Global Aerospace Fluoropolymers Market Size, Share, and COVID-19 Impact Analysis, By Type (Polytetrafluoroethylene, Polyvinylidene Fluoride, Fluorinated Ethylene Propylene, Perfluoro-Alkoxy, Ethylene Tetrafluoroethylene, Fluorinated Rubber), By Application (Aircraft Interiors, Aircraft Exteriors, Propulsion Systems, Spacecraft Components), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aerospace Fluoropolymers Market Insights Forecasts to 2033

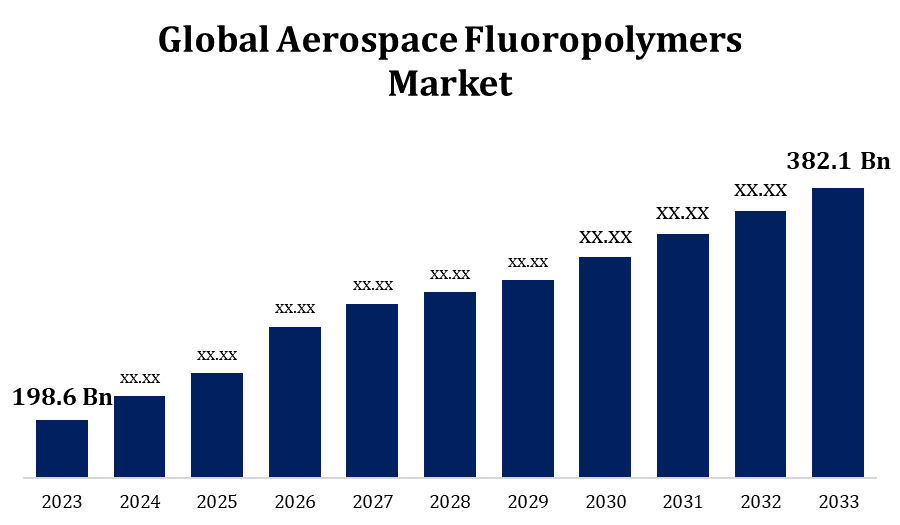

- The Aerospace Fluoropolymers Market Size was valued at USD 198.6 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.76% from 2023 to 2033.

- The Worldwide Aerospace Fluoropolymers Market Size is Expected to reach USD 382.1 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aerospace Fluoropolymers Market Size is Expected to reach USD 382.1 Billion by 2033, at a CAGR of 6.76% during the forecast period 2023 to 2033.

The aerospace fluoropolymers market is experiencing significant growth, driven by increased demand for lightweight and high-performance materials in the aviation and aerospace industries. Fluoropolymers, known for their exceptional chemical resistance, thermal stability, and low friction properties, are used in a variety of applications such as wire coatings, seals, gaskets, and fuel hoses. These materials help enhance fuel efficiency and reduce maintenance costs, making them ideal for modern aircraft designs. The market is further propelled by the expansion of commercial and military aviation, coupled with stringent safety and environmental regulations. North America currently leads the market due to the presence of major aerospace manufacturers, while the Asia-Pacific region is expected to witness rapid growth, driven by rising investments in aerospace infrastructure and increased production capacity.

Aerospace Fluoropolymers Market Value Chain Analysis

The value chain of the aerospace fluoropolymers market involves multiple stages, from raw material supply to end-product manufacturing and distribution. It begins with the extraction and processing of raw fluoropolymer materials, such as PTFE, FEP, and PFA, supplied by chemical companies. These materials are then formulated and modified by specialized fluoropolymer manufacturers to meet the stringent specifications required for aerospace applications, such as high-temperature resistance and chemical inertness. The processed fluoropolymers are supplied to component manufacturers who produce items like wire insulations, seals, and coatings. These components are integrated into aircraft systems by original equipment manufacturers (OEMs) and tier-1 suppliers. The final products are then distributed to the aerospace industry, where they are used in aircraft assembly, maintenance, and retrofitting, ensuring optimal performance and safety.

Aerospace Fluoropolymers Market Opportunity Analysis

The aerospace fluoropolymers market presents significant opportunities, driven by the increasing demand for lightweight and durable materials in aircraft manufacturing. The shift toward electric and hybrid aircraft is boosting the need for advanced fluoropolymer applications, such as insulation in high-voltage systems and lightweight components that enhance fuel efficiency. Additionally, the rising focus on reducing carbon emissions and enhancing safety standards has created a demand for high-performance materials with superior thermal and chemical resistance. Emerging economies in Asia-Pacific and the Middle East are witnessing rapid expansion in aerospace infrastructure, providing new avenues for market growth. Moreover, advancements in 3D printing and material innovations enable manufacturers to develop customized fluoropolymer solutions for aerospace applications, offering lucrative prospects for companies investing in research and development.

