Global Aerospace Maintenance Chemical Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Aircraft Cleaning Chemicals, Aircraft Leather Cleaners, Aviation Paint Removers, Aviation Paint Strippers, Specialty Solvents, Degreasers, and Aircraft Wash & Polish), By Aircraft Type (Commercial Aircraft, Single Engine Piston, Business Aircraft, Military Aircraft, Helicopters, Space, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aerospace Maintenance Chemical Market Insights Forecasts to 2033

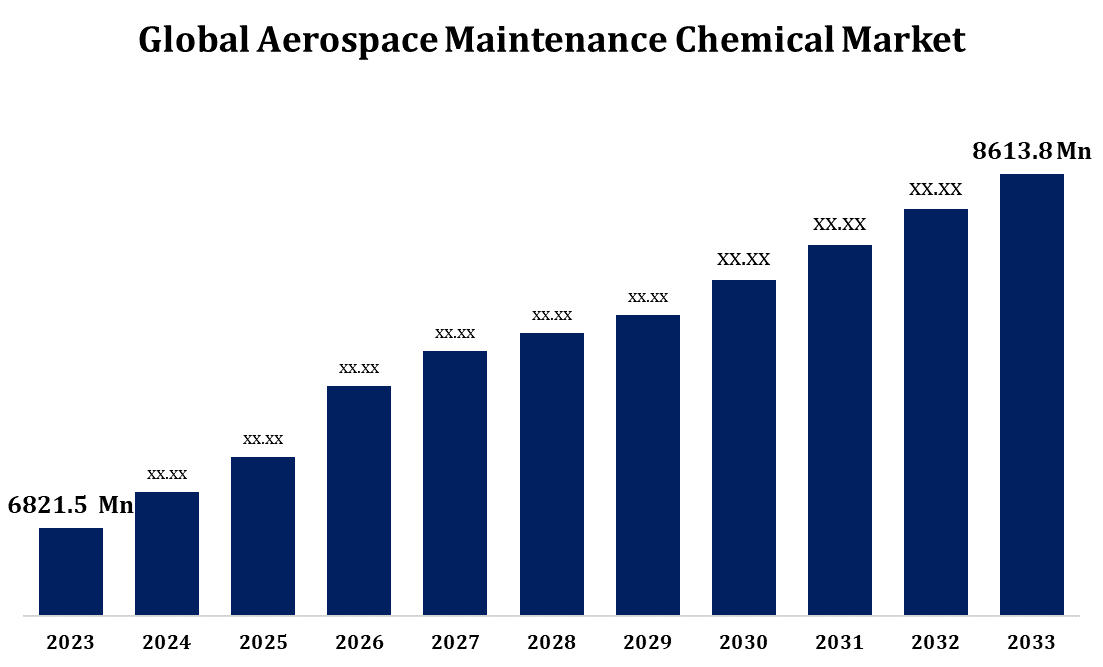

- The Aerospace Maintenance Chemical Market Size was valued at USD 6821.5 Million in 2023.

- The Market Size is Growing at a CAGR of 2.36% from 2023 to 2033.

- The Worldwide Aerospace Maintenance Chemical Market Size is Expected to reach USD 8613.8 Million by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aerospace Maintenance Chemical Market Size is Expected to reach USD 8613.8 Million by 2033, at a CAGR of 2.36% during the forecast period 2023 to 2033.

The aerospace maintenance chemical market encompasses a range of products used for cleaning, degreasing, surface treatment, and maintenance of aircraft. Driven by the increasing demand for air travel and the growth of the commercial aviation sector, this market is witnessing significant expansion. Maintenance, Repair, and Overhaul (MRO) operations are a key application area, requiring specialized chemicals to ensure aircraft safety and longevity. Factors such as stringent regulatory standards, rising defense budgets, and the need for eco-friendly and efficient maintenance solutions contribute to the market’s growth. Key segments include cleaning agents, deicing fluids, and corrosion inhibitors, with manufacturers focusing on product innovations and sustainability. The Asia-Pacific region is emerging as a significant market due to rising air traffic and increased investment in aviation infrastructure.

