Global Aerostructures Market Size, Share, and COVID-19 Impact Analysis, By Material (Composites, Alloys & Superalloys and Metals), By Aircraft Type (Commercial Aviation, Business & General Aviation, Military Aviation, UAVs and AAM), By End User (OEM, Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Aerospace & DefenseGlobal Aerostructures Market Insights Forecasts to 2032

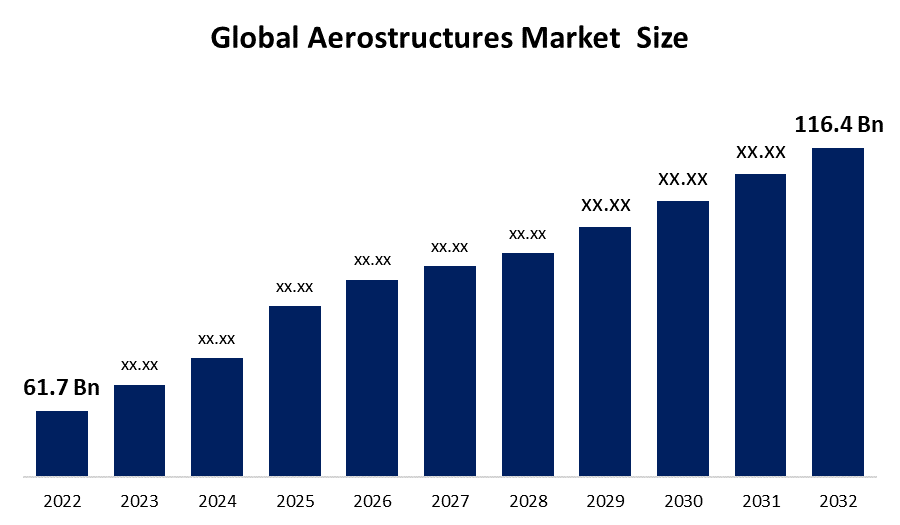

- The Global Aerostructures Market Size was valued at USD 61.7 billion in 2022.

- The Market is growing at a CAGR of 6.5% from 2022 to 2032

- The Worldwide Aerostructures Market Size is expected to reach USD 116.4 billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Aerostructures Market size is anticipated to exceed USD 116.4 billion by 2032, growing at a CAGR of 6.5% from 2022 to 2032. Factors driving the aerostructures industry include technological advancements in aerostructures, expansion of MRO services, and a decrease in the cost of composite materials.

Market Overview

Aerostructures are the structural components of an aircraft's airframe or body. Aerostructures are very useful for an aircraft to withstand aerodynamic forces during flight and thus include all of the components that assist an aircraft in flying. Aerostructures on any aircraft body include propulsion systems, flight control surfaces, wings, fuselages, and empennage. To reduce the overall weight of aerostructure manufacturing, prominent manufacturers generally prefer lightweight materials such as superalloys and composites. As the demand for composite materials in the aviation industry has increased significantly, manufacturers are turning to advanced technologies such as 3D printing and additive manufacturing to increase production capacity. One of the key factors expected to drive growth in the global aerostructures market is the increased deployment of commercial aircraft around the world. Growing passenger mobility over the last few years has resulted in a significant increase in the deployment rate of commercial aircraft, which is powerfully driving and supporting the growth of the global aerostructure market. Furthermore, problems associated with composite materials, such as material recycling, are expected to limit the global aerostructure market's growth during the forecast period.

Report Coverage

This research report categorizes the market for the global aerostructures market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the aerostructures market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the aerostructures market.

Global Aerostructures Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 61.7 Billion |

| Forecast Period: | 2022 - 2032 |

| Forecast Period CAGR 2022 - 2032 : | 6.5% |

| 2032 Value Projection: | USD 116.4 Billion |

| Historical Data for: | 2018 - 2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 131 |

| Segments covered: | By Material, By Aircraft Type, By End User, By Region |

| Companies covered:: | Airbus SE, FACC AG, Elbit System Ltd., ST Engineering, Ruag Holding AG, AAR Corporation, Bombardier Inc., Cyient Ltd., GKN plc (Redditch, Leonardo S.P.A., Saab AB, Spirit AeroSystems Holdings Inc., STELIA Aerospace Group, Triumph Group, Inc., Others |

Get more details on this report -

Driving Factors

The significant factor driving the growth of the aerostructures sector is the increase in demand for UAVs in military and commercial applications. The increased number of border conflicts and disputes between neighboring countries is driving the demand for military unmanned vehicles. As a result, the procurement of high-altitude long-endurance (HALE) and medium-altitude long-endurance (MALE) unmanned aerial vehicles (UAVs) is increasing in order to improve intelligence, surveillance, and reconnaissance (ISR) capabilities. These UAVs have a long endurance of 24 to 48 hours and fly at a higher altitude, which helps to improve military mission capabilities. Furthermore, UAVs made of composite materials outperform traditional UAVs in terms of performance.

