Global Aerospace Oxygen System Market Size, Share, and COVID-19 Impact Analysis, By Mechanism (Chemical Oxygen Generator, Compressed Oxygen System), By System Type (Passenger Oxygen System, Crew Oxygen System), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aerospace Oxygen System Market Insights Forecasts to 2033

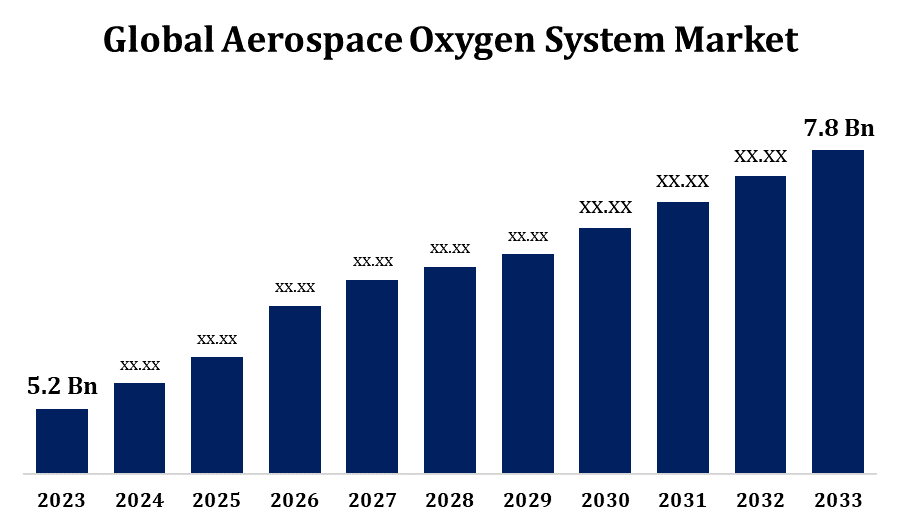

- The Aerospace Oxygen System Market was valued at USD 5.2 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.14% from 2023 to 2033.

- The Worldwide Aerospace Oxygen System Market is Expected to reach USD 7.8 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aerospace Oxygen System Market Size is Expected to reach USD 7.8 Billion by 2033, at a CAGR of 4.14% during the forecast period 2023 to 2033.

The aerospace oxygen system market is experiencing significant growth, driven by increasing air travel, technological advancements, and rising safety regulations. These systems are crucial for maintaining optimal oxygen levels for passengers and crew, especially during high-altitude flights and emergency situations. The demand is further fueled by the expanding commercial aviation sector, as well as military and defense applications. Key innovations include lightweight and more efficient oxygen systems that enhance aircraft performance while ensuring safety. Stringent regulations from aviation authorities, such as the FAA and EASA, are propelling the adoption of advanced oxygen systems. The market is also witnessing growing interest in sustainable and eco-friendly solutions. North America dominates the market, but Asia-Pacific is expected to see rapid growth due to increasing investments in the aerospace industry.

Aerospace Oxygen System Market Value Chain Analysis

The aerospace oxygen system market value chain consists of several key stages, starting with raw material suppliers who provide essential components like oxygen cylinders, masks, and regulators. These materials are then handed over to manufacturers, who design and assemble oxygen systems tailored for specific aircraft types, incorporating technologies such as chemical or compressed oxygen storage. Suppliers and OEMs (Original Equipment Manufacturers) play a crucial role in integrating these systems into aircraft. The next stage involves distribution channels, including aerospace equipment distributors and MRO (Maintenance, Repair, and Overhaul) service providers, ensuring proper system installation, maintenance, and compliance with aviation regulations. Finally, end-users such as commercial airlines, private jet operators, and military organizations utilize these oxygen systems, ensuring safety during flights. Regulatory bodies also influence the value chain by imposing safety and performance standards.

