Global Agricultural Lubricants Market Size, Share, and COVID-19 Impact Analysis, By Type (Mineral Oil-Based, Synthetic Oil-Based, and Bio-Based), By Application (Engine, Gear and Transmission, Implements, and Greasing), By Distribution Channel (Online & Offline), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: AgricultureGlobal Agricultural Lubricants Market Insights Forecasts to 2033

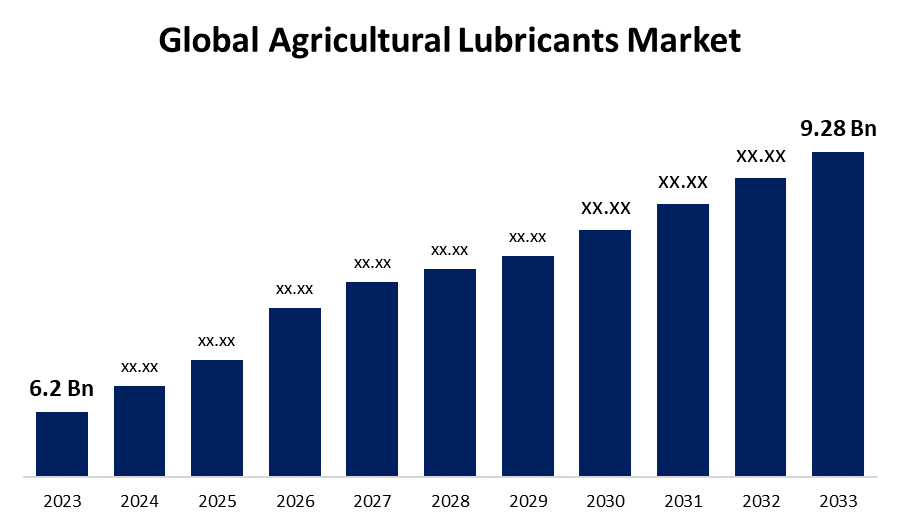

- The Global Agricultural Lubricants Market Size was Valued at USD 6.2 Billion in 2023

- The Market Size is Growing at a CAGR of 4.12% from 2023 to 2033

- The Worldwide Agricultural Lubricants Market Size is Expected to Reach USD 9.28 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Agricultural Lubricants Market Size is Anticipated to Exceed USD 9.28 Billion by 2033, Growing at a CAGR of 4.12% from 2023 to 2033.

Market Overview

Lubricants used in agriculture are specially produced to enhance the level of performance of farming machinery, provide excellent depletion prevention, assure good energy efficiency, and offer phenomenal performance even when exposed to the ultimate stringent working circumstances. Agricultural lubricants are lubricants used in agricultural equipment to increase the life of the machinery and equipment including harvesters, tractors, and verge cutters. They are also low-cost and assist in the minimization of fuel use. The use of advanced farming machinery is increasing, which is driving the demand for agricultural lubricants and allowing enterprises to produce globally. In addition, due to increasing farm advancement throughout the world, the agricultural lubricants sector is exceptionally increasing. Increasing the implementation of modern farming equipment to increase agriculture yield is an essential factor propelling the global market. The utilization of agricultural lubricants in the agriculture industry has been enhanced by the increasing use of supercharged engines in tractors, harvesters, grape-harvesting equipment, and silage harvesters. Furthermore, during the projected period, there will likely be an enhancement in the demand for agricultural lubricants due to the increasing need to minimize operating costs, minimize maintenance, and extend the lifespan of equipment. The demand for agricultural lubricants is expanding as there is a growing need for protection against wear and corrosion as well as for improved fuel efficiency.

Global Agricultural Lubricants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.2 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.12% |

| 2033 Value Projection: | USD 9.28 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 288 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Distribution Channel, By Region |

| Companies covered:: | ExxonMobil Corporation, Quaker Chemical Corporation, Fuchs Petrolub SE, BP plc, TotalEnergies SE, Apar Industries Ltd., Chevron Corporation, Repsol SA, Philips 66, Raj Petro Specialities, Nynas AB, Valvoline, Shell plc., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Driving Factors

The increasing implementation of modern agricultural operations and machinery is propelling the demand for lubricants to manage and operate agricultural machinery effectively. As the agricultural sector continues to adapt and embrace industrialization, the demand for high-performance lubricants, including engine oils, is anticipated to grow. The increasing advancement of farming equipment has resulted in a comprehensive rise in the demand for these lubricants. The robust rise of the farming sector, coupled with the increasing implementation of modern farming equipment, is predicted to play an essential role in propelling the demand for agricultural lubricants, generally engine oils. These oils are made to sustain the harsh outlook of agricultural work, including exposure to dust, debris, and high loads, and are important for assuring engines longevity and smooth operation by minimizing dissipating heat and securing wear and tear. The agricultural lubricant market is likely to be substantially influenced by the increasing preference for lubricant in the mentioned earlier and other industries.

