Global Aerospace Materials Market Size, Share, and COVID-19 Impact Analysis, By Product (Aluminum, Composites), By Application (Aerostructure, Propulsion System), By Aircraft Type (Commercial, Military), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aerospace Materials Market Insights Forecasts to 2033

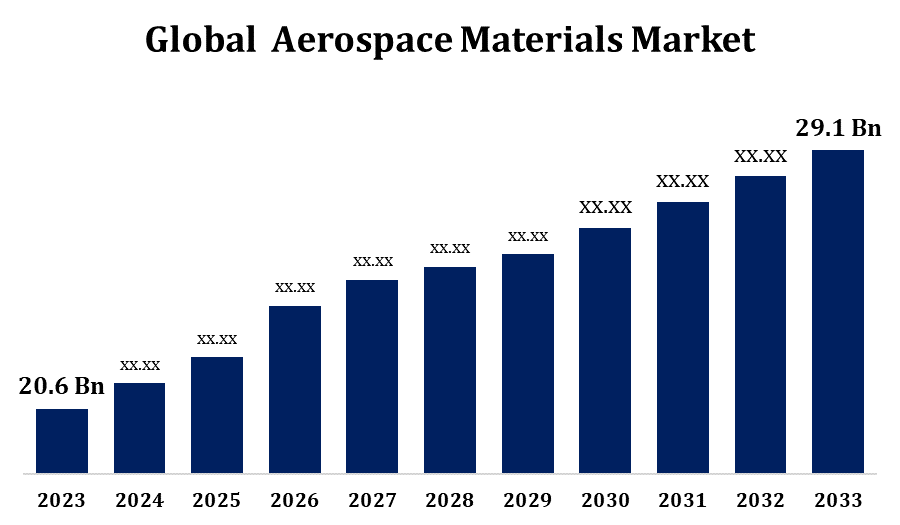

- The Aerospace Materials Market Size was valued at USD 20.6 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.51% from 2023 to 2033.

- The Worldwide Aerospace Materials Market Size is Expected to reach USD 29.1 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aerospace Materials Market Size is Expected to reach USD 29.1 Billion by 2033, at a CAGR of 3.51% during the forecast period 2023 to 2033.

The aerospace materials Market is Experiencing robust growth, driven by the rising demand for lightweight and fuel-efficient aircraft. Advanced materials, such as composites, aluminum alloys, titanium, and superalloys, are increasingly being adopted due to their high strength-to-weight ratio, corrosion resistance, and durability. The use of composites like carbon fiber reinforced polymers (CFRP) is expanding, particularly in commercial and military aircraft, to reduce weight and improve fuel efficiency. Additionally, advancements in manufacturing technologies, such as additive manufacturing and 3D printing, are enabling more complex designs and cost-effective production processes. Growing air passenger traffic and fleet expansion, especially in emerging economies, further bolster market demand. Key players are focused on R&D activities and strategic collaborations to develop innovative materials, enhancing performance and sustainability in the aerospace sector.

Aerospace Materials Market Value Chain Analysis

The aerospace materials market value chain encompasses several key stages, beginning with raw material suppliers who provide essential components like aluminum, titanium, composites, and specialty alloys. These raw materials are then processed by manufacturers into intermediate products, such as sheets, bars, and fibers, tailored to meet aerospace specifications. The next stage involves component manufacturers who use these processed materials to produce aircraft parts, including fuselages, wings, and engines. These components are then supplied to original equipment manufacturers (OEMs) like Boeing and Airbus for aircraft assembly. Supporting the value chain are distributors and logistics providers who ensure the timely supply of materials. The value chain is characterized by strong R&D collaboration among stakeholders to innovate lighter, stronger, and more sustainable materials, enhancing aircraft performance and fuel efficiency.

