Global Agricultural Insurance Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Crop-Hail Insurance, Livestock Insurance, Multi-Peril Crop Insurance (MPCL), and Others), By Distribution Channel (Insurance Companies, Banks, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: AgricultureGlobal Agricultural Insurance Market Insights Forecasts to 2033

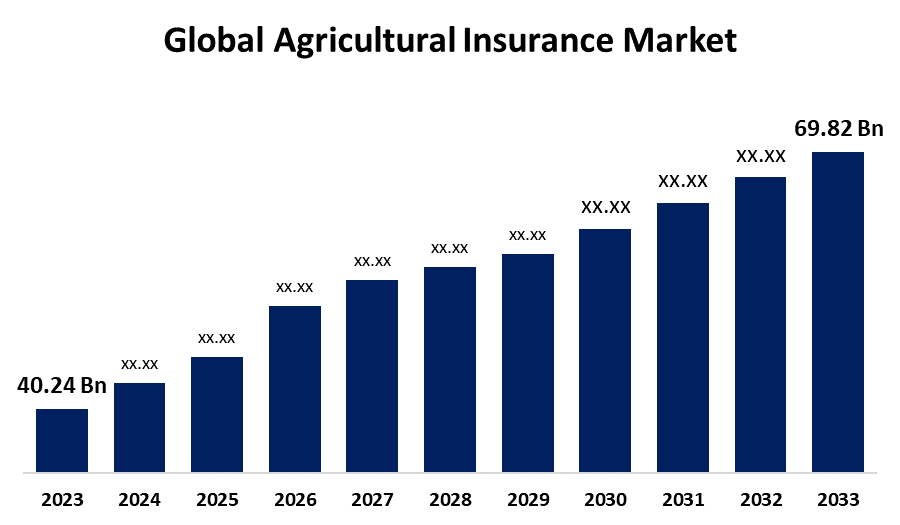

- The Global Agricultural Insurance Market Size was Valued at USD 40.24 Billion in 2023

- The Market Size is Growing at a CAGR of 5.6% from 2023 to 2033

- The Worldwide Agricultural Insurance Market Size is Expected to Reach USD 69.82 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Agricultural Insurance Market Size is Anticipated to Exceed USD 69.82 Billion by 2033, Growing at a CAGR of 5.6% from 2023 to 2033.

Market Overview

A type of insurance that protects farmers against crop-damaging weather events and other calamities is known as agricultural insurance. In addition to receiving incentives from government initiatives, insurance companies offer agricultural insurance. The insurance company selected will determine the extent of coverage. In addition to non-germination and floods, insurance frequently covers extreme rain, fire, lightning, waterspouts, high winds, cold winds, hail, drought, and frost.

For Instance, according to the Economic Survey 2023-24, With an average real insurance growth of 2.5% cent over the medium term, agriculture insurance rates are expected to increase starting in 2024. This increase is expected to be fueled by advancements in insurance infrastructure, including mobile applications and remote sensing for crop loss monitoring.

Plant diseases are becoming more common, which is causing a big demand spike for agricultural insurance and a big problem for farmers. Recent decades have seen an increase in the frequency and intensity of extreme weather events linked to climate change, which poses a serious threat to agricultural systems.

Report Coverage

This research report categorizes the market for agricultural insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the agricultural insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the agricultural insurance market.

Global Agricultural Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 40.24 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.6% |

| 2033 Value Projection: | USD 69.82 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 236 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel, By Region |

| Companies covered:: | Zurich Insurance Group, Swiss Re, XL Catlin, Munich Re, Tokio Marine Holdings, Hannover Re, Arch Capital Group, Chubb Limited, American International Group, Aon plc, QBE Insurance Group, Willis Towers Watson, Farmers Insurance Group, Allianz SE, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

There is a steady increase in the commercialization of farming and financial involvement in it. A financial instrument, such as insurance, might be considered by farmers, investors, and their banks as a way to mitigate some of the risk associated with their financial investment. In line with the trend toward commercialization, contract farming arrangements in which farms receive supplies and other services, including insurance are becoming increasingly common. In conclusion, there is a movement in farming to formalize risk management, and one clear tool that might be used for this purpose is insurance. Facilitating trade is one of the top concerns for governments when formulating policies. Agriculture exports are significant for the majority of developing nations, so complying with WTO rules is essential. The World Trade Organization (WTO) has approved crop insurance premium subsidies. The need for crop insurance information from governments has increased, according to the commercial insurance industry. It is evident from the nature of these inquiries that knowledge of this apparent channel for approved support to the farming community serves as their catalyst.

