Global Agriculture Analytics Market Size, Share, and COVID-19 Impact Analysis, By Offerings (Solutions and Services), By Agriculture Type (Precision Farming, Livestock Farming, and Vertical Farming), By Deployment Mode (Cloud and On-Premises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: AgricultureGlobal Agriculture Analytics Market Insights Forecasts to 2033

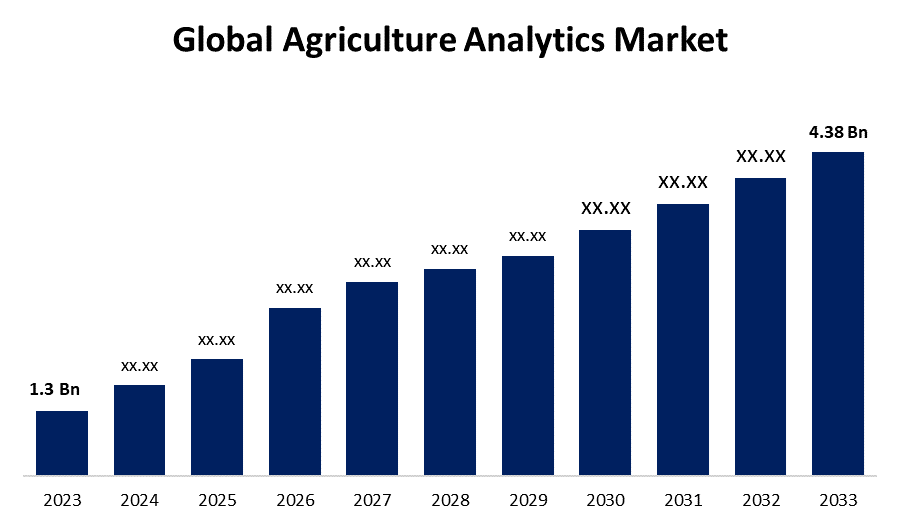

- The Global Agriculture Analytics Market Size was Valued at USD 1.3 Billion in 2023

- The Market Size is Growing at a CAGR of 12.92% from 2023 to 2033

- The Worldwide Agriculture Analytics Market Size is Expected to Reach USD 4.38 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Agriculture Analytics Market Size is Anticipated to Exceed USD 4.38 Billion by 2033, Growing at a CAGR of 12.92% from 2023 to 2033.

Market Overview

Cloud computing, big data, artificial intelligence, and the Internet of Things are just several modern technologies being used to manage and automate farming processes including managing livestock, crops, fields, and more. The adoption of advanced solutions in the farming industries is being driven by the increasing global need for food. Future food demand will more than double due to the population’s rapid expansion. Thus, the agriculture sector is expected to meet the problems of the future with the adoption of agro-analytics technology. Cultivable land is becoming less and less available. Agricultural land is being severely influenced by components including population growth, urbanization, water scarcity, and climate change. Companies and the government are encouraging the utilization of urban farming and vertical farming to manage the rising food demand. The usage of buildings and wasteland to arrange vertical columns for agricultural yields is driving the need for agriculture analytics solutions. Additionally, the system offers insights and alerts on a range of subjects, such as field planning, breeding management, irrigation management, and soil quality. This reduces damage and promotes the growth of high-quality crops.

Report Coverage

This research report categorizes the market for the global agriculture analytics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global agriculture analytics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global agriculture analytics market.

Global Agriculture Analytics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.3 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 12.92% |

| 2033 Value Projection: | USD 4.38 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 253 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Offerings, By Agriculture Type, By Deployment Mode, By Region |

| Companies covered:: | IBM Corporation, SAP SE, Oracle Corporation, Trimble Navigation Limited, Monsanto Company, Deere & Company, Agribotix LLC, Agjunction Inc., SST Development Group Inc., Iteris Inc., Taranis, Farmer’s Business Network Inc., Agrivi, Granular Inc., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Due to its ability to enable more informed and pertinent decision-making, analytics technologies help farmers increase their total productivity and efficiency. Global market expansion is thus anticipated to be largely driven by rising investment in the agriculture sector as well as farmland owners' adoption of advanced technologies to boost harvest. The increasing demand for food, driven by a rising worldwide population, is responsible for putting substantial pressure on farmland owners to increase food offerings. Furthermore, challenges including changing climatic conditions and soil degradation are hindering the ability of farm owners to obtain optimal crop production. Thus, to face this complicated situation, there is a significant rise in the implementation of farm analytical solutions from farmland owners as these solutions use technologies including global navigation satellite systems (GNSS), global positioning system (GPS), and unmanned aerial vehicles (drones) that taking a more informed decision and improving overall efficiency in agricultural practices and management.

