Global Agricultural Adjuvants Market Size, Share, and COVID-19 Impact Analysis By Type (Activator Modifiers and Utility Modifiers), By Application (Herbicides, Insecticides, Fungicides and Others), By Crop (Cereal & Grains, Oilseeds & Pulses, Fruits & Vegetables and Others) and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Analysis and Forecast 2021 - 2030

Industry: Advanced MaterialsGlobal Agricultural Adjuvants Market Size Insights Forecasts to 2030

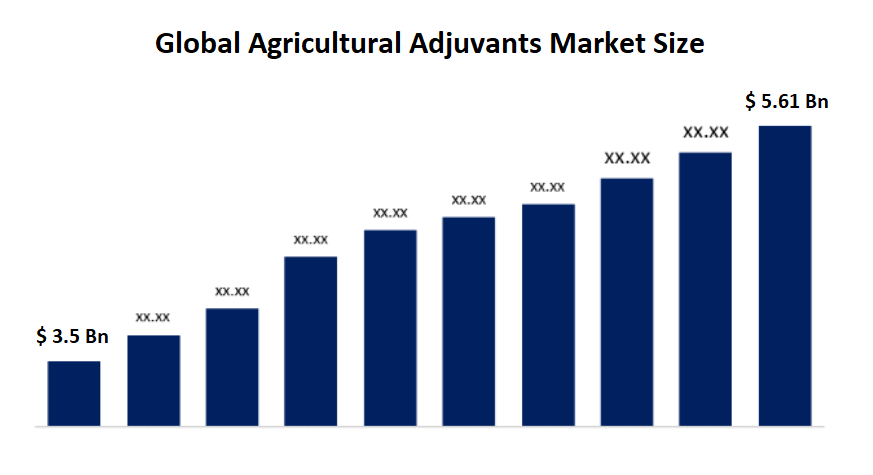

- The Global Agricultural Adjuvants Market Size was valued at USD 3.5 Billion in 2021.

- The Market is growing at a CAGR of 5.4% from 2022 to 2030

- The Global Agricultural Adjuvants Market Size is expected to reach USD 5.61 Billion by 2030

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The global Agricultural Adjuvants Market is expected to reach USD 5.61 Billion by 2030, at a CAGR of 5.4% during the forecast period 2022 to 2030. The rising need for efficient insecticides throughout the world is expected to drive market expansion. The market for agricultural adjuvants is also being driven by an increase in pesticide usage in agriculture to boost crop productivity and yield. Adjuvants come in numerous forms and are used with pesticides for a variety of objectives, such as improving pesticide penetration, wetting, and retention.

Market Overview

To increase the potency of the pesticide, insecticide, or herbicide and to improve the crop protection product's overall performance, adjuvants are added. Drift control, stickers, wetting agents, water conditioners, and penetrants are a few examples of these additives. A significant driver of the agricultural adjuvants industry is the rising need for food and drink due to the world's expanding population. Farmers are concentrating on boosting the output and yield of the crops by applying appropriate pesticides, which are driving the market, to fulfil the present demand for food. Adjuvants may undergo numerous chemical processes during manufacture that generate harmful fumes and trash since they are composed of chemicals and petrochemicals. While adjuvants might be helpful for the crop, they can also have negative consequences when consumed. By mapping and monitoring the toxicity emission within allowable limits, various regulatory bodies, including Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) and the Environmental Protection Agency (EPA), among others, handle them. The primary market restraints are regulations on agricultural adjuvants by various agencies in various countries. There are growing worries about how these herbicides will affect species that are not their intended targets as a result of the excessive usage of adjuvants. Most spray adjuvants are spread across the entire agricultural field in addition to the target plants. Regulations restrict their usage since each application (fungicides, insecticides, and herbicides) when coupled with the adjuvant causes environmental issues. Each of the several applications adds to air pollution since the spray adjuvants used on the crop are carried by the winds into the surrounding areas. Pesticide usage that is too high endangers the environment and slows market expansion. According to the environmental impact method, green adjuvants have little influence on people and the environment when employed with crop protection agents. The active compounds in crop protection chemicals are made more efficient and humane by the green adjuvants. The conscious decision of consumers to buy organic products has significantly increased the need for green adjuvants. Due to the high personal income and subsequent growth in urban residents' affordability, emphasis is now put on the product's nutritional content. Growing public awareness of this has led to an increase in demand for organic food items. The increase in demand for green adjuvants in the market for agricultural adjuvants is directly impacted by Green Adjuvants.

