Global Aerospace Foam Market Size, Share, and COVID-19 Impact Analysis, By Foam Type (PU, PE), By Application (Carbon Walls & Ceilings, Aircraft Seats), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aerospace Foam Market Insights Forecasts to 2033

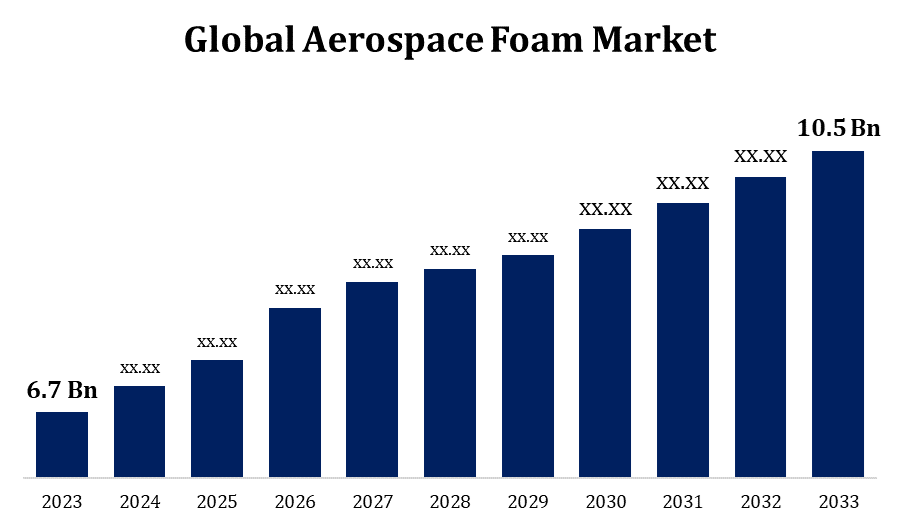

- The Aerospace Foam Market Size was valued at USD 6.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.60% from 2023 to 2033.

- The Worldwide Aerospace Foam Market Size is Expected to reach USD 10.5 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aerospace Foam Market Size is Expected to reach USD 10.5 Billion by 2033, at a CAGR of 4.60% during the forecast period 2023 to 2033.

The aerospace foam market is experiencing significant growth, driven by increasing demand for lightweight materials in aircraft manufacturing and maintenance. Key applications include insulation, cushioning, and soundproofing, with materials like polyurethane, polyethylene, and polyimide being widely utilized. The industry's expansion is fueled by advancements in technology and the rising focus on fuel efficiency and sustainability. Major players are investing in research and development to innovate eco-friendly foam solutions that meet stringent safety standards. The market is also benefiting from the growing commercial aviation sector and an upsurge in air travel post-pandemic. Additionally, military and defense applications contribute to market demand, ensuring robust growth prospects for aerospace foam manufacturers in the coming years.

Aerospace Foam Market Value Chain Analysis

The aerospace foam market value chain comprises several key stages, starting from raw material sourcing to end-user applications. It begins with the procurement of raw materials, such as polyurethane, polyethylene, and polyimide, which are processed into foam products. Manufacturers then engage in research and development to innovate and improve foam formulations, ensuring compliance with aerospace safety standards. After production, the foams are subjected to quality testing before being distributed to aircraft manufacturers, maintenance providers, and defense contractors. End users incorporate these foams in applications like insulation, seating, and soundproofing. Strong collaboration between suppliers, manufacturers, and end users is crucial for optimizing performance, reducing costs, and enhancing the sustainability of aerospace foam products, ultimately driving market growth and innovation.

Aerospace Foam Market Opportunity Analysis

The aerospace foam market presents substantial opportunities driven by several key factors. The increasing demand for lightweight materials to enhance fuel efficiency and reduce emissions in aircraft design is a significant catalyst for growth. The rise of electric and hybrid aircraft also opens avenues for innovative foam solutions tailored to new propulsion systems. Additionally, the expansion of the commercial aviation sector, particularly in emerging economies, boosts the need for high-performance foams for seating, insulation, and soundproofing. Furthermore, advancements in manufacturing technologies, such as 3D printing, allow for customization and reduced production costs, making aerospace foams more accessible. The growing emphasis on sustainability and eco-friendly materials presents an opportunity for companies to develop recyclable and biodegradable foam options, aligning with industry trends toward greener solutions.

