Global Aerospace Engineering Services Outsourcing Market Size, Share, and COVID-19 Impact Analysis, By Service (Design & Engineering, Manufacturing Support, Security & Certification, After-market Services), By Location (On-Shore, Off-Shore), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aerospace Engineering Services Outsourcing Market Insights Forecasts to 2033

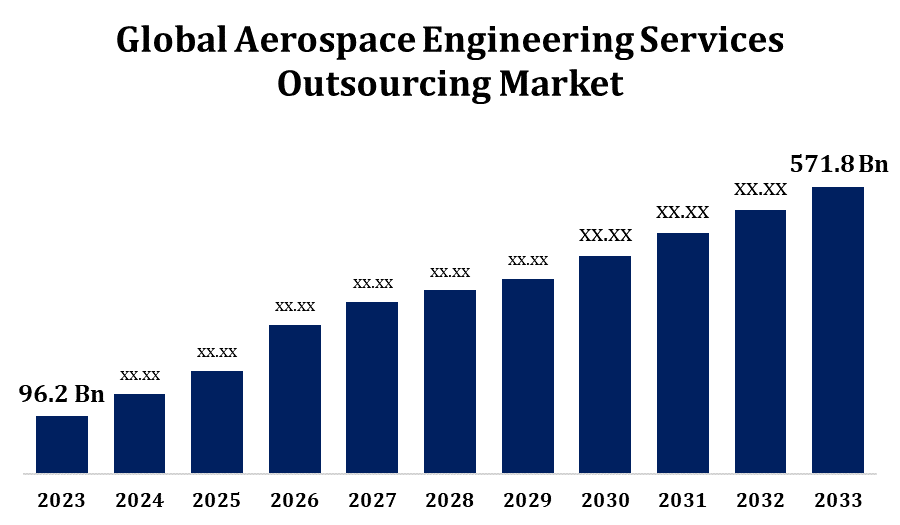

- The Aerospace Engineering Services Outsourcing Market Size Was Valued at USD 96.2 Billion in 2023.

- The Market Size is Growing at a CAGR of 19.51% from 2023 to 2033.

- The Worldwide Aerospace Engineering Services Outsourcing Market is expected to reach USD 571.8 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Aerospace Engineering Services Outsourcing Market Size is expected to reach USD 571.8 Billion by 2033, at a CAGR of 19.51% during the forecast period 2023 to 2033.

The Aerospace Engineering Services Outsourcing (ESO) market is experiencing significant growth, driven by rising demand for innovative and efficient aircraft designs, along with the need for cost optimization. This market encompasses various engineering services such as design, prototyping, testing, and system integration, which are increasingly being outsourced to specialized service providers. Key factors fueling this trend include the expansion of the global aviation sector, advancements in technologies like additive manufacturing and AI, and the focus on reducing product lifecycle costs. Leading aerospace companies are partnering with engineering service providers to access a global talent pool, leverage digital engineering tools, and maintain competitiveness. The market is projected to continue expanding, supported by increased R&D investments, the push for sustainability, and evolving regulatory standards in the aerospace industry.

Aerospace Engineering Services Outsourcing Market Value Chain Analysis

The value chain of the Aerospace Engineering Services Outsourcing (ESO) market consists of several key stages, beginning with research and development (R&D) and extending through design, engineering, manufacturing support, and post-production services. At the R&D stage, aerospace firms work closely with ESO providers to conceptualize and develop new technologies, materials, and designs. In the design and engineering phase, outsourced services include CAD modeling, simulation, and testing, ensuring cost-effective and optimized solutions. ESO firms also offer manufacturing support, providing expertise in process engineering, quality assurance, and compliance. Finally, post-production services like maintenance, repair, and overhaul (MRO) ensure continued operational efficiency and safety. This value chain helps aerospace companies leverage specialized capabilities, reduce development time, and enhance agility while focusing on their core competencies.

Aerospace Engineering Services Outsourcing Market Opportunity Analysis

The Aerospace Engineering Services Outsourcing (ESO) market presents significant growth opportunities, fueled by increasing adoption of advanced technologies such as AI, IoT, and additive manufacturing. As aerospace companies strive to innovate and reduce development costs, they are increasingly outsourcing R&D, design, and testing services to access specialized expertise and digital engineering capabilities. The shift toward electrification and sustainable aviation, including the development of electric and hybrid aircraft, is opening new avenues for ESO providers. Emerging markets in Asia-Pacific and the Middle East are driving demand for these services due to expanding aviation infrastructure and rising air passenger traffic. Moreover, the aftermarket services segment, including MRO activities, is also expected to see a surge in outsourcing, providing ESO firms with long-term, value-added growth prospects.

Global Aerospace Engineering Services Outsourcing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 96.2 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 19.51% |

| 2033 Value Projection: | USD 571.8 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Service, By Location, By Region |

| Companies covered:: | Honeywell International Inc., LISI Group, ALTRAN, Bertrandt, AKKA, Altair Engineering, Inc., Alten Group, L&T Technology Services Limited, Safran, and QuEST Global Services Pte. Ltd. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aerospace Engineering Services Outsourcing Market Dynamics

Rise in the need for specialized engineering skills and expertise

The growth of the Aerospace Engineering Services Outsourcing (ESO) market is significantly driven by the rising need for specialized engineering skills and expertise. As the aerospace industry becomes more complex with the integration of advanced technologies like AI, IoT, and additive manufacturing, companies require highly skilled professionals for niche areas such as avionics, aerostructures, and propulsion systems. However, sourcing and maintaining this talent in-house is both challenging and costly. This has led aerospace firms to collaborate with ESO providers, who offer a global talent pool with expertise in cutting-edge technologies and compliance with stringent industry standards. By leveraging these specialized skills, companies can accelerate innovation, reduce product development cycles, and enhance overall efficiency, thereby fueling the growth of the ESO market.

