Global Aerospace Insulation Market Size, Share, and COVID-19 Impact Analysis, By Product (Thermal, Acoustic, Electric), By Material (Ceramic Materials, Mineral Wool, Foamed Plastics, Fiberglass, Others), By End Use (Commercial Aircraft, Military Aircraft), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aerospace Insulation Market Insights Forecasts to 2033

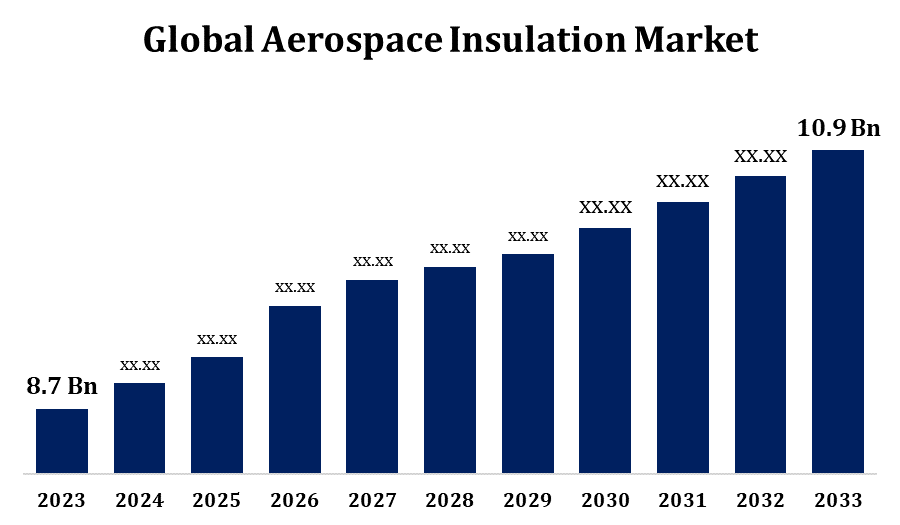

- The Aerospace Insulation Market Size was valued at USD 8.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.28% from 2023 to 2033.

- The Worldwide Aerospace Insulation Market Size is Expected to reach USD 10.9 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aerospace Insulation Market Size is Expected to reach USD 10.9 Billion by 2033, at a CAGR of 2.28% during the forecast period 2023 to 2033.

The aerospace insulation market is witnessing robust growth, driven by increasing air passenger traffic and stringent regulatory standards emphasizing fuel efficiency and noise reduction. Insulation materials such as foams, fiberglass, and ceramic-based products are extensively used in aircraft to enhance thermal management, acoustic comfort, and fire safety. The rising demand for lightweight materials that contribute to overall weight reduction without compromising performance is a key trend shaping the market. Advancements in technology and material sciences are enabling manufacturers to develop innovative insulation solutions tailored for commercial, military, and general aviation sectors. North America and Europe dominate the market due to their well-established aerospace industries, while the Asia-Pacific region is emerging as a lucrative growth hub with the expansion of regional aviation fleets and investments in infrastructure development.

Aerospace Insulation Market Value Chain Analysis

The aerospace insulation market value chain comprises several key stages, from raw material procurement to end-product delivery. It begins with the sourcing of raw materials like fiberglass, ceramic, and foams, which are supplied by chemical and material manufacturers. These materials are then processed and converted into various insulation products such as panels, blankets, and coatings by insulation manufacturers. Next, these products undergo rigorous testing to meet regulatory standards for thermal and acoustic insulation, fire resistance, and weight optimization. Distributors and suppliers play a pivotal role in ensuring the availability of these products to aircraft manufacturers and maintenance, repair, and overhaul (MRO) service providers. Finally, aerospace companies integrate these insulation solutions into aircraft systems, contributing to enhanced passenger comfort, safety, and fuel efficiency across commercial, military, and business jets.

