Global Aerospace Riveting Equipment Market Size, Share, and COVID-19 Impact Analysis, By Equipment (Hydraulic Riveting Equipment, Pneumatic Riveting Equipment, Electric Riveting Equipment), By End Use (OEM, MRO), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Aerospace Riveting Equipment Market Insights Forecasts to 2033

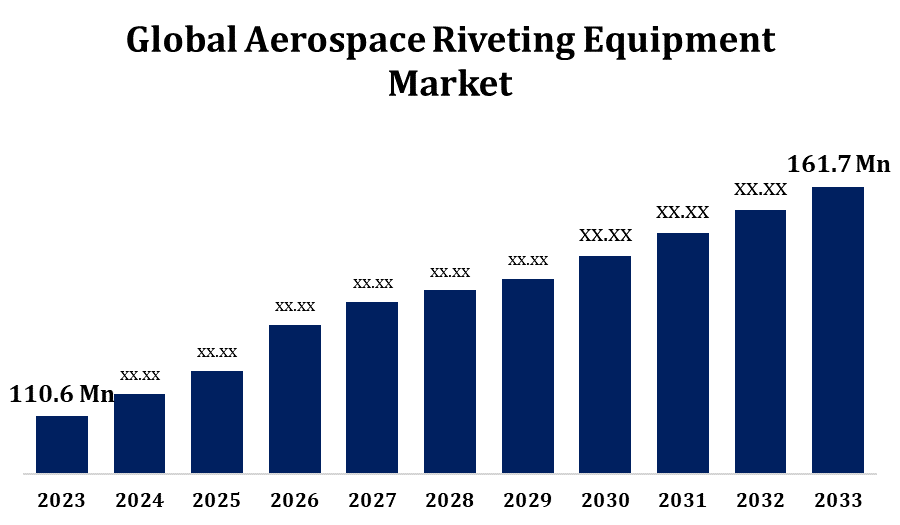

- The Aerospace Riveting Equipment Market Size Was Valued at USD 110.6 Million in 2023.

- The Market Size is Growing at a CAGR of 3.87% from 2023 to 2033.

- The Global Aerospace Riveting Equipment Market Size is expected to reach USD 161.7 Million by 2033.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Aerospace Riveting Equipment Market Size is expected to reach USD 161.7 million by 2033, at a CAGR of 3.87% during the forecast period 2023 to 2033.

The aerospace riveting equipment market is experiencing steady growth, driven by increasing demand for aircraft manufacturing and maintenance. Riveting equipment, such as pneumatic, hydraulic, and electric rivet guns, is essential in assembling and repairing aircraft structures. The market's expansion is fueled by rising air traffic, fleet modernization, and advancements in lightweight materials like composites and alloys that require precise riveting solutions. Key players are investing in automation and ergonomically designed equipment to improve efficiency and reduce operator fatigue. North America and Europe are leading markets, supported by the presence of major aircraft manufacturers and maintenance facilities. Meanwhile, Asia-Pacific is emerging as a lucrative region due to the growing aerospace sector and increased production capacity. The market is poised for sustainable growth amid technological innovations and strategic partnerships.

Aerospace Riveting Equipment Market Value Chain Analysis

The aerospace riveting equipment market's value chain encompasses several stages, from raw material procurement to end-user delivery. It begins with the sourcing of materials such as steel, aluminum, and composite components used to manufacture riveting equipment. Manufacturers, such as pneumatic, hydraulic, and electric riveting tool producers, play a critical role in designing and assembling these tools based on aerospace specifications. The equipment is then distributed through direct sales, distributors, and online platforms to aircraft manufacturers, MRO facilities, and suppliers. Integration of automation and digitization in riveting solutions has led to collaborations between tool manufacturers and software developers, enhancing the value chain's efficiency. End-users, including OEMs and MROs, drive demand, influenced by evolving industry standards, technological advancements, and the need for high precision in aerospace assembly and maintenance.

Aerospace Riveting Equipment Market Opportunity Analysis

The aerospace riveting equipment market offers significant growth opportunities due to the surge in aircraft production and rising investments in fleet modernization. With the adoption of advanced materials like composites and titanium alloys, the demand for specialized riveting solutions is increasing. Automation is a key opportunity, as automated riveting systems improve precision and reduce production time, making them highly sought after by manufacturers. Emerging markets in Asia-Pacific and the Middle East are also creating new avenues for growth, driven by increasing air travel and the establishment of new maintenance, repair, and overhaul (MRO) facilities. Furthermore, advancements in electric and battery-operated rivet guns are enhancing the appeal of lightweight, portable equipment. These factors, combined with ongoing innovations, are expected to create lucrative opportunities for market players in the coming years.

Global Aerospace Riveting Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 110.6 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.87% |

| 2033 Value Projection: | USD 161.7 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Equipment, By End Use, By Region |

| Companies covered:: | GESIPA Aerospace, Henrob, Huck Aerospace, Lockheed Martin, Northrop Grumman, Parker Hannifin Aerospace, POP Aviation & Industrial, PSM Aerospace, and STANLEY Engineered Fastening (SENCO) |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Aerospace Riveting Equipment Market Dynamics

Growing Need for Maintenance and Retrofitting

The aerospace riveting equipment market is experiencing increased demand for retrofitting and maintenance services due to the aging fleet of aircraft and the need to extend their operational life. Many airlines are investing in retrofitting existing aircraft to comply with evolving safety regulations, improve fuel efficiency, and upgrade interiors for better passenger comfort. Additionally, advancements in riveting technologies, such as automated and precision systems, are prompting airlines and MRO providers to retrofit older equipment to maintain competitiveness and operational efficiency. Regular maintenance and the need to replace worn-out riveting tools are also contributing to market growth, as these activities are critical to ensuring structural integrity and safety standards. Consequently, the retrofitting and maintenance segment is becoming a significant driver in the aerospace riveting equipment market’s expansion.

