Global Agricultural Films Market Size, Share, and COVID-19 Impact, By Raw Material (LDPE, LLDPE, Reclaims), By Application (Green House, Mulching, Silage), by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Chemicals & MaterialsGlobal Agricultural Films Market Insights Forecasts to 2032

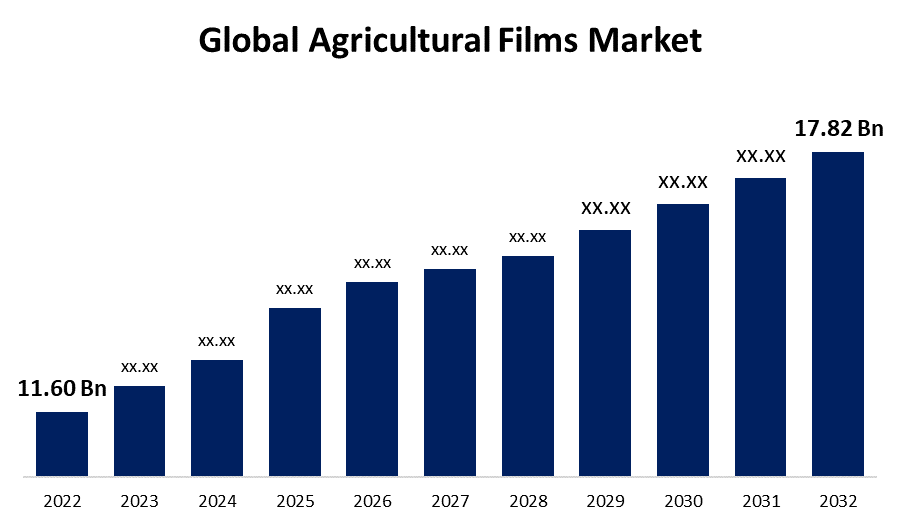

- The Agricultural Films Market Size was valued at USD 11.60 Billion in 2022.

- The Market Size is Growing at a CAGR of 7.4% from 2022 to 2032

- The Worldwide Agricultural Films Market Size is expected to reach USD 17.82 Billion by 2032

- North America is expected To Grow the fastest during the forecast period

Get more details on this report -

The Global Agricultural Films Market Size is expected to reach USD 17.82 Billion by 2032, at a CAGR of 7.4% during the forecast period 2022 to 2032.

To increase crop yield, safeguard plants, and conserve resources, agricultural films, often referred to as agricultural plastic or agriplastics, are frequently utilised in contemporary farming techniques. Mulch films, greenhouse films, silage films, and tunnel films are a few examples of the several types of these films, which are commonly produced from polyethylene (PE) or polypropylene (PP). Agricultural films provide many advantages, but their disposal might have an impact on the environment. Wildlife, water quality, and soil health can all suffer from improperly managed plastic garbage. Numerous initiatives, including as recycling programmes, biodegradable films, and enhanced collection systems, are in place to encourage responsible management.

Impact of COVID 19 On Global Agricultural Films Market

Global supply chains, including those for the creation and dissemination of agricultural films, were disrupted by the pandemic. The supply of raw materials has been impacted, which has hampered manufacturing and delivery procedures, as have lockdown procedures, international trade restrictions, and labour shortages. Certain agricultural products, particularly those used predominantly in the foodservice and hospitality industries, saw a decrease in demand as a result of the epidemic. The demand for agricultural films used in crop cultivation and protection was impacted by the decline in demand for fresh produce and other agricultural goods. Due to market uncertainty and shifting customer demand during the epidemic, some farmers were forced to rearrange their cultivation priorities and schedules. The demand for particular types of agricultural films, such as greenhouse films and mulch films, was impacted by this change in crop selection and land allocation.

