Global Agricultural Enzymes Market Size, Share, and COVID-19 Impact Analysis, By Product (Phosphatases, Sulfatases, and Dehydrogenases), By Crop Type (Cereals & Grains, Fruits & Vegetables, Turf & Ornamentals, Oilseeds & Pulses, and Others), By Functionality (Plant Growth Regulation, Crop Protection, and Fertility products), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: AgricultureGlobal Agricultural Enzymes Market Insights Forecasts to 2033

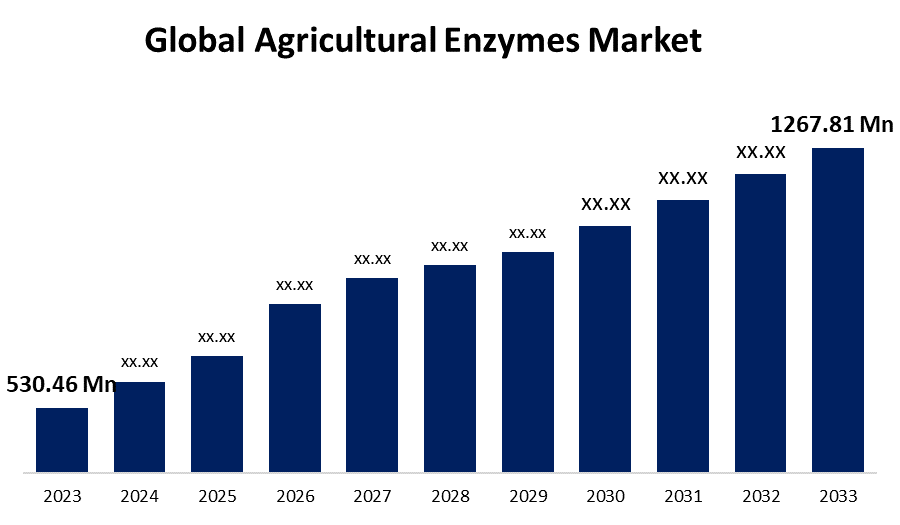

- The Global Agricultural Enzymes Market Size was Valued at USD 530.46 Million in 2023

- The Market Size is Growing at a CAGR of 9.1% from 2023 to 2033

- The Worldwide Agricultural Enzymes Market Size is Expected to Reach USD 1267.81 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Agricultural Enzymes Market Size is Anticipated to Exceed USD 1267.81 Million by 2033, Growing at a CAGR of 9.1% from 2023 to 2033.

Market Overview

Bioactive proteins known as agricultural enzymes contribute to increased crop yields, fertile soil, and safe food storage. They also shield the crops from a variety of diseases and pests. Through the ideal and advantageous balance of the biological, chemical, and physical components of soil, enzymatic activity aids in the maintenance of soil health. Crops that develop in healthy soil receive nutrients and can flourish under challenging circumstances. The quality of cash crops such as oilseeds, pulses, cereals, grains, and even fruits and vegetables has significantly increased as a result of the application of enzymes and a microbial complex. Due to the rising demand for organic food worldwide and growing knowledge of the negative effects of pesticides, there is a greater need than ever for agricultural enzymes. Food that is safe, controlled, certified, and of the highest quality can be produced owing to the utilization of enzymes in organic farming. They thereby preserve a robust ecosystem and provide important advantages for the environment and economy. In addition, a significant factor contributing to the expansion of the agricultural enzyme market is the growing public health concerns brought on by an increasing number of incidents of biochemical poisoning occurring globally. Food products are contaminated by pesticide residues due to the growing use of pesticides, which poses serious health risks to humans.

Report Coverage

This research report categorizes the market for the global agricultural enzymes market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global agricultural enzymes market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global agricultural enzymes market.

Global Agricultural Enzymes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 530.46 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.1% |

| 2033 Value Projection: | USD 1267.81 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Crop Type, By Functionality, By Region |

| Companies covered:: | Novozymes A/S, Syngenta AG, E. I. du Pont de Nemours and Company, Koninklijke DSM, Bayer AG, Aries Agro Limited, Stoller USA, Inc., Bioworks, Amano Enzyme Inc., Agrinos AS, Creative Enzymes, Enzyme Development Corporation, Greenmax Agro Tech, American Biosystems, Agrichem Bioengineering, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

A few crucial factors driving the market's growth are the rising interest in agro-biologicals, the notable growth of organic farming, and the rise in the overall output from limited arable land. When producing and preserving food, bioactive proteins known as agricultural enzymes are used in place of chemicals. They are also used to increase agricultural productivity and shield crops from a variety of pests and diseases. Furthermore, the chemicals find extensive application in biological processes related to agriculture, including silage fermentation, fiber bioprocessing, and crop and agricultural residue processing. Major companies are also investing in product development to offer the best agricultural solutions.

Restraining Factors

Production and formulation of enzymes can be costly, especially for specialized or genetically modified products. Expensive enzyme products might be the outcome of high production costs, making them unaffordable for small-scale farmers or individuals in low-income areas. A lack of proper networks for distribution and infrastructure in some areas might make it difficult to get agricultural enzyme products to consumers. Inadequate storage facilities and restricted access to rural areas might impede the distribution and accessibility of these items in agricultural markets.

Market Segmentation

The global agricultural enzymes market share is segmented into product, crop type, and functionality.

- The phosphatases segment dominates the market with the largest market share through the forecast period.

