Global Aerospace Coatings Market Size, Share, and COVID-19 Impact Analysis, By Technology (Liquid Coating, Powder Coating, Other), By End User (Commercial, Military, General, Other), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aerospace Coatings Market Insights Forecasts to 2033

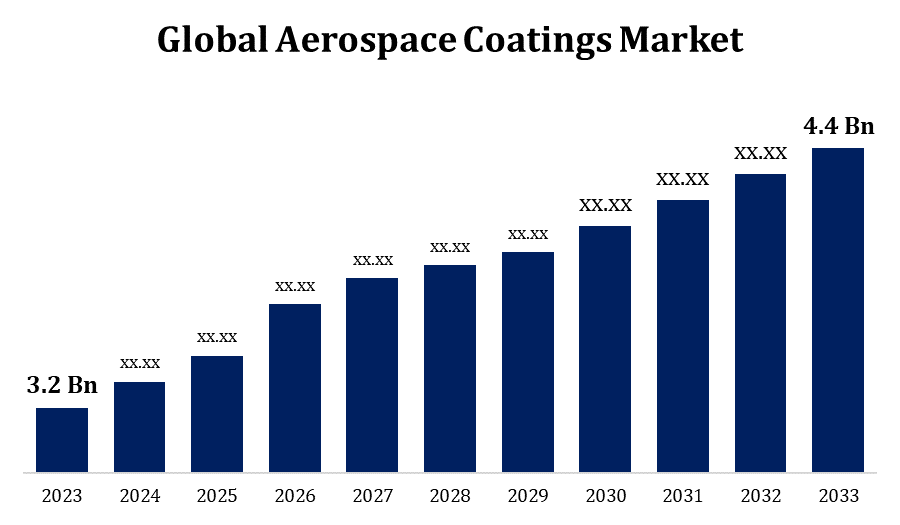

- The Global Aerospace Coatings Market Size was valued at USD 3.2 Billion in 2023

- The Market Size is Growing at a CAGR of 3.24% from 2023 to 2033

- The Worldwide Aerospace Coatings Market Size is expected to reach USD 4.4 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aerospace Coatings Market Size is expected to reach USD 4.4 Billion by 2033, at a CAGR of 3.24% during the forecast period 2023 to 2033.

The aerospace coatings market is experiencing significant growth, driven by the increasing demand for lightweight, durable, and corrosion-resistant coatings in the aviation industry. These coatings are essential for enhancing fuel efficiency, reducing drag, and improving the longevity of aircraft. With advancements in technology, coatings now offer better protection against extreme temperatures, UV radiation, and environmental wear, ensuring long-term structural integrity. Rising air traffic, expanding defense budgets, and the growing demand for commercial and military aircraft are key factors propelling market growth. Additionally, regulations focused on reducing emissions and environmental impact have spurred the development of eco-friendly coatings. North America leads the market, with Asia-Pacific regions showing rapid growth due to increasing investments in aviation infrastructure and aerospace manufacturing.

Aerospace Coatings Market Value Chain Analysis

The aerospace coatings market value chain begins with the procurement of raw materials, including resins, pigments, solvents, and additives. These materials are then processed by coating manufacturers who develop specialized formulations tailored to meet the performance demands of aerospace applications, such as corrosion resistance, durability, and lightweight properties. Next, distributors or suppliers deliver these coatings to original equipment manufacturers (OEMs) and maintenance, repair, and overhaul (MRO) service providers. OEMs apply these coatings during the production of new aircraft, while MROs use them for maintenance and repair purposes to ensure longevity and efficiency. The final stage includes the end users—commercial airlines, defense forces, and private aviation—who rely on these coatings to maintain safety, performance, and aesthetics. The value chain is further influenced by regulatory bodies ensuring compliance with environmental and safety standards.

Aerospace Coatings Market Opportunity Analysis

The aerospace coatings market presents significant opportunities driven by advancements in coating technologies and the growing aviation sector. Increasing air travel, especially in emerging markets like Asia-Pacific, boosts the demand for new commercial and military aircraft, opening avenues for advanced aerospace coatings. Lightweight and eco-friendly coatings are in high demand due to the industry's focus on fuel efficiency and sustainability, creating opportunities for manufacturers to innovate. The shift towards low-VOC (volatile organic compounds) and high-performance coatings, meeting stringent environmental regulations, also presents growth potential. Additionally, the rise of Maintenance, Repair, and Overhaul (MRO) activities, alongside the increasing use of composites in aircraft, offers further opportunities for specialized coatings designed for long-term durability, protection, and reduced environmental impact.

Global Aerospace Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.24% |

| 2033 Value Projection: | USD 4.4 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By End User, By Region |

| Companies covered:: | PPG Industries, Inc., The Sherwin-Williams Company, Akzo Nobel N.V., MANKIEWICZ GEBR. & Co., Hentzen Coatings, Inc., Walter Wurdack, Inc., Exova Group Limited, Ionbond, 3M, BASF SE, Hohman Plating, and other key companies. |

| Growth Drivers: | Demand for Aerospace Coatings is Driven by the Growth of Commercial Fleet |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aerospace Coatings Market Dynamics

Demand for Aerospace Coatings is Driven by the Growth of Commercial Fleet

The demand for aerospace coatings is closely tied to the expansion of the commercial aircraft fleet, driven by rising air travel and increasing global connectivity. Airlines are investing in new aircraft to meet growing passenger demand, especially in emerging markets like Asia-Pacific and the Middle East. As commercial fleets expand, the need for advanced coatings to protect aircraft from harsh environmental conditions, improve fuel efficiency, and maintain aesthetic appeal grows. Additionally, as airlines focus on reducing operating costs and emissions, the demand for lightweight, corrosion-resistant, and high-performance coatings has surged. The expansion of Maintenance, Repair, and Overhaul (MRO) services for aging fleets also contributes to increased demand, as coatings are essential for extending aircraft lifespan and ensuring operational safety.

