Global Aerospace And Defense Elastomers Market Size, Share, and COVID-19 Impact Analysis, By Product [Ethylene Propylene Diene Monomer (EPDM), Silicone Elastomers, and Fluor Elastomers), By Application (Profiles, O-Rings & Gaskets, Seals and Hoses], and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aerospace And Defense Elastomers Market Insights Forecasts to 2033

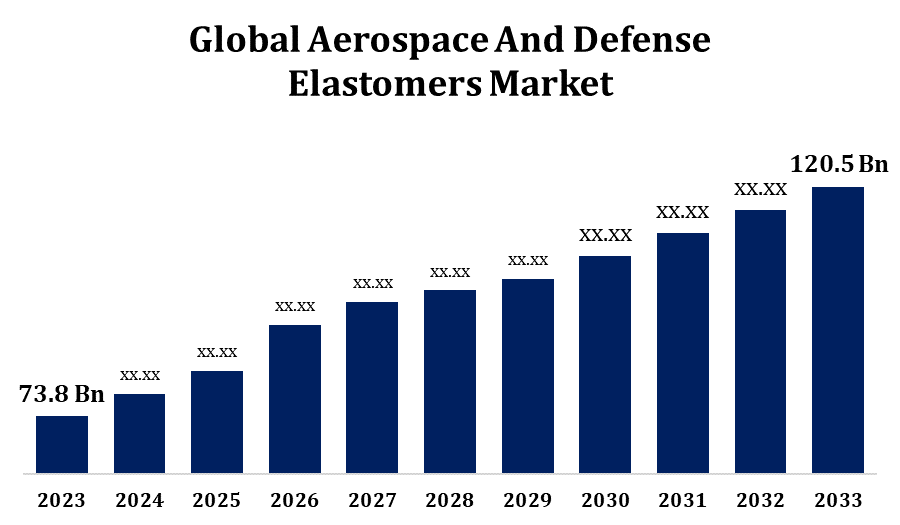

- The Aerospace And Defense Elastomers Market Size Was valued at USD 73.8 Million in 2023.

- The Market Size is Growing at a CAGR of 5.03% from 2023 to 2033.

- The Worldwide And Defense Elastomers Market Size is expected to reach USD 120.5 Million by 2033.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aerospace And Defense Elastomers Market Size is expected to reach USD 120.5 million by 2033, at a CAGR of 5.03% during the forecast period 2023 to 2033.

