Global Aerospace Data Recorder Market Size, Share, and COVID-19 Impact Analysis, By Type (Cockpit Voice Recorder (CVR), Quick Access Recorder, and Data Loggers), By Technology (Flash Cards, Cloud Computing, and Solid State Cockpit Voice Recorder), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aerospace Data Recorder Market Insights Forecasts to 2033

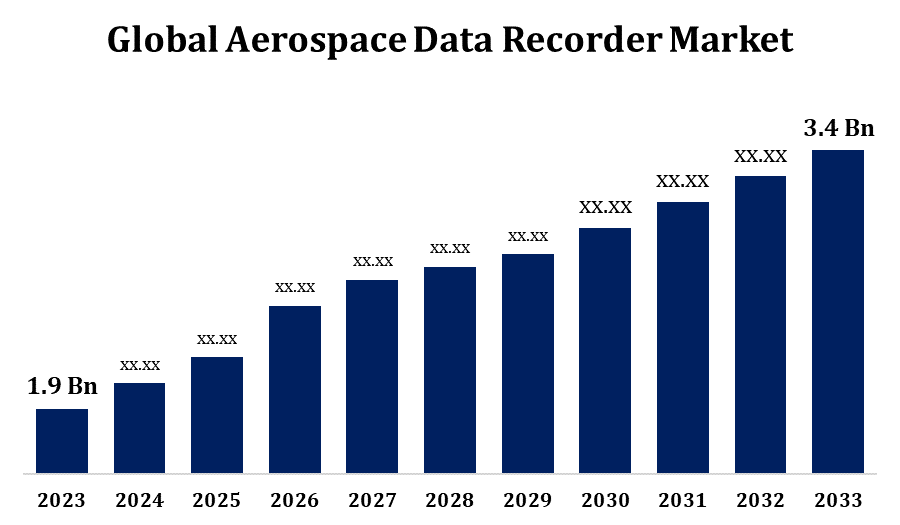

- The Global Aerospace Data Recorder Market Size was valued at USD 1.9 Billion in 2023.

- The Market is Growing at a CAGR of 5.99% from 2023 to 2033.

- The Worldwide Aerospace Data Recorder Market Size is Expected to reach USD 3.4 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aerospace Data Recorder Market Size is expected to reach USD 3.4 billion by 2033, at a CAGR of 5.99% during the forecast period 2023 to 2033.

The aerospace data recorder market is experiencing significant growth due to increased demand for real-time flight data monitoring and stringent safety regulations. These devices, which include cockpit voice recorders and flight data recorders, are crucial for recording and preserving information on aircraft performance, helping in post-incident investigations. The rise in global air traffic and advancements in avionics technology are driving market expansion. Modern aerospace data recorders are becoming more sophisticated, offering features such as real-time data streaming and larger data storage capacities. The military and defense sectors also contribute to market growth with the need for advanced data recording systems. However, high installation costs and maintenance challenges may pose barriers to the market’s growth. Key players are focusing on innovation to enhance reliability and data retrieval capabilities.

Aerospace Data Recorder Market Value Chain Analysis

The aerospace data recorder market's value chain involves several key stages, starting with raw material suppliers, who provide components such as sensors, microprocessors, and storage devices. These materials are then utilized by manufacturers to design and produce data recorders, which include flight data recorders (FDRs) and cockpit voice recorders (CVRs). Next, system integrators work to install these recorders into various aircraft models, ensuring compatibility with existing avionics systems. Distributors and suppliers deliver these products to airlines, defense organizations, and aircraft manufacturers. Regulatory bodies like the FAA and EASA play a critical role, ensuring compliance with aviation safety standards. Lastly, the aftermarket segment handles maintenance, repair, and replacement services. Each link in the chain is essential for ensuring the effective operation and long-term reliability of aerospace data recorders.

Aerospace Data Recorder Market Opportunity Analysis

The aerospace data recorder market presents substantial growth opportunities driven by advancements in aircraft technologies and rising safety standards. As air traffic continues to expand globally, the demand for sophisticated data recording systems with enhanced storage, real-time data streaming, and cloud integration features is increasing. Emerging markets in Asia-Pacific and the Middle East offer significant potential due to growing commercial and military aviation sectors. Additionally, the shift towards lighter, more durable materials in recorder manufacturing creates opportunities for cost-efficient, high-performance devices. The adoption of unmanned aerial vehicles (UAVs) in defense and commercial applications also drives the need for advanced data recording solutions. Regulatory mandates, such as those requiring extended recording durations and real-time data transmission, further open avenues for innovation and growth in the aerospace data recorder industry.

Global Aerospace Data Recorder Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.99% |

| 2033 Value Projection: | USD 3.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 228 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Type, By Technology, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | L3 Technologies Inc., Teledyne Technologies LLC, RUAG International Holding AG, Curtiss-Wright Corporation, AstroNova Inc., Universal Avionics Systems Corporation, FLYHT Aerospace Solutions Ltd., Leonardo DRS, Honeywell International Inc., Flight Data Systems Pty. Ltd., HR Smith Group, Danelec Marine A/S, ACR Electronics Inc., Phoenix International Holdings, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aerospace Data Recorder Market Dynamics

Surge In Air Crash Incidents Drives Demand For Aerospace Data Recorders

The rising number of air crash incidents has heightened the demand for aerospace data recorders, as these devices play a critical role in investigating accidents and improving aviation safety. Flight data recorders (FDRs) and cockpit voice recorders (CVRs), commonly known as black boxes, provide vital information on aircraft performance, pilot actions, and communication before crashes. Regulatory bodies have responded by enforcing stricter safety standards, requiring advanced data recording systems in both commercial and military aircraft. In addition, improvements in recorder technology, such as increased data storage and real-time streaming capabilities, enhance the efficiency of accident investigations. As global air traffic continues to rise, the need for reliable aerospace data recorders has become paramount to ensure safety and reduce the risk of future incidents.

