Global Agricultural Chelates Market Size, Share, and COVID-19 Impact Analysis, By Type (EDTA, EDDHA, DTPA, and IDHA), By Crop Type (Cereal & Grains, Fruit & Vegetables, Oilseeds & Pulses, and Others), By Application (Soil, Seed Dressing, Foliar Sprays, and Fertigation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: AgricultureGlobal Agricultural Chelates Market Insights Forecasts to 2033

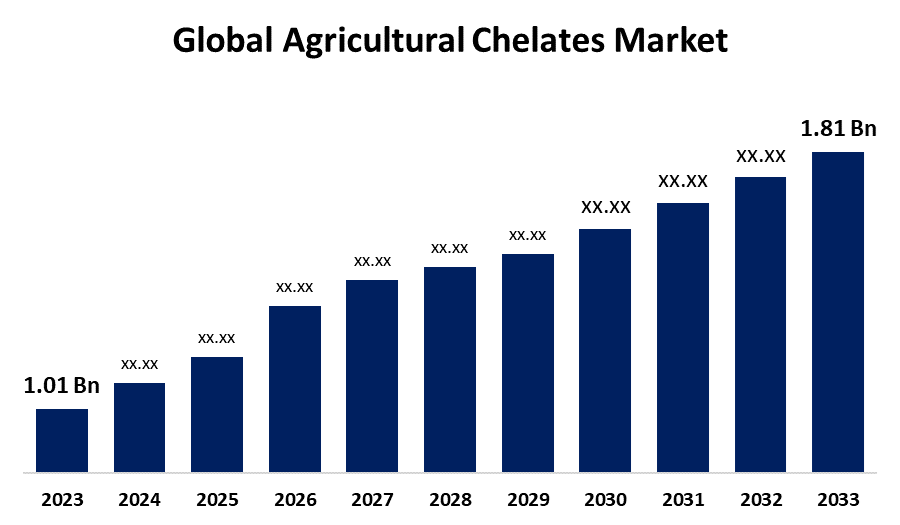

- The Global Agricultural Chelates Market Size was Valued at USD 1.01 Billion in 2023

- The Market Size is Growing at a CAGR of 6.01% from 2023 to 2033

- The Worldwide Agricultural Chelates Market Size is Expected to Reach USD 1.81 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Agricultural Chelates Market Size is Anticipated to Exceed USD 1.81 Billion by 2033, Growing at a CAGR of 6.01% from 2023 to 2033.

Market Overview

Agricultural chelates are chemical compounds that improve plant availability and absorption of critical minerals. These chemicals form stable, water-soluble complexes with metal ions, preventing them from leaving insoluble residues in the soil and making them more available for plant absorption. Agricultural chelates are critical for avoiding and treating nutritional shortages in crops, which can have a significant impact on crop productivity and quality. Furthermore, as organic molecules, chelates are easily absorbed by plant roots and foliage. They help to remove the positive charge from micronutrients, allowing neutral or slightly negatively charged chelates to pass more quickly through the capillaries on the leaf and root surfaces. They are also used in a variety of crops, including maize, bush beans, cucumbers, and citrus groves, due to their ease of transmission throughout the plant. This, together with increased demand for high-value goods, promotes the growth of the agricultural chelates industry. The rising occurrence of nutrient deficiencies in soils, combined with the requirement for environmentally acceptable agricultural approaches, increases the demand for chelates even further. Furthermore, as precision farming gains traction, the demand for chelates as a precise and targeted nutrient delivery alternative increases, contributing to the overall growth of the agricultural chelates business.

Report Coverage

This research report categorizes the market for the global agricultural chelates market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global agricultural chelates market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global agricultural chelates market.

Global Agricultural Chelates Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.01 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.01% |

| 2033 Value Projection: | USD 1.81 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 249 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Crop Type, By Application and By Region |

| Companies covered:: | BASF SE, Nouryon, The Dow Chemical Company, Yara International, ICL, Haifa Chemicals Ltd, Syngenta, Nufarm Ltd, Aries Agro Ltd, The Andersons Inc., ATP Nutrition, Manvert, BMS-Micronutrients NV, Wilbur-Ellis Company, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

As the world's population grows, so does the demand for better and more effective agriculture, which increases the need for agricultural chelates to boost nutrient uptake by plants. To improve soil quality and ensure optimal plant growth, chelates must be employed to combat widespread soil deterioration and nutrient depletion. Using modern agricultural practices, such as precision agriculture, promotes the usage of chelates, ensuring effective crop management and targeted nutrient delivery. The increasing demand for organic products encourages the use of eco-friendly and biodegradable chelates in organic farming operations. The use of agricultural chelates is supported by legislation and subsidies that promote environmentally friendly farming and environmental preservation. Ongoing research and development lead to the creation of more specific and effective chelate products, broadening their range of uses and improving market penetration. The rising use of precision farming and greenhouse farming is driving global market expansion. Furthermore, continuous research & development, as well as the launch of more efficient organic fertilizers, are projected to help drive market expansion in the future.

Restraining Factors

Soil and crop damage caused by the bioaccumulation of non-biodegradable chelates, as well as the increased use of organic fertilizers, are going to harm market revenue growth. Furthermore, farmers' lack of understanding of the need to supplement agricultural chelates is predicted to have an impact on global market growth. The cost of chelate products is greater than that of ordinary fertilizers, which may limit their uptake, particularly among small farmers.

