Global Agriculture Antibacterial Market Size, Share, and COVID-19 Impact Analysis, By Type (Antibiotic, Amide, Dithiocarbamate, and Copper-Based), By Crop Type (Oilseeds & Pulses, Cereals & Grains, and Fruits & Vegetables), By Application (Soil Treatment and Foliar Spray), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: AgricultureGlobal Agriculture Antibacterial Market Insights Forecasts to 2033

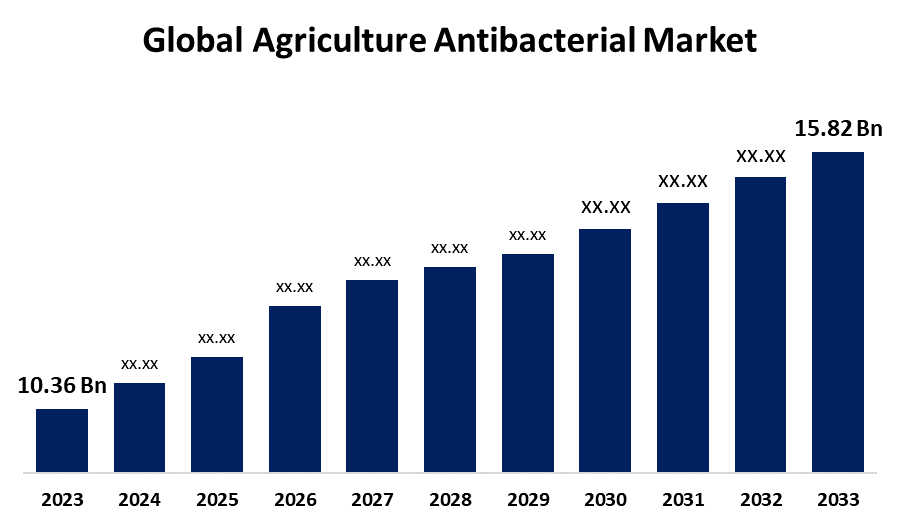

- The Global Agriculture Antibacterial Market Size Was Valued at USD 10.36 Billion in 2023

- The Market Size is Growing at a CAGR of 4.32% from 2023 to 2033

- The Worldwide Agriculture Antibacterial Market Size is Expected to Reach USD 15.82 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Agriculture Antibacterial Market Size is Anticipated to Exceed USD 15.82 Billion by 2033, Growing at a CAGR of 4.32% from 2023 to 2033.

Market Overview

An antibacterial treatment is an active ingredient that, when added during a product's or material's production process, helps to stop bacteria from growing and, in certain cases, even completely prevents them from developing within the product or material over its whole life. Antibacterial are also utilized in livestock farming, where they can be administered in subtherapeutic amounts in concentrated animal feed to promote growth, increase feed conversion efficiency, and prevent disease in animals. These are widely used in agriculture to boost crop output, in animal husbandry to treat sick animals, as prophylactic/metaphylactic measures to avoid infections, and at regulated levels as growth promoters in animal feed.

For Instance, in June 2024, for national surveillance systems to effectively contribute to the generation of trustworthy and timely evidence of antimicrobial resistance (AMR) in animals and food at the national, regional, and international levels, FAO launched its ambitious and comprehensive global information system. FAO is inviting its members to take part in the first InFARM annual open call for data in 2024 as part of the launch.

Due to the increased agricultural yield brought about by the growing need for food, market participants now have the chance to explore new potential markets. Large volumes of crop protection chemicals are expected to be necessary to improve food production for the growing population. Furthermore, while new plant technologies are being developed continually to fight pest infestations, this is also leading to the establishment of pest strains that are resistant to the technology.

Report Coverage

This research report categorizes the market for the agriculture antibacterial market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the agriculture antibacterial market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the agriculture antibacterial market.