Global Agricultural Adjuvants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 3.5 Billion |

| Forecast Period: | 2022-2030 |

| Forecast Period CAGR 2022-2030 : | 5.4 % |

| 2030 Value Projection: | USD 5.61 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 133 |

| Segments covered: | By Type, By Corp, By region |

| Companies covered:: | Clariant AG, Solvay, Corteva Agriscience, The Dow Chemical Company, Huntsman International LLC., Evonik Industries AG, Ingevity, Nufarm Limited, Croda International PLC, BASF SE, Miller Chemical & Fertilizer, LLC., Helena Chemical Company, WinField United, Wilbur-Ellis Company LLC, and Stepan Company. |

| Growth Drivers: | A significant driver of the agricultural adjuvants industry is the rising need for food and drink due to the worlds expanding population. |

| Pitfalls & Challenges: | Covid-19 Impact Analysis |

Get more details on this report -

Report Coverage

This research report categorizes the Market for global Agricultural Adjuvants based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Global Agricultural Adjuvants Market. Recent Market developments and competitive strategies such as expansion, Product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the Market. The report strategically identifies and profiles the key Market players and analyses their core competencies in each global Agricultural Adjuvants Market sub-segments.

Segmentation Analysis

- In 2021, the Activator Modifiers segment accounted for the largest share of the Market, with 59.2% and a Market revenue of 2.07 Billion.

Based on the Type, the Agricultural Adjuvants Market is categorized into Activator Modifiers and Utility Modifiers. In 2021, the Activator Modifiers segment accounted for the largest share of the Market, with 35.2% and a Market revenue of 2.07 Billion. Throughout the forecast period, the Activator Modifiers segment is anticipated to maintain its leading position because they are widely used in agrochemicals since they are easily accessible and inexpensive when compared to utility adjuvants. Surfactants (non-ionic, cationic, and anionic), as well as oil carriers, are activator adjuvants. The most often suggested adjuvants for herbicides, particularly for systemic and water-soluble herbicides, are surfactants.

- In 2021, the Herbicides segment accounted for the largest share of the Market, with 32.6% and a Market revenue of 1.14 Billion.

Based on the application, the Agricultural Adjuvants Market is categorized into Herbicides, Insecticides, Fungicides and Others. In 2021, the Herbicides segment accounted for the largest share of the Market, with 32.6% and a Market revenue of 1.14 Billion. Throughout the forecast period, the Herbicides segment is anticipated to maintain its leading position while expanding at the fastest CAGR because Herbicides are substances that are used to control unwelcome plants. Herbicides are most frequently used before or during planting of fruits, vegetables, oilseeds, and row crops to boost crop yield by decreasing other vegetation. The farmers utilise a variety of herbicides in addition to glyphosate, 2,4-D, atrazine, dicamba, cyanazine, and trifluralin. By using a selective herbicide, you may stop the growth of a specific weed while protecting the health of the surrounding plants. The market for agricultural adjuvants will be driven by the anticipated increase in herbicide usage.

- In 2021, the Cereal & Grains segment accounted for the largest share of the Market, with 30.6% and a Market revenue of 1.07 Billion.

Based on the crop, the Agricultural Adjuvants Market is categorized into Cereal & Grains, Oilseeds & Pulses, Fruits & Vegetables and Others. In 2021, the Cereal & Grains segment accounted for the largest share of the Market, with 30.6% and a Market revenue of 1.07 Billion. Throughout the forecast period, the Cereal & Grains segment is anticipated to maintain its leading position while expanding at the fastest CAGR because the greatest crop consumed worldwide is cereal and grain, mostly in Asia and the Pacific. The need for agricultural adjuvants is being driven by the rising consumption of cereal and grains including rice, wheat, rye, corn, oats, sorghum, and barley in several other places. For cereals and grains, non-ionic surfactants and agrochemicals are often advised.

