Global Agricultural Trailer Market Size, Share, and COVID-19 Impact Analysis, By Tractor Type (Orchard-Type Tractor Trailers, Garden Tractor Trailers, Row Crop Tractor Trailers, and Utility Tractor Trailers), By Tractor Horsepower (0-30 HP, 31-50 HP, 51-100 HP, 101-175 HP, 176-250 HP, and >250 HP), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: AgricultureGlobal Agricultural Trailer Market Insights Forecasts to 2033

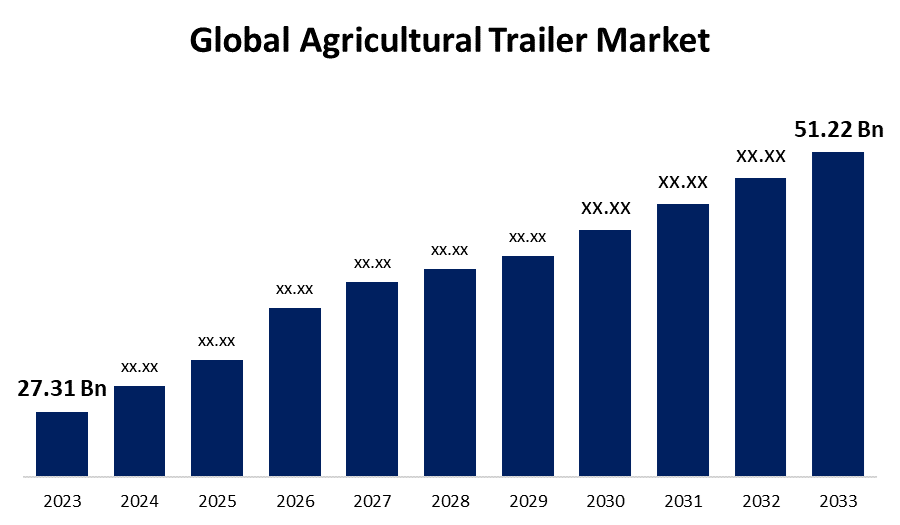

- The Global Agricultural Trailer Market Size was Valued at USD 27.31 Billion in 2023

- The Market Size is Growing at a CAGR of 6.49% from 2023 to 2033

- The Worldwide Agricultural Trailer Market Size is Expected to Reach USD 51.22 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Agricultural Trailer Market Size is Anticipated to Exceed USD 51.22 Billion by 2033, Growing at a CAGR of 6.49% from 2023 to 2033.

Market Overview

Trailers are well-known farm equipment that is used to move and haul a wide range of products, including tools and agricultural products, in both small and big numbers. When coupled and hooked to a tractor, a trailer can be a useful tool for moving products over short or large distances, including wood, soil, bales, and other goods. Tractor-trailers are highly popular in agricultural regions due to they are simple to attach to tractors, expedite transportation, and provide excellent dependability. Additionally, these help farmers become more efficient, which enables them to distribute their goods more quickly and provide more sales opportunities. Tractor trailers are becoming even more important as a result of their reduced rate of loss during transportation, which further assists farmers in easing their agricultural activities.

For instance, in July 2024, The FL 695 a steel-belted radial tire that BKT unveiled is specially made to improve trailer performance in agro-transportation and construction applications. With the FL 695, they have developed a tire that specifically addresses the requirements of agro-industrial applications, where trailers have a significant influence on performance and operating efficiency in addition to being essential to total production.

Report Coverage

This research report categorizes the market for agricultural trailer market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the agricultural trailer market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the agricultural trailer market.

Global Agricultural Trailer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 27.31 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.49% |

| 2033 Value Projection: | USD 51.22 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 268 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Tractor Type, By Tractor Horsepower, By Region |

| Companies covered:: | Bailey Trailers Limited, Behnke Enterprises, Beri Udyog, Doepker Industries Limited, ET Agricultural Trailers, Hittner Tractors, JPM Trailers, LANDFORCE, LOPEZ GARRIDO, Richard Western, The Drake Group, Western Fabrications, Yucheng Zeyi Machinery, Zonderland Constructie BV, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

The market for agricultural trailers is growing in developed nations due to the growing use of contemporary autonomous farm equipment, such as agricultural robots, for tasks like applying pesticides and insecticides to crops while agricultural trailers are attached to transport these chemicals. The worldwide agricultural trailer market is also being helped by the use of cutting-edge, novel technology, such as trailer surge brakes in agricultural trailers. The rise in global trade and transportation activity is driving up sales of automobile trailers. Global sales of agricultural trailers are also being boosted by this. Since the demand for agricultural trailers in developed nations is projected to be driven by these smart trailers, the future of the agricultural trailer market lies in the quick adoption of smart and connected trailers featuring telematics, Internet of Things (IoT) technology, and smart sensors. It is projected that this will present major prospects for related services for the leading suppliers in the market for agricultural trailers.

Restraining Factors

The substantial upfront expenses linked to acquiring advanced agricultural trailers present a noteworthy obstacle for small-scale farmers, impeding their ability to penetrate certain markets. Agricultural trailer producers face increased manufacturing costs and operating issues due to the complexity of regulatory compliance with safety and environmental regulations. The agricultural trailer market is less profitable as a result of pricing pressure and margin erosion brought on by market fragmentation and fierce competition among major players.