Restraining Factors

Due to crop insurance plans being expensive, it is anticipated that demand for these products will be limited. The inability of farm owners to pay crop insurance payments due to low farm area earnings might limit the uptake of the service. Since their farm owners or crop producers cannot afford the initial premium amounts, underdeveloped countries or those undergoing social economic warfare might not be able to implement crop insurance.

Market Segmentation

The agricultural insurance market share is classified into product type and distribution channel.

- The multi-peril crop insurance (MPCI) segment is estimated to hold the highest market revenue share through the projected period.

Based on the product type, the agricultural insurance market is classified into crop-hail insurance, livestock insurance, multi-peril crop insurance (MPCI), and others. Among these, the multi-peril crop insurance (MPCI) segment is estimated to hold the highest market revenue share through the projected period. It protects standing crops from all weather-related threats, including pests and diseases, and additional hazards such as delayed planting and non-emergence of seedlings due to top-soil slaking. Coverage for annual crops begins shortly after planting and lasts through harvest. The difference between the price that most farmers can afford to pay for MPCI insurance and the premium necessary for the high exposure and high anti-selection risk is increasingly being filled by government incentives and premium subsidies.

- The banks segment is anticipated to hold the largest market share through the forecast period.

Based on the distribution channel, the agricultural insurance market is divided into insurance companies, banks, and others. Among these, the banks segment is anticipated to hold the largest market share through the forecast period. In the agricultural insurance industry, banks are crucial as middlemen between insurance companies and farmers. Due to their extensive networks spanning both rural and urban areas, these financial institutions can provide insurance to a wide range of farmers. Banks' extensive reach ensures that even impoverished and remote agricultural areas can obtain vital insurance coverage, hence expanding the overall inclusivity of the agricultural insurance market.

For instance, Pradhan Mantri Fasal Bima Yojana intends to assist agriculture's sustainable production. The scheme's principal goals are lending money to farmers who suffered crop loss or damage as a result of unanticipated circumstances, ensuring the flow of finance to the agricultural sector, which will protect farmers from production risks while also promoting growth and competitiveness, crop diversification, and food security.

Under the general direction of the Government of India (GOI) and in cooperation with several other agencies, including financial institutions like commercial banks, cooperative banks, regional rural banks, and their regulatory bodies, the Pradhan Mantri Fasal Bima Yojana Scheme implemented through a multi-agency framework by selected insurance companies.

Regional Segment Analysis of the Agricultural Insurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

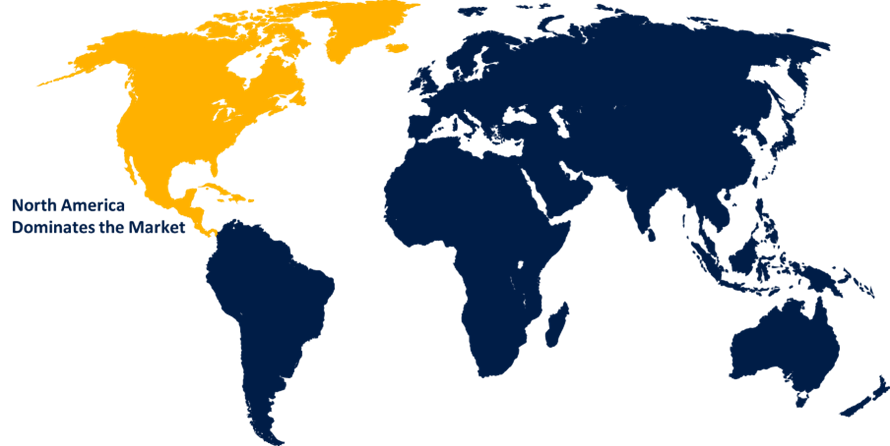

North America is anticipated to hold the largest share of the agricultural insurance market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the agricultural insurance market over the predicted timeframe. Some of the factors propelling the expansion of the regional market are the region's improved economic conditions and government measures to build out the insurance industry's infrastructure. Owing to its diverse crop and farming practices, the agricultural sector in North America is susceptible to a variety of risks, including fluctuations in the weather, pests, and market volatility. With around 250 million acres of cropland, the United States offers federal crop insurance through a commercial insurance company governed by the USDA.