Based on the product, the global agricultural enzymes market is segmented into phosphatases, sulfatases, and dehydrogenases. Among these, the phosphatases segment dominates the market with the largest market share through the forecast period. Enzymes called phosphatase accelerate the breakdown of organic phosphates, releasing phosphate ions that are easier for plants to absorb. Since phosphorus is a necessary mineral for plant growth and development, making more of it available to plants through these products can improve nutrient uptake by plants and total crop output. Furthermore, phosphorus fertilizers are frequently used in agriculture to raise the phosphorus levels of the soil. However, a large amount of applied phosphorus could immobilize in organic forms or bond to soil particles, rendering it inaccessible to plants. The efficiency of phosphorus fertilizers can be increased and the requirement for excessive phosphorus applications can be decreased by using phosphatase enzymes to help mobilize and mineralize organic phosphorus.

- The cereals & grains segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the crop type, the global agricultural enzymes market is segmented into cereals & grains, fruits & vegetables, turf & ornamentals, oilseeds & pulses, and others. Among these, the cereals & grains segment is anticipated to grow at the fastest CAGR growth through the forecast period. By dissolving complex proteins and carbs into simpler forms that animals can ingest more easily, enzymes like proteases and amylases can improve the digestibility of cereal grains. In the production of cattle and poultry, this results in better nutrient use, higher feed conversion rates, and increased animal performance. Cereal grains can become contaminated by fungi, which can produce mycotoxins including fumonisins, ochratoxins, and aflatoxins that are harmful to both human and animal health. Products that break down fungal cell walls and prevent the production of mycotoxin, such as glucanases, cellulases, and esterases, can reduce the risk of mycotoxin contamination in grains and guarantee the safety of food and feed.

- The fertility products segment accounted for the largest revenue share through the forecast period.

Based on the functionality, the global agricultural enzymes market is segmented into plant growth regulation, crop protection, and fertility products. Among these, the fertility products segment accounted for the largest revenue share through the forecast period. Enzymes promote microbial activity, nitrogen cycling, and the breakdown of organic materials, all of which increase soil health. Sustainable agricultural methods are made possible by healthy soils with balanced microbial populations, which are better able to promote plant growth and endure environmental shocks. Agricultural enzymes increase the efficiency of nutrient use, reducing the need for artificial fertilizers. Through their ability to increase the availability of nutrients found in organic additions or the soil itself, these products can assist reduce the demand for synthetic fertilizers, which in turn lowers input costs and the environmental effects of their use.

Regional Segment Analysis of the Global Agricultural Enzymes Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global agricultural enzymes market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global agricultural enzymes market over the predicted timeframe. Numerous specialty crops, such as fruits, vegetables, nuts, and herbs, are produced in the United States and call for particular management techniques. Enzyme-based solutions address specific issues with soil fertility, nitrogen management, pest control, and post-harvest quality across a wide range of specialized crops. They provide customized solutions for various crops and production systems.

Asia Pacific is expected to grow at the fastest CAGR growth of the global agricultural enzymes market during the forecast period. To fulfill the increasing food demands of their expanding populations, many Asia Pacific nations are rapidly expanding their agricultural sectors. Agricultural enzymes are becoming more and more appealing to farmers looking to maximize yields and profitability because they provide solutions to enhance crop productivity, soil health, and resource use efficiency. The Asia Pacific area is distinguished by a wide variety of crops, temperatures, and growth environments. Enzyme-based solutions address issues with soil fertility, nutrient management, insect control, and post-harvest quality across a wide range of crops, including rice, wheat, maize, fruits, vegetables, and cash crops. They can be customized to specific crop needs and production systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global agricultural enzymes market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novozymes A/S

- Syngenta AG

- E. I. du Pont de Nemours and Company

- Koninklijke DSM

- Bayer AG

- Aries Agro Limited

- Stoller USA, Inc.

- Bioworks

- Amano Enzyme Inc.

- Agrinos AS

- Creative Enzymes

- Enzyme Development Corporation

- Greenmax Agro Tech

- American Biosystems

- Agrichem Bioengineering

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, RizoPower, a new BioActivator made from soy, corn, cotton, sugarcane, rice, and wheat for foliar application, was launched by rhizobacteria BioSolucoes, a multinational leader in bio-innovation. The company announced that RizoPower contains a great novelty for the bioactivator area: the UBP molecule, which is exclusive to the company.

- In November 2023, Together, Blue Aqua, and SCD Probiotics aim to lower the usage of antibiotics in aquaculture.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global agricultural enzymes market based on the below-mentioned segments:

Global Agricultural Enzymes Market, By Product

- Phosphatases

- Sulfatases

- Dehydrogenases

Global Agricultural Enzymes Market, By Crop Type

- Cereals & Grains

- Fruits & Vegetables

- Turf & Ornamentals

- Oilseeds & Pulses

- Others

Global Agricultural Enzymes Market, By Functionality

- Plant Growth Regulation

- Crop Protection

- Fertility products

Global Agricultural Enzymes Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Novozymes A/S, Syngenta AG (a part of ChemChina), E. I. du Pont de Nemours and Company, Koninklijke DSM N.V., Bayer AG, Aries Agro Limited, Stoller USA, Inc., Bioworks, Inc., Amano Enzyme Inc., Agrinos AS, Creative Enzymes, Enzyme Development Corporation, Greenmax Agro Tech, American Biosystems, Inc., Agrichem Bioengineering, and Others.

-

2. What is the size of the Global agricultural enzymes Market?The Global Agricultural Enzymes Market Size is Expected to Grow from USD 530.46 Million in 2023 to USD 1267.81 Million by 2033, at a CAGR of 9.1% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the Global agricultural enzymes Market over the predicted timeframe.

Need help to buy this report?