Global Aerospace Lubricant Market Size, Share, and COVID-19 Impact Analysis, By Product (Gas Turbine Oil, Piston Engine Oil, Hydraulic Fluid, Others); By Technology (Syntehtic, Mineral-Based), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aerospace Lubricant Market Insights Forecasts to 2033

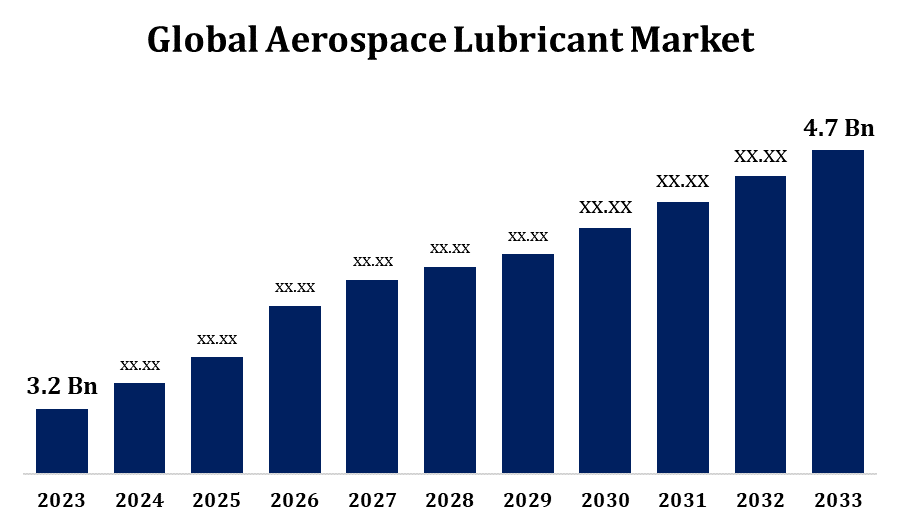

- The Aerospace Lubricant Market Size was valued at USD 3.2 Billion in 2023.

- The Market is Growing at a CAGR of 3.92% from 2023 to 2033.

- The Worldwide Aerospace Lubricant Market Size is Expected to reach USD 4.7 Billion By 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aerospace Lubricant Market Size is Expected to reach USD 4.7 Billion By 2033, at a CAGR of 3.92% during the forecast period 2023 to 2033.

The aerospace lubricant market is experiencing steady growth, driven by the increasing demand for advanced lubricants that ensure optimal performance and safety in aircraft operations. These lubricants are designed to withstand extreme conditions, such as high temperatures, pressure, and heavy loads, while providing corrosion resistance and minimizing wear and tear. Rising air passenger traffic, along with expanding military and space exploration activities, has heightened the need for high-quality lubricants in the aerospace sector. Additionally, the shift towards lightweight and fuel-efficient aircraft, along with advancements in synthetic lubricant technologies, is further boosting market demand. Key players are investing in research and development to create eco-friendly and high-performance products, positioning the market for continued expansion in the coming years.

Aerospace Lubricant Market Value Chain Analysis

The aerospace lubricant market value chain involves multiple stages, beginning with the procurement of raw materials such as synthetic oils, additives, and base oils. These components are processed by lubricant manufacturers to create products that meet the aerospace sector’s stringent specifications and performance standards. After formulation, the lubricants undergo comprehensive quality control and testing before being distributed through a network of suppliers and distributors. They are typically supplied directly to aircraft manufacturers, maintenance facilities, and airline operators. Original equipment manufacturers (OEMs) and maintenance, repair, and overhaul (MRO) service providers play a vital role in integrating these lubricants into various aircraft systems. The value chain concludes with end-users, including commercial, military, and private aircraft operators, to ensure safe and efficient aviation operations.

Aerospace Lubricant Market Opportunity Analysis

The aerospace lubricant market presents significant growth opportunities driven by rising global air traffic, expanding defense budgets, and increasing investments in space exploration. The shift towards lightweight, fuel-efficient aircraft is boosting the demand for advanced synthetic lubricants that enhance performance, reduce maintenance costs, and extend component life. The growing adoption of sustainable aviation practices and regulations aimed at reducing emissions have created a need for eco-friendly lubricants, opening avenues for innovation in biodegradable and low-toxicity products. Emerging markets in Asia-Pacific and the Middle East are witnessing increased investments in aviation infrastructure and fleet expansion, further fueling lubricant demand. Additionally, advancements in electric and hybrid-electric aircraft offer new opportunities for specialized lubricants that support novel propulsion systems and next-generation aviation technologies.