For instance, in July 2024, for farmers of specialty crops, the USDA Risk Management Agency (RMA) is increasing the range of insurance coverage choices, Increasing the number of Enterprise Units (EU) to include almonds, apples, walnuts, citrus (California, Arizona, and Texas), avocados, figs, macadamia nuts, pears, and prunes, in all remaining crops where OUs are available and the organic practice is insurable, expand OUs by organic practice.

Asia Pacific is expected to grow at the fastest CAGR growth of the agricultural insurance market during the forecast period. Due to typhoons, floods, landslides, droughts, earthquakes, volcanic eruptions, and tsunamis, natural calamities frequently affect it. Weather-related risks impact the region's crop production, incomes, assets, and the safety of those in vulnerable groups. Agricultural insurance schemes in Asia and the Pacific region vary from expansive government-managed initiatives in India and the Philippines to collaborations between public and private sectors. Throughout Asia and the Pacific, there are a variety of agriculture insurance schemes, from public-private partnerships to massive governmental programs in the Philippines and India. India ranks third in the world in terms of crop insurance claim ratio; the only nations with higher ratios are Canada and Italy, both of which endure at least one extreme weather event annually.

For instance, in July 2023, the Finance Minister of India proposed an allocation of rupees 14,600 crore for the government's crop insurance scheme in Budget 2024. With its flagship Pradhan Mantri Fasal Bima Yojana (PMFBY), the government spent rupees 15,000 crore, over the rupees 13,625 crore budget projection. These include the WINDS portal, the YES-Tech Manual, and the enrollment app AIDE/Sahayak, which uses modern satellite-based technology to assess agricultural damage. Depending on the crop cycle, the farmer (insured) pays 1.5–2% of the total premium under the system. The leftover premium is divided equally between the states and the center. Demand-driven and open to all farmers, it covers risks from pre-sowing to post-harvest.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the agricultural insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Zurich Insurance Group

- Swiss Re

- XL Catlin

- Munich Re

- Tokio Marine Holdings

- Hannover Re

- Arch Capital Group

- Chubb Limited

- American International Group

- Aon plc

- QBE Insurance Group

- Willis Towers Watson

- Farmers Insurance Group

- Allianz SE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, the government launched the SARATHI platform to assist insurance providers in contacting farmers. To assist insurance businesses in reaching out to farmers and the rural population with customized products as well as government-subsidized insurance products like Pradhan Mantri Fasal Bima Yojana (PMFBY), they launched a platform called SARATHI.

- In September 2023, to protect Uzbekistan's climate-vulnerable farmers, the Insurance Development Forum (IDF), the United Nations Development Programme (UNDP), the German government, and the Uzbek government initiated a EUR 1.9 million project to design and implement a sovereign risk transfer scheme that includes a multi-peril indemnity insurance product.

- In March 2023, under the Pradhan Mantri Fasal Bima Yojana (PMFBY), the government unveiled DigiClaim, a digital claim settlement module that will assist farmers in receiving the allotted cash online, similar to PM-Kisan. Regarding the launch, it has been operationalized in six states, showcasing the real transfer of claims into the beneficiary farmers' bank accounts.

- In October 2022, the First-of-its-kind satellite index-based farm yield insurance policy launched by HDFC ERGO

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the agricultural insurance market based on the below-mentioned segments:

Global Agricultural Insurance Market, By Product Type

- Crop-Hail Insurance

- Livestock Insurance

- Multi-Peril Crop Insurance (MPCI)

- Other

Global Agricultural Insurance Market, By Distribution Chanel

- Insurance Companies

- Banks

- Others

Global Agricultural Insurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the agricultural insurance market over the forecast period?The agricultural insurance market is projected to expand at a CAGR of 5.6% during the forecast period.

-

2. What is the market size of the agricultural insurance market?The global agricultural insurance market Size is Expected to Grow from USD 40.24 Billion in 2023 to USD 69.82 Billion by 2033, at a CAGR of 5.6% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the agricultural insurance market?North America is anticipated to hold the largest share of the agricultural insurance market over the predicted timeframe.

Need help to buy this report?