Aerospace Insulation Market Opportunity Analysis

The aerospace insulation market presents significant opportunities driven by rising air travel demand, aircraft modernization programs, and stringent regulations on safety and environmental impact. The shift toward lightweight and eco-friendly materials offers scope for innovation, particularly in developing advanced composites and nanomaterials that reduce weight and improve fuel efficiency. Expanding airline fleets, especially in emerging economies across Asia-Pacific and the Middle East, are creating new avenues for insulation suppliers. Additionally, the increasing focus on enhancing passenger comfort and reducing cabin noise in premium and business-class segments further fuels the demand for high-performance insulation solutions. Technological advancements, such as 3D printing and smart insulation materials with self-healing and adaptive capabilities, present new growth prospects for manufacturers seeking to cater to evolving industry requirements and sustainability goals.

Global Aerospace Insulation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.28% |

| 2033 Value Projection: | 10.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 226 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Material, By End Use, By Region |

| Companies covered:: | Duracote Corporation, Rogers Corporation, Dupont, BASF SE, 3M, Esterline Technologies Corporation, Triumph Group Inc., Zodiac Aerospace, Evonik Industries, Polymer Technologies Inc., Zotefoams, UPF Corporation, Boyd Corporation, Johns Manville, Orcon, AVS Industries, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aerospace Insulation Market Dynamics

An increase in the market for corrosion-resistant insulation and fuel-efficient engines

The aerospace insulation market is witnessing increased demand for corrosion-resistant insulation solutions and fuel-efficient engine technologies. This trend is driven by the need to enhance aircraft longevity, performance, and environmental sustainability. Corrosion-resistant insulation materials, such as ceramic-based composites and advanced polymers, are crucial in protecting critical aircraft components from harsh operating environments, moisture, and temperature fluctuations. Concurrently, the emphasis on fuel-efficient engines is boosting the adoption of lightweight insulation products that contribute to overall weight reduction without compromising thermal and acoustic properties. These developments are particularly relevant for newer aircraft models, which require cutting-edge materials to meet stringent regulatory standards and support energy-efficient performance. As a result, manufacturers are investing in research and development to introduce innovative insulation solutions, meeting the dual demands of durability and efficiency in aerospace applications.

Restraints & Challenges

Developing insulation materials that balance thermal efficiency, acoustic properties, and fire resistance while being lightweight and eco-friendly is a significant hurdle for manufacturers. Moreover, the aerospace industry’s rigorous testing and approval processes can delay the introduction of new products, affecting market entry and profitability. The rising cost of raw materials, such as advanced composites and ceramics, further impacts the cost structure, making it difficult for suppliers to offer competitive pricing. Additionally, the sector must adapt to the increasing demand for sustainable solutions, including the use of recyclable or bio-based materials, which adds to R&D expenses. These factors collectively constrain market growth and pose barriers for new entrants.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace Insulation Market from 2023 to 2033. The region’s focus on technological innovation and the adoption of advanced materials for thermal, acoustic, and fire insulation solutions are key growth drivers. Stringent regulatory standards set by agencies like the Federal Aviation Administration (FAA) compel manufacturers to use high-performance insulation materials, further fueling market demand. The U.S. is the primary contributor, with a strong defense sector and the highest production rates of commercial and military aircraft. Additionally, the push for sustainable aviation, including lightweight, fuel-efficient aircraft, has led to increased adoption of advanced insulation products. Canada also plays a role, with growing investments in regional aviation projects.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries like China, India, and Japan are at the forefront, with robust demand for both commercial and military aircraft. The region’s growing focus on indigenous aircraft production and modernization of existing fleets further fuels the adoption of advanced insulation materials. Additionally, the expansion of low-cost carriers and new routes is boosting the need for high-performance thermal and acoustic insulation solutions to enhance passenger comfort and operational efficiency. Favorable government policies supporting aerospace development and collaborations between local manufacturers and global players are opening new opportunities for insulation suppliers to establish a strong foothold in this lucrative and rapidly evolving market.