Global Aerospace Fluoropolymers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 198.6 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.76% |

| 2033 Value Projection: | USD 382.1 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 269 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | The Chemours Company, Daikin Industries, Ltd., AGC Group, Arkema S.A., Solvay S.A, 3M, Zhonghao Chenguang Research Institute of Chemical Industry Co., Ltd., Shin-Etsu Chemical Co., Ltd., Halopolymer OJSC, Gujarat Fluorochemicals Limited., and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Market Dynamics

Aerospace Fluoropolymers Market Dynamics

Rising Demand for Commercial and Regional Aircraft

The rising demand for commercial and regional aircraft is a key driver for growth in the aerospace fluoropolymers market. As global air traffic continues to increase, the need for new aircraft to accommodate growing passenger numbers is creating opportunities for fluoropolymer applications. These materials are essential in enhancing the durability and efficiency of various aircraft components, including wire coatings, fuel systems, and seals, due to their excellent resistance to heat, chemicals, and electrical conductivity. Additionally, the expansion of regional air travel, especially in emerging markets across Asia-Pacific and the Middle East, is contributing to higher aircraft production rates. As manufacturers focus on developing lightweight and fuel-efficient designs, the adoption of fluoropolymers is expected to accelerate, supporting enhanced performance and reduced operational costs.

Restraints & Challenges

High manufacturing costs and complex processing requirements are significant barriers, as fluoropolymers need specialized production techniques to maintain their unique properties, driving up overall costs. Additionally, fluctuations in the availability and prices of raw materials like fluorite can disrupt the supply chain and impact profitability. Stringent regulatory requirements concerning material safety and environmental impact further complicate market dynamics, as compliance necessitates additional testing and certification processes. The market also contends with increasing competition from alternative high-performance materials, such as advanced composites and ceramics, which offer similar benefits at potentially lower costs. Lastly, the slow pace of innovation in some segments of the aerospace industry poses a challenge to the adoption of novel fluoropolymer solutions.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace Fluoropolymers Market from 2023 to 2033. The region is home to major aircraft manufacturers like Boeing and Lockheed Martin, which drive demand for advanced materials that offer lightweight properties, high durability, and resistance to extreme temperatures and chemicals. The U.S. government’s substantial investments in military and space exploration programs further boost the adoption of fluoropolymers in critical applications such as fuel systems, wire insulations, and seals. Additionally, stringent regulations on aircraft safety and performance standards promote the use of high-quality fluoropolymer components. As the industry shifts towards next-generation aircraft designs and electric propulsion systems, North America is expected to remain a key growth region for the aerospace fluoropolymers market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries like China, India, and Japan are expanding their aerospace manufacturing capabilities, supported by government initiatives to boost domestic production and reduce dependency on imports. The growth of low-cost carriers and the surge in air travel are propelling the need for new aircraft, creating opportunities for fluoropolymer applications in various components such as wire insulation, seals, and fuel hoses. Additionally, the region’s focus on enhancing fuel efficiency and meeting international safety standards is leading to greater adoption of advanced materials. With rising R&D activities and collaboration between global and local manufacturers, Asia-Pacific is expected to be a significant growth driver in the aerospace fluoropolymers market.

Segmentation Analysis

Insights by Type

The Polytetrafluoroethylene segment accounted for the largest market share over the forecast period 2023 to 2033. PTFE’s versatility makes it ideal for a wide range of aerospace applications, including wire insulation, fuel hose linings, and seals, where durability and performance are critical. The growing focus on developing lightweight aircraft to enhance fuel efficiency and reduce emissions is further driving demand for PTFE, as it contributes to weight reduction without compromising safety or reliability. Additionally, PTFE’s ability to withstand harsh environmental conditions and maintain stability under extreme temperatures makes it a preferred material in both commercial and military aircraft. With increasing aircraft production and advancements in material technologies, the PTFE segment is expected to continue its upward trajectory.

Insights by Application

The aircraft interiors segment accounted for the largest market share over the forecast period 2023 to 2033. Fluoropolymers, such as PTFE and FEP, are widely used in interior components, including seating, insulation materials, and decorative panels, due to their fire resistance, durability, and ease of maintenance. As airlines strive to improve fuel efficiency, there is a growing focus on lightweight materials, making fluoropolymers an ideal choice for reducing aircraft weight while maintaining structural integrity. Additionally, increasing investment in premium cabins and in-flight entertainment systems is boosting the need for advanced wiring and insulation solutions, further fueling fluoropolymer demand. With evolving safety regulations and growing interest in electric aircraft, the use of fluoropolymers in aircraft interiors is set to expand significantly.

Recent Market Developments

- In January 2023, Saint-Gobain, through its Chryso business, announced the acquisition of Matchem in Brazil. Furthermore, they have entered into exclusive negotiations to acquire IDP Chemicals in Egypt.

Competitive Landscape

Major players in the market

- The Chemours Company

- Daikin Industries, Ltd.

- AGC Group

- Arkema S.A.

- Solvay S.A

- 3M

- Zhonghao Chenguang Research Institute of Chemical Industry Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Halopolymer OJSC

- Gujarat Fluorochemicals Limited.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace Fluoropolymers Market, Type Analysis

- Polytetrafluoroethylene

- Polyvinylidene Fluoride

- Fluorinated Ethylene Propylene

- Perfluoro-Alkoxy

- Ethylene Tetrafluoroethylene

- Fluorinated Rubber

Aerospace Fluoropolymers Market, Application Analysis

- Aircraft Interiors

- Aircraft Exteriors

- Propulsion Systems

- Spacecraft Components

Aerospace Fluoropolymers Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?