Global Agricultural Lighting Market Size, Share, and COVID-19 Impact Analysis, By Light Source (Fluorescent, HID, LED, and Others), By Installation (New and Retrofit), By Application (Aquaculture, Livestock, and Horticulture), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: AgricultureGlobal Agricultural Lighting Market Insights Forecasts to 2033

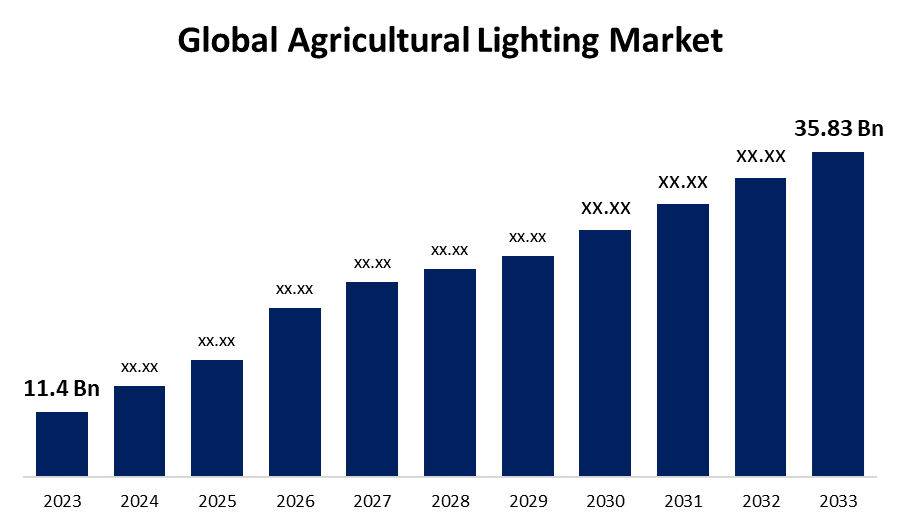

- The Global Agricultural Lighting Market Size was Valued at USD 11.4 Billion in 2023

- The Market Size is Growing at a CAGR of 12.1% from 2023 to 2033

- The Worldwide Agricultural Lighting Market Size is Expected to Reach USD 35.83 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Agricultural Lighting Market Size is Anticipated to Exceed USD 35.83 Billion by 2033, Growing at a CAGR of 12.1% from 2023 to 2033.

Market Overview

A vital component of keeping plants healthy is light. A plant's growth rate and duration of activity are directly correlated with the amount of light it receives. The most fundamental metabolic activity in plants is photosynthesis, which uses light energy. LED lights are being applied in agricultural applications in ways that almost look like alchemy: they are modifying the growth, flowering time, flavor, and even the vitamin and antioxidant content of plants. Their shelf life might be increased by the lighting.

Growing plants in controlled conditions has been shown to benefit from the usage of more light. It has been demonstrated that these light sources can affect phytochemical and developmental pathways. Light-emitting diodes (LEDs) are a type of artificial or supplemental light that have various advantages and special qualities. Consequently, indoor plant cultivation has seen a surge in the adoption of this innovative technology.

For instance, in January 2023, AMS OSRAM launched the OSCONIQ P3737, a high-power LED with chip technology that boasts exceptional resilience, a long lifespan, and an overall wall plug efficiency (WPE) of 83.2% in Hyper Red. Energy-efficient LED solutions are a significant tool available to greenhouse operators for energy conservation. According to the team, switching to LED lighting pays money since it significantly improves efficiency and reduces costs.

More biomass and shorter crop cycles might result from increased photon flux levels. Tests have demonstrated that an LED can continue to provide 90% of its initial light output after 102,000 hours of operation. This indicates that of all LEDs intended for horticulture fixtures, the OSCONIQ P3737 has the longest lifespan.

The impact that modern agriculture lighting has on crop quality and production, as well as its capacity to get around conventional limitations imposed by natural light cycles, are further reasons for its expanding significance.

Report Coverage

This research report categorizes the market for the global agricultural lighting market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global agricultural lighting market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global agricultural lighting market.

Global Agricultural Lighting Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 11.4 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 12.1% |

| 2033 Value Projection: | USD 35.83 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 266 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Light Source, By Installation, By Application, By Region |

| Companies covered:: | Agrolux, Valoya, LumiGrow, California Lightworks, Illumitex, Everlight Electronics, Bridgelux, Sunlight Supply, Gavita International B.V., Hortilux Schréder, VividGro, Apogee Instruments, Black Dog LED, Fluence, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Plant development is significantly impacted by artificial light. Plants can be impacted differently by light's various colors and wavelengths. Artificial lighting sources such as light-emitting diodes (LEDs) are becoming more and more common, particularly in greenhouse agriculture. Research has indicated that the fusion of red and blue spectra can improve growth characteristics including biomass, leaf area, and height in a variety of plants, including vegetables, ornamental plants, and medicinal herbs. Furthermore, plant morphology and light absorption can be influenced by light quality, which includes the blue light portion, and this can eventually have an impact on plant growth. Compact, dependable, and capable of quick switching are the qualities of LEDs. In addition to its long-term advantages in terms of durability, portability, and low power consumption, LED technology also has the potential to lower the carbon footprint of agricultural fields. Using artificial lighting, the greenhouse industry is one of the biggest energy consumers to lower energy usage.