Restraining Factors

One of the main barriers to expansion is the poor knowledge among farmers of the benefits and uses of farm analytics. The lack of competent personnel to efficiently adopt and oversee these advanced technologies complicates the global market's growth prospects. Further, the adoption of sophisticated farm analytics tools is hindered by threats to data security and privacy.

Market Segmentation

The global agriculture analytics market share is segmented into offerings, agriculture type, and deployment mode.

- The service segment dominates the market with the largest market share through the forecast period.

Based on the offerings, the global agriculture analytics market is segmented into solutions and services. Among these, the service segment dominates the market with the largest market share through the forecast period. Lack of awareness and comprehension among end users about the application of sophisticated farm analytical equipment is the primary driver of the increase. The anticipated outcome of this lack of experience is that the market's service sector would grow. Essential services including system integration and implementation, training, and advising are provided by analytical solution providers, which are crucial in fostering the growth of this market. With the help of these services, the complexity involved in implementing modern farm analytics solutions might be reduced, closing the knowledge gap and ensuring more efficient use of these technologies.

- The livestock farming segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the agriculture type, the global agriculture analytics market is segmented into precision farming, livestock farming, and vertical farming. Among these, the livestock farming segment is anticipated to grow at the fastest CAGR growth through the forecast period. Utilizing agriculture analytics services and solutions for livestock farming makes it possible to collect real-time data on animal health, feeding habits, hygienic practices, and location monitoring, among other topics, to improve livestock management procedures and raise the caliber and productivity of output. To increase farm productivity, livestock farming makes use of gadgets like robotic milking machines, GPS, RFID, feeding systems, and farm management systems, among other software technology solutions.

- The on-premises segment accounted for the largest revenue share through the forecast period.

Based on the deployment mode, the global agriculture analytics market is segmented into cloud and on-premises. Among these, the on-premises segment accounted for the largest revenue share through the forecast period. Global demand for on-premises farm analytics is being aided by end users' concerns about data security. The main consumers of on-premises agricultural analytics are large farms with stronger financial standing.

Regional Segment Analysis of the Global Agriculture Analytics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global agriculture analytics market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global agriculture analytics market over the predicted timeframe. Owing to the region's well-established infrastructure makes it easier for analytical services to be integrated seamlessly. Having a strong and well-developed infrastructure makes it easier to access and apply sophisticated analytics solutions to farming operations. The need for agriculture analytics solutions is also anticipated to rise as more North American farmers become aware of the advantages of sensor and analytics technologies. This increased understanding enables farmers to use these technologies to increase farm yields and improve operational efficiency, which supports the region's agriculture analytics market's steady expansion.

Asia Pacific is expected to grow at the fastest CAGR growth of the global agriculture analytics market during the forecast period. The Asia-Pacific region's rapidly growing population and growing food demand have increased farmers' need to increase agricultural productivity. A significant trend toward the use of cutting-edge analytical solutions is being driven by this rising demand as well as higher government spending in the agriculture sector. The obstacles in agricultural operations are greatly mitigated by these analytical solutions, which also contribute to better farm management, higher traceability, and better monitoring. Advanced analytics offers helpful insights for making wise decisions and allocating resources as farmers work to face the difficulties of growing their offerings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global agriculture analytics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IBM Corporation

- SAP SE

- Oracle Corporation

- Trimble Navigation Limited

- Monsanto Company

- Deere & Company

- Agribotix LLC

- Agjunction Inc.

- SST Development Group Inc.

- Iteris Inc.

- Taranis

- Farmer's Business Network Inc.

- Agrivi

- Granular Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, A generative Al-powered virtual assistant for agricultural management was tested by Bayer Global. An official statement from the company states that the tool is designed for farmers all over the world and offers quick answers to questions on agronomy and Bayer agricultural products. The system was developed in collaboration with Ernst & Young and Microsoft, and it was built using internal Bayer data.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global agriculture analytics market based on the below-mentioned segments:

Global Agriculture Analytics Market, By Offerings

- Solutions

- Services

Global Agriculture Analytics Market, By Agriculture Type

- Precision Farming

- Livestock Farming

- Vertical Farming

Global Agriculture Analytics Market, By Deployment Mode

- Cloud

- On-Premises

Global Agriculture Analytics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?