Global Agricultural Tire Market Size, Share, and COVID-19 Impact Analysis, By Application (Combine Harvesters, Tractors, Sprayers, Trailers, Loaders, and Others), By Distribution Channel (Aftermarket and OEM), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: AgricultureGlobal Agricultural Tire Market Insights Forecasts to 2033

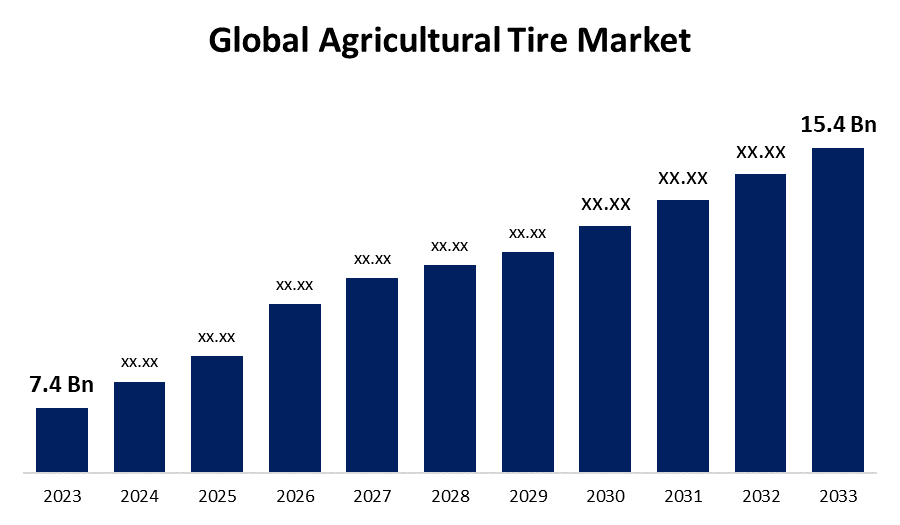

- The Global Agricultural Tire Market Size was Valued at USD 7.4 Billion in 2023

- The Market Size is Growing at a CAGR of 7.6% from 2023 to 2033

- The Worldwide Agricultural Tire Market Size is Expected to Reach USD 15.4 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Agricultural Tire Market Size is Anticipated to Exceed USD 15.4 Billion by 2033, Growing at a CAGR of 7.6% from 2023 to 2033.

Market Overview

Agricultural tires, sometimes referred to as farming tires, are made to be used on machinery and vehicles used in agriculture, including tractors, combines, sprayers, and trailers. These tires provide endurance, traction, and load-bearing capacity since they are designed to resist the particular difficulties and requirements of agricultural situations. The tread patterns on these tires are designed to maximize grip in a variety of field situations, such as mud, gravel, sand, and uneven ground. To maximize grip and reduce slippage, the tread design might incorporate deep lugs, self-cleaning bars, and open shoulders.

For Instance, In July 2024, Michelin unveiled the Cosmos machine, which will produce tires for agricultural use. The tire manufacturer unveiled its Cosmos machine at its Troyes manufacturing plant. This novel technology for producing farm tires was not previously used by the Michelin company. The Cosmos project, an attempt to install new, more ergonomic, and efficient agricultural tire production equipment, has taken place at the facility. Currently, the cosmos system is exclusive to the Michelin group since it makes use of cutting-edge technology that is tailored to the unique requirements of the manufacture of agricultural tires (size, weight, material technology, etc.).

The main factors propelling the market's expansion are the growing use of cutting-edge technology in farming and the rising need for effective and productive agricultural machinery end products.

Report Coverage

This research report categorizes the market for agricultural tire market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the agricultural tire market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the agricultural tire market.

Global Agricultural Tire Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.6% |

| 2033 Value Projection: | USD 15.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By Region, By Distribution Channel |

| Companies covered:: | Bridgestone, Continental AG, Pirelli, Titan International Inc., Trelleborg AB, Balkrishna Industries Limited (BKT), Sumitomo Rubber Industries Ltd., Yokohama Rubber Company Ltd., Mitas, Alliance Tire Group, CEAT Ltd., Maxam Tire International Ltd., Nokian Tyres, JK Tyre & Industries Ltd., and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Agricultural tires are essential for effective and productive farming operations due to they offer varied agricultural machinery and equipment load-bearing capability, traction, and stability. Due to their improved vehicle performance and lower resistance to rolling, efficient farm Tire help save gasoline. Agricultural tires must withstand severe operating circumstances, such as exposure to chemicals, sunshine, wetness, and mechanical stress. Therefore, the expansion of the agriculture tire market is being aided by the spike in demand for productive and effective agricultural gear. Field traction wheels are a feature of tractors, which are essential for increasing agricultural output and efficiency. Tractors are multipurpose tools used for a variety of jobs such as transporting, planting, cultivating, spraying, harvesting, and plowing.

For instance, the Macro-Management Scheme of Agriculture, developed by the Indian government, offers a 25% subsidy on tractors with up to 35 PTO HP. Concurrently, the Canadian government unveiled the Canadian Agricultural Loans Act, enabling farmers to borrow up to USD 500,000 to buy a tractor or land. Concerned regulatory bodies are likewise concentrating on machinery operator training programs per this. For example, the Innovative Solutions Canada (ISC) program saw the Canadian government invest over USD 860,000 in six enterprises in March 2022. Through the program, innovators will have the chance to create new goods, technology, and solutions to address issues facing the agriculture industry, making it more competitive and prosperous. These kinds of projects are anticipated to propel the agricultural tire market share in the coming years.