Restraints & Challenges

The Aerospace Engineering Services Outsourcing (ESO) market faces several challenges that can impact its growth. One major issue is the stringent regulatory and compliance requirements in the aerospace industry, which complicate the outsourcing of critical engineering functions. Ensuring data security and protecting intellectual property (IP) is another concern, as ESO providers handle sensitive information related to aircraft design and technology. Additionally, managing communication and collaboration between geographically dispersed teams can lead to inefficiencies and project delays. The shortage of highly skilled professionals in specialized domains, such as avionics and systems engineering, further limits the scalability of ESO services. Furthermore, fluctuations in demand due to economic cycles or geopolitical factors can impact outsourcing strategies, making it crucial for ESO firms to remain agile and adaptable to changing market conditions.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace Engineering Services Outsourcing Market from 2023 to 2033. The region's demand for outsourced engineering services is fueled by the need for advanced research and development (R&D), digital engineering solutions, and support for new aerospace programs. North American companies are increasingly outsourcing design, testing, and manufacturing support to optimize costs and enhance innovation. The growth of this market is further supported by investments in emerging technologies like electric propulsion, autonomous systems, and next-generation aircraft. Additionally, stringent safety and regulatory standards necessitate specialized expertise, making outsourcing a preferred strategy for maintaining competitiveness and compliance in a dynamic aerospace landscape.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries like India, China, and Japan are becoming prominent hubs for ESO services due to a strong engineering talent pool and competitive cost advantages. Local aerospace companies and international players are increasingly outsourcing engineering tasks such as design, simulation, and manufacturing support to capitalize on these resources. Government initiatives promoting aerospace R&D and the development of indigenous aircraft further stimulate the market. Additionally, partnerships between global aerospace leaders and regional ESO providers are enhancing technological capabilities. The region’s focus on sustainability, innovation, and MRO services creates new outsourcing opportunities, positioning Asia-Pacific as a key player in the global aerospace engineering services market.

Segmentation Analysis

Insights by Service

The manufacturing support segment accounted for the largest market share over the forecast period 2023 to 2033. This segment includes services like process engineering, quality assurance, tooling design, and supply chain management, which are critical for enhancing manufacturing efficiency and reducing time-to-market. As aerospace companies strive to streamline operations and focus on core competencies, they are outsourcing these functions to ESO providers who offer specialized expertise and advanced digital tools such as digital twins and automation. The rise of Industry 4.0 and smart manufacturing technologies further fuels the demand for outsourced manufacturing support. Moreover, the push for lightweight materials and complex component designs, particularly for next-generation aircraft, is driving the need for advanced manufacturing capabilities provided by ESO partners.

Insights by Location

The on-shore segment accounted for the largest market share over the forecast period 2023 to 2033. On-shore outsourcing involves leveraging engineering services within the same country or region, enabling aerospace firms to maintain closer oversight and alignment with ESO providers. This model reduces communication barriers, enhances project coordination, and ensures adherence to stringent industry standards and intellectual property (IP) protection. The trend is particularly strong in regions like North America and Europe, where regulatory requirements and complex engineering demands necessitate local expertise. Additionally, the on-shore model mitigates risks associated with geopolitical tensions and supply chain disruptions. As a result, aerospace firms are increasingly adopting on-shore ESO to enhance flexibility, maintain quality control, and optimize their engineering operations.

Recent Market Developments

- In 2022, Altair, a global leader in computational science and artificial intelligence (AI), has acquired Concept Engineering, a top provider of electronic system visualization software that streamlines the development, manufacturing, and servicing of complex electrical and electronic systems across industries like aerospace, automotive, and industrial.

Competitive Landscape

Major players in the market

- Honeywell International Inc.

- LISI Group

- ALTRAN

- Bertrandt

- AKKA

- Altair Engineering, Inc.

- Alten Group

- L&T Technology Services Limited

- Safran

- QuEST Global Services Pte. Ltd.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace Engineering Services Outsourcing Market, Service Analysis

- Design & Engineering

- Manufacturing Support

- Security & Certification

- After-market Services

Aerospace Engineering Services Outsourcing Market, Location Analysis

- On-Shore

- Off-Shore

Aerospace Engineering Services Outsourcing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Aerospace Engineering Services Outsourcing Market?The global Aerospace Engineering Services Outsourcing Market is expected to grow from USD 96.2 billion in 2023 to USD 571.8 billion by 2033, at a CAGR of 19.51% during the forecast period 2023-2033.

-

2.Who are the key market players of the Aerospace Engineering Services Outsourcing Market?Some of the key market players of the market are Honeywell International Inc., LISI Group, ALTRAN, Bertrandt, AKKA, Altair Engineering, Inc., Alten Group, L&T Technology Services Limited, Safran, and QuEST Global Services Pte. Ltd.

-

3.Which segment holds the largest market share?The on-shore segment holds the largest market share and is going to continue its dominance.

-

4.Which region dominates the Aerospace Engineering Services Outsourcing Market?North America dominates the Aerospace Engineering Services Outsourcing Market and has the highest market share.

Need help to buy this report?