Aerospace Materials Market Opportunity Analysis

The aerospace materials market presents significant growth opportunities, driven by the increasing demand for next-generation aircraft focused on sustainability and fuel efficiency. The adoption of advanced materials like carbon fiber composites, titanium alloys, and ceramic matrix composites is expanding as manufacturers seek to reduce weight and enhance performance. The rise of electric and hybrid aircraft offers further opportunities for specialized materials that can withstand high electrical and thermal stresses. Additionally, advancements in additive manufacturing and nanomaterials are enabling cost-effective production and enhanced material properties, opening new avenues for innovation. Emerging markets in Asia-Pacific, the Middle East, and Latin America are witnessing increased investments in aviation infrastructure, providing lucrative opportunities for suppliers. Strategic partnerships and R&D investments are crucial for capitalizing on these trends and developing cutting-edge material solutions.

Global Aerospace Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 20.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.51% |

| 2033 Value Projection: | USD 29.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By Aircraft Type, By Region |

| Companies covered:: | Huntsman International LLC, Toray Composites America, Inc., VSMPO-AVISMA, Arconic Inc., Kobe Steel, Ltd., Allegheny Technologies, Cytec Solvay Group, Hexcel Corp., Novelis, Constellium N.V., SGL Carbon, thyssenkrupp Aerospace, Formosa Plastics Corp., Strata Manufacturing PJSC, Teijin Ltd., and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aerospace Materials Market Dynamics

Rise in the rate of replacement of aging aircraft

The rising rate of replacement of aging aircraft is significantly boosting the aerospace materials market. As airlines focus on upgrading their fleets to improve fuel efficiency, safety, and environmental compliance, there is a growing demand for advanced materials. Newer aircraft models incorporate lightweight composites, high-strength aluminum alloys, and titanium to reduce overall weight and fuel consumption, driving a shift from traditional metals. This trend is particularly strong in developed regions like North America and Europe, where stringent regulations on emissions and noise pollution are accelerating the phase-out of older aircraft. Additionally, the increase in air passenger traffic and the need for more reliable, durable aircraft are further fueling this replacement wave, creating substantial opportunities for material suppliers and manufacturers specializing in next-generation aerospace materials.

Restraints & Challenges

The aerospace materials market faces several challenges, including high production costs and complex manufacturing processes associated with advanced materials like composites and superalloys. The need for specialized equipment and skilled labor increases the cost and time required for production, which can limit adoption, especially among smaller manufacturers. Stringent regulatory standards and testing requirements for materials in aerospace applications also pose hurdles, as they demand rigorous compliance and certification, adding to development timelines. Supply chain disruptions and the fluctuating prices of raw materials, such as aluminum and titanium, further complicate market dynamics. Additionally, the high cost of R&D needed to innovate and improve material properties, such as heat resistance and strength, may act as a barrier to entry for new players, impacting overall market growth and competitiveness.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace Materials Market from 2023 to 2033. High investments in defense and space exploration, as well as a strong focus on modernizing commercial aircraft fleets, are key growth drivers in the region. The demand for lightweight materials, such as carbon fiber composites and titanium alloys, is increasing due to the emphasis on enhancing fuel efficiency and reducing emissions. Moreover, the rising rate of replacement of aging aircraft is contributing to material demand. Advancements in manufacturing technologies like additive manufacturing and partnerships between aerospace OEMs and material suppliers are further boosting innovation and expanding the market for advanced materials in North America.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region is emerging as a key player in aerospace production, with investments in new manufacturing facilities and MRO (maintenance, repair, and overhaul) centers. This has led to a surge in demand for advanced materials such as aluminum alloys, composites, and specialty metals. The development of indigenous aircraft programs, like China’s COMAC C919 and Japan’s Mitsubishi SpaceJet, is further driving the adoption of lightweight materials to enhance fuel efficiency and performance. Additionally, the region’s focus on expanding its defense and space sectors creates lucrative opportunities for aerospace material suppliers, positioning Asia-Pacific as a significant market contributor.

