Global Aerospace And Defense Telemetry Market Size, Share, and COVID-19 Impact Analysis, By Telemetry Type (Radio Telemetry, Satellite Telemetry), By Component (Transmitters, Receivers), By End-User (Military, Aerospace Manufacturers, Research Institutions), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aerospace And Defense Telemetry Market Insights Forecasts to 2033

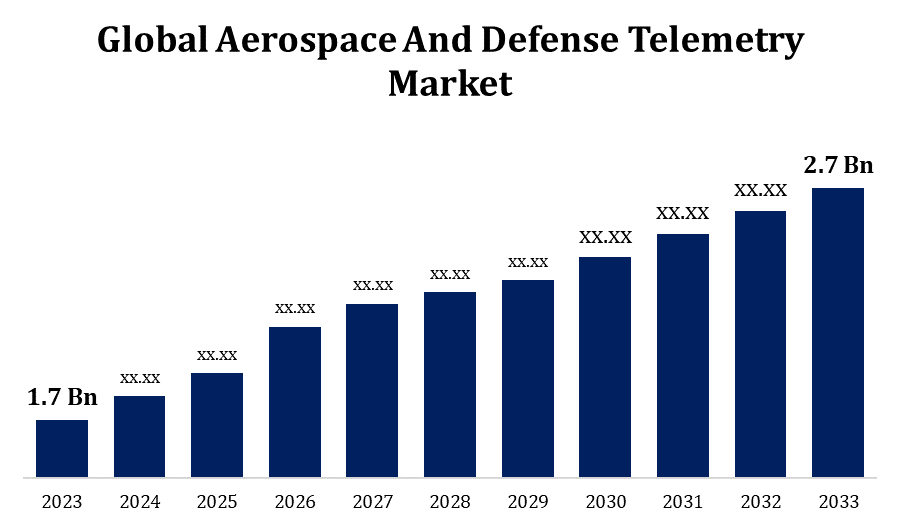

- The Global Aerospace And Defense Telemetry Market was valued at USD 1.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.73% from 2023 to 2033.

- The Worldwide Aerospace And Defense Telemetry Market Size is expected to reach USD 2.7 Billion by 2033.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aerospace And Defense Telemetry Market Size is expected to reach USD 2.7 Billion by 2033, at a CAGR of 4.73% during the forecast period 2023 to 2033.

The Aerospace and Defense Telemetry Market is witnessing significant growth due to rising demand for real-time data transmission in military and commercial aerospace sectors. Telemetry systems are crucial for monitoring aircraft, spacecraft, and missile performance, providing critical information on speed, altitude, and engine health. Technological advancements in wireless communication and sensor technologies are enhancing telemetry system capabilities, boosting market expansion. Increasing government investments in defense modernization and the growing adoption of unmanned aerial vehicles (UAVs) further drive market demand. North America remains a key player due to its robust aerospace and defense industry, while Asia-Pacific shows rapid growth potential. Challenges include high implementation costs and stringent regulatory requirements, but the market continues to advance with the integration of AI and machine learning for improved data analysis.

Aerospace And Defense Telemetry Market Value Chain Analysis

The value chain of the Aerospace and Defense Telemetry Market encompasses multiple stages, from component suppliers to end-users. At the initial stage, raw material providers supply essential materials like semiconductors, sensors, and communication devices. Component manufacturers then use these materials to produce telemetry systems, including transmitters, receivers, and antennas. These systems are integrated by aerospace and defense contractors into various platforms such as aircraft, spacecraft, and missiles. The integration stage is followed by testing and certification to ensure compliance with industry standards and regulations. Next, telemetry solutions are deployed and supported by service providers offering installation, maintenance, and data analysis services. Finally, end-users, including military organizations, space agencies, and commercial aerospace companies, utilize these systems for real-time data monitoring, operational efficiency, and mission-critical decision-making.

Aerospace And Defense Telemetry Market Opportunity Analysis

The Aerospace and Defense Telemetry Market offers substantial growth opportunities driven by advancements in technology and increased defense spending worldwide. The expanding use of telemetry in Unmanned Aerial Vehicles (UAVs), drones, and next-generation aircraft presents significant potential for market players. With the rise in satellite launches and space exploration initiatives, there is a growing demand for sophisticated telemetry systems to ensure mission success and safety. Emerging markets in Asia-Pacific and the Middle East are investing heavily in defense modernization, creating new business prospects. Additionally, the integration of artificial intelligence (AI) and machine learning in telemetry systems enhances data processing and decision-making capabilities, paving the way for innovative applications. These trends, coupled with the growing need for efficient data transmission, signal a robust market expansion trajectory.

Global Aerospace And Defense Telemetry Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.7 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.73% |

| 2033 Value Projection: | USD 2.7 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Telemetry Type, By End-User, and By Region |

| Companies covered:: | L3Harris Technologies, Honeywell International Inc., General Dynamics Corporation, Lockheed Martin Corporation, Maxar Technologies, BAE Systems, Cobham, Curtiss-Wright Corporation, and Others |

| Growth Drivers: | Rise in demand for unmanned systems to propel the market growth |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aerospace And Defense Telemetry Market Dynamics

Rise in demand for unmanned systems to propel the market growth

The increasing demand for unmanned systems, such as Unmanned Aerial Vehicles (UAVs), Unmanned Ground Vehicles (UGVs), and drones, is driving growth in the Aerospace and Defense Telemetry Market. These systems rely heavily on telemetry for real-time data transmission, enabling remote monitoring, navigation, and mission control. As military and commercial sectors increasingly adopt unmanned systems for surveillance, reconnaissance, and combat operations, the need for advanced telemetry solutions has intensified. Telemetry systems provide critical data on performance, location, and environmental conditions, essential for mission success and safety. The growth in autonomous vehicle technology, coupled with rising investments in defense modernization and border security, is further boosting market demand. As unmanned systems become more prevalent, the telemetry market is expected to experience substantial expansion.