Aerospace Oxygen System Market Opportunity Analysis

The aerospace oxygen system market presents significant growth opportunities, primarily driven by the rise in global air travel, increasing aircraft production, and heightened safety regulations. Emerging markets, particularly in Asia-Pacific, are witnessing increased demand due to expanding commercial aviation and defense sectors. The growing focus on lightweight and energy-efficient oxygen systems offers opportunities for manufacturers to develop innovative, eco-friendly solutions. Furthermore, advancements in aircraft technology, such as next-generation aircraft with higher altitude capabilities, demand more sophisticated oxygen systems. The rise in private aviation and space exploration sectors also offers new avenues for market expansion. Additionally, retrofitting aging aircraft fleets with modern oxygen systems provides a lucrative opportunity for aftermarket services. Regulatory support and stringent safety standards further encourage the adoption of advanced oxygen systems, ensuring market growth.

Global Aerospace Oxygen System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 5.2 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.14% |

| 2033 Value Projection: | USD 5.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 224 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Mechanism, By System Type, By Region |

| Companies covered:: | Collins Aerospace (U.S.), Zodiac Aerospace (France), ATR (France), KONGSBERG (Norway), Technodinamika (Russia), Cobham Limited (U.K.), Adams Rite Aerospace Inc. (U.S.), East/West Industries, Inc. (U.S.), Essex Industries, Inc. (U.S.), BAE Systems. (U.K.), NetAcquire Corporation (U.S.), Aerox Aviation Oxygen Systems (U.S.), Diehl Stiftung & Co. K.G. (Germany), Precise Flight, Inc (U.S.), Aeromedix, Inc. (U.S.), and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Dynamics

Aerospace Oxygen System Market Dynamics

Rise in global air passenger traffic and expanding airline fleets

The rise in global air passenger traffic and the expansion of airline fleets are key factors driving growth in the aerospace oxygen system market. Increasing demand for air travel, especially in emerging economies like Asia-Pacific and the Middle East, has led to a surge in new aircraft orders from both commercial and private airlines. This growth boosts the need for advanced oxygen systems, essential for passenger and crew safety at high altitudes. As airline fleets expand to meet rising travel demand, the aviation industry requires more oxygen systems for both new aircraft and the retrofitting of older fleets. Additionally, the trend toward fuel-efficient, long-haul aircraft necessitates sophisticated oxygen systems designed for extended and higher-altitude flights, further propelling market demand.

Restraints & Challenges

The aerospace oxygen system market faces several challenges that could impact its growth. One key challenge is the high cost of advanced oxygen systems, which can increase overall aircraft production and operational expenses. Additionally, the complex regulatory environment, with stringent safety and certification standards from authorities like the FAA and EASA, requires manufacturers to comply with rigorous testing and approval processes, leading to extended product development cycles. The market also contends with technical challenges in designing lightweight, energy-efficient oxygen systems that can meet the needs of modern aircraft while maintaining reliability under extreme conditions. Furthermore, supply chain disruptions and fluctuations in raw material costs can affect production timelines and profitability. Finally, the maintenance and retrofitting of aging aircraft fleets with newer systems may pose logistical and cost-related difficulties for operators.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace Oxygen System Market from 2023 to 2033. The region's robust aviation industry, coupled with the high demand for advanced oxygen systems in new-generation aircraft, boosts market growth. The U.S. is the key contributor, with a strong focus on modernizing its military aircraft and expanding its commercial aviation fleet. Additionally, stringent safety regulations enforced by agencies like the FAA further encourage the adoption of innovative oxygen technologies. The region also benefits from a well-established aerospace infrastructure, strong research and development capabilities, and a growing trend toward private aviation. These factors collectively position North America as a key player in the global aerospace oxygen system market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. As regional airlines continue to place large orders for new aircraft to meet passenger demand, the need for advanced oxygen systems is growing. Additionally, governments are investing heavily in modernizing their military aviation sectors, further boosting demand for oxygen systems in defense aircraft. The region is also seeing a rise in private aviation, contributing to market expansion. Furthermore, growing safety awareness and regulatory advancements are pushing airlines to adopt more sophisticated oxygen systems. Asia-Pacific is expected to become a major growth hub for the market, with China and India leading the demand.