Key Market Drivers

Technologies for producing agricultural films have advanced, resulting in the creation of more robust, effective, and adaptable films. For instance, the development of multi-layer films with superior barrier qualities has increased the efficiency of films in resource conservation and crop protection. Protected agriculture methods are becoming more widely used, such as high tunnel farming and greenhouse farming. These methods offer controlled growth environments, shield crops from outside influences, and boost yield and quality. The demand for agricultural films is fueled by the usage of greenhouse and tunnel films, which is a key element of protected agriculture. In developing countries, where farmers are increasingly using sophisticated farming methods to increase crop productivity and defend against unpredictably bad weather, agricultural films are becoming more and more popular. For producers and providers of agricultural film, this opens up a sizable market.

Key Market Challenges

With several producers and suppliers operating internationally, the agricultural films market is competitive. Profit margins and market share for businesses in the industry may be impacted by price volatility, shifting raw material costs, and fierce rivalry. To be competitive, businesses must constantly develop and distinguish their products. The creation, consumption, and disposal of agricultural films may be impacted by increased environmental restrictions and policies aimed at decreasing plastic waste and encouraging sustainability. For producers and consumers of agricultural films, compliance with these rules, which may include limitations on certain film types or requirements for recycling programmes, can be challenging. The expense of agricultural films can be a considerable barrier, particularly for small-scale farmers or those who work in areas with scarce financial resources. Adoption of high-quality films might be hampered by their affordability, particularly in developing agricultural economies.

Global Agricultural Films Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 11.60 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.4% |

| 2032 Value Projection: | USD 17.82 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Raw Material, By Application, by Region. |

| Companies covered:: | Berry Global Inc., KURARAY CO., LTD, Coveris, RKW Group, BASF SE, Dow, Trioplast Industrier AB, Rani Group, The Armando Alvarez, Groupe Barbier, AL-PACK Enterprises Ltd., Exxon Mobil Corporation, Novamont SpA, Britton Group Limited, PLASTIKA KRITIS, Industrial Development Company sal, ACHILLES CORPORATION, POLIFILM (GROUP), and Agriplast Tech India Private Limited |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

Raw Material Insights

LLDPE is dominating the market with the largest market share over the forecast period

On the basis of raw materials, the global agricultural films market is segmented into LDPE, LLDPE, Reclaims. Among these, LLDPE is dominating the market with the largest market share over the forecast period. The manufacture of high-quality LLDPE films with improved characteristics, such as increased puncture resistance, better tear strength, and increased light transmission, is the consequence of ongoing advancements in film manufacturing methods. These developments have helped LLDPE films gain more traction in the agriculture industry. Many governments all around the globe are putting rules into place and offering subsidies to stimulate the use of agricultural films and promote sustainable agriculture. These programmes encourage farmers to use cutting-edge farming methods and buy protective materials like LLDPE film.

Application Insights

Mulching accounted the largest market share over the forecast period

Based on the application, the global agricultural films market is segmented into Green House, Mulching, Silage. Among these, mulching accounted the largest market share over the forecast period. The benefits of mulching films are being recognised more and more by farmers and agricultural professionals. These coatings aid in lowering soil water evaporation, preventing weed growth, and raising soil warmth, which increases agricultural yields and lowers the need for pesticides and water. The demand for mulching films has also been influenced by the growing use of sustainable farming techniques. The demand for mulching films has increased as commercial agriculture has grown, particularly in areas with favourable climatic conditions. The use of mulching films has been made possible by the adoption of precision agricultural techniques, such as controlled watering and fertilisation. The optimal growth environment for crops is produced by these films in conjunction with precision farming techniques, leading to increased agricultural yields and resource efficiency.

