Global Aerospace Antimicrobial Coatings Market Size, Share, and COVID-19 Impact Analysis, By Coating (Silver, Copper), By Platform (Aviation, Space), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aerospace Antimicrobial Coatings Market Insights Forecasts to 2033

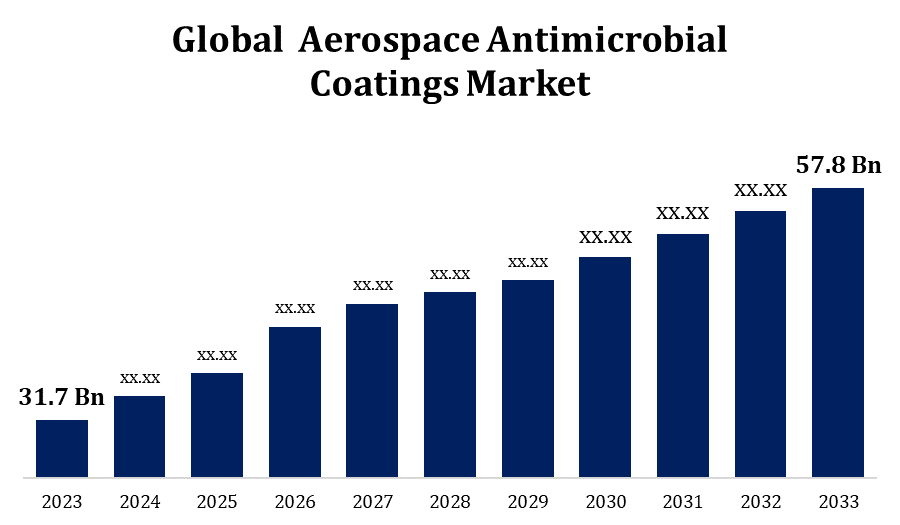

- The Aerospace Antimicrobial Coatings Market Size was valued at USD 31.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.19% from 2023 to 2033.

- The Global Aerospace Antimicrobial Coatings Market is expected to reach USD 57.8 Billion by 2033.

- Asia Pacific is Expected To Grow the fastest during the forecast period.

Get more details on this report -

The Global Aerospace Antimicrobial Coatings Market is expected to reach USD 57.8 billion by 2033, at a CAGR of 6.19% during the forecast period 2023 to 2033.

The Aerospace Antimicrobial Coatings Market is experiencing significant growth driven by increasing awareness of hygiene and safety in aircraft. These coatings are designed to prevent the growth of bacteria, fungi, and viruses on various aircraft surfaces, enhancing passenger and crew safety. The rise in air travel, coupled with stringent regulatory standards, has prompted airlines and manufacturers to invest in antimicrobial solutions. Key drivers include technological advancements in coating materials, the growing demand for long-lasting protective coatings, and heightened health concerns post-pandemic. Major market players are focusing on innovative product development and strategic partnerships to expand their market presence. North America dominates the market due to advanced aviation infrastructure, while Asia-Pacific shows rapid growth potential due to increasing air traffic and aircraft fleet expansion.

Aerospace Antimicrobial Coatings Market Value Chain Analysis

The value chain of the Aerospace Antimicrobial Coatings Market involves multiple stages, from raw material sourcing to end-user application. It begins with the procurement of raw materials, such as resins, pigments, biocides, and other chemicals, which are supplied by chemical manufacturers. These materials are then formulated into antimicrobial coatings by coating manufacturers, who develop specialized products tailored for aerospace applications. The next stage involves distribution through various channels, including direct sales, distributors, and suppliers, to aircraft manufacturers, maintenance, repair, and overhaul (MRO) service providers, and airlines. End-users, such as aircraft OEMs and MRO providers, apply these coatings to aircraft interiors and high-touch surfaces. Continuous feedback and innovation cycles help improve product efficacy and compliance with regulatory standards, completing the value chain.

Aerospace Antimicrobial Coatings Market Opportunity Analysis

The Aerospace Antimicrobial Coatings Market presents significant growth opportunities driven by rising health and safety concerns, particularly in the post-pandemic landscape. Increased awareness among airlines and passengers about hygiene standards has amplified demand for antimicrobial solutions in aircraft interiors. Expanding air travel, especially in emerging markets like Asia-Pacific and the Middle East, offers substantial growth potential for coatings manufacturers. Technological advancements in antimicrobial materials, such as nanocoatings and self-cleaning surfaces, further fuel market innovation. Moreover, stringent regulatory requirements and certification processes create opportunities for manufacturers to develop high-performance, compliant coatings. Strategic collaborations between coating suppliers and aircraft OEMs and MRO providers can strengthen market presence, while growing interest in sustainable and long-lasting antimicrobial solutions provides avenues for differentiation and expansion.