Aerospace Maintenance Chemical Market Value Chain Analysis

The aerospace maintenance chemical market value chain consists of raw material suppliers, chemical manufacturers, distributors, MRO service providers, and end-users such as commercial airlines and defense organizations. Raw materials, including solvents, surfactants, and specialty chemicals, are procured by manufacturers to produce cleaning agents, lubricants, deicing fluids, and corrosion inhibitors. Manufacturers, often in collaboration with research institutes, focus on developing innovative and regulatory-compliant products. These chemicals are then distributed to MRO service providers through specialized distributors or directly to the end-users. MRO service providers utilize these chemicals for maintenance and repair to ensure optimal aircraft performance and safety. The value chain is influenced by factors like regulatory standards, supply chain efficiency, and environmental considerations, with sustainability and innovation being critical drivers for competitive advantage.

Aerospace Maintenance Chemical Market Opportunity Analysis

The aerospace maintenance chemical market offers several growth opportunities driven by increasing air travel, expanding global fleet sizes, and stringent safety and environmental regulations. As the aviation industry pushes for eco-friendly solutions, there is a rising demand for sustainable and non-toxic chemicals, presenting opportunities for manufacturers to develop biodegradable products and reduce volatile organic compounds (VOCs). Emerging markets in Asia-Pacific and the Middle East are experiencing rapid growth in both commercial and military aviation sectors, creating a strong demand for maintenance chemicals. Additionally, advancements in materials like composite structures and additive manufacturing in aerospace require new, specialized chemicals for repair and cleaning. Companies investing in R&D for product innovation, compliance with evolving regulations, and expansion into untapped regions can capitalize on these opportunities to gain market share.

Global Aerospace Maintenance Chemical Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6821.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.36% |

| 2033 Value Projection: | USD 8613.8 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 224 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Aircraft Type, By Region |

| Companies covered:: | 3M (U.S.), Royal Dutch Shell (Netherlands), Aerochemicals (France), Arrow Solutions (England), Aviation Chemical Solutions (U.S.), Callington Haven Pty Ltd. (Australia), Eastman Chemical Company (U.S.), Exxon Mobil Corporation (U.S.), Florida Chemical Supply, Inc. (U.S.), Hansair Logistics Inc. (U.S.), Henkel AG & Co., KGaA (Germany), Nexeo Solutions (U.S.), KLX Inc. (U.S.), Krayden, Inc.(U.S.), and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aerospace Maintenance Chemical Market Dynamics

Increase in the number of air travelers worldwide

The rise in the number of air travelers globally is a significant driver for the aerospace maintenance chemical market. As air travel demand grows, particularly in regions like Asia-Pacific, the Middle East, and Latin America, airlines are expanding their fleets and increasing flight frequencies. This surge leads to higher Maintenance, Repair, and Overhaul (MRO) activities, boosting the demand for cleaning agents, deicing fluids, and other maintenance chemicals. Additionally, the increased wear and tear on aircraft due to more frequent usage necessitates regular maintenance and servicing to ensure safety and compliance. As a result, manufacturers are focusing on providing high-performance, cost-effective, and eco-friendly chemical solutions. The expanding global air passenger traffic, especially in emerging economies, offers significant opportunities for the aerospace maintenance chemical industry to cater to growing MRO needs.

Restraints & Challenges

The aerospace maintenance chemical market faces several challenges, primarily driven by stringent environmental and safety regulations. Compliance with global standards such as REACH and EPA regulations necessitates ongoing reformulation of products, increasing production costs and time-to-market. Additionally, the demand for sustainable and non-toxic alternatives puts pressure on manufacturers to innovate while maintaining product effectiveness. Supply chain disruptions, including raw material shortages and fluctuating prices, further complicate market dynamics. The adoption of advanced materials like composites in aircraft construction also requires new, specialized chemicals, adding complexity to R&D efforts. Market competition is intensifying, with key players vying to provide efficient, eco-friendly solutions. Balancing innovation, regulatory compliance, and cost-efficiency poses a significant challenge for companies aiming to capture market share in this evolving landscape.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace Maintenance Chemical Market from 2023 to 2033. The U.S. is a key contributor, supported by a robust defense sector, significant investment in commercial aviation, and the presence of leading aerospace companies. Rising aircraft deliveries, fleet expansion, and an increase in the frequency of maintenance cycles are fueling demand for high-performance maintenance chemicals. Additionally, stringent environmental and safety regulations by agencies like the FAA and EPA push manufacturers toward developing eco-friendly and compliant products. The need for specialized chemicals for advanced materials, such as carbon composites used in modern aircraft, is also increasing, creating opportunities for product innovation and development in the region.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Countries like China, India, and Japan are witnessing a surge in fleet expansion and new aircraft deliveries, leading to heightened MRO activities and increased demand for maintenance chemicals. Additionally, the region is becoming a major hub for MRO services due to lower labor costs and strategic investments in aviation infrastructure. The growing use of new-generation aircraft with composite materials necessitates advanced chemical solutions, further fueling market growth. Moreover, rising environmental awareness is pushing manufacturers to develop sustainable and regulatory-compliant products. These factors collectively make Asia-Pacific a lucrative market with significant growth potential.