Restraints & Challenges

The aerospace riveting equipment market faces several challenges that impact its growth. High initial costs and complex installation processes for advanced riveting systems make it difficult for small and medium-sized enterprises (SMEs) to invest, limiting market penetration. Additionally, the demand for high-precision riveting equipment, essential for modern aircraft manufacturing, requires continuous technological upgrades, leading to increased R&D expenses for manufacturers. The shortage of skilled labor is another concern, as the operation and maintenance of these sophisticated systems require specialized expertise. Furthermore, fluctuations in the aerospace sector—due to economic uncertainties, geopolitical tensions, and fluctuating demand for new aircraft—affect the procurement and adoption of new equipment. Lastly, stringent regulations and compliance standards pose challenges for manufacturers to ensure that new systems meet the evolving safety and environmental norms.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Aerospace Riveting Equipment Market from 2023 to 2033. The region’s strong aerospace industry is supported by a well-established supply chain and robust investments in research and development, fostering innovation in riveting technologies. Additionally, the growing need for fleet modernization, retrofitting of older aircraft, and increasing production of commercial and military aircraft are boosting demand for advanced riveting equipment. Government initiatives and defense spending further contribute to market expansion. Moreover, the presence of skilled labor and advanced manufacturing capabilities enables faster adoption of automated and precision riveting systems. As a result, North America is expected to continue leading the global aerospace riveting equipment market in terms of technological advancements and revenue generation.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Emerging economies like China, India, and Southeast Asian countries are investing heavily in their aerospace sectors to enhance domestic production and reduce reliance on imports. Additionally, the rise of low-cost carriers and growing air passenger traffic are prompting airlines to expand their fleets, thereby fueling demand for aerospace riveting equipment. Government initiatives, such as the "Make in India" and "Made in China 2025" policies, are encouraging local manufacturing and technological advancements in aerospace production. Furthermore, collaborations between international aerospace companies and local firms are leading to the adoption of advanced riveting technologies.

Segmentation Analysis

Insights by Equipment

The hydraulic riveting equipment segment accounted for the largest market share over the forecast period 2023 to 2033. Hydraulic systems are preferred for their consistent pressure control, making them ideal for creating strong, reliable joints in critical aircraft structures. The rise in production of lightweight aircraft using composite and high-strength materials is driving demand for hydraulic riveting equipment, as these materials require specialized joining techniques. Additionally, hydraulic riveters offer greater durability and lower maintenance costs compared to pneumatic and manual alternatives. The segment’s growth is further supported by increased investments in fleet modernization and retrofitting, where hydraulic riveting tools are used extensively for structural modifications and repairs. This trend is expected to continue as aerospace manufacturers seek efficient solutions for complex assembly processes.

Insights by End Use

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. Major aircraft manufacturers are investing in state-of-the-art riveting systems to enhance production efficiency, ensure high-quality assemblies, and meet stringent safety standards. The rise in the production of commercial and military aircraft, coupled with the shift towards lightweight materials and innovative designs, necessitates advanced riveting solutions that OEMs are well-positioned to provide. Additionally, collaborations between OEMs and technology firms are fostering the development of automated riveting systems, further propelling market growth. The ongoing trend of fleet modernization and the push for environmentally sustainable practices also contribute to the increasing reliance on OEMs for efficient and innovative riveting equipment, positioning this segment for continued expansion.

Recent Market Developments

- In October 2023, the new battery-operated, semi-automatic blind rivet setter, called the GESIPA GBS 1000, is intended for medium-duty and lightweight applications. It has an easy-to-use interface, an ergonomic design, and a brushless motor.

Competitive Landscape

Major players in the market

- GESIPA Aerospace

- Henrob

- Huck Aerospace

- Lockheed Martin

- Northrop Grumman

- Parker Hannifin Aerospace

- POP Aviation & Industrial

- PSM Aerospace

- STANLEY Engineered Fastening (SENCO)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Aerospace Riveting Equipment Market, Equipment Analysis

- Hydraulic Riveting Equipment

- Pneumatic Riveting Equipment

- Electric Riveting Equipment

Aerospace Riveting Equipment Market, End Use Analysis

- OEM

- MRO

Aerospace Riveting Equipment Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Aerospace Riveting Equipment Market?The global Aerospace Riveting Equipment Market is expected to grow from USD 110.6 million in 2023 to USD 161.7 million by 2033, at a CAGR of 3.87% during the forecast period 2023-2033.

-

2. Who are the key market players of the Aerospace Riveting Equipment Market?Some of the key market players of the market are GESIPA Aerospace, Henrob, Huck Aerospace, Lockheed Martin, Northrop Grumman, Parker Hannifin Aerospace, POP Aviation & Industrial, PSM Aerospace, and STANLEY Engineered Fastening (SENCO).

-

3. Which segment holds the largest market share?The OEM segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Aerospace Riveting Equipment Market?North America dominates the Aerospace Riveting Equipment Market and has the highest market share.

Need help to buy this report?