Restraints & Challenges

The Aerospace and Defense Telemetry Market faces several challenges that could impede growth. High implementation costs of advanced telemetry systems, including specialized sensors, communication devices, and software, pose a significant barrier for market players, particularly in emerging economies. Stringent regulatory standards and compliance requirements further complicate the deployment of telemetry solutions, necessitating extensive testing and certification processes. Cybersecurity threats also present a critical challenge, as telemetry systems are vulnerable to hacking and data breaches, which could compromise sensitive military and aerospace information. Additionally, the market contends with technological limitations, such as signal interference and limited bandwidth, which can affect data transmission reliability. These challenges, combined with the need for constant innovation, create a complex landscape for companies operating within this sector.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace And Defense Telemetry Market from 2023 to 2033. The United States, in particular, is a key contributor due to its large defense budget, substantial aerospace manufacturing base, and numerous ongoing military and space projects. The presence of leading companies, such as Lockheed Martin, Northrop Grumman, and Raytheon, further strengthens the region's market position. Increasing demand for Unmanned Aerial Vehicles (UAVs) and space exploration missions also boosts the need for advanced telemetry solutions. Additionally, initiatives by NASA and other government agencies to develop next-generation satellites and spacecraft are accelerating growth. Despite market maturity, North America remains a hub for innovation, offering sustained opportunities for expansion and technological integration.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Developing nations are investing heavily in modernizing their military capabilities, including the adoption of advanced telemetry systems for aircraft, missiles, and unmanned systems. The rise in regional security tensions and the need for enhanced surveillance and reconnaissance capabilities are further propelling demand. Additionally, the region's growing participation in space exploration and satellite launches is increasing the requirement for reliable telemetry solutions. Local players, supported by government initiatives, are entering the market, fostering competition and innovation. As a result, Asia-Pacific is emerging as a key growth market, offering lucrative opportunities for global and regional telemetry providers.

Segmentation Analysis

Insights by Telemetry Type

The Satellite telemetry segment accounted for the largest market share over the forecast period 2023 to 2033. As nations and private entities invest in satellite constellations for global coverage and real-time data transmission, the demand for advanced telemetry systems has increased. These systems are crucial for monitoring satellite health, performance, and trajectory, ensuring mission success and longevity. The expansion of small satellites (CubeSats) and the rise of mega-constellations further boost telemetry needs, especially for tracking, control, and data relay. Additionally, advancements in telemetry technology, such as higher data transmission rates, enhanced reliability, and improved encryption for secure communication, are driving market growth. The satellite telemetry segment is poised for continued expansion as global satellite activities increase.

Insights by Component

The transmitters segment accounted for the largest market share over the forecast period 2023 to 2033. Transmitters play a critical role in sending real-time data from various platforms, such as aircraft, missiles, and UAVs, to ground stations for monitoring and analysis. The rising use of unmanned systems and autonomous vehicles, which require continuous communication for navigation and mission control, is fueling demand for advanced telemetry transmitters. Technological advancements, such as miniaturization, improved power efficiency, and enhanced signal clarity, are further driving segment growth. Additionally, the growing deployment of telemetry systems in space exploration, satellite communication, and missile testing is boosting the need for high-performance transmitters, making this segment a key contributor to market expansion.

Insights by End User

The military segment accounted for the largest market share over the forecast period 2023 to 2033. As military forces enhance their capabilities with advanced technologies, telemetry systems become crucial for real-time data transmission in applications like missile guidance, surveillance, reconnaissance, and combat operations. The rising adoption of unmanned systems, such as UAVs and autonomous vehicles, further boosts demand for telemetry solutions to support remote monitoring and mission-critical decision-making. Geopolitical tensions and security challenges are prompting countries to invest in sophisticated telemetry for missile defense, battlefield management, and secure communication. Additionally, technological advancements, such as enhanced data encryption and AI-based analytics, are improving telemetry efficiency and reliability, driving growth within the military segment of the market.

Recent Market Developments

- In January 2023, a multi-billion dollar contract was awarded to Orbit Communications equipment and a top integrator in Southeast Asia to provide OceanTRx 7MIL satellite communication equipment to a nearby navy.

Competitive Landscape

Major players in the market

- L3Harris Technologies

- Honeywell International Inc.

- General Dynamics Corporation

- Lockheed Martin Corporation

- Maxar Technologies

- BAE Systems

- Cobham

- Curtiss-Wright Corporation

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace And Defense Telemetry Market, Telemetry Type Analysis

- Radio Telemetry

- Satellite Telemetry

Aerospace And Defense Telemetry Market, Component Analysis

- Transmitters

- Receivers

Aerospace And Defense Telemetry Market, End Users Analysis

- Military

- Aerospace Manufacturers

- Research Institutions

Aerospace And Defense Telemetry Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aerospace And Defense Telemetry Market?The global Aerospace And Defense Telemetry Market is expected to grow from USD 1.7 billion in 2023 to USD 2.7 billion by 2033, at a CAGR of 4.73% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aerospace And Defense Telemetry Market?Some of the key market players of the market are L3Harris Technologies, Honeywell International Inc., General Dynamics Corporation, Lockheed Martin Corporation, Maxar Technologies, BAE Systems, Cobham, and Curtiss-Wright Corporation.

-

3. Which segment holds the largest market share?The military segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aerospace And Defense Telemetry Market?North America dominates the Aerospace And Defense Telemetry Market and has the highest market share.

Need help to buy this report?