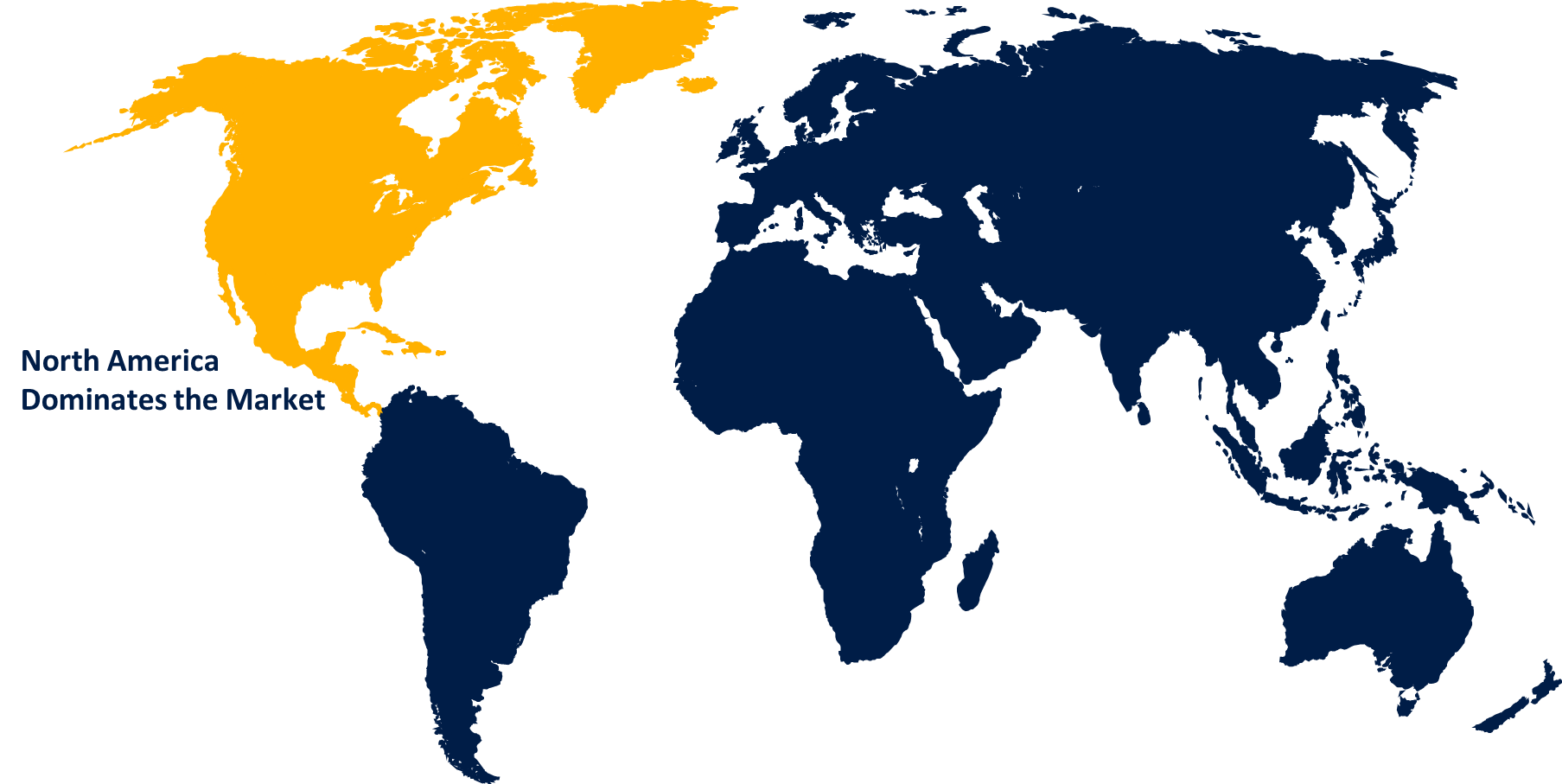

The Aerospace and Defense Elastomers Market is experiencing steady growth, driven by increasing demand for lightweight and durable materials in aircraft, spacecraft, and military applications. Elastomers, such as silicone, ethylene propylene diene monomer (EPDM), and fluorosilicone, are favored for their exceptional resistance to extreme temperatures, chemicals, and weather conditions. They are widely used in seals, gaskets, hoses, and insulation to enhance performance and safety. The market is further propelled by the expansion of the aviation sector, rising defense budgets, and the growing emphasis on fuel efficiency and emissions reduction. North America dominates the market due to its established aerospace industry, while Asia-Pacific shows significant potential for growth. Technological advancements and increased R&D investments are expected to drive future market expansion.

Aerospace And Defense Elastomers Market Value Chain Analysis

The Aerospace and Defense Elastomers Market value chain comprises several key stages, starting with raw material suppliers who provide base elastomers like silicone, EPDM, and fluorosilicone. These materials are then processed by elastomer manufacturers who design and formulate them into specific products, such as seals, gaskets, and hoses, tailored to meet the stringent requirements of the aerospace and defense sectors. Component manufacturers integrate these elastomers into various aircraft, spacecraft, and military equipment parts. The final products are then distributed to original equipment manufacturers (OEMs) and end-users, including airlines, defense contractors, and government agencies. The value chain is influenced by factors such as technological advancements, stringent regulatory standards, and the need for high-performance materials, fostering innovation and collaboration across the supply chain to meet market demands.

Aerospace And Defense Elastomers Market Opportunity Analysis

The Aerospace and Defense Elastomers Market presents significant growth opportunities driven by rising demand for lightweight, durable, and high-performance materials in aviation and defense applications. Growing investments in advanced aircraft and defense technologies, alongside a push for fuel-efficient and environmentally sustainable solutions, are expanding the market scope for elastomers like silicone, EPDM, and fluorosilicone. Emerging markets in Asia-Pacific, with increased defense budgets and burgeoning aerospace sectors, offer substantial growth potential. Additionally, technological innovations in elastomer formulations to enhance resistance to extreme conditions, chemicals, and mechanical stress create opportunities for specialized products. Strategic partnerships and R&D investments focusing on developing next-generation elastomers for advanced applications further bolster market prospects, positioning companies to leverage the evolving needs of aerospace and defense industries.

Global Aerospace And Defense Elastomers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 73.8 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.03% |

| 2033 Value Projection: | USD 120.5 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By Region |

| Companies covered:: | Saint-Gobain, Solvay, Lanxess, Dow Corning, Greene, Tweed, Chemours, Trelleborg, Shin-Etsu, Momentive, Saint-Gobain, and Wacker |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aerospace And Defense Elastomers Market Dynamics

A global increase in replacing existing aircraft with newer models

Airlines and defense organizations are increasingly investing in next-generation aircraft to improve fuel efficiency, reduce maintenance costs, and comply with stricter environmental regulations. This shift drives demand for high-performance elastomers such as silicone, EPDM, and fluorosilicone, which are essential in manufacturing lightweight, durable components like seals, gaskets, and insulation materials. As newer aircraft designs incorporate more complex systems and require enhanced resistance to extreme temperatures, chemicals, and mechanical stress, the need for specialized elastomers grows. This trend presents significant opportunities for elastomer manufacturers to supply innovative materials that meet the evolving needs of the global aerospace and defense sectors.