Regional Segment Analysis of the Agricultural Adjuvants Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Get more details on this report -

Asia Pacific emerged as the largest Market for the global Agricultural Adjuvants Market, with a Market share of around 32.9% and 1.15 Billion of the Market revenue in 2021.

- Asia Pacific emerged as the largest Market for the global Agricultural Adjuvants Market, with a Market share of around 32.9% and 1.15 Billion of the Market revenue in 2021. The demand for Agricultural Adjuvants is being driven by the rising acceptance by the market. The market for Agricultural Adjuvants was dominated by the Asia Pacific region mostly due to a number of variables, including an increase in the population, a need for better crop types, and the existence of nations with large arable landmasses. The agriculture industry has a significant impact on the region's per capita income. The overall amount of arable land in the area is decreasing as a result of urbanisation and industrialisation. As a result, farmers use agrochemicals that aid in boosting productivity and production. India, China, and Japan are the main contributors to the expansion of the regional market.

- North America Market is expected to grow at the fastest CAGR between 2021 and 2030, This expansion can be ascribed to elements like the U.S. and Canada's increased emphasis on agricultural activity. The adoption of innovative farming practises like precision farming is anticipated to raise demand for agrochemicals in the area and for agricultural adjuvants.

Competitive Landscape

The report offers the appropriate analysis of the key organizations/companies involved within the global Agricultural Adjuvants Market along with a comparative evaluation primarily based on their Product offering, business overviews, geographic presence, enterprise strategies, segment Market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including Product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the Market.

List of Key Market Players:

- Clariant AG

- Solvay

- Corteva Agriscience

- The Dow Chemical Company

- Huntsman International LLC.

- Evonik Industries AG

- Ingevity

- Nufarm Limited

- Croda International PLC

- BASF SE

- Miller Chemical & Fertilizer, LLC.

- Helena Chemical Company

- WinField United

- Wilbur-Ellis Company LLC

- Stepan Company

Key Target Audience

- Market Players

- Investors

- Applications

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Some of the Key Developments:

- In March 2020, The BREAK-THRU SF 420 and BREAK-THRU SP 171 tank-mix adjuvants were introduced by Evonik Industries AG.

- In March 2020, A novel non-ionic surfactant called EMBRECE-EA was introduced by Wilbur-Ellis Holdings Inc. to improve the efficacy of fungicides, insecticides, and miticides by enhancing the wetting and spreading of spray ingredients. According to the business, EMBRECE-EA can offer a high-performance substitute for adjuvants that contain organosilicon in situations where there are worries about phytotoxicity, spray mix run-off, and beneficial insect toxicity.

Market Segment

This study forecasts global, regional, and country revenue from 2019 to 2030. Spherical Insights has segmented the global Agricultural Adjuvants Market based on the below-mentioned segments:

Global Agricultural Adjuvants Market, By Type

- Activator Modifiers

- Utility Modifiers

Global Agricultural Adjuvants Market, By Application

- Herbicides

- Insecticides

- Fungicides

- Others

Global Agricultural Adjuvants Market, By Crop

- Cereal & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Global Agricultural Adjuvants Market, Regional Analysis

North America

- US

- Canada

- Mexico

Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

South America

- Brazil

- Argentina

- Rest of South America

Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Agricultural Adjuvants market?As per Spherical Insights, the size of the Agricultural Adjuvants market was valued at USD 3.5 billion in 2022 to USD 5.61 billion by 2030.

-

What is the market growth rate of the Agricultural Adjuvants market?The Agricultural Adjuvants market is growing at a CAGR of 5.4% from 2022 to 2030.

-

Which country dominates the Agricultural Adjuvants market?Asia Pacific emerged as the largest market for Agricultural Adjuvants.

-

Who are the key players in the Agricultural Adjuvants market?Key players in the Agricultural Adjuvants market are Clariant AG, Solvay, Corteva Agriscience, The Dow Chemical Company, Huntsman International LLC., Evonik Industries AG, Ingevity, Nufarm Limited, Croda International PLC, BASF SE, Miller Chemical & Fertilizer, LLC., Helena Chemical Company, WinField United, Wilbur-Ellis Company LLC, and Stepan Company.

-

Which factor drives the growth of the Agricultural Adjuvants market?Growing Need to Reduce Pesticide Waste is expected to drives the market's growth over the forecast period.

Need help to buy this report?