Market Segmentation

The global agricultural chelates market share is classified into type, crop type, and application.

- The EDTA segment is expected to dominate the global agricultural chelates market during the forecast period.

Based on the type, the global agricultural chelates market is divided into EDTA, EDDHA, DTPA, and IDHA. Among these, the EDTA segment is expected to dominate the global agricultural chelates market during the forecast period. Its exceptional stability, efficacy, and economic value. Due to they form extremely stable complexes with micronutrients, such as EDTA (ethylenediaminetetraacetic acid) and DTPA (diethylenetriaminepentaacetic acid), synthetic chelates are widely used in agriculture to ensure plant availability even in difficult soil conditions. The synthetic chelate synthesis process also allows for large-scale production, which helps to satisfy expanding agricultural demand efficiently.

- The cereal & grains segment is expected to dominate the global agricultural chelates market during the forecast period.

Based on the crop type, the global agricultural chelates market is divided into cereal & grains, fruit & vegetables, oilseeds & pulses, and others. Among these, the cereal & grains segment is expected to dominate the global agricultural chelates market during the forecast period. For optimal growth and production effectively, these crops require a balanced supply of micronutrients such as zinc, iron, manganese, and copper. Chelated micronutrients ensure that these crops receive the necessary elements needed for maximum growth and output since they are more efficient and accessible to plants than traditional versions.

- The foliar sprays segment is expected to hold the largest share of the global agricultural chelates market over the predicted timeframe.

Based on the application, the global agricultural chelates market is divided into soil, seed dressing, foliar sprays, and fertigation. Among these, the foliar sprays segment is expected to hold the largest share of the global agricultural chelates market over the predicted timeframe. Foliar spraying is an agricultural practice that involves the application of water and agricultural chelates using spray pumps, tractor-mounted sprayers, drones, and aircraft. This approach offers the ability to maximize output, limit nutrient losses, and reduce environmental contamination.

Regional Segment Analysis of the Global Agricultural Chelates Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe is anticipated to hold the largest share of the global agricultural chelates market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the global agricultural chelates market over the predicted timeframe. In countries such as Spain and the Netherlands, there has been an increase in area under protected cultivation, including greenhouses, due to the increasing demand from other European countries. Many ranges of crops, such as cereals, pulses, fruits, oilseeds, and cash crops, witness export demands in these countries. Soil type varies from region to region and the crop growth is highly dependent on that. Due to the deficiency of micronutrients reported in soils across Europe, the agricultural chelates market is projected to witness a high scope of growth. Throughout Europe, the use of precision agricultural techniques has increased. These techniques include soil testing, remote sensing, and variable-rate nutrient application. Chelation-enhanced micronutrients optimize the dispersion of nutrients. To address zinc shortages in wheat, Germany employs chelated zinc in conjunction with precise nutrient control. In Europe, fruits, vegetables, grains, and specialty crops are grown. Chelated micronutrients tailor nutrition solutions for each crop. Italian tomato growers use chelated iron to prevent iron deficiency chlorosis in calcareous soils. Europe also has stringent environmental legislation and ambitious sustainability goals. Chelation-based micronutrients are used in environmentally friendly nutrient management. To reduce the amount of nutrients that run off into waterways, the Netherlands urges farmers to use chelated micronutrients.

Asia Pacific is expected to grow at the fastest pace in the global agricultural chelates market during the forecast period. The Asia-Pacific area is the largest market for agricultural chelates, with China, India, and Japan leading the way. China is the world's most populous country, with one of the most extensive agricultural systems. Farmers are motivated to plant crops with high yields due to the rapid growth of the population and the growing demand for food. This boosts the country's demand for agricultural chelates. The continuous need for high-quality crop and food products, rapidly growing population, fast urbanization, government assistance, and widespread implementation of precision irrigation techniques and other modern technologies are among the primary drivers driving Asia Pacific market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global agricultural chelates market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Nouryon

- The Dow Chemical Company

- Yara International

- ICL

- Haifa Chemicals Ltd

- Syngenta

- Nufarm Ltd

- Aries Agro Ltd

- The Andersons Inc.

- ATP Nutrition

- Manvert

- BMS-Micronutrients NV

- Wilbur-Ellis Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, Andersons, Inc. delighted to announced that it has received ResponsibleAg certification for its Plant Nutrient facility located near Sergeant Bluff, Iowa. The only program in the country that offers a voluntary, thorough evaluation of agricultural facilities that handle and store input supplies.

- In March 2023, Syngenta Crop Protection has partnered with Aphea. Bio to offer breakthrough agricultural technology to European markets. The collaboration aims to accelerate the deployment of a unique biological seed treatment solution across various European nations within the next five years, subject to regulatory approval.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global agricultural chelates market based on the below-mentioned segments:

Global Agricultural Chelates Market, By Type

- EDTA

- EDDHA

- DTPA

- IDHA

Global Agricultural Chelates Market, By Crop Type

- Cereal & Grains

- Fruit & Vegetables

- Oilseeds & Pulses

- Others

Global Agricultural Chelates Market, By Application

- Soil

- Seed Dressing

- Foliar Sprays

- Fertigation

Global Agricultural Chelates Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?