For illustration, the research paper Environmental and Experimental Botany (Elsevier) which was published in April 2021 concluded that tomato plant growth was strongly impacted by blue light in artificial solar background light, with particular effects on plant height, stem diameter, leaf area, and chlorophyll content. In contrast to other light sources, blue light encouraged plant growth, demonstrating the significance of blue light for plant development.

Innovative lighting solutions designed for certain crops have been introduced as a result of ongoing research and development efforts in the field of agricultural technologies.

Restraining Factor

In general, plants use the red, orange, yellow, green, blue, indigo, and violet light spectrum, which spans 400 to 750 nm. Certain spectrums promote the growth of plants, while others enhance the production of fruits and flowers. Red light encourages flower and fruit formation, while blue light aids in photosynthesis, root development, and vegetative growth. There are situations when blue light is ineffective during the flowering and budding stages, which could result in fewer plant buds. Compact fluorescent lamps (CFLs) and LEDs are more practical than HID lights due to they produce full-spectrum light more effectively. Due to their full light spectrum capabilities, low heat waste and maintenance, and long lifespan, LED lights are a useful tool for growers looking to scale up plant output. Plant development is impacted by the incorrect kind of LED choices. Though they have a low color rendering index (CRI), HPS lights stimulate better plant development. The absence of blue/ultraviolet radiation from HPS lights causes plants to grow longer. The market is the high expenses of electricity of the LED grow light technology and the practicality of growing a limited range of crop species under agricultural light conditions. The efficient integration of several components and the technologies utilized in CEA establishments. Technical proficiency is essential due to the complexity involved in implementing regulated environmental conditions. These elements are posing the biggest obstacles to the expansion of the global agricultural Lighting market.

Market Segmentation

The global agricultural lighting market share is segmented into light source, installation, and application.

- The LED segment dominates the market with the largest market share through the forecast period.

Based on the light source, the global agricultural lighting market is segmented into fluorescent, HID, LED, and others. Among these, the LED segment dominates the market with the largest market share through the forecast period. Agricultural LED lights artificial lightning, which promotes and enhances plant growth. It is utilized for a variety of farming practices, including greenhouses, indoor farming, and vertical farming. The growth of floriculture is also contributing to an increase in the usage of agricultural lighting for fruit, vegetable, and floriculture cultivation, which is positively influencing the market even more. The market is expanding as a result of the population's rapid increase, the availability of scarce land resources, and the growing annual dividends.

For illustration, in July 2024, Nature's Miracle and Traxon Technologies entered a distribution partnership to distribute OSRAM horticultural lighting applications in the United States. Traxon was ams OSRAM's LED lighting division until December 2022. By this arrangement, OSRAM General Lighting Luminaires for horticultural applications will only be distributed and sold by Nature's Miracle, the exclusive authorized distributor in the United States. The new range is expected to be on sale in the third quarter of 2024, according to Nature's Miracle.

- The retrofit segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the installation, the global agricultural lighting market is segmented into new and retrofit. Among these, the retrofit segment is anticipated to grow at the fastest CAGR growth through the forecast period. Retrofitting light fixtures in livestock facilities, vertical farms, and commercial greenhouses lowers maintenance costs and energy usage. Due to growth lights must run for almost 14 to 18 hours a day, depending on the kind of plants being grown, which leads to cheap running expenses. LED grow lights have a long lifespan, are lightweight, and have a high efficiency when HID bulbs are retrofitted with them. It is anticipated that these reasons will drive the global market for retrofit installs to rise.

- The horticulture segment accounted for the largest revenue share through the forecast period.

Based on the application, the global agricultural lighting market is segmented into aquaculture, livestock, and horticulture. Among these, the horticulture segment accounted for the largest revenue share through the forecast period. More potential uses for LED light technology have emerged as a result of its recent deployment. Given that LEDs are beneficial in increasing the growth and production of a variety of crops, it appears that further research is needed to fully understand the rise in bioactive molecules, especially those that are health-promoting. By doing so, nutrition security will be ensured and sustainable goal 3 (excellent health and well-being) will be met. The benefits of LEDs, especially in protected cultivation, to improve fruit development and growth might result in the development of new horticultural technologies that will not only improve certain compounds found in these products but also enable more energy-efficient and sustainable greenhouse crop production.