Restraints & Challenges

Stringent regulatory standards and certifications are required for materials used in aerospace and defense applications, which can lead to lengthy approval processes and increased costs for manufacturers. Additionally, fluctuations in raw material prices, such as silicone and fluorosilicone, can affect production costs and profit margins. The market also faces challenges from the availability of alternative materials, like thermoplastics and composites, which offer similar benefits in terms of weight and durability. Furthermore, supply chain disruptions, such as geopolitical tensions and trade restrictions, can hinder the timely delivery of elastomers. These challenges necessitate innovation, cost management, and strategic planning to ensure competitiveness and sustainability in the market.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace And Defense Elastomers Market from 2023 to 2033. The presence of leading aircraft manufacturers, such as Boeing and Lockheed Martin, and a high concentration of aerospace OEMs and suppliers contribute to robust demand for elastomers. These materials are crucial for developing lightweight, durable components like seals, gaskets, and hoses that meet stringent performance and safety standards. Additionally, continuous investments in advanced technologies, such as next-generation aircraft and military equipment, further fuel market growth. Regulatory support and government initiatives aimed at enhancing defense capabilities and modernizing fleets also play a critical role. North America's market is expected to grow steadily, driven by innovation and a strong focus on enhancing fuel efficiency and reducing emissions.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Increased air travel demand, rising defense budgets, and the push for modernizing military fleets drive the need for advanced elastomers used in aircraft and defense applications. Local manufacturers and suppliers are investing heavily in research and development to produce high-performance elastomers, such as silicone and EPDM, that can withstand extreme temperatures and harsh conditions. Moreover, government initiatives to develop indigenous aerospace and defense capabilities are bolstering market growth. The region's strategic focus on increasing fuel efficiency, safety standards, and sustainability presents lucrative opportunities for elastomer manufacturers to capture a growing market share.

Segmentation Analysis

Insights by Product

The Fluor Elastomers segment accounted for the largest market share over the forecast period 2023 to 2033. Fluor elastomers, such as fluoroelastomer (FKM) and perfluoroelastomer (FFKM), are increasingly used in critical applications like fuel systems, O-rings, seals, and gaskets where high performance and reliability are essential. The growing demand for advanced aircraft and defense equipment that operate in challenging environments, including high-altitude and severe weather conditions, is driving the adoption of these specialized materials. Additionally, their ability to maintain elasticity and mechanical properties under extreme conditions makes them ideal for enhancing fuel efficiency, safety, and longevity in aerospace components. Rising R&D investments in innovative fluor elastomer formulations further support this segment's growth.

Insights by Application

The O-Rings & Gaskets segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the critical need for reliable sealing solutions in aircraft and military equipment. These components are essential for preventing fluid and gas leaks, ensuring optimal performance and safety across various systems, including engines, hydraulics, and fuel systems. The increasing production of new-generation aircraft and the modernization of existing fleets are boosting demand for high-performance elastomers like silicone, fluorosilicone, and EPDM used in O-Rings and gaskets. Furthermore, the need for materials that can withstand extreme temperatures, pressure variations, and exposure to aggressive chemicals drives the segment's expansion. Innovations in elastomer formulations aimed at enhancing durability, flexibility, and resistance to wear and tear are further propelling growth in this segment.

Recent Market Developments

- In November 2021, two of the top aerospace businesses, Tweed and L3Harris, teamed up in an exciting collaboration. Their common objective was to create cutting-edge elastomeric seals that could endure the rigours of hostile aircraft environments.

Competitive Landscape

Major players in the market

- Saint-Gobain

- Solvay

- Lanxess

- Dow Corning

- Greene

- Tweed

- Chemours

- Trelleborg

- Shin-Etsu

- Momentive

- Saint-Gobain

- Wacker

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace And Defense Elastomers Market, Product Analysis

- Ethylene Propylene Diene Monomer (EPDM)

- Silicone Elastomers

- Fluor Elastomers

Aerospace And Defense Elastomers Market, Application Analysis

- Profiles

- O-Rings & Gaskets

- Seals and Hoses

Aerospace And Defense Elastomers Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Aerospace And Defense Elastomers Market?The global Aerospace And Defense Elastomers Market is expected to grow from USD 73.8 million in 2023 to USD 120.5 million by 2033, at a CAGR of 5.03% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aerospace And Defense Elastomers Market?Some of the key market players of the market are Saint-Gobain, Solvay, Lanxess, Dow Corning, Greene, Tweed, Chemours, Trelleborg, Shin-Etsu, Momentive, Saint-Gobain, Wacker.

-

3. Which segment holds the largest market share?The Fluor Elastomers segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aerospace And Defense Elastomers Market?North America dominates the Aerospace And Defense Elastomers Market and has the highest market share.

Need help to buy this report?