Global Aerospace Foam Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.7 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.60% |

| 2033 Value Projection: | USD 10.5 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 269 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Foam Type, By Application, By Region |

| Companies covered:: | Boyd Corp., Evonik Industries AG, ERG Aerospace Corp., SABIC, BASF SE, ZOTEFOAMS PLC, General Plastics Manufacturing Company, Solvay, UFP Technologies, Inc., Recticel NV/SA, NCFI Polyurethanes, DuPont, Rogers Corp., ARMACELL, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Market Dynamics

Aerospace Foam Market Dynamics

The anticipated significant growth of the military aircraft manufacturing sector to propel market growth

The projected substantial growth of the military aircraft manufacturing sector is expected to significantly boost the aerospace foam market. As defense budgets increase globally, there is a rising demand for advanced military aircraft equipped with innovative technologies. This surge necessitates lightweight and high-performance materials, such as aerospace foams, for applications including insulation, cushioning, and soundproofing. Additionally, the focus on enhancing the durability and efficiency of military aircraft further drives the need for specialized foam solutions that meet stringent safety and performance standards. Collaborations between aerospace foam manufacturers and defense contractors will foster innovation and the development of customized products tailored to specific military requirements. This growing synergy is likely to create new opportunities, propelling the aerospace foam market forward in tandem with the expanding military aircraft industry.

Restraints & Challenges

One significant issue is the stringent regulatory requirements governing the aerospace industry, which necessitates rigorous testing and compliance for materials used in aircraft. This can lead to increased costs and longer timeframes for product development. Additionally, fluctuations in raw material prices, particularly for polymers and other foaming agents, can impact profit margins and supply chain stability. The market also encounters competition from alternative lightweight materials, such as composites, which may offer superior performance characteristics. Furthermore, the need for continuous innovation to meet evolving industry standards and customer demands can strain resources for manufacturers.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace Foam Market from 2023 to 2033. The United States, home to major aircraft manufacturers and military contractors, significantly contributes to the demand for lightweight foam materials used in insulation, cushioning, and soundproofing applications. The increasing focus on fuel efficiency and environmental sustainability is prompting manufacturers to adopt advanced foam technologies, such as recyclable and eco-friendly materials. Moreover, the resurgence of commercial air travel post-pandemic and the growing investments in military aircraft development further bolster market expansion. Collaboration between industry players and research institutions enhances innovation, ensuring the availability of high-performance aerospace foams that meet rigorous safety and quality standards. This dynamic landscape positions North America as a critical hub for aerospace foam advancements.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region is investing heavily in both commercial and military aircraft production, driving demand for advanced foam materials. The region's growing middle class and rising disposable incomes contribute to a surge in passenger numbers, prompting airlines to seek lightweight, efficient, and comfortable seating solutions. Additionally, government initiatives to enhance defense capabilities and boost indigenous aircraft production further propel the market. As manufacturers prioritize sustainability, there is a growing trend toward eco-friendly foam options. The Asia Pacific aerospace foam market is poised for significant advancements, supported by technological innovations and strategic collaborations among industry stakeholders.

Segmentation Analysis

Insights by Foam Type

The Polyurethane segment accounted for the largest market share over the forecast period 2023 to 2033. Polyurethane foams are favored for their lightweight nature, excellent thermal insulation, and superior cushioning capabilities, making them ideal for various applications, including seating, insulation, and soundproofing in aircraft. The increasing emphasis on fuel efficiency and weight reduction in aircraft design drives demand for these high-performance foams. Furthermore, advancements in polyurethane formulations are enhancing their durability and fire resistance, aligning with stringent safety regulations in aerospace. As manufacturers continue to innovate and develop eco-friendly polyurethane options, this segment is expected to expand significantly, catering to the evolving needs of both commercial and military aviation sectors.

Insights by Application

The carbon walls & ceilings segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is due to the increasing demand for lightweight, durable materials that enhance structural integrity and thermal insulation in aircraft. Carbon-based foams offer superior strength-to-weight ratios and excellent soundproofing properties, making them ideal for cabin interiors and fuselage applications. The rising focus on passenger comfort and safety is driving airlines and manufacturers to incorporate advanced materials that meet stringent fire and safety regulations. Additionally, the growing emphasis on sustainability is pushing companies to explore carbon foams that are recyclable and environmentally friendly. As the aerospace industry continues to innovate and seek performance-driven solutions, the carbon walls and ceilings segment is set to expand, contributing to overall market growth and advancements in aerospace design.

Recent Market Developments

- In January 2017, Diversified Silicone Products, Inc., a US-based company that develops and manufactures bespoke silicone products, was acquired by Rogers Corporation. The acquisition increased the range of products offered by Rogers Corporation's operating division, Elastomeric Material Solutions (EMS).

Competitive Landscape

Major players in the market

- Boyd Corp.

- Evonik Industries AG

- ERG Aerospace Corp.

- SABIC

- BASF SE

- ZOTEFOAMS PLC

- General Plastics Manufacturing Company

- Solvay

- UFP Technologies, Inc.

- Recticel NV/SA

- NCFI Polyurethanes, DuPont

- Rogers Corp.

- ARMACELL

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace Foam Market, Foam Type Analysis

- PU

- PE

Aerospace Foam Market, Application Analysis

- Carbon Walls & Ceilings

- Aircraft Seats

Aerospace Foam Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?