Regional Segment Analysis of the Global Agricultural Lighting Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

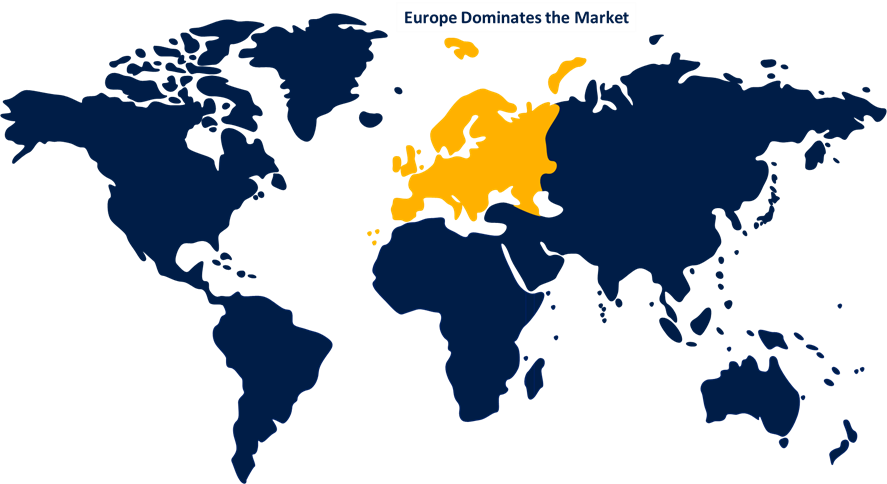

Europe is anticipated to hold the largest share of the global agricultural lighting market over the predicted timeframe.

Get more details on this report -

Europe is projected to hold the largest share of the global agricultural lighting market over the forecast period. Due to its robust economies and thriving sectors that boost capital investment capacities, Large tracts of land are planted with greenhouses in nations like the Netherlands, Spain, France, and Italy, which also have an unusually large amount of facilities for raising livestock, including poultry and dairy. Here in the region, LED grow lights are progressively being used as the main source of lighting for indoor farming, rather than only as a supplement.

Asia Pacific is expected to grow at the fastest CAGR growth of the global agricultural lighting market during the forecast period. Some of the world's biggest agricultural economies are found in the Asia Pacific area, which is home to countries like China, India, Japan, and Southeast Asian states. Robust agricultural sectors play a crucial role in the national economy of these countries. The region's extensive agricultural operations generate a significant demand for agricultural lighting solutions, leading to a substantial market share. There are great potential opportunities for the market due to the diverse variety of lighting requirements for the various crops grown throughout the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global agricultural lighting market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Agrolux

- Valoya

- LumiGrow

- California Lightworks

- Illumitex

- Everlight Electronics

- Bridgelux

- Sunlight Supply

- Gavita International B.V.

- Hortilux Schréder

- VividGro

- Apogee Instruments

- Black Dog LED

- Fluence

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, The dynamic grow light that Photosynthetic, a provider of agricultural lighting solutions, is introducing was created especially for the CEA sector. This device is a cutting-edge dynamic lighting solution designed to maximize energy efficiency, encourage sustainability, and improve plant growth and output. Photosynthetic will have a stand at 05.464VF at the GreenTech event.

- In November 2023, A €17 million Series A fundraising round was closed by RED Horticulture to finance the company's expansion and the advancement of its high-performance lighting techniques. Leading the round were Unigrains, Demeter IM, and the European Circular Bioeconomy Fund (ECBF). A portion of the funding comes from BPI's support programs and a banking pool that includes BNP Paribas, CIC, Crédit Agricole, and Société Générale.

- In February 2023, The world leader in optical solutions, ams-OSRAM AG, announced a partnership with Revolution Microelectronics (US), a designer of controlled agriculture environments, to supply illumination for GreenCare Collective's new futuristic facility. The partnership will be based on the OSLON Square platform and OSLON SSL LEDs. Using state-of-the-art crop steering techniques and seasonal programmed spectrum controls, GreenCare Collective's state-of-the-art facility has devised a perpetual harvest system that yields an additional harvest of plants per year.

- In January 2023, The new horticulture LED product RavayeTM from Polymatech Electronics, a semiconductor chip manufacturer focusing on opto-semiconductors, has been launched. With a wider spectrum of light for quicker and healthier plant growth, better farming conditions, and lower lighting system costs, these solutions redefined the standard for enhanced greenhouse and vertical farming lighting for professional horticultural applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global agricultural lighting market based on the below-mentioned segments:

Global Agricultural Lighting Market, By Light Source

- Fluorescent

- HID

- LED

- Others

Global Agricultural Lighting Market, By Installation

- New

- Retrofit

Global Agricultural Lighting Market, By Application

- Aquaculture

- Livestock

- Horticulture

Global Agricultural Lighting Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?Agrolux, Valoya, LumiGrow, California Lightworks, Illumitex, Everlight Electronics Co., Ltd., Bridgelux, Inc., Sunlight Supply, Inc., Gavita International B.V., Hortilux Schréder, VividGro, Apogee Instruments, Inc., Black Dog LED, Fluence, and Others

-

2.What is the size of the global agricultural lighting market?The Global Agricultural Lighting Market Size is Expected to Grow from USD 11.4 Billion in 2023 to USD 35.83 Billion by 2033, at a CAGR of 12.1% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?Europe is anticipated to hold the largest share of the global agricultural lighting market over the predicted timeframe.

Need help to buy this report?