Regional Insights

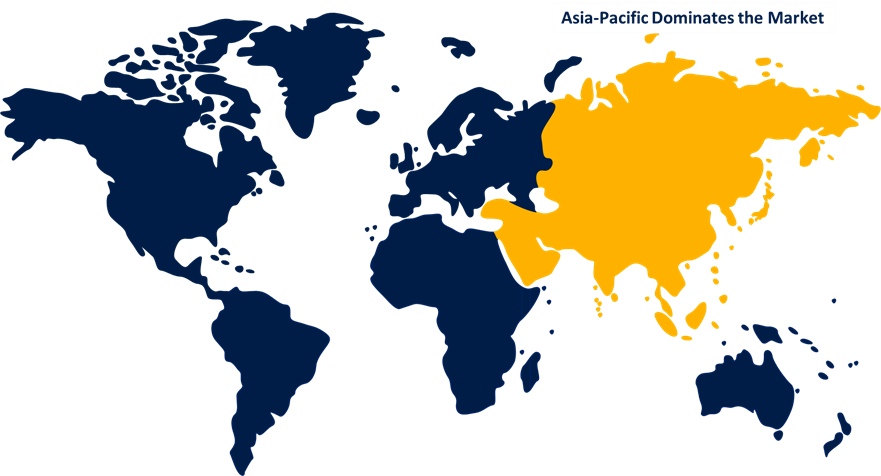

Asia Pacific holds the highest market share over the forecast period

Get more details on this report -

Among all other regions, Asia Pacific holds the highest market share over the forecast period. The production of high-quality agricultural films has been facilitated by technological improvements in the Asia-Pacific region. These films fulfil the unique needs of farmers in the area by providing superior mechanical qualities, durability, UV resistance, and light transmission. Governments in the Asia-Pacific region have been aggressively promoting the adoption of contemporary agricultural practises and technologies through subsidies and other financial incentives. These programmes frequently support the use of agricultural films to encourage resource conservation, boost crop yields, and promote sustainable farming.

North America is witnessing the fastest market growth over the forecast period. Both the agricultural infrastructure and the market for agricultural products are well-developed in North America. The region's favourable economic circumstances and consumer demands for high-quality produce foster a favourable atmosphere for the market expansion of agricultural films. Environmental sustainability is becoming more and more important in North America. Growing in popularity are agricultural films that are recyclable or biodegradable since they provide an environmentally beneficial alternative to standard films. The demand for sustainable agricultural films is driven by farmers and other agricultural practitioners who are increasingly thinking about how their practises may affect the environment.

Recent Market Developments

- In May 2023, Berry Global joined hands with CleanFarms and Poly-Ag Recycling to Spread Agricultural Films More Widely.

- In August 2021, a New seven-layer silage barrier film has been launched by RKW Agri.

List of Key Companies

- Berry Global Inc.

- KURARAY CO., LTD

- Coveris

- RKW Group

- BASF SE

- Dow

- Trioplast Industrier AB

- Rani Group

- The Armando Alvarez

- Groupe Barbier

- AL-PACK Enterprises Ltd.

- Exxon Mobil Corporation

- Novamont SpA

- Britton Group Limited

- PLASTIKA KRITIS

- Industrial Development Company sal

- ACHILLES CORPORATION

- POLIFILM (GROUP)

- Agriplast Tech India Private Limited

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Agricultural Films Market based on the below-mentioned segments:

Agricultural Films Market, Product Analysis

- Wood

- Plastics

- Overprints

- Conformal Coatings

- Others

Agricultural Films Market, Application Analysis

- Industrial Coatings

- Electronic Coatings

- Graphic Arts

Agricultural Films Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of Agricultural Films Market?The global Agricultural Films Market is expected to grow from USD 11.60 Billion in 2022 to USD 17.82 Billion by 2032, at a CAGR of 7.4% during the forecast period 2022-2032.

-

2.Who are the key market players of Agricultural Films Market?Some of the key market players of Berry Global Inc., KURARAY CO., LTD, Coveris, RKW Group, BASF SE, Dow, Trioplast Industrier AB, Rani Group, The Armando Alvarez, Groupe Barbier, AL-PACK Enterprises Ltd., Exxon Mobil Corporation, Novamont SpA, Britton Group Limited, PLASTIKA KRITIS, Industrial Development Company sal, ACHILLES CORPORATION, POLIFILM (GROUP), Agriplast Tech India Private Limited.

-

3.Which segment hold the largest market share?Mulching segment holds the largest market share is going to continue its dominance.

-

4.Which region is dominating the Agricultural Films Market?Asia Pacific is dominating the Agricultural Films Market with the highest market share.

Need help to buy this report?