Segmentation Analysis

Insights by Material

The ceramic material segment accounted for the largest market share over the forecast period 2023 to 2033. Ceramics are increasingly preferred in applications requiring high-temperature insulation, such as in engine nacelles, exhaust systems, and heat shields. Their inherent fire-resistant and corrosion-resistant qualities make them ideal for use in harsh environments, ensuring the protection and longevity of critical components. The demand for fuel-efficient and lightweight aircraft is further driving the adoption of ceramic-based insulation, as it helps reduce overall aircraft weight without compromising performance. Additionally, advancements in ceramic matrix composites (CMCs) are enabling the development of next-generation insulation solutions that enhance engine performance and support higher operating temperatures, contributing to reduced emissions and better fuel economy.

Insights by Product

The thermal insulation segment accounted for the largest market share over the forecast period 2023 to 2033. As modern aircraft operate in extreme temperature conditions, from high altitudes to subzero environments, thermal insulation materials are essential for maintaining operational efficiency and passenger comfort. Lightweight and high-performance insulation solutions, such as fiberglass, foam, and ceramic-based products, are widely adopted to reduce heat transfer, minimize energy loss, and enhance fuel efficiency. The growing focus on developing advanced materials with better thermal conductivity and fire-resistant properties is further propelling segment growth. Moreover, rising investments in the research and development of eco-friendly, recyclable thermal insulation materials align with the industry's sustainability goals, creating additional opportunities for market expansion.

Insights by End Use

The commercial segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are investing in advanced insulation materials to improve thermal and acoustic performance in cabins, reduce noise levels, and enhance in-flight comfort, especially in premium classes. Lightweight insulation materials are also being adopted to support fuel efficiency and comply with stringent environmental regulations. The surge in new aircraft deliveries from major manufacturers like Boeing and Airbus, combined with retrofitting activities for existing fleets, is further boosting demand in this segment. Additionally, growing airline operations in emerging markets, particularly in Asia-Pacific and the Middle East, are creating substantial opportunities for insulation suppliers to cater to diverse commercial aviation needs.

Recent Market Developments

- In January 2023, Aerogel Core Ltd. has developed next-generation materials tailored for the aerospace and automotive sectors. The company has introduced ultra-light, low-carbon 'aerogel' insulation materials, which can be utilized for soundproofing and heat shielding in aviation and automotive applications.

Competitive Landscape

Major players in the market

- Duracote Corporation

- Rogers Corporation

- Dupont

- BASF SE

- 3M

- Esterline Technologies Corporation

- Triumph Group Inc.

- Zodiac Aerospace

- Evonik Industries

- Polymer Technologies Inc.

- Zotefoams

- UPF Corporation

- Boyd Corporation

- Johns Manville

- Orcon

- AVS Industries

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace Insulation Market, Product Analysis

- Thermal

- Acoustic

- Electric

Aerospace Insulation Market, Material Analysis

- Ceramic Materials

- Mineral Wool

- Foamed Plastics

- Fiberglass

- Others

Aerospace Insulation Market, End Use Analysis

- Commercial Aircraft

- Military Aircraft

Aerospace Insulation Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aerospace Insulation Market?The global Aerospace Insulation Market is expected to grow from USD 8.7 billion in 2023 to USD 10.9 billion by 2033, at a CAGR of 2.28% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aerospace Insulation Market?Some of the key market players of the market are Duracote Corporation; Rogers Corporation; Dupont; BASF SE; 3M; Esterline Technologies Corporation; Triumph Group Inc.; Zodiac Aerospace; Evonik Industries; Polymer Technologies Inc.; Zotefoams; UPF Corporation; Boyd Corporation; Johns Manville; Orcon; AVS Industries.

-

3 Which segment holds the largest market share?The commercial segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aerospace Insulation Market?North America dominates the Aerospace Insulation Market and has the highest market share.

Need help to buy this report?