Global Agriculture Antibacterial Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 10.36 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.32% |

| 023 – 2033 Value Projection: | USD 15.82 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | Analysis, By Type, By Crop Type, By Region |

| Companies covered:: | Corteva Agriscience, Syngenta, Valent BioSciences LLC, OHP Inc, Nufarm, DOW Chemical Company, Sumitomo Chemical Co., Adama Agricultural Solutions Ltd., Nippon Soda Co., BASF SE, E.I. du Pont de Nemours and Company, Aviagen Group, Bayer CropScience AG, FMC Corporation., Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Due to an increase in bacterial crop diseases, the market for antibacterial products for agriculture is anticipated to develop during the projected period. Due to hazardous bacteria spreading, the number of diseases caused by them is rising. The symptoms of plant pathogenic bacteria include galls, wilts, overgrowth, blights, cankers, soft rots, and scabs. These bacteria cause damage to plants. Plants impacted by bacteria yield inefficient, low-yielding harvests. A plant with bacterial infection yields a low-quality, low-quantity crop. When farmers lose money due to unsuitable crops, it affects their expectations. The avoidance of crops damaged by diseases is a reflection of the global growth in health consciousness. The market for antibacterials in agriculture has grown as a result of the consequences of bacterial infections in plants.

Restraining Factors

Overuse of antibiotics stunts plant growth, which is harmful to the growth of plants and poses a serious risk to human health. Overuse of the substance endangers countless lives and decreases the effectiveness of necessary medications. Increased environmental pollutants brought on by different antibiotics deplete plants' nutrition and have an impact on aquatic and groundwater life. It is anticipated that the entry of more lucrative and safe substitutes will impede market expansion. In the approaching years, growing consumer demand and acceptance of natural products as well as organic farming will impede industry expansion.

Market Segmentation

The agriculture antibacterial market share is classified into type, crop type, and application.

• The antibiotic segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the agriculture antibacterial market is classified into antibiotic, amide, dithiocarbamate, and copper-based. Among these, the antibiotic segment is estimated to hold the highest market revenue share through the projected period. Due to the growing need for animal protein in emerging nations and the promotion of intensive farming, which results in the residue of antibacterial in animal products, the antibiotic sector is projected to have the largest global agricultural antibacterial market share. Antibiotic-resistant bacteria can be pathogenic to humans, easily transferred through food chains, and yet widely dispersed in the environment through animal wastes, which makes them a serious threat to public health. Humans might develop complicated, chronic, incurable diseases as a result, which might result in expensive medical care or even death. Antibiotics reduce the growth of gastrointestinal organisms that compete for nutrients, increasing feed efficiency and nutrient absorption. Governmental and professional associations have long raised concerns about the potential for drug-resistant microorganisms to emerge from the abuse of antimicrobial medications in cattle production.

• The cereals & grains segment is anticipated to hold the largest market share through the forecast period.

Based on the crop type, the agriculture antibacterial market is classified into oilseeds & pulses, cereals & grains, and fruits & vegetables. Among these, the cereals & grains segment is anticipated to hold the largest market share through the forecast period. A variety of causes, including dust, water, diseased plants, insects, soil, fertilizers, and animal waste, can contaminate cereal grains shortly after they are harvested. Molds are primarily Alternaria, Fusarium, Helminthosporium, and Cladosporium, though other genera might also be present. Bacteria found in gains primarily come from the families Pseudomonadaceae, Micrococcaceae, Lactobacillaceae, and Bacillaceae to address such challenges use antibacterials to be done for the protection of cereals and grains. Furthermore, cereals and grains are high in fiber, carbs, and other nutrients, and the majority of people globally rely on them for their nutrition. Corn, rice, wheat, oats, barley, rye, and other crops are examples of cereals and grains. If incorporated into a diet, this aids in the prevention of chronic illnesses.

• The soil treatment segment dominates the market with the largest market share through the forecast period.

Based on the application, the agriculture antibacterial market is categorized into soil treatment and foliar spray. Among these, the soil treatment segment dominates the market with the largest market share through the forecast period. Since bactericides and other food additives are being used more frequently pesticide growth control agents are becoming more prevalent in the early stages of plant development. In agricultural soil treatment, antibacterial chemicals are used to control and prevent bacterial infections that could damage plants. Bacterial pathogens found in soil can induce serious plant diseases such as blight, wilt, and root rot, which can have a major negative effect on crop productivity and health. Farmers can use antibacterials to target these dangerous bacteria, which lowers disease incidence and encourages healthy plant growth.

