Global Aerospace Defense MRO Market Size, Share, and COVID-19 Impact Analysis, By Product (Engine, Airframe, Line, Component), By Applications (Narrow Body Aircraft, Wide Body Aircraft, Regional Aircraft, Others), By End-User (Commercial Aviation, Business & General Aviation, Military Aviation, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Industry: Aerospace & DefenseGlobal Aerospace Defense MRO Market Insights Forecasts to 2032

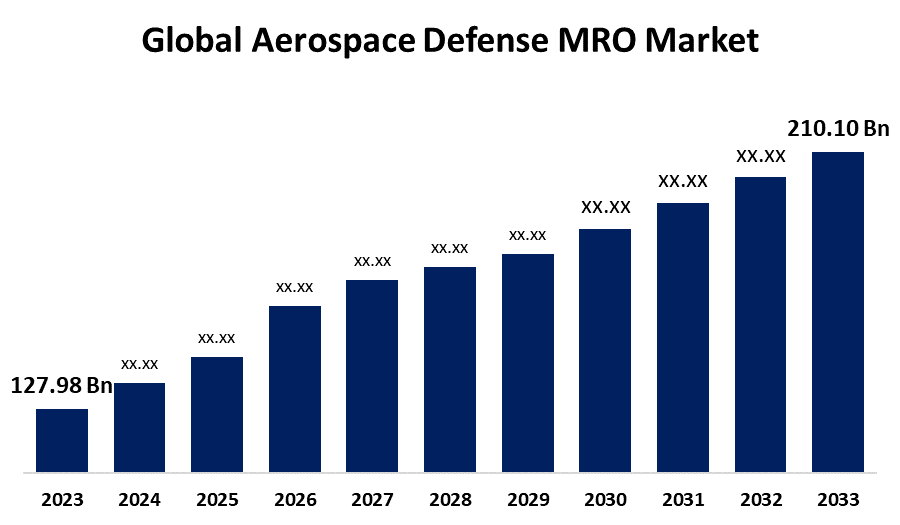

- The Global Aerospace Defense MRO Market Size was valued at USD 127.98 Billion in 2023

- The Market Size is growing at a CAGR of 5.08% from 2023 to 2033

- The Worldwide Aerospace Defense MRO Market Size is Expected to Reach USD 210.10 Billion by 2033

- The Europe Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aerospace Defense MRO Market Size is anticipated to exceed USD 210.10 Billion by 2033, growing at a CAGR of 5.08% from 2023 to 2033.

Market Overview

Aerospace defense MRO refers to the maintenance, repair, and overhaul of aircraft defense equipment. It includes scheduled maintenance to prevent breakdowns and ensure peak performance, as well as unscheduled repairs to address unexpected problems. MRO activities are essential for the safe and efficient operation of aerospace and defense assets, ensuring regulatory compliance and extending their life. Aerospace and defense MRO organizations are classified as airline or operator MROs, independent or third-party MRO organizations, and OEM MRO organizations that offer MRO services. SMEs play a minor role in OEM MRO services, falling primarily into the independent MRO sector. OEMs and global third-party companies have adopted advanced predictive and preventive aircraft maintenance technologies to digitize and automate their airframe maintenance activities, thereby improving overall maintenance process efficiency. The adoption of advanced technologies such as artificial intelligence and machine learning is expected to enable firms to compete on a global scale while lowering MRO costs. Furthermore, the use of new materials and manufacturing techniques necessitates changes in MRO processes and capabilities. Aside from that, the growing demand for specialized services in the aviation industry provides a promising market outlook. The growing adoption of aircraft component maintenance, repair, and overhaul (MRO) as the aircraft fleet ages is driving global aerospace defense MRO market growth. In accordance with this, many airlines and operators continue to operate older aircraft models due to the significant capital investment required for fleet replacement. These aging aircraft require more frequent and extensive maintenance to meet safety and performance standards. Furthermore, MRO providers play an important role in extending the life of these aircraft by performing routine inspections, repairs, and component replacements.

Report Coverage

This research report categorizes the market for global aerospace defense MRO market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global aerospace defense MRO market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global aerospace defense MRO market.

Global Aerospace Defense MRO Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 127.98 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.08% |

| 2033 Value Projection: | USD 210.10 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Applications, By End-User, By Region |

| Companies covered:: | Lufthansa Technik AG, AAR Corp., ST Engineering Ltd., Delta TechOps, HAECO Group, Collins Aerospace (Raytheon Technologies Corporation), Bombardier Inc., United Airlines, Inc., Textron Inc., General Dynamics Corporation, Turkish Technic Inc., FL Technics, Barnes Aerospace, Inc., and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The aerospace and defense MRO market is growing due to aircraft fleet expansions, rapid urbanization in emerging economies, an increase in the number of tourists worldwide, and the penetration of low-cost carriers (LCCs). Increased global air passenger traffic due to low-cost airlines has created a growing demand for highly efficient flight safety mechanisms and security checks to ensure maximum passenger safety. Furthermore, as global trade relations improve among major economies, demand for cargo services is expected to rise, driving growth in the global aerospace defense MRO market. This section delves into key drivers such as increased air traffic, aging aircraft fleets, technological advancements, regulatory requirements, and a growing demand for cost-effective maintenance solutions. Understanding market drivers enables industry participants to align their strategies and capitalize on global aerospace defense MRO growth opportunities.

