These countries are investing heavily in modernizing their defense systems and expanding commercial aviation fleets, boosting demand for chemicals such as adhesives, coatings, lubricants, and sealants for aircraft production, maintenance, and repair. The region’s growing focus on sustainability and eco-friendly materials presents additional opportunities for distributors offering green chemical solutions. However, the market faces challenges such as regulatory complexities, particularly with varying safety and environmental standards across countries. Despite these hurdles, the region is becoming a key player in the global aerospace and defense chemical distribution market as local supply chains and infrastructure continue to develop, attracting international distributors and manufacturers.

Segmentation Analysis

Insights by Products

The Adhesives & Sealants segment accounted for the largest market share over the forecast period 2023 to 2033. As manufacturers shift toward composite materials, advanced adhesives and sealants are essential for bonding and sealing these structures, offering high strength while reducing the weight of components. These products play a critical role in ensuring the integrity, durability, and safety of aircraft under extreme operational conditions. The segment also benefits from innovations in adhesive technologies, such as epoxy-based adhesives and high-performance sealants, which provide superior resistance to temperature, pressure, and corrosion. Additionally, the rise of electric and hybrid aircraft and the growing demand for eco-friendly solutions are creating new opportunities for distributors supplying sustainable adhesives and sealants that meet strict aerospace and defense standards.

Insights by End Use

The aerospace segment accounted for the largest market share over the forecast period 2023 to 2033. The demand for specialized chemicals, such as adhesives, sealants, coatings, and lubricants, is increasing as aircraft manufacturers focus on lightweight, fuel-efficient designs using advanced materials like composites and carbon fiber. The push for more sustainable aviation, including electric and hybrid aircraft, is also driving the need for innovative, eco-friendly chemical solutions. Maintenance, repair, and overhaul (MRO) services are another significant growth area, as airlines seek to extend the lifecycle of aircraft through high-performance chemicals. With increasing aircraft deliveries and a robust aviation sector, the aerospace segment continues to offer strong growth potential for chemical distributors worldwide.

Recent Market Developments

- On March 2019, Univar Solutions Inc. announced the completion of its acquisition of Nexeo Solutions. This acquisition is anticipated to enhance the company's market share in the global aerospace and defense chemical distribution sector, with a particular focus on strengthening its presence in North America and the Asia-Pacific regions.

Competitive Landscape

Major players in the market

- Aero Hardware & Parts Company

- Aerospace Chemical Supplies Ltd

- Aviall, Inc.

- Aviation Chemicals Solutions, Inc.

- Aviocom B.V.

- Boeing Distribution Services

- E.V. Roberts

- Ellsworth Adhesives

- Graco Supply Company

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace and Defense Chemical Distribution Market, Product Analysis

- Lubricants & Greases

- Oils & Hydraulic Fluids

- Adhesives & Sealants

- Paints & Coatings

- Cleaners & Solvents

- Others

Aerospace and Defense Chemical Distribution Market, End Use Analysis

- Aerospace

- Defense

Aerospace and Defense Chemical Distribution Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aerospace and Defense Chemical Distribution Market?The global Aerospace and Defense Chemical Distribution Market is expected to grow from USD 6.2 billion in 2023 to USD 7.5 billion by 2033, at a CAGR of 1.92% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aerospace and Defense Chemical Distribution Market?Some of the key market players of the market are Aero Hardware & Parts Company, Aerospace Chemical Supplies Ltd, Aviall, Inc., Aviation Chemicals Solutions, Inc., Aviocom B.V., Boeing Distribution Services, E.V. Roberts, Ellsworth Adhesives, and Graco Supply Company.

-

3. Which segment holds the largest market share?The aerospace segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aerospace and Defense Chemical Distribution Market?North America dominates the Aerospace and Defense Chemical Distribution Market and has the highest market share.

Need help to buy this report?