Regional Segment Analysis of the Agriculture Antibacterial Market

• North America (U.S., Canada, Mexico)

• Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

• Asia-Pacific (China, Japan, India, Rest of APAC)

• South America (Brazil and the Rest of South America)

• The Middle East and Africa (UAE, South Africa, Rest of MEA)

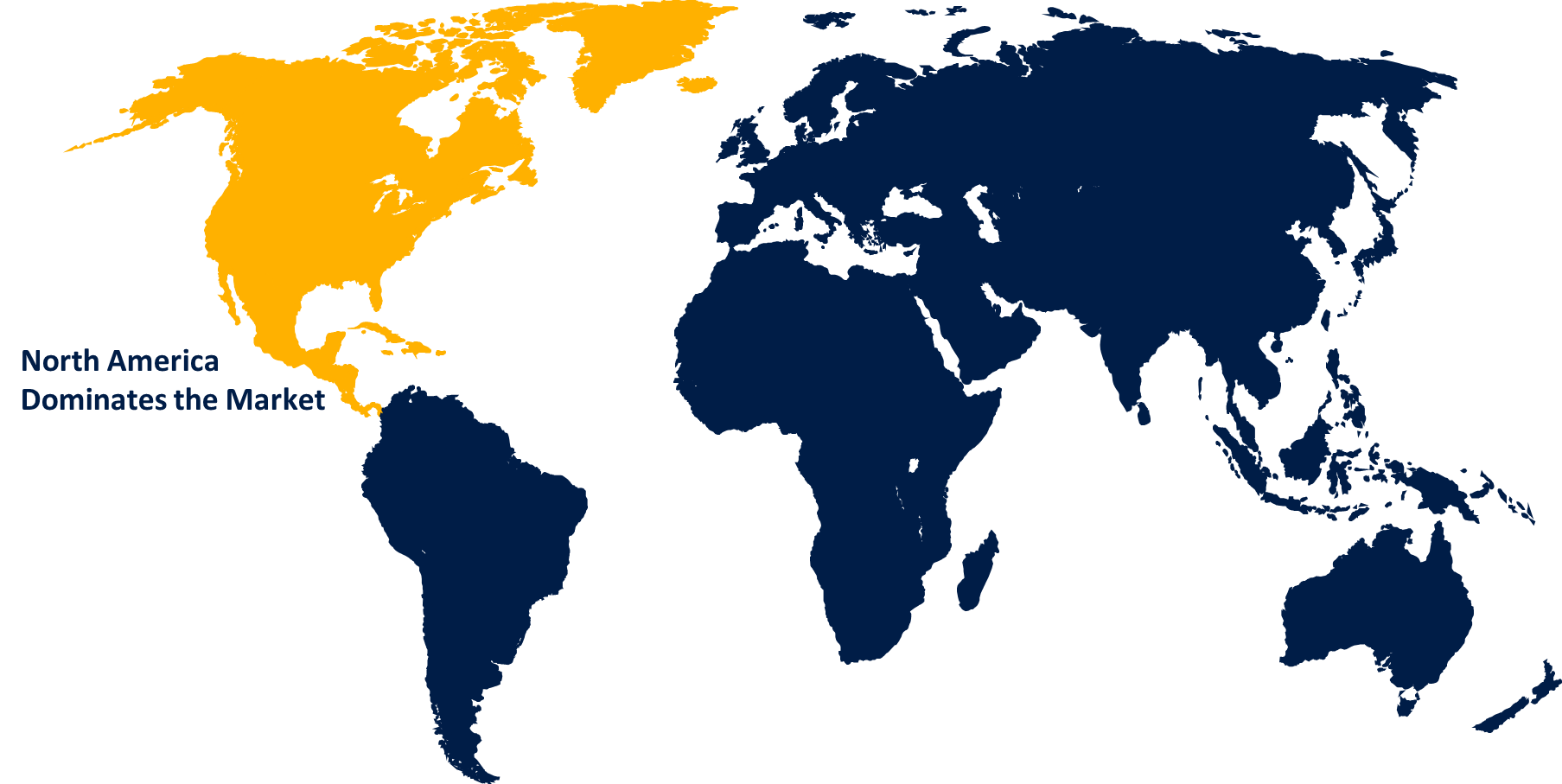

North America is anticipated to hold the largest share of the agriculture antibacterial market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the agriculture antibacterial market over the predicted timeframe. Due to the expansion of the agricultural sector's land region and the growing demand for high-quality commodities. The region of Asia-Pacific will have the greatest CAGR during the projection period. Other significant elements supporting the region's growth include the rising incidence of bacterial agricultural diseases, rising personal disposable income, and a sharp increase in spending on R&D capabilities. For instance, Erwinia amylovora is the bacterium that causes the destructive blight disease that affects apples, pears, and other pome fruits. The bacteria can infect shoot tips, fruits, stems, and the rootstock of the tree in addition to infecting blooms. It can also propagate through the vascular system. Another disease for which spray treatments of antibiotics have been utilized to give some degree of control as part of an integrated management approach is bacterial spots of peaches and related Prunus fruit species. In the US, hardly many antibiotics have been approved for use on vegetation. The FRAC (Fungicide Resistance Action Committee) code list, which is produced to reduce the danger of cross-resistance, consequently frequently includes antibiotics in addition to fungicides.

AsiaAsia Pacific is expected to grow at the fastest CAGR growth of the agriculture antibacterial market during the forecast period. The market for antibacterial products in agriculture is expanding as a result of rising agricultural operations and consumer desire for high-quality produce. The nations in this region have seen a rise in the use of antibacterial products as a result of farmers becoming more conscious of how bacterial infections affect crop output. With escalating rates of treatment failures and resistance to most medicines in common infections, India has become a global hotspot for antibiotic resistance (ABR). Numerous research demonstrates how commonly antimicrobials are used as growth promoters. The production of chicken has seen a particularly high rate of nontherapeutic antibiotic use.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the agriculture antibacterial market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Corteva Agriscience

- Syngenta

- Valent BioSciences LLC

- OHP Inc

- Nufarm

- DOW Chemical Company

- Sumitomo Chemical Co.

- Adama Agricultural Solutions Ltd.

- Nippon Soda Co.

- BASF SE

- E.I. du Pont de Nemours and Company

- Aviagen Group

- Bayer CropScience AG