Restraints & Challenges

Strict environmental regulations regarding volatile organic compounds (VOCs) have pushed manufacturers to develop eco-friendly coatings, increasing production costs and complicating formulations. Developing coatings that meet the stringent durability, corrosion resistance, and lightweight requirements of modern aircraft while maintaining environmental compliance is technically demanding. Additionally, the high cost of raw materials and specialized application processes can be a barrier for manufacturers, especially in price-sensitive markets. The long approval cycles for aerospace coatings due to strict safety and performance standards further slow down innovation and market entry. Fluctuations in the aviation industry, such as economic downturns or disruptions caused by geopolitical issues, can also lead to reduced demand for new aircraft and, consequently, coatings.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace Coatings Market from 2023 to 2033. The United States, being a global leader in both commercial and military aviation, significantly contributes to the demand for advanced coatings that enhance aircraft performance, fuel efficiency, and durability. The region's well-established Maintenance, Repair, and Overhaul (MRO) sector further fuels the need for aerospace coatings as airlines focus on maintaining aging fleets. Additionally, stringent environmental regulations in North America encourage the development of low-VOC, eco-friendly coatings. Growing defense budgets, increased air travel, and investments in cutting-edge aviation technologies, such as electric and hybrid aircraft, further bolster market growth. The demand for lightweight, high-performance coatings continues to rise as airlines strive to reduce operating costs.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Emerging economies like China, India, and Southeast Asian countries are investing heavily in aviation infrastructure, driving the expansion of their commercial fleets. The rise in air passenger traffic, growing defense budgets, and the emergence of low-cost carriers contribute to the demand for new aircraft and related coatings. Asia-Pacific is also a hub for aircraft manufacturing and assembly, further stimulating the need for advanced coatings that offer corrosion resistance, fuel efficiency, and environmental compliance. As the region focuses on developing eco-friendly and lightweight coatings, opportunities for innovation in high-performance, low-VOC formulations continue to grow, alongside an expanding Maintenance, Repair, and Overhaul (MRO) sector.

Segmentation Analysis

Insights by Technology

The liquid coating segment accounted for the largest market share over the forecast period 2023 to 2033. Liquid coatings are favored for their ease of application, uniform coverage, and superior aesthetic finishes. They provide excellent protection against corrosion, extreme temperatures, and chemical exposure, making them essential for both new aircraft production and Maintenance, Repair, and Overhaul (MRO) activities. The rising demand for fuel-efficient, lightweight coatings also drives advancements in liquid formulations, focusing on reducing drag and enhancing performance. While environmental concerns over volatile organic compounds (VOCs) challenge the segment, the development of low-VOC and water-based liquid coatings has opened new opportunities for sustainable growth. The increasing production of aircraft in emerging regions like Asia-Pacific further contributes to the expansion of this segment.

Insights by End User

The commercial aviation segment accounted for the largest market share over the forecast period 2023 to 2033. As air traffic increases, especially in emerging markets like Asia-Pacific and the Middle East, airlines are investing in new aircraft and upgrading existing fleets, boosting the need for advanced coatings that enhance fuel efficiency, durability, and aesthetics. The shift towards lightweight, corrosion-resistant coatings is crucial for improving aircraft performance and reducing operational costs. Moreover, strict environmental regulations have led to the development of eco-friendly, low-VOC coatings, further driving market growth. Maintenance, Repair, and Overhaul (MRO) activities are also on the rise as airlines work to extend the life of their aircraft, increasing demand for aerospace coatings in this segment.

Recent Market Developments

- In May 2023, Henkel, a global leader in adhesive technologies, has unveiled a cutting-edge adhesive technology center in the U.S. This new facility is dedicated to delivering innovative and dependable aerospace coatings, tailored to meet the growing demands of the aerospace industry.

Competitive Landscape

Major players in the market

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Akzo Nobel N.V.

- MANKIEWICZ GEBR. & Co.

- Hentzen Coatings, Inc.

- Walter Wurdack, Inc.

- Exova Group Limited

- Ionbond

- 3M

- BASF SE

- Hohman Plating

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace Coatings Market, Technology Analysis

- Liquid Coating

- Powder Coating

- Other

Aerospace Coatings Market, End User Analysis

- Commercial

- Military

- General

- Other

Aerospace Coatings Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aerospace Coatings Market?The global Aerospace Coatings Market is expected to grow from USD 3.2 billion in 2023 to USD 4.4 billion by 2033, at a CAGR of 3.24% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aerospace Coatings Market?Some of the key market players of the market are PPG Industries, Inc., The Sherwin-Williams Company, Akzo Nobel N.V., MANKIEWICZ GEBR. & Co., Hentzen Coatings, Inc., Walter Wurdack, Inc., Exova Group Limited, Ionbond, 3M, BASF SE, and Hohman Plating.

-

3. Which segment holds the largest market share?The liquid coating segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aerospace Coatings Market?North America dominates the Aerospace Coatings Market and has the highest market share.

Need help to buy this report?