Global Aerospace Antimicrobial Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 31.7 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 6.19% |

| 023 – 2033 Value Projection: | USD 57.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Coating, By Platform, By Region |

| Companies covered:: | AkzoNobel N.V.(Netherlands), Axalta Coating Systems Ltd. (US), The Sherwin-Williams Company (US), BASF (Germany), PPG Industries Inc. (US), Nippon Paint Holdings Co. Ltd. (Japan), RPM International Inc. (US), Koninklijke DSM N.V.(Netherlands), Sika AG (Switzerland), Lanxess AG (Germany), |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Market Dynamics

Aerospace Antimicrobial Coatings Market Dynamics

The growing need in the medical and healthcare sectors for antimicrobial coatings

The growing need for antimicrobial coatings in the medical and healthcare sectors significantly impacts the Aerospace Antimicrobial Coatings Market. As awareness of infection control increases, especially in environments with high human contact, the demand for antimicrobial solutions extends beyond hospitals to other sectors, including aerospace. Airlines are adopting antimicrobial coatings to enhance hygiene and safety, mirroring practices in healthcare settings to prevent pathogen transmission on high-touch surfaces. The convergence of healthcare standards with aviation hygiene protocols is driving innovation in durable, effective coatings that inhibit microbial growth. Furthermore, heightened regulatory scrutiny and passenger demand for safer travel environments push airlines and aircraft manufacturers to adopt these technologies, accelerating market growth. This trend aligns with the broader emphasis on health and safety in public spaces post-pandemic.

Restraints & Challenges

High development costs and complex manufacturing processes can limit the adoption of advanced antimicrobial coatings. Stringent regulatory standards require extensive testing and certification, which can delay product launches and increase costs for manufacturers. Limited awareness among smaller airlines and aircraft operators about the benefits of antimicrobial coatings also hampers market expansion. Additionally, the coatings must demonstrate durability and effectiveness under harsh conditions, such as high altitudes and varying temperatures, which presents technical challenges. Market growth is further constrained by the need to balance antimicrobial efficacy with environmental sustainability, as certain biocides and chemicals used in coatings may face regulatory scrutiny or bans. These factors collectively create hurdles in scaling up market presence.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace Antimicrobial Coatings Market from 2023 to 2033. The presence of leading aircraft manufacturers like Boeing and significant MRO providers, coupled with a high volume of air travel, creates strong demand for advanced antimicrobial coatings. Post-pandemic, there has been an increased focus on passenger safety, prompting airlines to adopt antimicrobial technologies to enhance cabin cleanliness and reduce infection risks. Stringent regulatory requirements by bodies such as the Federal Aviation Administration (FAA) further drive innovation in the development of durable and effective coatings. Moreover, rising investments in research and development, along with strategic collaborations between coating suppliers and aerospace companies, position North America as a dominant market with sustained growth potential.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries such as China, India, and Japan are experiencing rapid growth in their aviation sectors, driven by rising middle-class incomes and increased demand for air travel. Airlines in the region are increasingly adopting antimicrobial coatings to enhance cabin hygiene and comply with evolving health regulations. Additionally, the presence of major aircraft manufacturers and suppliers, along with significant investments in airport infrastructure, supports market expansion. The region also benefits from growing awareness of health standards post-pandemic, pushing for the adoption of innovative antimicrobial solutions. As a result, Asia-Pacific is poised for substantial market growth in the coming years.

Segmentation Analysis

Insights by Coating

The silver segment accounted for the largest market share over the forecast period 2023 to 2033. Silver ions are highly effective at disrupting microbial cell functions, making them a preferred choice for high-touch surfaces in aircraft interiors, such as armrests, tray tables, and lavatories. Growing health and safety concerns post-pandemic have led airlines and manufacturers to invest in these coatings to enhance passenger safety. Additionally, silver-based coatings are durable and remain effective over extended periods, reducing maintenance costs and downtime for airlines. The increasing adoption of silver antimicrobial coatings aligns with stringent regulatory standards for hygiene, further driving demand and supporting the segment's expansion in both established and emerging aerospace markets.

Insights by Platform

The aviation segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are adopting antimicrobial coatings for aircraft interiors, including seats, tray tables, overhead compartments, and lavatories, to reduce the risk of microbial transmission. Post-pandemic, there is a heightened focus on ensuring clean and safe cabin environments, leading to greater investment in advanced antimicrobial technologies. Regulatory pressures and evolving health guidelines are encouraging airlines and aircraft manufacturers to implement these coatings to comply with safety standards. Moreover, the expansion of airline fleets, particularly in regions like Asia-Pacific and the Middle East, is further boosting demand. Innovations in coating technology, such as long-lasting and self-cleaning formulations, are also contributing to sustained growth in the aviation segment.

Recent Market Developments

- In November 2020, PPG Industries disclosed that JOHNSTONE, one of its brands, has expanded its product line with the introduction of anti-bacterial matt paint, which is intended to eradicate bacterial development.

Competitive Landscape

Major players in the market

- AkzoNobel N.V.(Netherlands)

- Axalta Coating Systems Ltd. (US)

- The Sherwin-Williams Company (US)

- BASF (Germany)

- PPG Industries Inc. (US)

- Nippon Paint Holdings Co. Ltd. (Japan)

- RPM International Inc. (US)

- Koninklijke DSM N.V.(Netherlands)

- Sika AG (Switzerland)

- Lanxess AG (Germany)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace Antimicrobial Coatings Market, Coating Analysis

- Silver

- Copper

Aerospace Antimicrobial Coatings Market, Platform Analysis

- Aviation

- Space

Aerospace Antimicrobial Coatings Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?