Restraining Factors

The market for agricultural tires is growing more slowly than it used to due to issues with high beginning prices and environmental concerns. For example, compaction of the soil can have a detrimental effect on crop productivity, soil health, and the environment when heavy machinery is used with conventional tires. Farmers, regulators, and environmentalists are all concerned about this issue. Apart from this, the main obstacle that farmers and agricultural enterprises must overcome is the high upfront cost of buying tires for agriculture. The cost of these tires, particularly the specialty and high-tech varieties, can be prohibitive for many prospective purchasers.

Market Segmentation

The agricultural tire market share is classified into application and distribution channels.

- The tractors segment is estimated to hold the highest market revenue share through the projected period.

Based on the application, the agricultural tire market is classified into combine harvesters, tractors, sprayers, trailers, loaders, and others. Among these, the tractors segment is estimated to hold the highest market revenue share through the projected period. The market was dominated by the tractors segment high horsepower tractors are popular due to their ability to be used for a variety of farming tasks. Consequently, as tractors become more popular and are used for more tasks, there is an increasing need for tires. The harvesters segment is anticipated to see an increase in demand for farm tire due to various harvesters being introduced to meet different farming needs.

- The OEM segment is anticipated to hold the largest market share through the forecast period.

Based on the distribution channel, the agricultural tire market is divided into OEM segment and is anticipated to hold the largest market share through the forecast period. With the OEM channel, there is a growing need for farm tires for new agricultural vehicles like harvesters and tractors. In developed nations, there is a huge demand for these vehicles due to farmers can afford the new, high-priced farm equipment that makes it easier to farm large areas of land. The existence of various platforms, including online, authorized, and third-party dealers, is likely to increase demand for new tires through aftermarket channels.

Regional Segment Analysis of the Agricultural Tire Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the agricultural tire market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the agricultural tire market over the predicted timeframe. Due to independent tire companies and producers of farming equipment being heavily represented in the area. The need for high-quality tires in the industry is being driven by nations with large fertile areas and sophisticated agricultural processes, like the United States and Canada. Well-known tire manufacturers, such as Bridgestone, Michelin, and Titan, have built strong retail networks and supply chains in rural areas to efficiently fulfill consumers replacement demands. The area is also a desirable market for harvesting trucks and compact load tractors, which use high-end tire types appropriate for demanding field work. Globally, North America is the leader in agricultural automation and mechanization.

Asia Pacific is expected to grow at the fastest CAGR growth of the agricultural tire market during the forecast period. led by a rise in farm mechanization, mostly in China and India. Over the past ten years, there has been an increase in demand for high-capacity harvesting equipment in these countries, which are the world's top producers of rice, wheat, and other commodities. Operators therefore favor customized tire fittings with cutting-edge rubber compounds for demanding grain-collecting tasks. An increasing number of smallholder farms are upgrading their fleets of vehicles as a result of an emerging middle class with easier access to loans for machinery.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the agricultural tire market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bridgestone

- Continental AG

- Pirelli

- Titan International Inc.

- Trelleborg AB

- Balkrishna Industries Limited (BKT)

- Sumitomo Rubber Industries Ltd.

- Yokohama Rubber Company Ltd.

- Mitas

- Alliance Tire Group

- CEAT Ltd.

- Maxam Tire International Ltd.

- Nokian Tyres

- JK Tyre & Industries Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Trelleborg Tire secures a contract with John Deere, staking its future on growth. The business has a growth strategy in place for Brazil, where it plans to be present in over 300 John Deere dealerships. Signed at Agrishow 2024, this new relationship will formally start in July. Beginning this month, farmers in Brazil will have access to John Deere's extensive product line of over 700 items including state-of-the-art technology from Trelleborg in the company's after-sales department. With this economic pact, the two leaders, who were previously worldwide partners, strengthened their regional partnership.

- In April 2024, AG-TRAC F-2, a robust tire designed for optimal performance on a variety of farm terrains, is released by Hercules Tire. This tire provides the flotation, durability, and steering response required for smooth operation in a variety of agricultural applications. It is available in two essential 16" sizes for 2WD Front Tractor wheel locations. The AG-TRAC F-2's sturdy design guarantees long-lasting performance and it is made to resist the rigors of agricultural operations. Its sturdy construction provides excellent grip and traction on a range of terrain, which makes it perfect for usage in pastures, fields, and other agricultural settings.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the agricultural tire market based on the below-mentioned segments:

Global Agricultural Tire Market, By Application

- Combine Harvesters

- Tractors

- Sprayers

- Trailers

- Loaders

- Others

Global Agricultural Tire Market, By Distribution Channel

- Aftermarket

- OEM

Global Agricultural Tire Market, By Offering

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the agricultural tire market over the forecast period?The agricultural tire market is projected to expand at a CAGR of 7.6% during the forecast period.

-

2. What is the market size of the agricultural Tire market?The global agricultural tire market Size is Expected to Grow from USD 7.4 Billion in 2023 to USD 15.4 Billion by 2033, at a CAGR of 7.6% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the agricultural tire market?Asia Pacific is anticipated to hold the largest share of the agricultural tire market over the predicted timeframe.

Need help to buy this report?