Segmentation Analysis

Insights by Product

The titanium segment accounted for the largest market share over the forecast period 2023 to 2033. Titanium alloys are increasingly used in critical aircraft components such as landing gears, engine parts, and airframes, reducing overall weight and enhancing fuel efficiency. The growing production of commercial aircraft, coupled with an increasing focus on replacing aging fleets, is driving demand for titanium materials. Additionally, the rise in air traffic and defense investments are contributing to increased production of advanced fighter jets and military aircraft, which extensively utilize titanium. Technological advancements in titanium processing and recycling have also made it more cost-effective, promoting wider adoption. As a result, the titanium segment is expected to continue its strong growth trajectory within the aerospace materials market.

Insights by Application

The aerostructure segment accounted for the largest market share over the forecast period 2023 to 2033. Aerostructures, which include critical components such as fuselages, wings, and empennages, require materials that provide high strength, durability, and lightweight properties. The adoption of advanced composites like carbon fiber reinforced polymers (CFRP) and high-strength aluminum and titanium alloys is rising as manufacturers seek to reduce the weight of aircraft, enhance fuel efficiency, and lower emissions. Additionally, the trend toward the use of modular aerostructures in aircraft design is boosting the demand for innovative material solutions. Growing investments in next-generation aircraft, including electric and hybrid models, are further accelerating the adoption of advanced materials in aerostructures, solidifying this segment’s market expansion.

Insights by Aircraft Type

The commercial segment accounted for the largest market share over the forecast period 2023 to 2033. Airlines are investing in lightweight materials such as composites, aluminum alloys, and titanium to enhance fuel efficiency, reduce maintenance costs, and comply with stringent emission regulations. The trend toward replacing older aircraft with newer, more fuel-efficient models is further stimulating demand for advanced materials. Additionally, the rise of low-cost carriers in emerging markets and a focus on long-haul travel are driving the need for aircraft with greater range and capacity, pushing manufacturers to adopt high-performance materials. Technological advancements in materials and production methods are enabling the development of innovative designs, supporting the continued growth of the commercial aerospace segment.

Recent Market Developments

- In December 2023, Teijin Limited announced that TenaxTM Carbon Fibre will be manufactured and sold. TenaxTM Carbon Fibre is made using residual materials from biomass products and sustainable acrylonitrile (AN) waste. The product is used in the aircraft industry among other industries.

Competitive Landscape

Major players in the market

- Huntsman International LLC

- Toray Composites America, Inc.

- VSMPO-AVISMA

- Arconic Inc.

- Kobe Steel, Ltd.

- Allegheny Technologies

- Cytec Solvay Group

- Hexcel Corp.

- Novelis

- Constellium N.V.

- SGL Carbon

- thyssenkrupp Aerospace

- Formosa Plastics Corp.

- Strata Manufacturing PJSC

- Teijin Ltd.

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace Materials Market, Product Analysis

- Aluminum

- Composites

Aerospace Materials Market, Application Analysis

- Aerostructure

- Propulsion System

Aerospace Materials Market, Aircraft Type Analysis

- Commercial

- Military

Aerospace Materials Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aerospace Materials Market?The global Aerospace Materials Market is expected to grow from USD 20.6 billion in 2023 to USD 29.1 billion by 2033, at a CAGR of 3.51% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aerospace Materials Market?Some of the key market players of the market are Huntsman International LLC; Toray Composites America, Inc.; VSMPO-AVISMA; Arconic Inc.; Kobe Steel, Ltd.; Allegheny Technologies; Cytec Solvay Group; Hexcel Corp.; Novelis; Constellium N.V.; SGL Carbon; thyssenkrupp Aerospace; Formosa Plastics Corp., U.S.A.; Strata Manufacturing PJSC; Teijin Ltd.

-

3. Which segment holds the largest market share?The commercial segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aerospace Materials Market?North America dominates the Aerospace Materials Market and has the highest market share.

Need help to buy this report?