Restraints & Challenges

The aerospace data recorder market faces several challenges, despite its growing demand. One of the primary hurdles is the high cost of development, installation, and maintenance of advanced data recorders, which can burden airlines and aircraft manufacturers. Additionally, integrating new data recorder technologies with existing avionics systems poses technical challenges, especially in older aircraft models. Compliance with evolving regulatory standards, which mandate higher data storage capacity and real-time transmission, adds complexity and cost to production. The growing trend toward miniaturization and the need for more durable, crash-resistant materials further complicate design processes. Furthermore, ensuring data security and preventing potential cyber threats is a concern as real-time data streaming becomes more prevalent. These factors collectively pose barriers to market growth and innovation.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace Data Recorder Market from 2023 to 2033. The presence of major aircraft manufacturers like Boeing, along with key defense contractors, drives demand for advanced flight data and cockpit voice recorders. Regulatory agencies such as the Federal Aviation Administration (FAA) mandate strict safety requirements, fueling the adoption of modern data recording technologies with enhanced capabilities like real-time data transmission. The region's military and defense sector also contributes significantly to the market, with increasing demand for high-performance data recorders in military aircraft and unmanned aerial vehicles (UAVs). Furthermore, technological advancements and ongoing investments in aerospace research and development provide a robust environment for innovation in the North American aerospace data recorder market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries like China, India, and Southeast Asian nations are experiencing a surge in commercial aircraft orders to support rising passenger volumes, leading to higher demand for advanced data recorders. Additionally, growing military expenditures in the region are boosting the adoption of sophisticated flight data and cockpit voice recorders in defense aircraft. Governments are tightening safety regulations, which accelerates the integration of modern, high-capacity data recording systems. The rise of low-cost carriers and increased aircraft fleet sizes further contribute to market expansion. Despite this growth, challenges include varying regulatory standards and the high cost of upgrading older aircraft fleets with new data recorder technologies.

Segmentation Analysis

Insights by Type

The cockpit voice recorder (CVR) segment accounted for the largest market share over the forecast period 2023 to 2033. Regulatory mandates from aviation authorities, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), require the installation of CVRs in both commercial and military aircraft, ensuring compliance with stringent safety standards. The expansion of the global aviation industry, particularly in emerging markets, has led to an increase in aircraft production and, consequently, a higher demand for CVRs. Furthermore, technological advancements have resulted in more sophisticated CVRs capable of recording a wider range of audio data, enhancing their functionality and reliability. These developments are expected to propel the growth of the CVR segment in the coming years.

Insights by Technology

The flash cards segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is due to the increasing demand for advanced storage solutions with high data capacity and faster retrieval speeds. Flash cards, known for their durability, compact size, and resistance to harsh environmental conditions, are essential components in modern flight data recorders (FDRs) and cockpit voice recorders (CVRs). As aviation safety regulations tighten, there is a growing need for robust data storage that can survive extreme conditions, including high-impact crashes and intense heat. The shift towards solid-state memory over traditional magnetic tape has further boosted the adoption of flash cards. Additionally, advancements in flash memory technology, such as increased storage capacity and enhanced durability, are driving the growth of this segment in both commercial and military aviation sectors.

Recent Market Developments

- In June 2022, Leonardo DRS, a U.S.-based provider of mid-tier defense technology, merged with RADA Electronic Industries Ltd., with the financial details of the deal remaining undisclosed.

Competitive Landscape

Major players in the market

- L3 Technologies Inc.

- Teledyne Technologies LLC

- RUAG International Holding AG

- Curtiss-Wright Corporation

- AstroNova Inc.

- Universal Avionics Systems Corporation

- FLYHT Aerospace Solutions Ltd.

- Leonardo DRS

- Honeywell International Inc.

- Flight Data Systems Pty. Ltd.

- HR Smith Group

- Danelec Marine A/S

- ACR Electronics Inc.

- Phoenix International Holdings

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace Data Recorder Market, Type Analysis

- Cockpit Voice Recorder (CVR)

- Quick Access Recorder

- Data Loggers

Aerospace Data Recorder Market, Technology Analysis

- Flash Cards

- Cloud Computing

- Solid State Cockpit Voice Recorder

Aerospace Data Recorder Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aerospace Data Recorder Market?The Global Aerospace Data Recorder Market is expected to grow from USD 1.9 Billion in 2023 to USD 3.4 Billion by 2033, at a CAGR of 5.99% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aerospace Data Recorder Market?Some of the key market players of the market are L3 Technologies Inc., Teledyne Technologies LLC, RUAG International Holding AG, Curtiss-Wright Corporation, AstroNova Inc., Universal Avionics Systems Corporation, FLYHT Aerospace Solutions Ltd., Leonardo DRS, Honeywell International Inc., Flight Data Systems Pty. Ltd., HR Smith Group, Danelec Marine A/S, ACR Electronics Inc., Phoenix International Holdings and other key vendors.

-

3. Which segment holds the largest market share?The CVR segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aerospace Data Recorder Market?North America dominates the Aerospace Data Recorder Market and has the highest market share.

Need help to buy this report?