- FMC Corporation.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In July 2024, the University of Queensland's ARC Training Centre for Environmental and Agricultural Solutions to Antimicrobial Resistance (ARC CEA StAR) was officially opened by the ARC. The mission of ARC CEA StAR is to work with industry partners to create solutions for antimicrobial resistance (AMR) and to teach the next generation of researchers how to tackle AMR's consequences on the environment and the agricultural sector.

• In May 2024, Antimicrobial resistance (AMR) is a global problem that affects both humans and animals and makes treating diseases difficult or impossible. Defra has unveiled a new five-year plan to address this issue. By the new national action plan, the UK will decrease the number of antimicrobials such as antibiotics, antifungals, and antivirals that it uses on people and animals and will step up its monitoring of drug-resistant illnesses in advance of their emergence.

• In October 2023, A new Working Group on Youth Engagement for Antimicrobial Resistance (AMR) has been established by the Quadripartite (Food and Agriculture Organization of the United Nations, United Nations Environment Programme, World Health Organization, and World Organization for Animal Health). The working group's members will advise and direct the four-pronged initiatives to increase awareness of AMR and include youth in worldwide action.

• In January 2023, The Quadripartite Technical Group on Integrated Surveillance on Antimicrobial Use and Resistance was formed by the Quadripartite organizations, which are the World Health Organization (WHO), the World Organization for Animal Health (WOAH), the United Nations Environment Programme (UNEP), and the Food and Agriculture Organization of the United Nations (FAO).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the agriculture antibacterial market based on the below-mentioned segments:

Global Agriculture Antibacterial Market, By Type

- Antibiotic

- Amide

- Dithiocarbamate

- Copper-Based

Global Agriculture Antibacterial Market, By Crop Type

- Oilseeds & Pulses

- Cereals & Grains

- Fruits & Vegetables

Global Agriculture Antibacterial Market, By Application

- Soil Treatment

- Foliar Spray

Global Agriculture Antibacterial Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the agriculture antibacterial market over the forecast period?The agriculture antibacterial market is projected to expand at a CAGR of 4.32% during the forecast period.

-

2.What is the market size of the agriculture antibacterial market?The Global Agriculture Antibacterial Market Size is Expected to Grow from USD 10.36 Billion in 2023 to USD 15.82 Billion by 2033, at a CAGR of 4.32% during the forecast period 2023-2033.

-

3.Which region holds the largest share of the agriculture antibacterial market?North America is anticipated to hold the largest share of the agriculture antibacterial market over the predicted timeframe.

Need help to buy this report?