Market Segmentation

The agricultural trailer market share is classified into tractor type and tractor horsepower.

- The utility tractor-trailers segment is estimated to hold the highest market revenue share through the projected period.

Based on the tractor type, the agricultural trailer market is classified into orchard-type tractor trailers, garden tractor trailers, row crop tractor trailers, and utility tractor trailers. Among these, the utility tractor-trailers segment is estimated to hold the highest market revenue share through the projected period. A trailer used for moving goods is called a utility trailer. It can be attached to a tractor or truck and is usually smaller than a standard trailer. Large items including lawn tractors, agri equipment, brushes, and other items are frequently moved using utility trailers. Utility trailers come in a wide variety of styles and designs. The steel or aluminum frame, along with wood, metal, or plastic box and floor, make up the construction of utility trailers. While some have two axles, others only have one. Utility trailers come in a range of sizes and designs as well.

- The 51-100 HP segment is anticipated to hold the largest market share through the forecast period.

Based on the tractor horsepower, the agricultural trailer market is divided into 0-30 HP, 31-50 HP, 51-100 HP, 101-175 HP, 176-250 HP, and >250 HP. Among these, the 51-100 HP segment is anticipated to hold the largest market share through the forecast period. The utility tractors that manage every farming duty in the vast farm field fall into the 51–100 horsepower segment. The tractor is more stable on difficult tasks when operating in this horsepower level. Larger and wider instruments can be handled by them more quickly. Tractors in the 51–90 horsepower segment are useful for several tasks. These tractors are ideal for transporting because of their exceptional loading capacity and exceptional durability. They are well-known in airports, businesses, and many other places. They have a sufficient lifting capacity.

Regional Segment Analysis of the Agricultural Trailer Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the agricultural trailer market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the agricultural trailer market over the predicted timeframe. The primary factors contributing to consumption were the high demand for agricultural equipment, growing farm mechanization, population growth driving up food grain consumption, rising sales of agricultural equipment, labor scarcity in agricultural activities, and the farming community's desire to increase the effectiveness of agricultural transportation in this region. Furthermore, the Government supports financially the regional farmers through various schemes. For instance, the Sub-Mission on Agriculture Mechanization (SMAM), aims to increase farm mechanization's reach to small and marginal farmers as well as the regions, while also inclusively accelerating its expansion in India. Over 15,75,719 pieces of agricultural machinery and equipment, such as tractors, power tillers, self-propelled machinery, and plant protection equipment, have been distributed to state governments to date, totaling Rs. 6748.78 crore. Additionally, 23472 Custom Hiring Centers, 504 Hi-Tech Hubs, and 20597 Farm Machinery Banks have been established.

North America is expected to grow at the fastest CAGR growth of the Agricultural Trailer market during the forecast period. All-terrain vehicles (ATVs) are widely used by farmers in North America for light transportation and field surveying. More and more recreational vehicles, like ATVs, are being equipped with agricultural trailers to carry minor farm tools and vegetables. In developed countries, this is also the main factor driving sales of agricultural trailers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the agricultural trailer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bailey Trailers Limited

- Behnke Enterprises

- Beri Udyog

- Doepker Industries Limited

- ET Agricultural Trailers

- Hittner Tractors

- JPM Trailers

- LANDFORCE

- LOPEZ GARRIDO

- Richard Western

- The Drake Group

- Western Fabrications

- Yucheng Zeyi Machinery

- Zonderland Constructie BV

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, A new trailer design was unveiled by Richard Western at LAMMA 2024 in response to requests from contractors and farmers for a versatile trailer that can withstand severe circumstances and heavy loads while still holding sizable goods.

- In July 2022, In the 4x2 tractor market, Ashok Leyland announced the introduction of the AVTR 4220 with 41.5T GCW and the AVTR 4420 with 43.5T GCW. With this introduction, Ashok Leyland becomes the first Indian OEM to provide two-axle tractors with 41.5T and 43.5T GCW.

- In June 2020, In New Delhi, Daimler India Commercial Vehicles (DICV) has declared the arrival of the heavy-duty, next-generation BharatBenz tractor-trailer. According to its specifications, the 5228TT model has the maximum GCW of any 4x2 tractor up to 54T.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the agricultural trailer market based on the below-mentioned segments:

Global Agricultural Trailer Market, By Tractor Type

- Orchard-Type Tractor Trailers

- Garden Tractor Trailers

- Row Crop Tractor Trailers

- Utility Tractor Trailers

Global Agricultural Trailer Market, By Tractor Horsepower

- 0-30 HP

- 31-50 HP

- 51-100 HP

- 101-175 HP

- 176-250 HP

- >250 HP

Global Agricultural Trailer Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the agricultural trailer market over the forecast period?The agricultural trailer market is projected to expand at a CAGR of 6.49% during the forecast period.

-

2. What is the market size of the Agricultural Trailer market?The Global Agricultural Trailer Market Size is Expected to Grow from USD 27.31 Billion in 2023 to USD 51.22 Billion by 2033, at a CAGR of 6.49% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the Agricultural Trailer market?Asia Pacific is anticipated to hold the largest share of the Agricultural Trailer market over the predicted timeframe.

Need help to buy this report?