Global Agricultural Micronutrients Market Size, Share, and COVID-19 Impact Analysis, By Type (Zinc, Boron, Iron, Manganese, Molybdenum, and Copper), By Form (Chelated and Non-Chelated), By Application (Soil, Foliar, and Fertigation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: AgricultureGlobal Agricultural Micronutrients Market Insights Forecasts to 2033

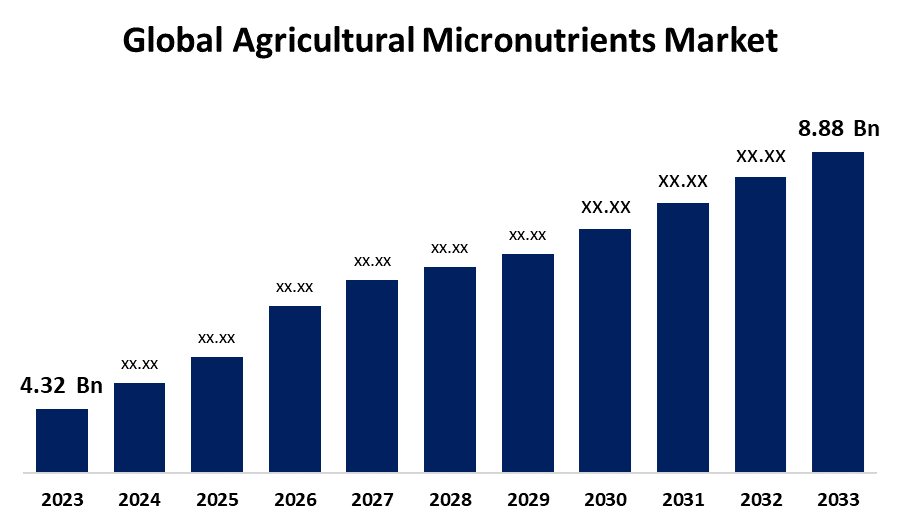

- The Global Agricultural Micronutrients Market Size was Valued at USD 4.32 Billion in 2023

- The Market Size is Growing at a CAGR of 7.47% from 2023 to 2033

- The Worldwide Agricultural Micronutrients Market Size is Expected to Reach USD 8.88 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Agricultural Micronutrients Market Size is Anticipated to Exceed USD 8.88 Billion by 2033, Growing at a CAGR of 7.47% from 2023 to 2033.

Market Overview

Agricultural micronutrients promote plant growth and play a crucial part in adequate crop nutrition. These include the elements iron (Fe), boron (B), molybdenum, zinc (Zn), copper (Cu), and manganese (Mn. A shortage of any of these nutrients in the soil can hinder plant growth and cause crop loss. Increased awareness and knowledge of the many micronutrients and their advantages, including their essential roles in a number of vital cellular processes, including protein metabolism, gene transcription, the production of chlorophyll, the structural and functional integrity of bio membranes, photosynthetic metabolism, facilitating in the absorption of other elements, controlling a number of biochemical reactions, lowering populations of microbes, and improving preserving quality rising plant analysis and soil testing have discovered micronutrient insufficiency in many soils, that will increase the agricultural micronutrients market over the projection period. The increasing utilization of synthetic fertilizers is also driving the rise of agricultural micronutrients, as it safeguards crops from UV radiation and insects while also improving production, that will benefit the whole development of the agricultural micronutrients market. Due to intensive cultivation, soil deterioration, loss of nutrients through leaching, liming of acid soils, unequal application of fertilizer such as NPK, and lack of replenishment, the frequency of micronutrient deficiencies in crops has grown significantly in the past few years. These and other significant variables are projected to result in a huge demand for agriculture micronutrients over the forecast period.

Report Coverage

This research report categorizes the market for the global agricultural micronutrients market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global agricultural micronutrients market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global agricultural micronutrients market.

Global Agricultural Micronutrients Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.32 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.47% |

| 2033 Value Projection: | USD 8.88 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 299 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Form, By Application, By Region |

| Companies covered:: | Yara International, Coromandel International, Akzo Nobel Nutrients, BASF SE, FMC, Andersons Inc., Land O’lakes, The Mosaic Company, Haifa Chemicals, Lemagro, Helena Chemical Company, UPL, ADAMA, Corteva Agriscience, Environmental Science US LLC (Envu), Nufarm Ltd., and other key vendors |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Growing knowledge of plant nutrition among farmers, as well as technological improvements, are projected to improve the market across the forecast period. The global sector has experienced an increase in farmers, awareness of plant nutrition, and acknowledgment of the beneficial utilization of agricultural micronutrients. Zinc treatment to corn has been widely accepted around the world. New developments in precision farming tools allowing effective micronutrient administration are also projected to drive industry expansion during the estimated time frame. Micronutrients are available in inadequate amounts to plants, and in most situations, deficiency can cause diseases that affect crops. Crops struggle with micronutrient deficiencies and imbalances caused by temperature, humidity, and soil pH fluctuations. Increased pH levels in the soil reduce the accessibility of micronutrients. Non-governmental and government entities focus on mineral fertilization measures to address deficiencies. This trend towards quality-driven production of contributes to the increased focus on the global agricultural micronutrient market.