Restraining Factors

One of the most significant obstacles confronting aerospace MRO companies today is the ongoing labor shortage and the retention of a highly skilled workforce. Recognizing market constraints enables industry participants to devise effective strategies for overcoming obstacles and maintaining growth. Furthermore, long MRO service lead times due to a shortage of aircraft parts and skilled labor contribute to aircraft being unavailable for flight operations. This raises the operating costs of airlines, restricting market growth.

Market Segmentation

The global aerospace defense MRO market share is classified into product, application, and end user.

- The engine segment is expected to grow fastest in the global aerospace defense MRO market during the forecast period.

The global aerospace defense MRO market is categorized by product into engine, airframe, line, and component. Among these, the engine segment is expected to grow fastest in the global aerospace defense MRO market during the forecast period. Aero-engine maintenance is one of the most important security concerns for keeping airplanes safe and operational. The need to protect the environment from pollution and follow FAA and EASA regulations while improving the performance of aircraft engines are critical factors to consider during airplane engine MRO. In addition, aircraft engines must produce more power while using less fuel. This can be accomplished by improving the efficiency of aircraft engines and maintaining them properly.

- The narrow-body aircraft segment is expected to grow at the highest pace in the global aerospace defense MRO market during the forecast period.

Based on the application, the global aerospace defense MRO market is divided into narrow-body aircraft, wide-body aircraft, regional aircraft, and others. Among these, the narrow-body aircraft segment is expected to grow at the highest pace in the global aerospace defense MRO market during the forecast period. Narrow-body aircraft are typically single-aisle aircraft with a smaller seating capacity, intended for short to medium-haul routes. Furthermore, narrow-body aircraft components frequently require maintenance, including avionics, engines, landing gear, and cabin systems. Aside from that, MRO providers are focusing on providing timely and efficient services to reduce aircraft downtime for airlines operating these aircraft.

- The commercial aviation segment is expected to hold the largest share of the global aerospace defense MRO market during the forecast period.

Based on the end user the global aerospace defense MRO market is divided into commercial aviation, business & general aviation, military aviation, and others. Among these, the commercial aviation segment is expected to hold the largest share of the global aerospace defense MRO market during the forecast period. Commercial aviation maintenance models have changed dramatically over the past two decades. The market is expected to grow due to increased fleet size, rapid urbanization, GDP growth in emerging economies, increased tourism, higher penetration of low-cost carriers (LCC), and mandatory maintenance programs for aging aircraft. Furthermore, increased demand for cargo services as a result of improved global economic connections is expected to drive the commercial aviation global aerospace defense MRO market's growth during the forecast period.

Regional Segment Analysis of the Global Aerospace Defense MRO Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is anticipated to hold the largest share of the global aerospace defense MRO market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is projected to hold the largest share of the global aerospace defense MRO market over the forecast years. Which is driven by continued economic growth, increased passenger traffic, and rising domestic aircraft demand as Japan, China, and India's economies expand. Because of the availability of a skilled workforce, competitive labor costs, the expansion of engineering services, and R&D expertise, the area is emerging as a potential international hub for aerospace parts and MRO services. Furthermore, the market is expected to expand significantly as a consequence of increased domestic and international traffic, in addition to rising demand for international cargo, which will drive demand for MRO services.

Europe is expected to grow the fastest in the global aerospace defense MRO market during the forecast period. Cross-border ownership and manufacturing networks have increased the integration and regulation of the European aerospace defense MRO industry. Global air travel is expected to expand rapidly, with a growing demand for fuel-efficient, cost- and energy-saving aircraft. Europe's Flightpath 2050 aviation strategy calls for a reduction in fuel emissions and noise. These necessitate aerospace industry innovation and investment in advanced aircraft maintenance and repair services. Similarly, European armed forces maintain an aging fleet of helicopters and aircraft. The old and aging aircraft fleet increases demand for aircraft MRO, driving global aerospace defense MRO market growth during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved in the global aerospace defense MRO along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lufthansa Technik AG

- AAR Corp.

- ST Engineering Ltd.

- Delta TechOps

- HAECO Group

- Collins Aerospace (Raytheon Technologies Corporation)

- Bombardier Inc.

- United Airlines, Inc.

- Textron Inc.

- General Dynamics Corporation

- Turkish Technic Inc.

- FL Technics

- Barnes Aerospace, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2023, The Crown Group announced that it is fully prepared to provide total MRO and Avionics support to India's existing fighter jet fleet, which includes the Indian Navy's MiG-29K, and the Indian Air Force's MiG-29, Jaguar, Mirage 2000, and Sukoi-30.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Global Aerospace Defense MRO Market based on the below-mentioned segments:

Global Aerospace Defense MRO Market, By Product

- Engine

- Airframe

- Line

- Component

Global Aerospace Defense MRO Market, By Application

- Narrow Body Aircraft

- Wide Body Aircraft

- Regional Aircraft

- Others

Global Aerospace Defense MRO Market, By End-User

- Commercial Aviation

- Business and General Aviation

- Military Aviation

- Others

Global Aerospace Defense MRO, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1) What are the key driving factors for the growth of the aerospace defense MRO Market?An increase in demand from end-use industries and a surge in the need for lightweight composites in aerospace and wind turbine applications are presently driving the growth of the aerospace defense MRO Market

-

2) What segments are covered in the aerospace defense MRO Market report?The global aerospace defense MRO Market is segmented based on type, product, application, and geography.

-

3) What is the projected market size & growth rate of the aerospace defense MRO Market?Aerospace defense MRO Market was valued at USD 127.98 Billion in 2023 and is projected to reach USD 210.10 Billion by 2033, growing at a CAGR of 5.08% from 2023 to 2033.

Need help to buy this report?