Report Coverage

This research report categorizes the market for the global agricultural lubricants market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global agricultural lubricants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global agricultural lubricants market.

Market Segmentation

The global agricultural lubricants market share is segmented into type, application, and distribution channel.

• The bio-based segment dominates the market with the largest market share through the forecast period.

Based on the type, the global agricultural lubricants market is segmented into mineral oil-based, synthetic oil-based, and bio-based. Among these, the bio-based segment dominates the market with the largest market share through the forecast period. This growth can be ascribed to their comprehensive lubrication, completely reducing friction and wear on machinery components. In addition, their low-friction accessory contributes to increased efficiency in agricultural operations. With a minimal evaporation rate, bio-based lubricants assure dependable lubrication, lowering the need for continuous top-ups. Moreover, agricultural operations and equipment innovations necessitate agricultural lubricants that bring robust prevention and operational accuracy further contributing to the constant expansion of bio-based lubricants in the global agricultural lubricants market.

• The engine segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the application, the global agricultural lubricants market is segmented into engine, gear & transmission, implements, and greasing. Among these, the engine segment is anticipated to grow at the fastest CAGR growth through the forecast period. This noteworthy percentage can be ascribed to the farm tractor market's global expansion. Every tractor has at least one engine, and the capacity of each engine to consume oil varies from two to three liters. Nothing else on the tractor uses as much oil as this part does. Consequently, the market for agricultural lubricants is dominated by the engine application segment.

• The offline segment accounted for the largest revenue share through the forecast period.

Based on the distribution channel, the global agricultural lubricants market is segmented into online and offline. Among these, the offline segment accounted for the largest revenue share through the forecast period. Manufacturers, dealers, and distributors offering lubricants for agricultural machinery are found in the offline market. are mostly distributed through retail channels, which include hypermarkets, dealers, distributors, wholesalers, specialty shops, and specialized hardware and electronics stores. Specialty and convenience stores are the offline distribution channels that lubricant players in the market use. A corporation can offer its products through branded stores called specialty stores. Conversely, convenience stores are types of retail establishments where clients can easily and swiftly make purchases.

Regional Segment Analysis of the Global Agricultural Lubricants Market

• North America (U.S., Canada, Mexico)

• Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

• Asia-Pacific (China, Japan, India, Rest of APAC)

• South America (Brazil and the Rest of South America)

• The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global agricultural lubricants market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global agricultural lubricants market over the predicted timeframe. Due to the existence of large producers of agricultural lubricants promoting their products in the market and the localized increase in awareness of bio-based products. China is the biggest user of lubricants in the globe and the region. Despite the country's modest economic progress, agricultural machinery set the groundwork for agricultural modernization. Since the nation is the world's top producer of a variety of commodities, such as potatoes, rice, and cotton, agricultural machinery was essential to the development of agricultural modernity.

North America is expected to grow at the fastest CAGR growth of the global agricultural lubricants market during the forecast period. The agricultural lubricants market is being driven by the growing use of agricultural machinery to improve productivity and reduce overall production costs in the area. More variety than any other region might be found in North America, which spans from the frigid arctic regions to the Central American jungles. The agricultural sectors in North America exhibit this variance. Furthermore, it is expected that the growing demand for organic products will raise the need for agriculture over the projected period, leading to a notable rise in the demand for agricultural lubricants.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global agricultural lubricants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ExxonMobil Corporation

- Quaker Chemical Corporation

- Fuchs Petrolub SE

- BP plc

- TotalEnergies SE

- Apar Industries Ltd.

- Chevron Corporation

- Repsol SA

- Philips 66

- Raj Petro Specialities

- Nynas AB

- Valvoline

- Shell plc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, To improve collaboration in several areas, including retailing fuel, trading in oil and gas, selling lubricants and marine fuel, and upstream operations, Sinopec and BP have signed a Memorandum of Understanding (MoU).

- In April 2023, ExxonMobil announced plans to invest nearly $110 million to build a lubricants production plant in India. The facility is expected to start operating by the end of 2025.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global agricultural lubricants market based on the below-mentioned segments:

Global Agricultural Lubricants Market, By Type

- Mineral Oil-Based

- Synthetic Oil-Based

- Bio-Based

Global Agricultural Lubricants Market, By Application

- Engine

- Gear & Transmission

- Implements

- Greasing

Global Agricultural Lubricants Market, By Distribution Channel

- Online

- Offline

Global Agricultural Lubricants Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?