Restraining Factors

The formation of biodegradable chelates can indeed restrict the growth of agricultural micronutrients. However biodegradable chelates are meant to degrade in the environment, their presence in aquatic systems can lead to bioaccumulation in plants and creatures. As a result, these chelates may unintentionally reduce the bioavailability of important micronutrients in agricultural soils. This unexpected effect can restrict crops' efficient uptake of micronutrients, potentially resulting in nutritional shortages and lower crop yields. The utilization of biodegradable chelates must be balanced with consideration for their possible effects on the environment, since their formation may disturb the sensitive nutritional balance needed for healthy plant growth.

Market Segmentation

The global agricultural micronutrients market share is classified into type, form, and application.

- The zinc segment is expected to hold the largest share of the global agricultural micronutrients market during the forecast period.

Based on the type, the global agricultural micronutrients market is divided into zinc, boron, iron, manganese, molybdenum, and copper. Among these, the zinc segment is expected to hold the largest share of the global agricultural micronutrients market during the forecast period. The growing awareness of zinc shortage in soils around the world, as well as its diverse role in plant development. This is a crucial nutrient in human metabolism, activating over one hundred enzymes and promoting the folding of proteins to support and control gene expression.

- The chelated segment is expected to dominate the global agricultural micronutrients market during the forecast period.

Based on the form, the global agricultural micronutrients market is divided into chelated and non-chelated. Among these, the chelated segment is expected to dominate the global agricultural micronutrients market during the forecast period. Chelation improves micronutrient stability and availability, reducing the potential risk of nutrient shortages in crops and maintaining overall plant health. Additionally, chelated micronutrients help plants fight pests and diseases, which improves crop protection. Their environmentally favorable properties, especially allowing for lower application quantities, demonstrate their sustainability in modern farming. Chelates are versatile in terms of application methods, including foliar sprays, seed treatments, and soil applications, making them suitable for a wide range of farming demands.

- The foliar segment is expected to hold a significant revenue share of the global agricultural micronutrients market during the forecast period.

Based on the application, the global agricultural micronutrients market is divided into soil, foliar, and fertigation. Among these, the foliar segment is expected to hold a significant revenue share of the global agricultural micronutrients market during the forecast period. The foliar application ensures that plants acquire micronutrients as rapidly as possible, which is especially important during critical growth stages. It permits precise and targeted nutrient management, which addresses specific crop shortages. Foliar treatment increases nutrient uptake, resulting in better crop health and output. This strategy is more effective for the environment due to the reduces extra runoff and waste.

Regional Segment Analysis of the Global Agricultural Micronutrients Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to grow at the highest CAGR in the global agricultural micronutrients market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to grow at the highest CAGR in the global agricultural micronutrients market over the predicted timeframe. Countries in this region are significant exporters of high-quality agricultural products. The size and amount of food produced have an impact on the value of exports, and micronutrients have an important effect on the quality of plant development, as a lack of such elements might disrupt trade transactions. Such as boron is a key micronutrient that reduces mango quality. According to statistics from the National Institute of Health, micronutrient deficiencies cause abnormalities in plant growth and reduced production. Asia Pacific countries' adherence to government guidelines, as well as significant subsidies for crop nutrition and fertilization, are able to supply farmers with huge profit margin. Fertilizers are a major factor driving the expansion of this industry across the region. The need for good-quality agricultural goods, as well as expanding agricultural practices, are predicted to drive micronutrient fertilizer market expansion in the Asia Pacific region during the forecast period.

North America is expected to grow at the fastest pace in the global agricultural micronutrients market during the predicted timeframe. The market will be driven by increased use of micronutrient fertilizers. A variety of factors, such as soil type, crop system, regional environmental circumstances, and economic factors, influence the usage of micronutrient fertilizers to address deficiencies in the United States. Important driving causes for this rise in the United States include increased demand for excellent quality and consistent products, as well as changes in farming techniques and intensification, such as precision agriculture, low-till management, and the introduction of genetically modified crops.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global agricultural micronutrients market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yara International

- Coromandel International

- Akzo Nobel Nutrients

- BASF SE

- FMC

- Andersons Inc.

- Land O’lakes

- The Mosaic Company

- Haifa Chemicals

- Lemagro

- Helena Chemical Company

- UPL

- ADAMA

- Corteva Agriscience

- Environmental Science US LLC (Envu)

- Nufarm Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, Andersons Inc. has created MicroMark DG, a new brand of granular micronutrients that employs dispersion granule (DG) technology. The new technology produces homogenous spherical grains, making blending and spreading easier and more effective. The first products to be issued will be MicroMark DG Blitz, which contains calcium, boron, manganese, and zinc, and MicroMark DG Humic, which contains calcium, sulfur, manganese, zinc, and humic acid.

- In February 2022, Plant Response, a prominent industry consolidator of biologically-based products, was bought by The Mosaic Company. Following this acquisition, Mosaic changed the name of the business to Mosaic Biosciences, to promote crops and their inherent biology.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global agricultural micronutrients market based on the below-mentioned segments:

Global Agricultural Micronutrients Market, By Type

- Zinc

- Boron

- Iron

- Manganese

- Molybdenum

- Copper

Global Agricultural Micronutrients Market, By Form

- Chelated

- Non-Chelated

Global Agricultural Micronutrients Market, By Application

- Soil

- Foliar

- Fertigation

Global Agricultural Micronutrients Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?