Segmentation Analysis

Insights by Mechanism

The Chemical Oxygen Generator segment accounted for the largest market share over the forecast period 2023 to 2033. Unlike traditional compressed oxygen systems, chemical oxygen generators are compact, lightweight, and activate instantly, making them ideal for commercial aircraft, especially in high-altitude and long-haul flights. The demand for chemical oxygen generators is also increasing due to the rising production of next-generation aircraft, which prioritize space-saving and energy-efficient technologies. Furthermore, stringent safety regulations by aviation authorities mandate the inclusion of reliable emergency oxygen systems, further driving the segment's growth. The ability to store oxygen without high-pressure tanks adds to its appeal, contributing to its rising adoption across both commercial and defense aviation sectors.

Insights by System Type

The Passenger Oxygen System segment accounted for the largest market share over the forecast period 2023 to 2033. As global passenger traffic rises, airlines are investing in advanced oxygen systems to ensure the safety and comfort of passengers during high-altitude flights. These systems are essential for maintaining adequate oxygen levels in the cabin, especially during emergencies like cabin depressurization. Innovations in design and technology have led to the development of more efficient and lightweight oxygen systems that enhance overall aircraft performance. Furthermore, regulatory mandates from aviation authorities, such as the FAA and EASA, require airlines to equip their aircraft with reliable passenger oxygen systems, further driving market demand. The growing trend towards modernizing aircraft fleets also contributes to the expansion of this segment.

Recent Market Developments

- On March 2021, Cobham Mission Systems, a prominent U.S.-based manufacturer of military aircraft oxygen systems, has secured a new contract to supply oxygen concentrator systems for the entire fleet of U.S. Navy T-45 Goshawk jet trainers. These systems play a crucial role in ensuring pilots receive optimal oxygen levels.

Competitive Landscape

Major players in the market

- Collins Aerospace (U.S.)

- Zodiac Aerospace (France)

- ATR (France)

- KONGSBERG (Norway)

- Technodinamika (Russia)

- Cobham Limited (U.K.)

- Adams Rite Aerospace Inc. (U.S.)

- East/West Industries, Inc. (U.S.)

- Essex Industries, Inc. (U.S.)

- BAE Systems. (U.K.)

- NetAcquire Corporation (U.S.)

- Aerox Aviation Oxygen Systems (U.S.)

- Diehl Stiftung & Co. K.G. (Germany)

- Precise Flight, Inc (U.S.)

- Aeromedix, Inc. (U.S.)

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace Oxygen System Market, Mechanism Analysis

- Chemical Oxygen Generator

- Compressed Oxygen System

Aerospace Oxygen System Market, System Type Analysis

- Passenger Oxygen System

- Crew Oxygen System

Aerospace Oxygen System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Aerospace Oxygen System Market?The global Aerospace Oxygen System Market is expected to grow from USD 5.2 billion in 2023 to USD 7.8 billion by 2033, at a CAGR of 4.14% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aerospace Oxygen System Market?Some of the key market players of the market are Collins Aerospace (U.S.), Zodiac Aerospace (France) ATR (France), KONGSBERG (Norway), Technodinamika (Russia), Cobham Limited (U.K.), Adams Rite Aerospace Inc. (U.S.), East/West Industries, Inc. (U.S.), Essex Industries, Inc. (U.S.), BAE Systems. (U.K.), NetAcquire Corporation (U.S.), Aerox Aviation Oxygen Systems (U.S.), Diehl Stiftung & Co. K.G. (Germany), Precise Flight, Inc (U.S.), Aeromedix, Inc. (U.S.).

-

3. Which segment holds the largest market share?The Passenger Oxygen System segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aerospace Oxygen System Market?North America dominates the Aerospace Oxygen System Market and has the highest market share.

Need help to buy this report?