Restraining Factors

The properties of composite materials make them an excellent choice for the development of aircraft structures. However, one disadvantage of these materials is expected to stymie market growth. Because composite material is typically used in conjunction with other materials such as foam cores, recycling it is extremely difficult. As a result, solid waste management issues are expected to arise in the coming years.

Market Segmentation

The Global Aerostructures Market share is classified into material, aircraft type, and end user.

- composites segment is expected to grow at the fastest pace in the global aerostructures market during the forecast period.

The global aerostructures market is categorized by material into composites, alloys & superalloys, and metals. Among these, the composites segment is expected to grow at the fastest pace in the global aerostructures market during the forecast period. During the forecast period, the composite material will grow at the fastest rate. The increase is due to higher acceptance of the development of aircraft components. Composite-material aircraft components provide high design flexibility, strength, durability, and low weight. These composite properties aid in improving aircraft performance and lowering the overall weight. Composite materials are used in aerostructure components such as the wings and fuselage of the Boeing 787 and the Airbus 350 XWB.

- The UAVs segment is expected to grow at the highest pace in the global aerostructures market during the forecast period.

Based on the aircraft type, the global aerostructures market is divided into commercial aviation, business & general aviation, military aviation, UAVs, and AAM. Among these, the UAVs segment is expected to grow at the highest pace in the global aerostructures market during the forecast period. The growing use of UAVs for military and commercial purposes is driving up demand for UAVs. The demand for lightweight and customized designs is also propelling the UAV segment of the aerostructures market.

- The OEM segment is expected to hold the largest share of the global aerostructures market during the forecast period.

Based on the end user, the global aerostructures market is divided into OEM and aftermarket. Among these, the OEM segment is expected to hold the largest share of the global aerostructures market during the forecast period. This is due to the growing demand for unmanned aerial vehicles (UAVs) in a variety of applications such as border surveillance, city area monitoring, medicine delivery, parcel deliveries, and others. Furthermore, the growing demand for composite products to improve airplane operation through innovative component design is expected to drive market growth.

Regional Segment Analysis of the Global Aerostructures Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global aerostructures market over the predicted timeframe.

Get more details on this report -

North America is projected to hold the largest share of the global aerostructures market over the predicted years. This is due to the growing business and commercial aviation industry in the region with the highest global demand for aerospace and defense aircraft. Furthermore, the rapid adoption of advanced manufacturing technologies and significant investment in R&D activities are expected to drive market growth. The presence of several key market participants, including Bombardier Inc., Triumph Group, Inc., and Spirit Aerosystems, Inc., will further favor market growth.

Asia Pacific is expected to grow at the fastest pace in the global aerostructures market during the forecast period. The increased emphasis on developing aircraft manufacturing facilities in the region can be attributed to the growth. The market is being fueled further by supportive government initiatives and an increased defense budget. The region's increased commercial and military aircraft development and procurement programs are expected to drive market growth. For example, the Boeing Company established the first 737 aircraft manufacturing plant in China in December 2018 as part of a joint venture with the Commercial Aircraft Corporation of China. The Boeing Company invested approximately USD 33 million to acquire a significant stake in the joint venture.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global aerostructures along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Airbus SE

- FACC AG

- Elbit System Ltd.

- ST Engineering

- Ruag Holding AG

- AAR Corporation

- Bombardier Inc.

- Cyient Ltd.

- GKN plc (Redditch

- Leonardo S.P.A.

- Saab AB

- Spirit AeroSystems Holdings Inc.

- STELIA Aerospace Group

- Triumph Group, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Spirit AeroSystems Inc. and Joramco have agreed to become Spirit-authorized MRO centres. They will first provide nacelle services to selected players and their products under this agreement.

- In December 2022, Airbus SE has announced the extension of its contract with Axiscades Technologies Ltd. for engineering services for Airbus aircraft programmes. At various locations, the contract will provide engineering services and product development for fuselage and wings.

- In September 2022, Spirit AeroSystems Inc. has been offered a contract by The Boeing Company to supply horizontal stabilizers for the US Air Force's KC-135R Stratotankers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Aerostructures Market based on the below-mentioned segments:

Global Aerostructures Market, By Material

- Composites

- Alloys & Superalloys

- Metals

Global Aerostructures Market, By Aircraft Type

- Commercial Aviation

- Business & General Aviation

- Military Aviation

- UAVs

- AAM

Global Aerostructures Market, By End User

- OEM

- Aftermarket

Global Aerostructures Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?