Global Aerospace Lubricant Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.92% |

| 2033 Value Projection: | USD 4.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Product, By Technology, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Aerospace Lubricants, Inc., Astronics Corporation, Crane Aerospace Inc., Eastman Chemical Company, Exxon Mobil Corporation, LUBRICANT CONSULT GMBH, Nye Lubricants, Inc., NYCO Solution ahead, Royal Dutch Shell plc, Shell Global, TotalEnergies Company, The Chemours Company, Zodiac Aerospace, and Other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aerospace Lubricant Market Dynamics

Increase in air travel and freight activities around the world

The aerospace lubricant market is witnessing strong growth due to the rise in global air travel and freight activities. Increasing passenger traffic, driven by a recovering tourism sector and expanding middle-class population, has led to higher demand for new aircraft and enhanced maintenance requirements. Similarly, the surge in e-commerce and international trade is boosting air freight volumes, necessitating more frequent maintenance, repair, and overhaul (MRO) services. As airlines expand their fleets and optimize operations, the need for high-performance lubricants that improve engine efficiency and reduce operational costs is increasing. Furthermore, the shift towards longer-haul flights and stringent safety standards are driving the adoption of advanced synthetic lubricants, positioning the market for further growth as air transportation and cargo activities continue to rise globally.

Restraints & Challenges

The aerospace lubricant market faces several challenges, primarily due to stringent regulatory standards and the high cost of advanced formulations. Compliance with environmental regulations, such as those imposed by the European Union’s REACH and the U.S. Environmental Protection Agency (EPA), requires manufacturers to develop eco-friendly and low-toxicity lubricants, adding to research and production costs. Additionally, volatility in raw material prices and supply chain disruptions can impact profitability and product availability. The aerospace industry’s stringent performance requirements also necessitate extensive testing and certification, leading to longer development cycles. Moreover, the increasing use of electric and hybrid-electric propulsion systems is shifting lubricant demand, creating uncertainty in market growth. These challenges make it essential for companies to invest in innovation while maintaining cost-efficiency and regulatory compliance.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace Lubricant Market from 2023 to 2033. The North American aerospace lubricant market is a key contributor to global growth, driven by the presence of leading aircraft manufacturers, defense contractors, and a robust aviation industry. The region benefits from high investments in research and development, leading to advanced lubricant formulations that meet stringent performance and environmental standards. Growing air passenger traffic and freight activities, particularly in the U.S., have increased the demand for commercial and military aircraft, boosting lubricant consumption. Additionally, the expanding focus on space exploration and the rising adoption of electric and hybrid aircraft technologies provide new growth opportunities. The presence of major maintenance, repair, and overhaul (MRO) service providers in North America further strengthens the market, ensuring steady demand for high-performance lubricants to maintain safety and operational efficiency across diverse aviation applications.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific aerospace lubricant market is experiencing rapid growth, fueled by increasing air traffic, expanding airline fleets, and significant investments in aviation infrastructure. Countries like China, India, and Japan are seeing a surge in domestic and international travel, driving the demand for new aircraft and related maintenance services. The rise of low-cost carriers and regional connectivity initiatives is further boosting lubricant consumption in the commercial aviation segment. Additionally, regional governments are enhancing their defense capabilities, leading to increased procurement of military aircraft and helicopters, which supports lubricant demand. Growing investments in space exploration and the emergence of aerospace manufacturing hubs in China and Southeast Asia provide further growth opportunities. The market’s expansion is supported by strategic partnerships and joint ventures between global and local lubricant manufacturers.

Segmentation Analysis

Insights by Product

The gas turbine oil segment accounted for the largest market share over the forecast period 2023 to 2033. These oils are essential for ensuring optimal engine performance, reducing wear, and extending component life under extreme operating conditions. The rise in global air traffic and the need for fuel-efficient engines have led to a surge in demand for high-performance turbine oils that provide superior thermal stability, oxidation resistance, and load-carrying capacity. Additionally, stringent regulations on emissions and the push for more efficient propulsion systems have prompted advancements in synthetic gas turbine oils. Emerging markets in Asia-Pacific and the Middle East, with expanding fleets and rising aircraft production, are further contributing to the segment's growth trajectory.

Insights by Technology

The mineral based segment accounted for the largest market share over the forecast period 2023 to 2033. Although synthetic and bio-based lubricants are gaining traction, mineral-based lubricants continue to be preferred for specific applications that do not require extreme performance characteristics. Their affordability and adequate lubrication properties make them suitable for low to moderate temperature and pressure conditions. However, the segment faces challenges due to the increasing adoption of synthetic alternatives that offer superior thermal stability, oxidation resistance, and longer service life. Additionally, stringent environmental regulations and a growing emphasis on sustainable aviation solutions are leading to a gradual decline in demand for mineral-based lubricants, particularly in advanced economies. Despite these trends, emerging markets still provide growth opportunities for this segment.

Recent Market Developments

- In October 2023, Movychem s.r.o. partnered with aerospace company Xeriant, Inc., which specialises in Advanced Air Mobility.

Competitive Landscape

Major players in the market

- Aerospace Lubricants, Inc.

- Astronics Corporation

- Crane Aerospace Inc.

- Eastman Chemical Company

- Exxon Mobil Corporation

- LUBRICANT CONSULT GMBH

- Nye Lubricants, Inc.

- NYCO Solution ahead

- Royal Dutch Shell plc

- Shell Global

- TotalEnergies Company

- The Chemours Company

- Zodiac Aerospace

- Others.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace Lubricant Market, Product Analysis

- Gas Turbine Oil

- Piston Engine Oil

- Hydraulic Fluid

- Others

Aerospace Lubricant Market, Technology Analysis

- Syntehtic

- Mineral-Based

Aerospace Lubricant Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?