Segmentation Analysis

Insights by Aircraft Type

The commercial aircraft segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are expanding their operations to meet growing passenger demand, resulting in more frequent maintenance and repair activities. Additionally, the accelerated pace of aircraft deliveries, particularly of fuel-efficient and long-range models, has intensified the need for high-quality maintenance chemicals. Newer aircraft, built with composite materials, require specialized cleaning, degreasing, and corrosion protection solutions, further boosting market demand. Stringent safety and environmental regulations are also prompting airlines to use compliant and eco-friendly chemicals, while digitalization in MRO processes enhances chemical usage efficiency. This segment’s growth is expected to continue as the global aviation industry recovers and expands post-pandemic.

Insights by Product Type

The aircraft cleaning chemicals segment accounted for the largest market share over the forecast period 2023 to 2033. Rising air passenger traffic has heightened the focus on aircraft cleanliness, boosting demand for cleaning agents like exterior wash solutions, interior cleaners, and disinfectants. The COVID-19 pandemic further emphasized the importance of sanitation, leading to the adoption of advanced cleaning solutions that meet stringent health regulations. Additionally, newer materials used in aircraft construction, such as composites and specialty coatings, require specific cleaning formulations that are both effective and non-damaging. Manufacturers are responding with eco-friendly, non-toxic, and biodegradable products, addressing growing environmental concerns and regulatory requirements. This segment is expected to see continued growth as airlines prioritize safety and customer experience.

Recent Market Developments

- In June 2023, for the aircraft sector, Aerchem International introduced a new range of water-based lubricants. Compared to conventional lubricants made of petroleum, these lubricants are intended to be safer to use and more environmentally friendly.

Competitive Landscape

Major players in the market

- 3M (U.S.)

- Royal Dutch Shell (Netherlands)

- Aerochemicals (France)

- Arrow Solutions (England)

- Aviation Chemical Solutions (U.S.)

- Callington Haven Pty Ltd. (Australia)

- Eastman Chemical Company (U.S.)

- Exxon Mobil Corporation (U.S.)

- Florida Chemical Supply, Inc. (U.S.)

- Hansair Logistics Inc. (U.S.)

- Henkel AG & Co., KGaA (Germany)

- Nexeo Solutions (U.S.)

- KLX Inc. (U.S.)

- Krayden, Inc.(U.S.)

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace Maintenance Chemical Market, Product Type Analysis

- Aircraft Cleaning Chemicals

- Aircraft Leather Cleaners

- Aviation Paint Removers

- Aviation Paint Strippers

- Specialty Solvents

- Degreasers

- Aircraft Wash & Polish

Aerospace Maintenance Chemical Market, Aircraft Type Analysis

- Commercial Aircraft

- Single Engine Piston

- Business Aircraft

- Military Aircraft

- Helicopters

- Space

- Others

Aerospace Maintenance Chemical Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aerospace Maintenance Chemical Market?The global Aerospace Maintenance Chemical Market is expected to grow from USD 6821.5 million in 2023 to USD 8613.8 million by 2033, at a CAGR of 2.36% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aerospace Maintenance Chemical Market?Some of the key market players of the market are 3M (U.S.), Royal Dutch Shell (Netherlands), Aerochemicals (France), Arrow Solutions (England), Aviation Chemical Solutions (U.S.), Callington Haven Pty Ltd. (Australia), Eastman Chemical Company (U.S.), Exxon Mobil Corporation (U.S.), Florida Chemical Supply, Inc. (U.S.), Hansair Logistics Inc. (U.S.), Henkel AG & Co., KGaA (Germany), Nexeo Solutions (U.S.), KLX Inc. (U.S.), and Krayden, Inc.(U.S.).

-

3. Which segment holds the largest market share?The commercial aircraft segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aerospace Maintenance Chemical Market?North America dominates the Aerospace Maintenance Chemical Market and has the highest market share.

Need help to buy this report?